Home › Forums › Trading System Mentor Course Community › Progress Journal › Seth’s Journal.

- This topic is empty.

-

AuthorPosts

-

November 11, 2020 at 6:28 am #112447

JulianCohen

ParticipantAlexander, I have a total for my portfolio of MOCs and then split that total and apply it to each system. If I add a system, the account total stays the same, I just readjust the split between systems.

BTW if either of you can write up an IBKR API that allows me to run any number of systems in the one API and apply order references to them, and allow me to set maximum entries for each of the systems, then I’m happy to pay for it.

Just putting it out there….

November 11, 2020 at 9:44 pm #112448

November 11, 2020 at 9:44 pm #112448Nick Radge

KeymasterMy developer is going to take a look at a single API that can multiple systems. I’ll see what the costing is.

November 12, 2020 at 4:17 pm #112449Anonymous

InactiveJulian Cohen wrote:BTW if either of you can write up an IBKR API that allows me to run any number of systems in the one API and apply order references to them, and allow me to set maximum entries for each of the systems, then I’m happy to pay for it.Just putting it out there….

Hey Julian. This is complete and functional**, however I won’t pass it out until I have an audit or two. BUT, BUT – I would be happy to get some feedback, if and only if you would run it on paper. Probably easiest if you ping me via imessage if you have an iPhone. Skype is [email protected], or direct email is [email protected] – let’s go from there. I need another week to clean some things up, but in the console it does work correctly for me for a full trading day on the paper brokerage.

I’d love to hear what other stuff people would like to see from an API.

I have a call with nick on Sunady and I want to ask him a few questions for some specifics, but I do want to ask here as well:

Is it important to anyone that MOC exit orders are placed IMMEDIATELY after the position is fully filled, or do you care if they are all submitted right after when the remaining limit orders are closed? I have mine currently coded this way, the latter.

I’ve looked at scripting out some code to pull intra-day stock data, this opens up the possibility for intra-day limit closes as well, that also fall back onto MOC if the intra-day take profit was not hit. I think that this will end up needing to be tested in python for ease of use, since I don’t want to bother messing in amibroker for intra-day data.

Rereading this:

Quote:“I have a total for my portfolio of MOCs and then split that total and apply it to each system. If I add a system, the account total stays the same, I just readjust the split between systems.”On my to-do list is also (not near-term) being able to skip the position sizing in amibroker, because this could all be done simply outside of it with python. You could fetch your daily balance, tell the API how much money in % is allocated to each system, and then simply have the API divide price by allocation and max_positions for share quantity. Not too hard.

functional**

I’m writing this for all systems of the same STYLE to be ran on one API instance – e.g. all MOC LONG can be under one roof. Could likely make all MOC long and short work, but I don’t think it is necessary. I like some segmentation, anyway.Julian – when you say “maximum entries for each system”, do you mean submitting 100 orders and cancelling after 40 are filled for one system? Or truncating the amibroker output file to a specified number based on ranking and only submitting that quantity of orders? (that is what I currently do)

November 12, 2020 at 4:24 pm #112454Anonymous

InactiveHey Alex – I’m in Charlotte NC, so not too far depending on where you are in VA. Cool!

Regarding the job: There were certain aspects of small business ownership that I absolutely LOATHED. Social media. I hate it. Despise it. I did not know when I started this career 11 years ago that social media would be central to growth of a micro-sized small business. Ugh. Also, I’d like to be able to take vacation without having to pay for vacation time (essentially what I had to do, since I had to pay someone else to run the gym).

My contact info is in the post above – Alex, feel free (or anyone who is reading) to shoot me a message. Twitter is fine as well, although I do not check it daily https://twitter.com/algo_seth

November 12, 2020 at 7:36 pm #112456Anonymous

InactiveOk, here’s the API in it’s infancy:

Not heard is the first few words before the mic was recorded “hey friends, I’ve been working on an API…”

https://www.youtube.com/watch?v=p5MGgerteBQ

Maybe I need to make a separate google account… can’t rightly use the gym any more!

November 12, 2020 at 8:29 pm #112457Anonymous

InactiveAH! That was the other question. I know some of you have exclude lists because Amibroker has symbols like BRK.A and BRK.B – but TWS interprets the “.” as a space, so the symbols are “BRK A” and “BRK B”. I can fix this in the API so that periods are replaced with spaces in the ‘Symbol’ column. Am I right on that, or is that not always the case?

November 13, 2020 at 12:31 am #112458JulianCohen

ParticipantSeth Lingafeldt wrote:AH! That was the other question. I know some of you have exclude lists because Amibroker has symbols like BRK.A and BRK.B – but TWS interprets the “.” as a space, so the symbols are “BRK A” and “BRK B”. I can fix this in the API so that periods are replaced with spaces in the ‘Symbol’ column. Am I right on that, or is that not always the case?I have a “IB Shite” Watchlist that converts those particular tickers with a line of code, but I’ve recently switched to using the Code from Craig’s template and I can’t make it work properly so I’ve just excluded them. I should write to Craig and ask him to help me correct it….note to self!

