Forums › Trading System Mentor Course Community › Progress Journal › Sean’s Journal

- This topic has 100 replies, 2 voices, and was last updated 3 weeks, 2 days ago by

RichardKoziel.

-

AuthorPosts

-

June 2, 2024 at 3:00 am #116157

ScottBilton

ParticipantNice result after moving your assets, it takes guts. It keeps the confidence / belief there!

June 2, 2024 at 3:37 am #116158GlenPeake

ParticipantCongratz on the month and good luck with the self managed strategies….. I’m certain they’re in good hands!

Nice to see you’re also holding $CU6.au….. It’s been on a cracking trend…. I’m also holding it in WTT and LSS

June 2, 2024 at 4:27 am #116162

June 2, 2024 at 4:27 am #116162Sean Murphy

ParticipantThis is a big outcome from me starting the mentor program Glen. I may not be a whiz at strategy building, but the bones are there!

June 2, 2024 at 4:35 am #116160Sean Murphy

ParticipantThanks Scott, and yes, I respect the challenge. But, seeing the fund manager change their style was the final straw. Onward and upward.

June 2, 2024 at 4:43 am #116163GlenPeake

ParticipantSean Murphy post=14766 userid=5450 wrote:This is a big outcome from me starting the mentor program Glen. I may not be a whiz at strategy building, but the bones are there!

I would argue you’re ahead of 99% of the other punters out there…… Strategy Whiz or not….

June 2, 2024 at 5:52 am #116164

June 2, 2024 at 5:52 am #116164Nick Radge

KeymasterGreat work Sean. The best decisions always seem to be the hardest. That said, you’ve done the work so it’ll pay off in due course.

June 3, 2024 at 12:09 am #116167Sean Murphy

ParticipantThanks Nick, yes it will all pay pay off in due course. “A portfolio of robust strategies operated over the long term”.

June 9, 2024 at 1:22 am #116172Sean Murphy

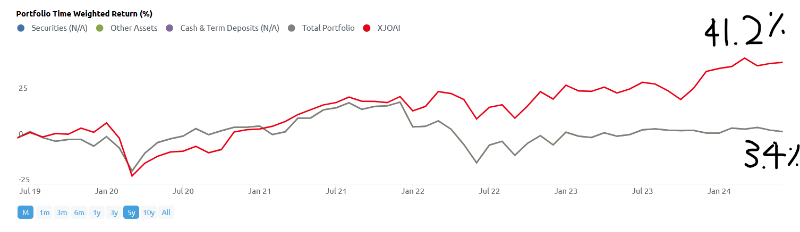

ParticipantFor the sake of completeness and as a reminder to myself, I’ll include a chart of the recent 5-year performance of our exited managed fund.

From July 2019 to June 2024, the managed fund had a total return of 3.4% compared with the All Ordinaries Accumulation Index return of 41.2%. For the fund, the bulk of the returns were derived from dividends, which were reinvested, despite it being a ‘growth’ fund.Five years from now, I will enjoy looking back at this point, and seeing my equity curve trending above the XAOAI.

