Forums › Trading System Mentor Course Community › Progress Journal › Scott’s Journal

- This topic has 821 replies, 4 voices, and was last updated 1 week, 5 days ago by

ScottMcNab.

-

AuthorPosts

-

December 1, 2023 at 9:49 pm #103305

ScottMcNab

ParticipantNov2023 Index ETFs (paper trading) 3.9%

currently holding ijp, ivv, vgs and ndq

prob go live in Jan so the next month likely to also be good on paperFebruary 1, 2024 at 7:46 am #103306ScottMcNab

ParticipantNot really happy with return of my etf systems so it back on hold

started live trading MRV system with small account after long layoff…TWS was so far out of date it refused to update and needed re-installation…updates on Chartist API smooth

will continue to monitor results v back-test to make sure I have not missed anything crucial regarding changes in RT code since I was last live….so just the one system at the moment and will endeavour to resurrect the other 5 I used to trade over the next month or two….or three..orFebruary 1, 2024 at 8:18 am #115950JulianCohen

ParticipantSeeing as the other strategies have had a nice OOS period of time, did they make money?

February 1, 2024 at 7:34 pm #115951ScottMcNab

ParticipantI think basic pattern was lost money in 2022 and recovered in 2023 but will look further….seeing all the OOS talk a while back on the RT forum I was tempted to post the results of a couple but there are a few individuals on that forum that can be a bit arrogant/abrasive ….my first ever system constructed at the completion of the Mentor Course was designed in 2016 and started trading in early 2017. It has had two changes in that time after I switched from Ami to RT. The first was to add an exit if stock tanked (doesn’t actually improve back test but seemed prudent after covid) and the second was allowing entry following day (v Ami default of waiting until exit signal to be eligible again)…i might back those changes out and compare them

February 1, 2024 at 10:08 pm #115954Nick Radge

KeymasterQuote:there are a few individuals on that forum that can be a bit arrogant/abrasiveYeah. I rarely post now. Not worth the grief.

February 2, 2024 at 8:18 am #115955JulianCohen

ParticipantI just ignore him

February 2, 2024 at 9:50 am #103307

February 2, 2024 at 9:50 am #103307ScottMcNab

ParticipantAnother fun friday night on call as unpaid uber driver for the girls….so played around with back test results

