Home › Forums › Trading System Mentor Course Community › Progress Journal › Scott’s Journal

- This topic has 816 replies, 2 voices, and was last updated 19 hours, 21 minutes ago by

Nick Radge.

-

AuthorPosts

-

December 5, 2022 at 7:50 am #103297

ScottMcNab

ParticipantMRV RUI…so far so good

December 5, 2022 at 7:51 am #103298ScottMcNab

ParticipantMRV RUA….wtf….

December 5, 2022 at 10:15 pm #103299

December 5, 2022 at 10:15 pm #103299JulianCohen

ParticipantThe RUA has been quite volatile this year.

December 6, 2022 at 2:09 am #115300Nick Radge

KeymasterThe S&P 500 fell 1.8% today, its 58th decline of 1% or more this year. That’s the most downside volatility we’ve seen since 2008.

December 8, 2022 at 12:48 am #103300

December 8, 2022 at 12:48 am #103300ScottMcNab

ParticipantI’m still unsure about it tbh. One the one hand when I designed the MRV RUA it was as part of a suite of MOC and 3-4 day MRV systems and so it has no index filter or stock selection criteria that will exclude trades in a downturn. This is fine when the return of the portfolio is concerned and as such the system has not done anything unusual or unexpected in the market that we have experienced.

On the other hand, as Nick has highlighted, this has been an unusual year….but this system did so much worse than it has in years with similar down days. I will (most likely) turn off a system if DD hits 2x previous max historical DD and this system was heading towards that level. I am not considering any major changes but am thinking more along the lines of “just because it has never happened in the past it doesn’t mean it cant in the future”. I am not really keen on going too far down this rabbit hole. I am thinking it may be prudent to simply add a line of code that gradually reduces position size in this particular strategy (even if it results in a slight drop in CAGR) to ensure I do not have a crisis of confidence in the system in the future (no doubt I would turn it off just before it bounced).

I will think on it more. I am keenly aware of the risk that I am potentially making (another) rookie mistake here but am weighing it up against the desire to retain confidence in the system going forward.

December 8, 2022 at 1:09 am #115302JulianCohen

ParticipantI would say in this circumstance your gut instinct is correct. Better to taper a strategy to your sleep at night level, than to cut it and worry that it might improve immediately.

This way you still have skin in the game.

December 8, 2022 at 1:26 pm #115303LEONARDZIR

ParticipantScott this reminds me of Perry Kaufman’s observation that almost all systems undergo increase volatility and drawdowns in the future. I follow some of his systems and he doesn’t ‘r use index filters. but shuts off the system if the volatility of the system returns is too high.