June 30, 2024 at 2:48 am #116177Sean Murphy

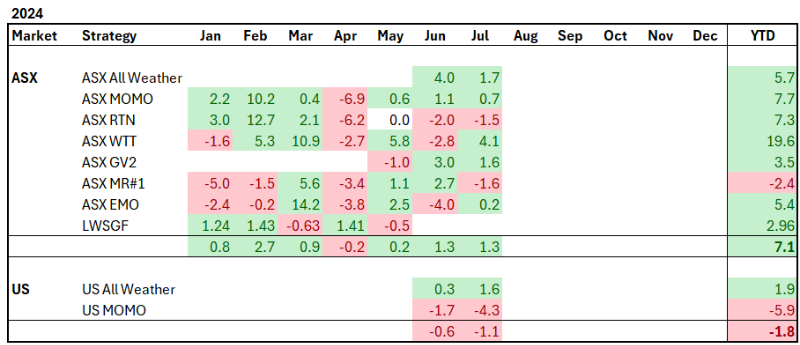

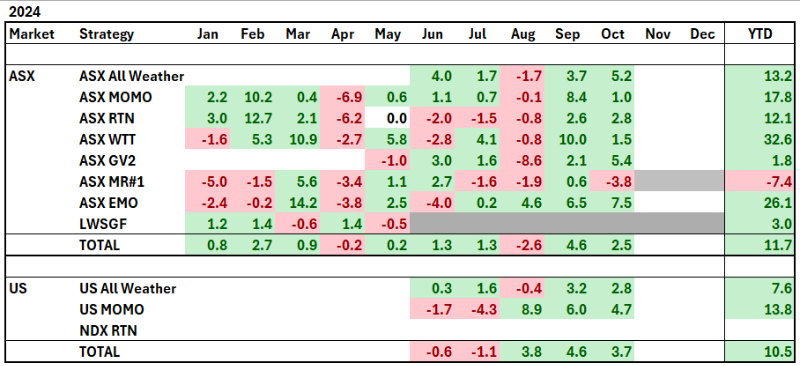

ParticipantAt the start of the month, I implemented new strategies in the Australian and US markets. In the ASX, I implemented the All Weather and Growth strategies to complement the existing ASX MR#1, ASX WTT, ASX EMO, ASX MOMO and ASX XTO strategies. In the US markets, I implemented the All Weather and US MOMO. All in all, I am happy to finally deploy this range of strategies. Having these deployed, now gives me more head space to work on further strategies, and launch into RealTest.

And to stroke my confirmation bias, the managed fund we left, is down a further 2.7% since. ASX

All Weather 3.96%

MOMO 1.08%

XTO RTN -1.95%

WTT -2.79%

EMO -3.99%

MR#1 2.71%

Total 1.72%

USAll Weather 0.28%

MOMO -1.68%

Total -0.64%Total drawdown slowly shrinks -17.34%.August 4, 2024 at 10:09 am #116193Sean Murphy

ParticipantSo ends the first month of the new FY. It marks the second month of operating a suite of strategies across the AUS and US markets. The focus of the month has really been about making sure my processes were in place and executing. The start of August looks a bit bumpy, did someone mention Murphy’s Law?

I’ll try reporting my strategy performance like this.

August 6, 2024 at 1:23 am #116251

August 6, 2024 at 1:23 am #116251Sean Murphy

ParticipantThe recent volatility in Japanese, US and AUS markets appears to be a litmus test for the status of my mind. So, I’ve decided to journal some observations that down the track I may reflect upon. Particularly, I wanted to capture that compared with periods like 2020 and through the grind of 2022-23, my mind set is different this time.

At this time, I find myself looking at the markets with a calm, semi-detached interest. None of what is going on is under my control. My focus and control is on executing my strategies and completing the trades, just following the exits as they come along. They are my responsibilities. There is no knee-jerk emotional response. If the markets continue to head south, so be it, exits will happen. The plans are in place, the strategies have their exits, and when the markets are ready, the strategies will have entries.

In prior periods of volatility, I spent a lot of energy attempting to second guess where the markets were heading. Now, I understand the markets will go where they do. I know full well, that my suite of strategies will be ready and waiting for the opportunities, on daily, weekly and monthly timeframes.

Training, Executing, Trusting.

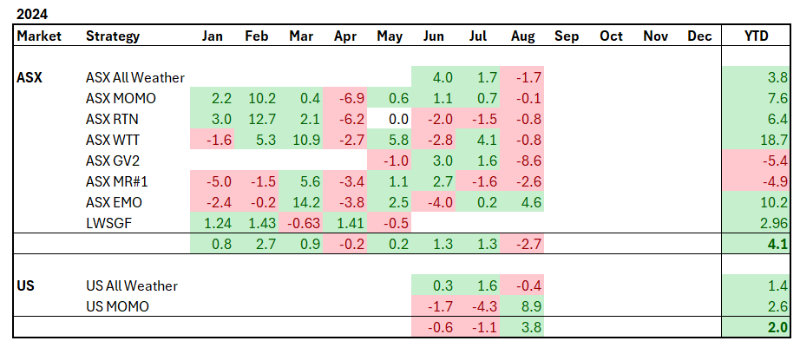

September 1, 2024 at 10:47 pm #115425Sean Murphy

ParticipantA hold my breath sort start to the month. When the volatility began in early August from the unwinding of the so-called Yen-carry trade, for me it was my first big test to stay true to my systems. I had to trust that if a large correction was to unfold, the systems would exit in due time, and my portfolio would be spared the worst of it. If so, we would rebuild when the market was ready. So, it was a good learning experience for me to hang tight and ride the wave. I’m glad I did. All’s well, no harm no foul, carry on. With the volatility for the month, I was surprised at how few trades my ASX MR#1 system took, just 10. Of these, 7 were opened in the first 2 days, and 3 in the last 3 days of the month. The uptrend condition for individual stocks prevented entries. The open trades are all showing a profit, subject to closing them out today, Monday. Elsewhere, my ASX growth took a fair hit. Exits, triggered by earning reports in the early part of the month, did the most damage.Looking at the relative performance of the different strategies across the US and AUS markets, I am starting to see the material benefit of the strategy diversity. Net result for the month down <1%.