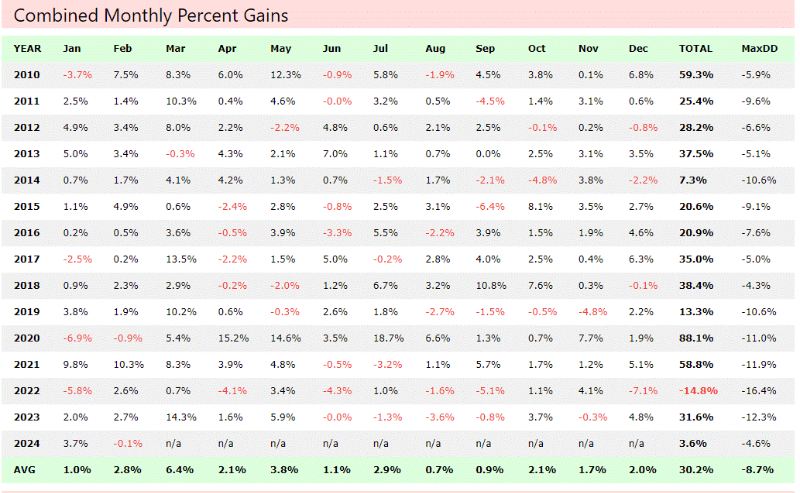

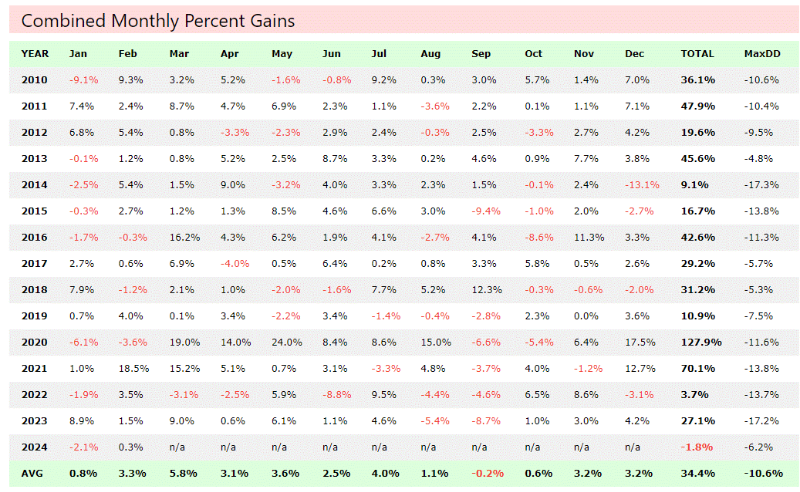

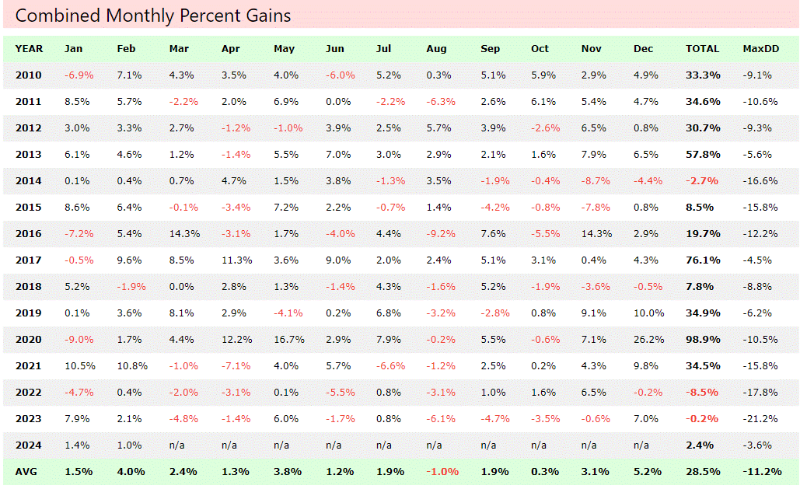

I only have 3 distinct mrv type systems..in practice they are used either moc, mono or mrv (3-6) days with or without leverage and spread between RUI, RUA and USA (much as the same as many here do) but I was unsure how to test the systems against each other per se…. in the end just used all USA as universe and tested as a MRV system without leverage (10×10)…in reality some systems did not achieve these returns as results of the same system on RUI not as good as on USA…anyway…lets see if I can post pics in a readable format

sys1 was designed end of 2016 and traded live since 2017 in different forms (moc, mrv, mono)…I tried to add in the old code (to copy the amibroker delay if missed entry) but didn’t seem to work unless added legacymode:true….which then mucked up something else and I lost interest…so apologies that the results are without that original feature

February 6, 2024 at 4:02 am #103308

February 6, 2024 at 4:02 am #103308ScottMcNab

Participant3 systems running now at very low acct size

I’m finding it strange and interesting in a slightly twisted way the push back I am getting psychologically …I don’t really seem to want to get back into it…systems have years out of sample and have not degraded in US, XAO or TSX markets… but still

Perhaps it was covid ? I found that time quite stressful…up until then I don’t recall it bothering me too much

I feel like trading at full size is like waking up every morning waiting to see if the stranger at the door is going to punch me in the face or hand me a wad of cash…I could reduce size but it seems to defeat the purpose.

I guess the only answer is to stop whining, suck it up and get back in the ring…but I find it intriguing nonethelessFebruary 7, 2024 at 5:08 am #115963JulianCohen

ParticipantScott McNab post=14510 userid=5311 wrote:I guess the only answer is to stop whining, suck it up and get back in the ring…but I find it intriguing nonethelessThat’s the way mate….You’ve got a tough chin, just take it and carry on. The wad of cash will appear at some point.

February 7, 2024 at 7:41 am #103309ScottBilton

ParticipantFrom 1 Scott to another: this is a confidence game.

How to get that confidence back and build up the size on top of gains?

Also helpful: I only look at my acct balance once per month. On TWS I’ve switch from Mosaic view to Legacy, so can do my stuff without seeing the balance.February 8, 2024 at 4:12 am #103310ScottMcNab

ParticipantSeems it was my sixth sense…all 3 systems bought NYCB

February 9, 2024 at 9:22 am #115967

February 9, 2024 at 9:22 am #115967JulianCohen

ParticipantHave you tried putting them all into one portfolio and then restricting the stocks that can be held in more than one strategy?

February 9, 2024 at 11:07 pm #115968ScottMcNab

ParticipantI have thought about it and promptly put it back in the basket labelled “beyond my limited intelligence”….I am waiting for one of the “lodgers” to become proficient at coding and then I will slide it across her desk in exchange for keys to the car or some other bribe

Do you know off the top of your head please how it would output the buy/sell orders ? Would it be as a single csv that I then need to divide into three separate csv files to upload into Chartist API for each system ? Or does it have the ability to generate individual buy/sell CSV files for each of the 3 systems ? Either would work I guess so no big deal either way.. Hmm…I need to have a crack and see what (garbage) I produce.

Good prompt regarding my laziness…appreciated

February 9, 2024 at 11:19 pm #115969Nick Radge

KeymasterScott, are you on RT or still AB?

February 10, 2024 at 2:44 am #115970JulianCohen

ParticipantIf you are using RT it will produce one file that you upload to your API. The strategy name will be the order reference so it is easy for RT and you to tell what from what.

It’s not code intensive…reach out to me and I’ll guide you through

-

AuthorPosts

- You must be logged in to reply to this topic.