Home › Forums › Trading System Mentor Course Community › Progress Journal › Steve W’s Journal

- This topic is empty.

-

AuthorPosts

-

November 26, 2021 at 11:53 am #114074

TimothyStrickland

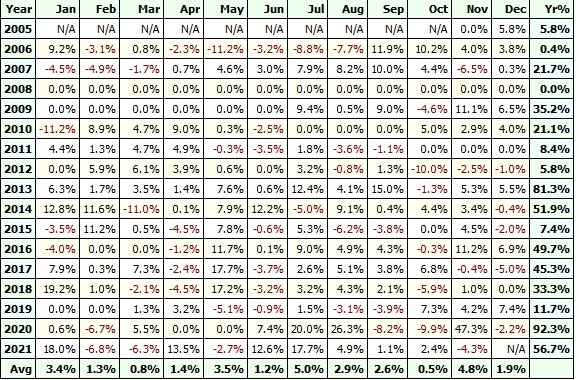

Member@Steve, that seems like a pretty robust strategy. it looks like it is getting similar performance to my NDX Momo system.

Nick, you still recommend putting more weight on recent years for backtesting right? I think I remember you telling me that, I have it written down. Doesn’t seem like it matters much with Steve’s system since it seems consistent over 15+ years.

This is my NDX Momo system. I think I initially tested 2013-2018 ish. I opened it up after that and noticed it didn’t perform as well pre-2010. At this point, I believe Nick mentioned that he puts more weight on recent years (so something to keep in mind).

CAR: 30.4% over the 15 year period, much higher in recent years. Max system drawdown: -32.63%

November 26, 2021 at 12:21 pm #114075TimothyStrickland

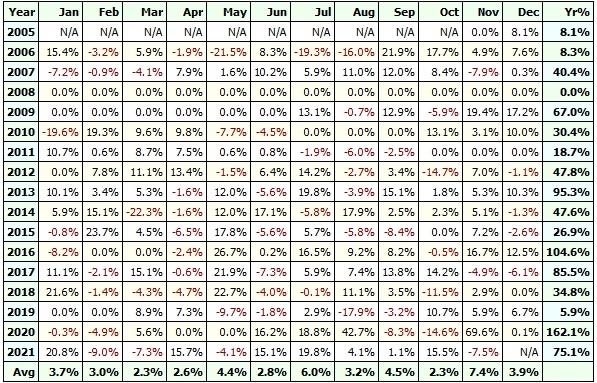

MemberThis is my NDX Aggressive strategy. I built it a similar way, however, this system has up to 35-40% drawdowns!

I have recently retired it, but I think instead I may just run a hedge on it in the event of a crash. I need to test that though.

CAR: 50.66% much higher in recent years

Max DD: -45.33%!!! yikes (which is why I need to hedge it)

Exposure: 76.98%I was willing to accept more risk than most. As a general rule of thumb, if you make the system more aggressive with fewer stocks, leveraged, or focused position sizing, you open yourself up to larger drawdowns and the risk of a black swan event.

November 30, 2021 at 2:45 am #114076SteveWallbrink

MemberHey Tim,

Your recent returns are much higher than mine – thanks for that, I will look at that in more detail my NDX system – makes sense to put more weight on recent years.December 5, 2021 at 10:23 pm #114089SteveWallbrink

MemberASX

Weekly Trend XAO: -2.5%

Weekly Trend XSO: -4%US

MOC R1000: -1,7%Aims this month

1. Implement a R2000 MOC.

2. Ramp up funding of US systems – investigate hedging US currency with increased US capital.

3. implement an XTO and an NDX momo system.I really think that the monthly momo rotational systems will be incredibly important to my portfolio – they seem so inherently robust.

Still tinkering whit the momo systems just getting my head around my drawdowns and consistency of returns – they dont seem quite up to scratch just now.

December 5, 2021 at 10:23 pm #114090SteveWallbrink

MemberASX

Weekly Trend XAO: -2.5%

Weekly Trend XSO: -4%US

MOC R1000: -1,7%Aims this month

1. Implement a R2000 MOC.

2. Ramp up funding of US systems – investigate hedging US currency with increased US capital.

3. implement an XTO and an NDX momo system.I really think that the monthly momo rotational systems will be incredibly important to my portfolio – they seem so inherently robust.

Still tinkering whit the momo systems just getting my head around my drawdowns and consistency of returns – they dont seem quite up to scratch just now.

January 4, 2022 at 10:15 pm #114160SteveWallbrink

MemberHappy new year to everyone

2021 returns:

ASX

weekly trend: +28%

B&H: +22%US

MOC R1000: +1.1% (started Oct)I will add ASX and US monthly rotational to next month

January 4, 2022 at 10:25 pm #114264SteveWallbrink

MemberHappy New Year to everyone.

I thought I would share my journey with a monthly momentum rotational system on the XAO.

I really like the inherent robustness of a momentum rotational system.

Trading monthly doesn’t bother me – the system will be for my Super Fund.

I plan to dilute signal luck by also using an existing separate weekly trend system on the XAO.

My goal is >20% CAGR and 20% to 25% DD. I also want low trading frequency (low # trade /year) and to have relatively consistent positive returns for each year end.What I have learnt is that simple is best. No fancy momentum calculations. Just looking for stocks going up more than down with some volatility but not too volatile and a regime filter.

For my investigations I have been guided by:

Nick’s Video

As well as recent forum posts about rotational systems.The plan is to:

[ul]

[li]Use no price, volume or TO filters following Glen’s lead.

ROC momentum ranking.

A regime filter.

A positive trend filter – such as C>MA or ROC up/down days.

Investigate if any one other additional filter adds to CAGR or reduces drawdown.

Investigate position sizing options

Investigate Worst Rank Held options.

