- This topic is empty.

-

AuthorPosts

-

August 27, 2020 at 8:17 pm #112021

SaidBitar

ParticipantTerry Dunne wrote:Hi Said,I’m getting to the point where I’m thinking about a system with no entry criteria at all, just a ranking and a stretch…I’ll let you know how it goes.

Regards,

Terry

This is how i normally start. I set price and volume filters then I set the stretch.

I check the results at this stage mainly the percentage of the winning trades if it is 55% and above then i am OK.the second stage i play with ranking to get CAR more than MDD. i do not target high CAR and low MDD at this stage. So at this stage i know that the ranking is OK.

then i add entry filters to get better selection, one filter at a time till i reach decent numbers and acceptable number of trades per year.

the main reason i do this is because i lack imagination in getting brilliant ideas so i follow the simplest way.

August 27, 2020 at 10:03 pm #112028TerryDunne

ParticipantGood point, thanks Seth.

August 27, 2020 at 10:06 pm #112030TerryDunne

ParticipantNice process Said, I will adopt it as my own!

Like you I wouldn’t want to have to rely on my creatvitiy/imagination…for anything really!

August 28, 2020 at 12:34 am #112029Anonymous

InactiveSaid Bitar wrote:the main reason i do this is because i lack imagination in getting brilliant ideas so i follow the simplest way.Love it.

August 31, 2020 at 2:49 am #112035TrentRothall

ParticipantIs anyone running a MOC system without leverage?

August 31, 2020 at 4:07 am #112047GlenPeake

ParticipantTrent Rothall wrote:Is anyone running a MOC system without leverage?No Trent…. For me, the backtests just didn’t make it economically viable..ballpark figures were 11% CAR -6%DD…My capital is best used elsewhere etc…

I’m having much improved results with my MR systems, which DO NOT use leverage. They both trade the R1000.

So if you’re looking for short term systems that don’t require leverage…. then it’s certainly possible. Average hold time is approx 3 days.

August 31, 2020 at 5:14 am #112049TrentRothall

ParticipantCheers Glen, that was what i was thinking/ what my testing was showing. I will have to dig into the US MR testing again. Are you using the CBT template for selectio bias?

August 31, 2020 at 5:31 am #112050GlenPeake

ParticipantCBT….. Yep!! I’m using the CBT code for selection bias etc…

Let me know if you want to see some backtest reports for my MR systems as a comparison etc…

August 31, 2020 at 1:12 pm #112048LEONARDZIR

ParticipantTrent, I am running my MOC without leverage. It is one of several systems in my MR portfolio that are combined in one account. Tests great with no leverage.

September 1, 2020 at 8:24 pm #112011OmarAouane

ParticipantVery interesting topic that you brough in there Terry. I am currently in the process of finalizing couple of MOC systems. I have a hard time to define optimum strech. I found that the higher the strech the lower the CAGR and the DD. But more importantly the lower strech, the lower the average profit per trade meaning a small distorsion in market conditions and you turn on the negative side. I prefer lower CAGR but higher avg profit to get some margin.

Regarding Nick’s adage, I understood it like you meaning be patient and consistent and definitely not about getting to 1000 trades the quickest way possible.Once approved by Nick I will post backtest on my journal.

September 2, 2020 at 1:44 am #112078TerryDunne

ParticipantHi Omar,

Your experience with higher stretch is what most people experience I think. My focus is on absolute maximum drawdown as well as CAGR /DD, so I favour big stretches. Others who don’t have my ‘issues’ focus more on CAGR.

I discovered in the GFC that seeing at a 30% drawdown in back testing is very different to experiencing it IRL.

Good luck with the course, looking forward to seeing your results!

Terry

September 23, 2020 at 5:26 am #112051TrentRothall

ParticipantGlen Peake wrote:CBT….. Yep!! I’m using the CBT code for selection bias etc…Let me know if you want to see some backtest reports for my MR systems as a comparison etc…

G’day Glen,

That would be great if you wouldn’t mind throwing up some reports.

September 23, 2020 at 5:50 am #112012GlenPeake

ParticipantSure, no probs Trent.

I’ll post a 15 year backtest and a 5 year backtest in the following posts.

This will be for my MR#2 system, that I post monthly return stats for in my journal. I ‘tweaked’ the system during COVID… so I’ve only been trading this version of the system since mid-MAY.

