Forums › Trading System Mentor Course Community › Progress Journal › Terry’s Journal

- This topic has 211 replies, 3 voices, and was last updated 3 weeks ago by

TerryDunne.

-

AuthorPosts

-

September 2, 2023 at 3:48 am #115756

Nick Radge

KeymasterTerry,

We’ll be discussing this in next week’s call, but basically, our focus is pushing for multiple equity pathways and lower volatility, specifically moving a move away from the single print maxDD as a guideline.What I’m doing is trading a series of lower-risk, lower-leveraged, MOC systems that are uncorrelated. On their own, they don’t look like much, but, as Kate alluded to, combined they become quite potent. More importantly, we’re not relying on a single setup/equity pathway. This seems to be the trap for many in the MOC/MR space over the last 18 months.

Here are the current stats, where I have 3x Long/Short MOC systems and have added in the short version of the HFT (multi day). The long HFT is traded in another account.

Now, when you put them together, the correlations are very low – not much green or red on the page. As you can see above, leverage is still well controlled, meaning I have scope to add more – so long as the correlations remain low.

Now, when you put them together, the correlations are very low – not much green or red on the page. As you can see above, leverage is still well controlled, meaning I have scope to add more – so long as the correlations remain low. September 2, 2023 at 5:07 am #115760

September 2, 2023 at 5:07 am #115760Nick Radge

KeymasterI should also add that the volatility of the portfolio is 15.07%, which in the scheme of things is moderate, especially with the use of leverage.

September 2, 2023 at 8:45 am #115761TerryDunne

ParticipantWow Nick, this is shocking to me – in a good way! Until now I believed that a crappy system plus another crappy system equals 2 crappy systems.

Thank you for the posts, there is a lot to think about.

My first thought is, do you allow the same stocks to be traded over the different systems at the same time or do you exclude duplicates?

Terry

September 2, 2023 at 10:30 pm #115762Nick Radge

KeymasterTerry,

I learned a lesson many years ago from the Turtles. They kept every market in their portfolio, even those that never made money in backtests. Back then they were limited to 52 markets, but since then they have taken that to some 300 markets – all for the sake of catching some outlier somewhere.Even with my ASX All Weather portfolio, I started with 6 ETFs. Then I started adding in more (mainly based on length of history) and the risk-adjusted returns started being significantly better. When you look at them individually, some look very poor. But add them to the portfolio, the sum of the group is much better.

“…do you allow the same stocks to be traded over the different systems at the same time or do you exclude duplicates?”

No. One symbol only across all systems – the beauty of RealTestSeptember 2, 2023 at 11:05 pm #115765Sean Murphy

ParticipantQuote:“…do you allow the same stocks to be traded over the different systems at the same time or do you exclude duplicates?”No. One symbol only across all systems – the beauty of RealTestOne symbol only across all systems to offer greatest opportunity to find that next outlier? Is that the intent?

Thanks for your insights Terry and Nick.

September 2, 2023 at 11:56 pm #115766KateMoloney

ParticipantHi Terry,

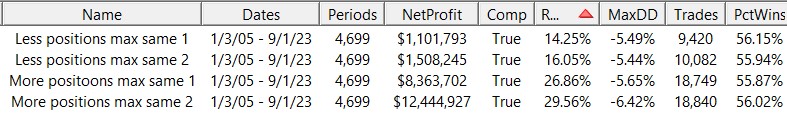

It is early days for me, but results so far look interesting on the MOCs.

This is a combined strategy with 7 long / short strategies, MOC only. Position sizing and risk per position is very modest.

Now I’m attempting to add more systems to generate higher returns. It requires a different mindset and I’m still wrapping my head around how to stress test the ideas effectively (e.g do I do it in the entire template or stress test individually).

September 2, 2023 at 11:57 pm #115768

September 2, 2023 at 11:57 pm #115768KateMoloney

ParticipantSorry about the quality, hopefully this is better

September 2, 2023 at 11:58 pm #115769

September 2, 2023 at 11:58 pm #115769KateMoloney

Participant September 3, 2023 at 12:27 am #111861

September 3, 2023 at 12:27 am #111861BenOsborn

Participantwow they are some low Max DDs

September 3, 2023 at 5:24 am #111862JulianCohen

ParticipantTerry I have been developing my strategies this way for over a year now. Unfortunately the mean reversion idea hasn’t been particularly profitable in that time, but I carried on developing that way.

I keep one symbol across all multi day hold strategies, and one symbol across all MOC strategies. MOC and MR can hold the same stock. I use statsgroups to control this.

I have no more than 3 conditions for entry in any one strategy, apart from price and liquidity filters, although the majority only have 2.

If an MOC strategy has more than a 10% MDD during InSample or OutOfSample testing, I don’t use it. For MR I allow a deeper MDD, up to 20%

I use the same stretch for all strategies, to avoid the temptation to make things less robust. Most strategies are based on InMEL, however all shorts are InRUI only and that has helped me to get fills that I wasn’t getting in the wider universe of stocks.

I have four different ranking methods, which helps to differentiate between selections.

My theoretical leverage would appear to be massive, as I have 15 strategies all using around 8% or 5% of total account size, however using statsgroups I can set the combined leverage exposure to 400 and on average it is around 150%

All looks great on paper, but in all honesty I’m still waiting for it to pay off. However I think I have the theory correct, and seeing as Nick seems to have been working on the same kind of lines is solace. As far as I can see, I have done as much as I can to set the probability in my favour. I just have to wait.

This is the InSample drawdown Graph and a section of the Report…I have a number of strategies only producing 2-3% but I still keep them as they cost me nothing in time or opportunity cost to run as they are all part of the same script, so I figure why not.

I uploaded a pdf as I’ve never been able to get a screenshot to work well in this forum..not sure why

September 3, 2023 at 6:48 am #115770TerryDunne

ParticipantThanks for the information Julian, it’s really useful.

As I’m still a sceptic…can I ask whether the return live matches the back test return over the same period?

Thanks,

Terry

September 3, 2023 at 8:19 am #115771JulianCohen

ParticipantI have changed things around a bit in the last couple of months, so there isn’t a constant to backtest against. However every day I check trades against the backtest and there’s very little differential.

If I can just find a period of time where I don’t change things I can give a definitive answer to that question.

September 29, 2023 at 11:22 pm #115772TerryDunne

ParticipantSeptember 2023

MOC 1000 (2.22%)

MOC 2000 (2.86%)

MR 2000 (14.67%)

Closed 0.00%Total (3.48%)

Still black for the year (just)…it would be nice if this were to stop now.

October 31, 2023 at 11:45 pm #115828TerryDunne

ParticipantOctober 2023

MOC 1000 0.61%

MOC 2000 (1.82%)

MOC Short (0.42%)

MR 2000 (9.74%)

Closed 0.00%Total (1.33%)

Yet another losing month, although this one ‘feels’ better than the previous ones as the second half of the month was positive.

First couple of days of MOC shorts, on R1000 only, and only when I’m not taking signals for MOC R1000 long, so that I can double up on using the $$$.

October 31, 2023 at 11:51 pm #115861KateMoloney

ParticipantGreat to see you trying new things re: the shorts Terry,

-

AuthorPosts

- You must be logged in to reply to this topic.