Home › Forums › Trading System Mentor Course Community › Progress Journal › Scott’s Journal

- This topic has 816 replies, 2 voices, and was last updated 3 hours, 5 minutes ago by

Nick Radge.

-

AuthorPosts

-

April 3, 2020 at 8:19 am #103238

ScottMcNab

ParticipantNot seen stock change symbol before.

Bought RTN on 1 Apr

Log on tonight…holdings of RTN is 0 and now have RTX…which cant even find anywhere on NYSE?Not sure if TWS playing up again like did a few months ago or a corporate action of some kind..

April 3, 2020 at 8:23 am #111227SaidBitar

MemberSimilar thing happened to me in WTT few months back with Option care health

April 3, 2020 at 8:33 am #111228ScottMcNab

ParticipantJust found it…merger…hmm

April 30, 2020 at 12:03 am #103239ScottMcNab

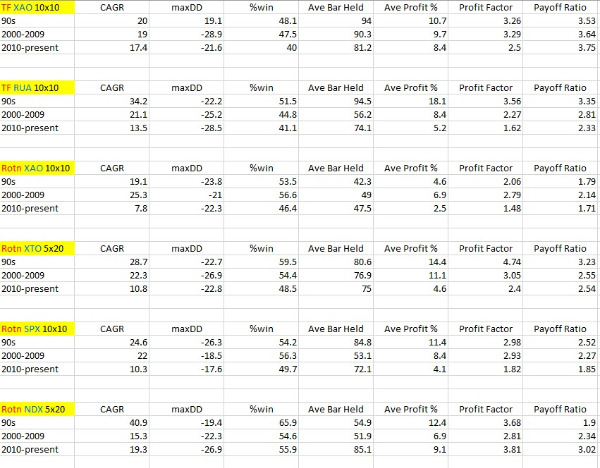

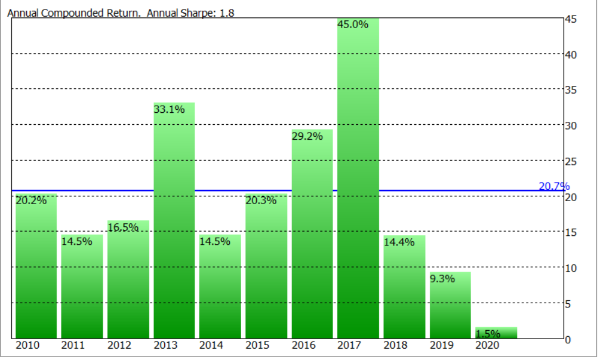

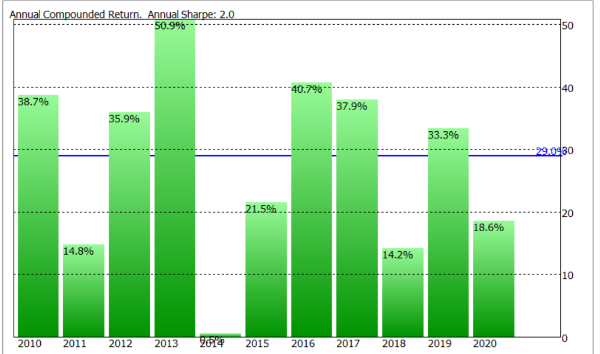

ParticipantCouple of the posts recently regarding performance of longer term systems so thought I would test again

only 2 systems here..first is a longer term TF system and other is rotational system…these 2 systems are then applied to different markets

April 30, 2020 at 12:08 am #103240

April 30, 2020 at 12:08 am #103240ScottMcNab

Participantso…the air conditioned lawn mowers purchased for the grounds keepers in the 90’s were sold off and now Jim’s mowing comes twice a year