As luck would have it, I closed out the following position in CVNA overnight

September 23, 2020 at 5:52 am #112169

September 23, 2020 at 5:52 am #112169GlenPeake

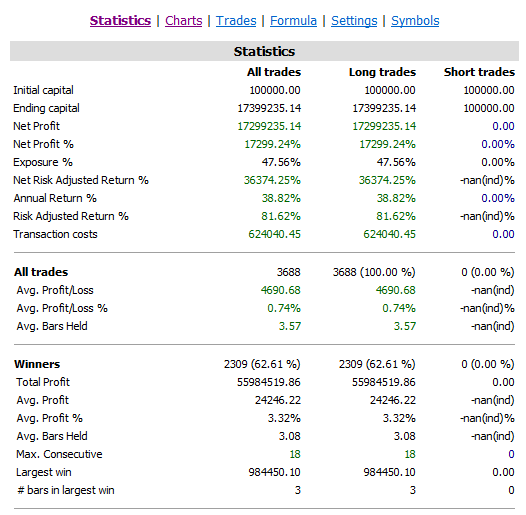

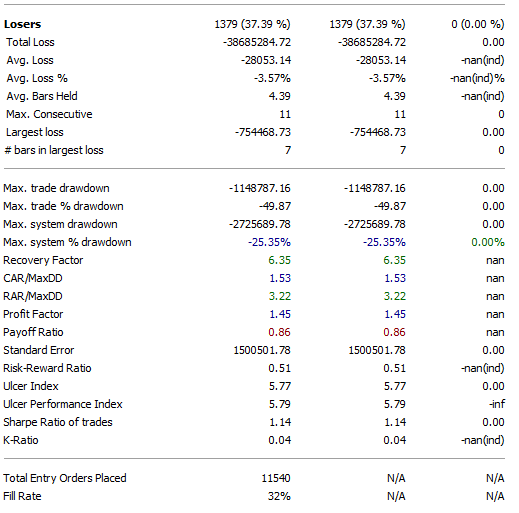

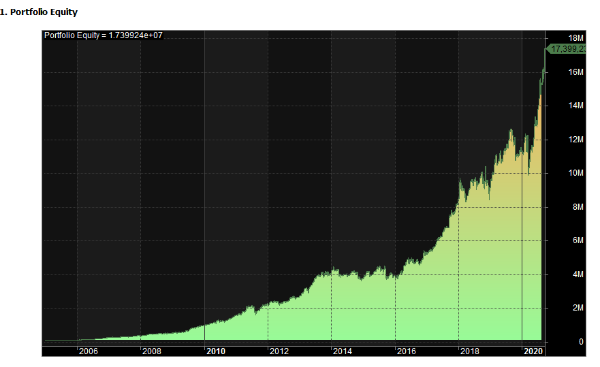

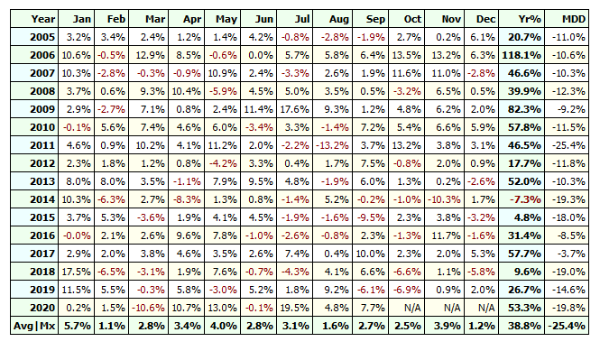

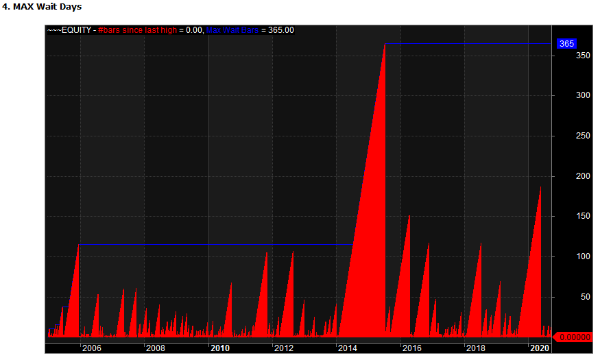

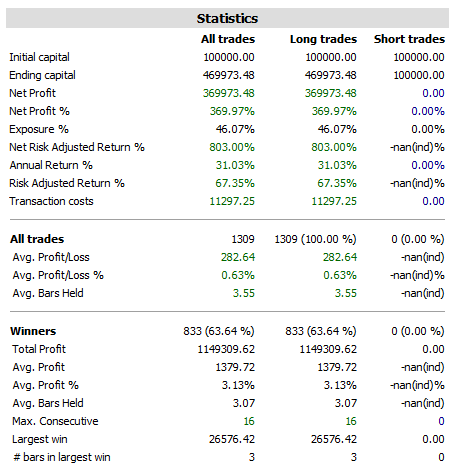

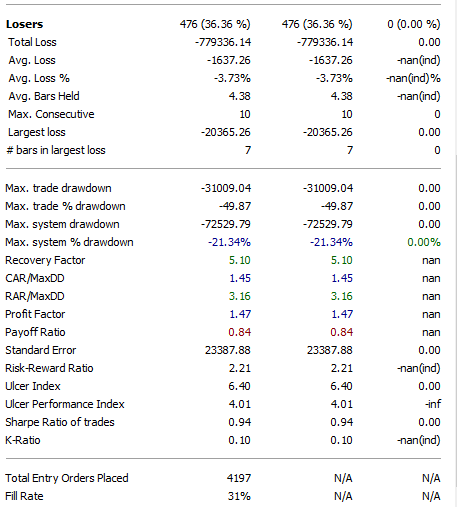