November 13, 2020 at 12:33 am #112455JulianCohen

ParticipantSeth Lingafeldt wrote:Julian – when you say “maximum entries for each system”, do you mean submitting 100 orders and cancelling after 40 are filled for one system? Or truncating the amibroker output file to a specified number based on ranking and only submitting that quantity of orders? (that is what I currently do)I have started to reintroduce some selection bias so my API is set for 30 trades and I put 40 entries into the .csv file

November 24, 2020 at 4:19 pm #112462Anonymous

InactiveHey Alex, I’d like to get some feedback on my API. Ping me if you wouldn’t mind.

December 1, 2020 at 5:15 pm #111260Anonymous

InactiveNovember

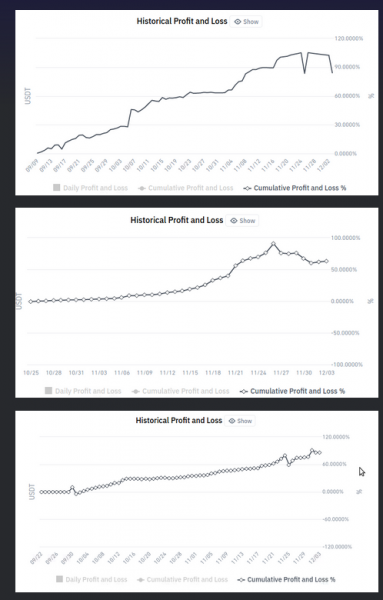

Rocinante R1000: -9.46%Prime Directive NDX: +38.63%

Not upset about anything at all for the moment… Applied to a job that Trent sent to me on twitter a few weeks ago. Transitioning with the new gym owner and will finish that at the end of the month. Wow, he has a lot to learn and his movement looks like shit. Got to start somewhere, but I sure as hell am glad I don’t own a gym anymore in the middle of a global pandemic.

Need to brush up on my resume. Would not be opposed to moving for a job, although it seems more likely as time goes on that I may find something remote.

Hoping to have MyPyAPI v 0.1 release candidate out soon. No GUI. Trying to code for submitting more orders than you want to fill has been quite a learning exercise. I think I have it all working at a rudimentary level.

Putting a Christmas tree up today! I love the tree with the lights. It is so pleasant and makes the house smell wonderful.

Oh yeah, bitcoin stuff has done well, too. I’ll post that tomorrow. No more account liquidations. Hah!

December 1, 2020 at 11:38 pm #112603TrentRothall

ParticipantNice one Seth! Not a bad month!

Good luck with the application!

December 1, 2020 at 11:59 pm #112605GlenPeake

ParticipantWOW! Great numbers Seth!

December 4, 2020 at 4:28 pm #112606Anonymous

Inactive

Crypto accounts have done better since I reduced position size. I’ve done too many stupid things in the past there, time to shape up.

December 30, 2020 at 3:48 pm #112626Anonymous

InactiveDecember

Rocinante R1000: +5.11%Prime Directive NDX: -6.27%

I needed to change to a non-professional IB account, so I’m using this week to transfer money. Huge -4% down day on Monday to close out the month.

Wouldn’t you know, today my bank is having technical difficulties so I can’t login and initiate the wire transfer.

January 3, 2021 at 12:06 am #111261Anonymous

InactiveSo the 2020 report card is a thing here? Ok, sure. Let’s do it.

Well, I started the mentor program almost one year ago. I locked down and was in a rough spot mentally with trying to sell a business that was not open. For better or worse I was able to exit on November 2nd. Better for me because I wanted to get out, but likely at a much worse price than had I sold it before the pandemic. Price didn’t change my desires, though, so I am happy with the decision.

I started trading my MOC system in May and almost immediately went into a drawdown. I started trading my NDX rotational system in June and only dipped my toe in with 5% of the account balance, because I thought “surely these economic times are unprecedented, the market can’t possibly go up…”

Well, I learned that one the hard way, but only with opportunity cost. The MOC system is green for the year by a few percent and the retirement account is green 50% for the year; I moved to 100% equity by mid-september.

I’m happy to post and see what everyone else is doing on the forum, and I have almost became impervious to getting jealous about other people’s results. If you are a beginner here, please heed Nick’s advice about the beginner’s cycle. Be confident in your systems, and trade the system. Like Mike said:

Quote:Many here and on Fintwit are posting record numbers

but I have accepted my time has not yet arrived.I’ve likely used up more mentor hours with Nick than he bargained for when I started the course, and graciously some since ending as well. I’ve made friends from this course that I text about trading things and non-trading things. I helped a friend from the course build a computer, that was fun!

At the risk of blowing up Nick’s head even further by talking of his immense market knowledge, his scrupulous and Socratic teaching method, and his patience for countless hours of phone calls with yours truly…

Ah, what the heck; I’ll stop there. I think everyone gets the picture.– RealTest is cool. Please email me if you need any help with it. [email protected]

More Long and Short systems go live tomorrow.

– I am interested in this hedge tool that is floating around… maybe time to… schedule another call….. -

AuthorPosts

- You must be logged in to reply to this topic.