Use basic parameter values rounded to 10s – I have only used 20, 100, 200 as parameter inputs

[/li]

[li][/li]

[/ul]RANKING

I have used ROC momentum for ranking.REGIME FILTER

For index regime filters ($XAO.au), I investigated:

[ul]

[li]C>MA

C>Keltner Band lower line

ADX

Dual MA

Bull Power EMA

MACD signal line > MA[/li]

[li][/li]

[/ul]For the index regime filter, I have chosen C>Keltner Band lower line, which is quite an aggressive filter offering fairly high capital employment.

The Keltner band lower line is a 20 period MA deviated by 2 * ATR(20) using $XAO.au.TICKER FILTERS

For ticker filters, I investigated:

[ul]

[li]smoothed relative momentum (relative to $XAO.au)

gap filter

ROC up/down ratio

historical volatility

volume up/down ratio

C>MA

Dual MA[/li]

[li][/li]

[/ul]I found that the ROC up/down ratio and historical volatility filters offered high CAGR and lower drawdown.

POSITION SIZING

I tested 20% (5 positions) and 10% (10 positions) fixed % of portfolio equity

Also 20%, 15% and 10% risk parity volatility based position size / 20 max open positionsWORST RANK HELD

I found that the system could cope with WRH 20, which meets my aim of minimising the # of trades per year.Some code to follow in the next post.

January 4, 2022 at 10:32 pm #114265SteveWallbrink

MemberThis is the code is used:

//=================================================================================

_SECTION_BEGIN(“ROC Up-Dn 2”);RocUpTog = ParamToggle(“ROC Up-Dn 2”, “On|Off”, 0);

ROCpar = Param(“ROC”, 1, 1, 20, 1);

LB = 100;Down = IIf(ROC(Close,ROCpar) < 0, True, False);

CountDown = Sum(Down, LB);Up = IIf(ROC(Close, ROCpar) > 0, True, False);

CountUp = Sum(Up, LB);UpFilt = CountUp > CountDown;

ROCup = IIf(RocUpTog, 1, UpFilt);_SECTION_END();

//=================================================================================//=========================================================

_SECTION_BEGIN(“Historical Volatility 200 < %"); HVTog = ParamToggle(“HV 200 <", "On|Off", 0);

HistVol200 = StDev(log(Close/Ref(Close,-1)),200)*(252^.5)*100;HVpar = Param(“HV Param <",50,30,70,5);

HVa = HistVol200 < HVpar;

HVon = IIf(HVTog, 1, HVa);_SECTION_END();

//=========================================================January 4, 2022 at 10:43 pm #114266SteveWallbrink

MemberMonthy momentum ASX XAO

Backtest SummariesBACK TEST RESULTS ON XAO – 2000-2022

All back tests use: ROC mom, Keltner XAO regime filter, ROC up>down filter, Historical Volatility filter.20% Fixed Pos Size (5 positions), 20WRH

Annual Return % 45.59%

Winners 241 (62.11 %)

Max. system % drawdown -27.80%

Recovery Factor 6.26

CAR/MaxDD 1.64

RAR/MaxDD 1.85

Profit Factor 3.71

Payoff Ratio 2.26

Trades Per Annum 1810% Fixed Pos Size (10 positions), 20WRH

Annual Return % 39.25%

Winners 485 (56.13 %)

Max. system % drawdown -26.81%

Recovery Factor 7.34

CAR/MaxDD 1.46

RAR/MaxDD 1.65

Profit Factor 3.22

Payoff Ratio 2.51

Trades Per Annum 3920% RISK PARITY VOLATILITY Pos Size | 20 Max positions, 20WRH

Annual Return % 37.46%

Winners 587 (51.67 %)

Max. system % drawdown -25.63%

Recovery Factor 7.23

CAR/MaxDD 1.46

RAR/MaxDD 1.65

Profit Factor 2.71

Payoff Ratio 2.54

Trades Per Annum 5220% RISK PARITY VOLATILITY Pos Size | 20 Max positions, 20WRH

(no historical volatility filter – assuming volatility position size is taking care of this)

Annual Return % 42.18%

Winners 708 (51.05 %)

Max. system % drawdown -29.30%

Recovery Factor 5.63

CAR/MaxDD 1.44

RAR/MaxDD 1.62

Profit Factor 2.77

Payoff Ratio 2.66

Trades Per Annum 6315% RISK PARITY VOLATILITY Pos Size | 20 Max positions, 20WRH

(no historical volatility filter – assuming volatility position size is taking care of this)

Annual Return % 37.07%

Winners 917 (50.36 %)

Max. system % drawdown -26.01%

Recovery Factor 6.42

CAR/MaxDD 1.43

RAR/MaxDD 1.64

Profit Factor 2.81

Payoff Ratio 2.77

Trades Per Annum 8310% RISK PARITY VOLATILITY Pos Size | 20 Max positions, 20WRH

(no historical volatility filter – assuming volatility position size is taking care of this)

Annual Return % 29.81%

Winners 1092 (50.21 %)

Max. system % drawdown -23.27%

Recovery Factor 6.56

CAR/MaxDD 1.28

RAR/MaxDD 1.76

Profit Factor 2.61

Payoff Ratio 2.59

Trades Per Annum 99January 5, 2022 at 3:49 am #114267danielbarbaro79

MemberHey Steve , looks very impressive , Nice work

I need to get kids to school so i can get into system building as well

All my super is in monthly rotations the same ,

log on 1 time a month and that’s it – so easyFebruary 25, 2022 at 3:28 am #114268SteveWallbrink

MemberMy MOC system has been so boring over the past few months.

Then last night – bam.

February 25, 2022 at 7:29 am #114432KateMoloney

ParticipantWell done Steve !

-

AuthorPosts

- You must be logged in to reply to this topic.