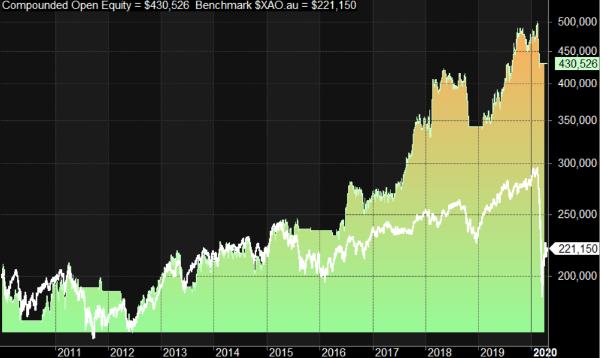

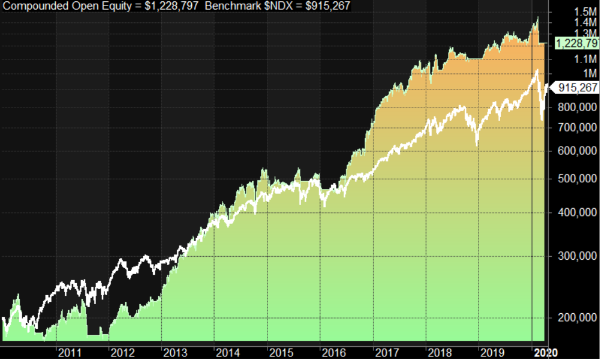

It never is a simple as it seems though…rotn system on XAO looks like (was) a dog for last decade and NDX smashed it (even though exactly the same system)…but when compare to underlying index the XAO rotn system outpaced the returns compared to index while NDX kept pace. (edit…XAO done bit over 10% while Rotn on XAO returned over 100% when I look more closely)

I find these longer term systems harder to trade than shorter term systems…not unusual to be in drawdown for 2years. They can underperform a market for years too…but taken over any decade they have always kept pace or outperformed (so far)

In the end, I think we just have to accept what the market gives us and to diversify across systems and markets…unless we can predict which market will outperform in the next decade what other logical choice do we have?…the next decade may resemble any of the previous ones or be completely different again…may look like Tokyo in 90s or NDX in 90s or SPX in 70s :S

April 30, 2020 at 3:37 am #111365

April 30, 2020 at 3:37 am #111365GlenPeake

ParticipantHey Scott,

I guess it’s a case of next 1000 Trades and diversification.

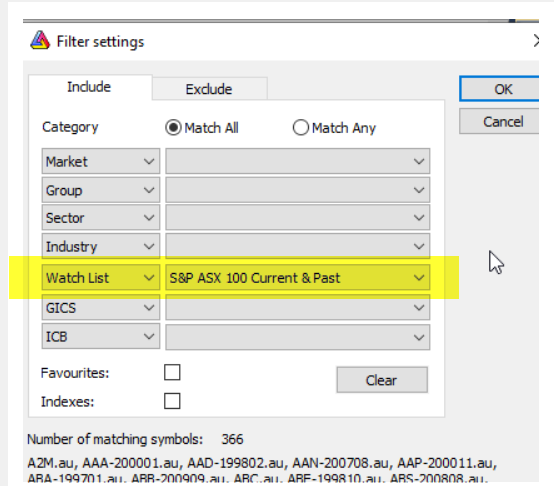

Just curious, for your XAO / XTO rotational stats, which universe did you run the backtest on?

For me I’m running against ASX100.

Stats below:

//////////////////////////////////////////////////////////////////

2010 – Present

CAGR: 20.04%

maxDD: -19.53%WIN%: 64.49%

AveBarHeld: 55.75

AveProfit%: 7.77%ProfitFactor 3.63

Payoff Ratio: 2.00//////////////////////////////////////////////////////////////////

2000 – 2009

CAGR:21.16%

maxDD: -33.70%WIN%: 64.96%

AveBarHeld: 56.99

AveProfit%: 8.00%ProfitFactor 4.58

Payoff Ratio: 2.47April 30, 2020 at 4:59 am #111367ScottMcNab

ParticipantHa…Those were the mind blowing stats that sent me of on a 2 week rotation binge..I couldn’t get anywhere close to them

This in turn made me refocus on original goal ..if I get to 70 and have achieved 15% CAGR and not greater than 25% DD for portfolio I will be thrilled (firstly to still be alive but also with) the results. I sometimes take for granted what we have been able to create in this course!

The 2 week dive resulted in a new rotation system which has a lot fewer moving parts…it also exits any day the index filter turns nasty but will not restart until next month (if index filter allows)…this hurts back-test metrics but is just what I need to do psychologically to be able to trade it going forward

I am a bit confused re the universe question…XAO is All Ords and XTO is ASX 100..was that the universe question sorry or was it more to do with filters used?April 30, 2020 at 5:43 am #111368GlenPeake

ParticipantYep… universe. I.e. watchlist universe etc.