December 11, 2022 at 4:30 pm #115304RobertMontgomery

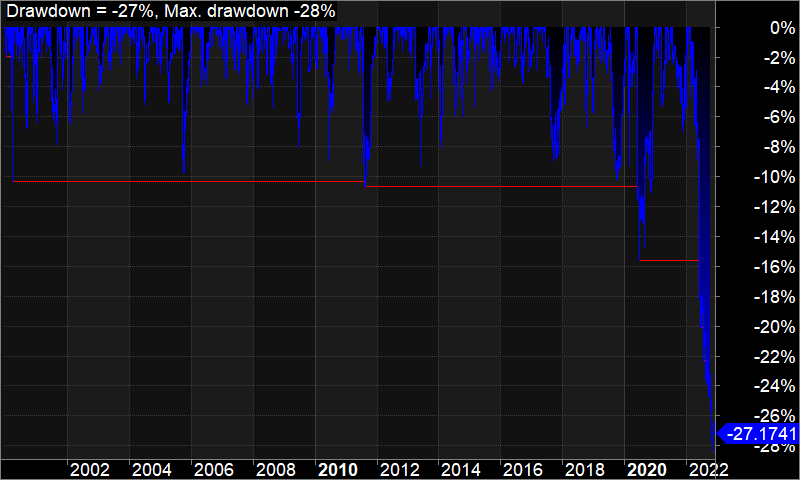

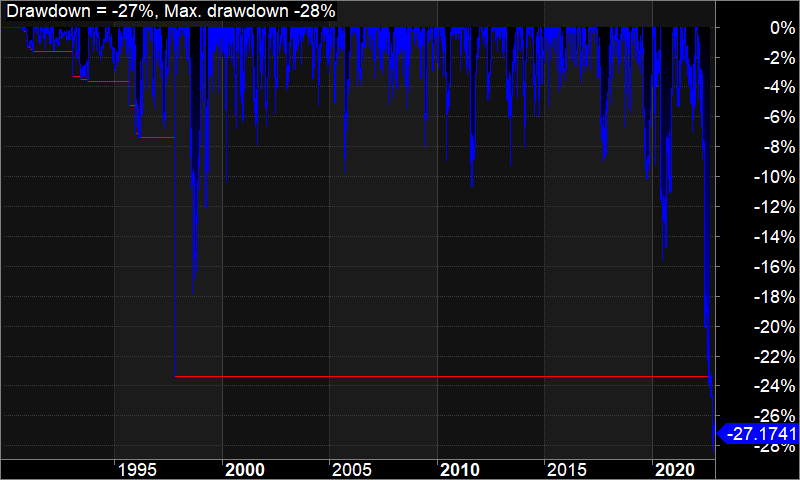

ParticipantJust for perspective and sharing this is what my MOC system on the R3000 has been doing recently. It navigated 2008 much better than 2022, interested to hear what others think could be contributing and if I should be considering changes to the rules.

December 11, 2022 at 11:38 pm #115305

December 11, 2022 at 11:38 pm #115305KateMoloney

ParticipantHow did your system perform in the 90’s?

In 2008 the interest rates dropped, this year they are rising and in higher increments.

I added a dynamic stretch to my MOC systems – it increases the stretch when the market is trending down.

December 12, 2022 at 12:04 am #115306RobertMontgomery

Participant December 31, 2022 at 9:28 pm #115307

December 31, 2022 at 9:28 pm #115307ScottMcNab

ParticipantHi Kate.. I just found this message which is strange…my apologies…the backtest images were from 1995 so the system found this year tought…like the dynamic stretch too…I think i was a tad naive designing this one…have decided to add an exit if stock tanks since previous low

December 31, 2022 at 9:30 pm #103301ScottMcNab

ParticipantNo trading again in Dec….sat on sidelines for 3/4 of year so finished year flat

Happy New Year to all….pretty glad to see the end of 2022….roll on 2023

February 5, 2023 at 8:37 am #103302ScottMcNab

ParticipantSpent month converting systems into RT. Traded for about 4-6 months using RT back in 2021 so had a framework to work and update from…been quite a few changes since then. Trading has just been with small account size to live test (1 mistake found so far)

October 8, 2023 at 2:53 am #103303ScottMcNab

ParticipantStill on the sidelines…went to cash Feb 2022…boredom and FOMO led me trade July-Sep 2022 with about 5% of equity….missed carnage of 2022 but also missed out on rebound in 2023 so swings and roundabouts

Been playing around with ETF’s

ended up deciding on a model using Aus domiciled etf’s in hope of avoiding hedging currency risk…and also decided to limit myself to stock indices initially

as the USA makes approx half of world stock market I made 2 lists….one with Aussie plus other world markets and the second only USA Index etfs

I worry that this decision is curve fitting….the other possibility is to have a single list of all world index etfs and simply let the system pick

currently sticking with the 2 lists but would welcome feedback

each list (world ex-USA and USA) gets 50%

there are 18 etfs in world list and system picks 4

are only 4 in USA so system picks 2

no double upstesting from 2014 onwards I came up with quite a few systems that seemed ok but was unable to decide…as I am essentially just trend following an index I took the systems and ran them over SPY from its onset….that knocked a few contenders out with large drawdowns….results of best system were cagr 9 maxDD 18 vola 11

so I then applied them to stocks themselves (using same entry criteria as an index filter) and ran them back to 1995… was only really left with a single system

when I run this back over my 2 lists of etfs from 2014 onwards I get a cagr of a bit over 8 and a max DD of about 16 (with vola a bit over 10)

It seems a bit underwhelming to be honest

Perhaps the results are not unreasonable for a simple trend following system on stock indices

November 1, 2023 at 8:53 pm #103304ScottMcNab

ParticipantStarted paper trading aus domiciled world etf TF system….which then immediately exited 2 of the 4 positions….off to the races

-

AuthorPosts

- You must be logged in to reply to this topic.