October 1, 2024 at 12:09 am #116301

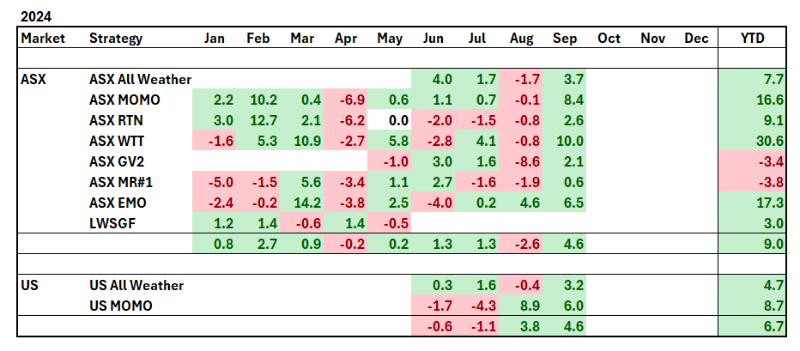

October 1, 2024 at 12:09 am #116301Sean Murphy

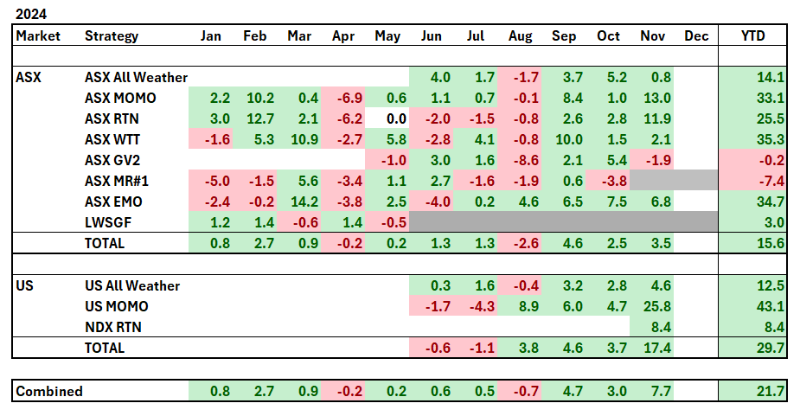

ParticipantA full house of green is nice to see. I’ll take that. Interesting coincidence that both AUS and US results for the month were the same.

I have another decision to make, but I’ll put that in another post.

November 1, 2024 at 10:15 am #116332

November 1, 2024 at 10:15 am #116332Sean Murphy

ParticipantAnother month in the green, for all strategies bar one: the ASX MR#1.After 200+ trades in the MR#1 system, including a revision after 100 trades, I’ve come to the conclusion that its not possible to reliably trade the strategy. The differences between backtest and livetrade were insurmountable. The result on a handful of trades destroyed the profits that I had steadily amassed. Two positions gapped through my exit price forcing me to chase the exit, and so considerably underperforming the backtest. A third, failed to get a fill on what turned out to be a solid profit. A fourth, I elected not to take the trade because of media attention on the stock, but it too turned out to be a highly profitable trade in the backtest. And, a fifth, went south on media speculation about the CEO, resulting in a disproportionate loss. So, what did I learn? I learnt that just because a strategy appears profitable in backtest, it is not necessarily profitable in live trade. Liquidity and price volatility on the ASX can work against such a system. I developed a better understanding of MR systems, and how they operate. I patiently executed 200 trades, giving the system every chance to be profitable, got a good sample of trades to assess expectancy, from which I could conclude to park it. Perhaps an indicator that the system was not a good fit for me was the angst lurking in the background each time I sought to exit positions; would I get my exit at the open or not? I tried several different approaches to exit, including hidden orders, but there was always concern that I might not get my exit. Where to from here? I will reallocate the capital to another strategy in the US market. Doing so will bring my allocation a step closer to 50:50 ASX:US markets.Onwards.

November 30, 2024 at 1:23 am #115426

November 30, 2024 at 1:23 am #115426Sean Murphy

ParticipantWell, that was a good month, with total account up 7.7%. A raft of positions popped across multiple strategies, compounding returns.

For what it is worth, since converting my managed fund over to these strategies, my equity is up ~16%. By comparison, the data for the fund shows a rise of ~2%. The fund manager continues to execute, in their words, “a highly strategic sell down” of its 25-30% holdings in BBOZ and SPXU. This comparison vindicates my decision to learn the tools of the trade to self-manage, haha. Thanks Nick!

-

AuthorPosts

- You must be logged in to reply to this topic.