Home › Forums › Trading System Mentor Course Community › Performance Metrics & Brag Mat › Share Trade Tracker

- This topic is empty.

-

AuthorPosts

-

May 22, 2020 at 10:16 pm #102027

Nick Radge

KeymasterScott over at XL Automation is embarking on a big rebuild of STT and has reached out to me for assistance.

Some key functions and features that I he’s looking to include are:

– expand to include other trade types (eg CFD)

– enhance the Sell trade entry to allow for different methods of matching against Buys to close positions

– include foreign currency conversions within the sheet so that multiple portfolios can be tracked and seen directly in a Home currency (eg AUD or USD)

– Dividend ReInvestment functionality to create the required changes in positions when a DRP is received

– expand and extend the reporting to give better analysis across the portfolio’s and timeframes

– upload trade improved capability to use import templatesA few things I’d like to see are to do with higher frequency strategies that do a lot of trades, so

(1) speed of processing

(2) size of book/memory capability

(3) A quick clear function for the trade upload pageLet me know if you have any requests and I’ll pass them along.

Nick

May 23, 2020 at 3:22 am #111492Anonymous

InactiveDo you think there is any chance on adding DDE capability such that it can suck data in from the TWS API directly to populate trades and positions (whether still sitting as open positions or full round trip trade of opened then closed) and the associated end of day cash balance reflecting this?

One communication I had with Scott a couple of years ago was regarding the ability to enter a starting portfolio cash position at a certain date in time (assuming no open positions, just all cash), and then after recording trades in the trades window over time that the ending cash balance would reflect the cash position honouring any P&L from round trip trades as it currently does, but also reflect the cash position on any open trades that have not yet experienced a full round trip. At the time he said this was a feature that was not available and would only handle the round trip portion of trades.

So for me it would be good to be able to use it with a view of knowing where for example, starting at 1st July of the year, what my opening cash and open positions balance was, then over the course of the year be able to track both cash amounts and any open positions amounts, much like a portfolio snapshot and how the overall account has performed and is currently positioned in its cash vs open positions view.

If this functionality where available, then also some simple tick/toggle option where you could easily toggle between the “Closed trades” vs “Open and Closed Trades” view.

May 25, 2020 at 3:04 pm #111493Anonymous

InactiveI’ll second the DDE and/or any type of non-GUI based interaction. I’d love to leave a tiny linux box ($5 a month from Vultr if you needed it hosted) up with IB Gateway that STT could just connect to and pull my trades automatically. As IB has developed Gateway for Win/Lin/Mac, that would open up automation capabilities quite a lot.

I’m completely unaware of the limitations of VBA (I have no exposure there) but I know that is why STT can only be ran on a Windows version of Excel. Props to the STT dev team for making such a thorough tool within that scope.I would probably sign off of using TWS if this was a feature and rely completely on Gateway.

May 29, 2020 at 3:00 am #111498Anonymous

InactiveWould be good to see the trades uploaded via the IB trade sheet can recognise short selling activities as short sales.

Currently my IB uploads just lump both the short and long positions into the buys and sells sheets and none into the short trades sheet.

I know why, because in the trade sheet all the trades are simply listed as BOT or SLD regardless of being a long or short trade.

Still, would be nice to be able to see them in a separate list.

June 5, 2020 at 6:20 am #111526Nick Radge

KeymasterFrom Scott. Appreciate any thoughts.

Based on feedback from users I am thinking the following list of changes and new features will be a good first step as I start to improve STT.Here is a short video of a spreadsheet I developed for someone else that I am thinking to use as the basis for the new features of STT

The functions below are the ones proposed for implementation in the new version

1) Change to have all Trade detail on a single sheet. One of the key restrictions for the design of the workbook now is having the Buy and Sell trades on separate sheets. For alot of the calculations and reports I then need to match these together in the background. So in the next version I am proposing to reformat the trades sheet and combine Buy, Sell and Shorts to a single worksheet

2) Include automated currency conversion to the Trades. A large number of users have asked for this and with the approach on a single sheet I can implement easily implement this. It would show a Home Currency value for whichever Home Currency the trade is made in and then a conversion to the chosen currency for the workbook. For The Chartist users this could be AUD for others it could be USD

3) Direct entry and update of some fields on the Trades sheet. One key source of feedback from users has been an inability to enter and update data directly on the trades sheet. So with this version I am proposing we allow that for a number of fields. It will give them more control over the data and removes the need for entry forms for all changes

4) New options for Sale Trades, in the current version the user must select a specific trade to SELL and then completely close or partially close it. In this version I would propose to allow them to see all the open trades for a security and then close any or all of them based on the quantity for the SELL and what open trades have been selected.

5) Updated Open Positions, Dashboard, Charts – with the inclusion of currency conversion some additions can be made to the summary sheets and these will include the ability to see the portfolio values across the currencies and then a conversion to the home currency

6) Optimised loading of Trade details, key feedback has been the speed of upload for trades to the STT workbook. So we will develop a new guided upload that will take the upload process from minutes to seconds.

The rest of the STT features will remain as they are (eg Dividends, Cash Accounts, Update Prices)

June 5, 2020 at 9:14 am #111588JulianCohen

ParticipantSounds good Nick. I have my STT for AUD in a separate spreadsheet to the one for USD. Would you ask Scott if he would consider allowing a partial import from a spreadsheet when doing a transfer across of data, assuming that one can not do this at the moment. This would allow me, and possibly others, to transfer one or a number of AUD systems across to the main USD based sheet, or vice versa.

June 9, 2020 at 6:09 pm #111589Anonymous

InactiveCould we ask for support for IB importing via FLEX reports? IB will email them to you nightly, which is awesome. This is as close to the current export method’s format as I can get the FLEX report – Scott would have to allow some different values, but they are largely similar. I have a screen in Said’s thread for my IB configuration for the following output:

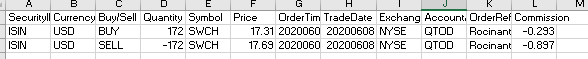

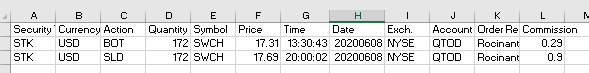

SecurityIDType;CurrencyPrimary;’Buy/Sell;Quantity;Symbol;Price;OrderTime;TradeDate;Exchange;AccountAlias;OrderReference;CommissionFLEX report output:

TWS export output:

June 9, 2020 at 10:37 pm #111616

June 9, 2020 at 10:37 pm #111616Nick Radge

KeymasterWhy do you want a flex as well at the TWS output?

June 9, 2020 at 11:19 pm #111619Anonymous

InactiveI keep my STT in a cloud folder so I sometimes access it from my home PC and sometimes from my VPS. I could add my trades without having to export via TWS on the VPS first.

I sent him my .csvs and the feature will actually already be in the new build in some manner. I’m on the beta list so I’ll test it for the flex report.

-

AuthorPosts

- You must be logged in to reply to this topic.