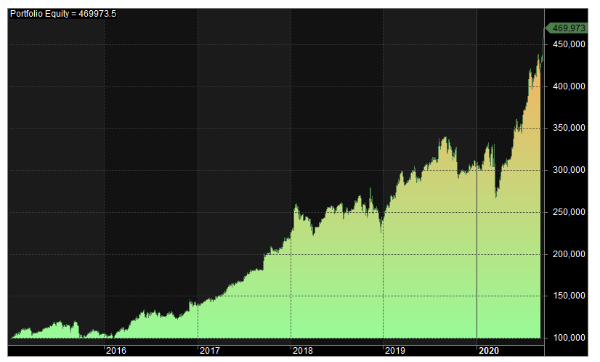

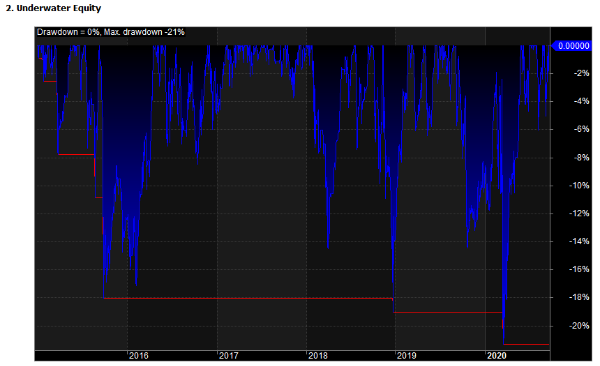

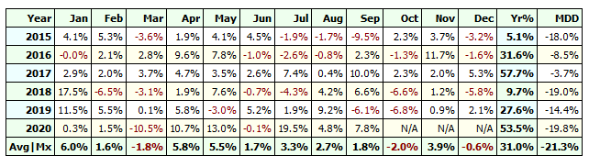

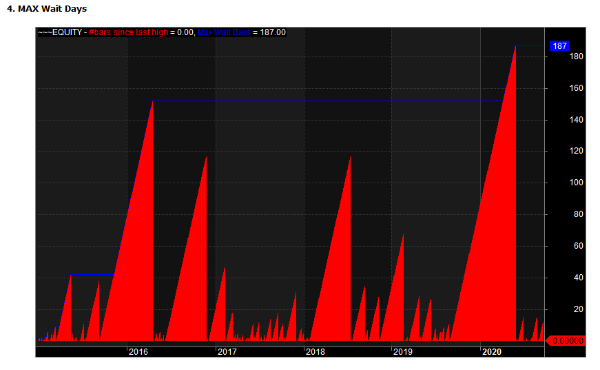

Participant15 Year Backtest MR#2 System

(No Leverage)

September 23, 2020 at 5:54 am #112170

September 23, 2020 at 5:54 am #112170GlenPeake

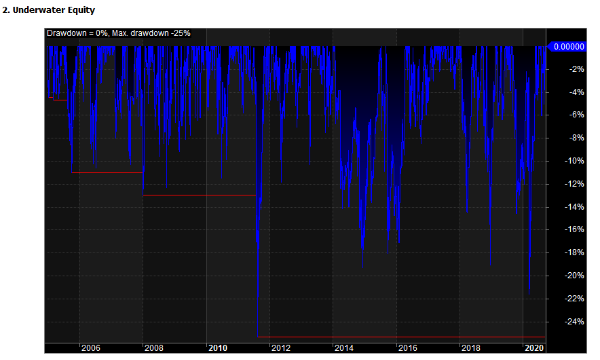

Participant5 Year Backtest MR#2 System

(No Leverage)

-

AuthorPosts

- You must be logged in to reply to this topic.