I.e.

Apologies for the confusion.

ASX100 for me (so far), has proven superior/stable for results in the monthly rotational backtests etc…..

Also from a diversification point of view…. My WTT universe targets XAO All Ords…. and because of MIN/MAX price filters will “generally” exclude some of the ASX100 stocks, due to the ASX100 stocks above my MAX Price filter of $10…..

Therefore, minimal correlation between my WTT system and ASX100 system…. sure there will be double ups here and there between my WTT/ASX100 ROTN, stocks from time to time, but that probably will ‘hopefully’ be a profitable outcome etc.

As a side thought, with exiting intra month for capital protection approach and psychological trade-ability (is ‘trade-ability’ even a word lol)…..maybe consider (if you haven’t already done so) Nick’s suggested approach, i.e. divide capital into 50/50, buy 50% at the start of month and then manage the other 50% using the weekly approach.

But your comment

“I sometimes take for granted what we have been able to create in this course!”…is certainly a valid one and resonates with me. It’d be even ‘tougher’ trading without the systems that we’ve developed from the course. I’d never be able to build/deploy the systems I have without Nick’s/Craig’s and the forum’s assistance.

We may not be seeing the big % returns we’d all love to be seeing/experiencing….. but we’re not wiping ourselves out, sitting on -50%, -60%, -70% drawdown etc keep in mind, that some of the big funds are also doing it tough (or even going out the back door).

It’s interesting listening to some of my work colleagues talk about how bad their SUPER is performing down circa 20-30%….. keeping in mind that for the majority, it’s being managed by the ‘professionals’…..

We’re certainly trading at a much higher/professional level than previous/most of the punters out there.

April 30, 2020 at 6:02 am #111369Nick Radge

KeymasterQuote:It’s interesting listening to some of my work colleagues talk about how bad their SUPER is performing down circa 20-30%….. keeping in mind that for the majority, it’s being managed by the ‘professionals’…..Well, it’s actually worse than it looks. Those superfunds are majority in bonds which ‘tend’ to be lower risk than straight equities.

April 30, 2020 at 6:16 am #111370GlenPeake

ParticipantNick Radge wrote:Quote:It’s interesting listening to some of my work colleagues talk about how bad their SUPER is performing down circa 20-30%….. keeping in mind that for the majority, it’s being managed by the ‘professionals’…..Well, it’s actually worse than it looks. Those superfunds are majority in bonds which ‘tend’ to be lower risk than straight equities.

Yeah it makes you wonder….It’s a pretty scary thought that we may only just be scratching the surface with the ‘really bad’ financial performance news, yet to hit the headlines.

April 30, 2020 at 6:20 am #111371Nick Radge

KeymasterIt also makes you wonder what would’ve happened if equities didn’t have this bounce. Peter Switzer’s “Dividend” fund is -36%.

Forager Funds are -70%.

Montgomery just shuttered yet another long/short fund as its lost money every year since launch in 2016.

Some of the Perpetual funds are -48%.

The Regal Small Companies Fund is -48%

It’s fucking pathetic, if not disgraceful…

April 30, 2020 at 7:31 am #111372JulianCohen

ParticipantBut they are all experts!

Definition: ex is something that has deceased

Spurt is a drip under pressureApril 30, 2020 at 9:38 pm #103241ScottMcNab

ParticipantApril 2020

XTO Rotn: switched off by Index filter

MRV RUA: -0.3% (only 3 trades only for the month…applied for Jobkeeper allowance)

MRV RUI: 6.4%May 15, 2020 at 11:17 am #103242ScottMcNab

Participantthe MRV RUA was rejected for Jobkeeper on grounds it was just a lazy sod

Here are the current stats from 2020 (10 positions at 10%)

This system has a filter so only trades when price above a MA…so I combined it with another system in development but only used it when below the MA…so original system only above MA..new system only when below MA (10 positions at 10%)

May 15, 2020 at 10:20 pm #111445

May 15, 2020 at 10:20 pm #111445Nick Radge

KeymasterQuote:rejected for Jobkeeper on grounds it was just a lazy sod

-

AuthorPosts

- You must be logged in to reply to this topic.