Home › Forums › Trading System Mentor Course Community › Trading System Brainstorming › Same Day Trading Idea Discussed on the Group Call

- This topic is empty.

-

AuthorPosts

-

June 28, 2016 at 12:31 pm #104509

ScottMcNab

ParticipantScott McNab wrote:Darryl Vink wrote:Said Bitar wrote:It will be great if anyone can verify if there is any benefit from exiting on same day on the close, because there is chance i made mistake some where and day dreaming about the results

I had a go with some interesting results: –edit: results based on 20/20 position size/max positions from 1/1/200 till 24/6/2016

Results at first glance are a bit misleading wtih my system. Here is the initial results table that looks good!:Then on closer inspection at the profit table. There are clearly some bumper years that skew the results:

Is that maxDD of -18 correct Darryl? Seems lower than any of the individual years ?

June 28, 2016 at 12:46 pm #104510Anonymous

InactiveScott McNab wrote:Is that maxDD of -18 correct Darryl? Seems lower than any of the individual years ?good question… i noticed the other day while backtesting… i assumed the monthly average shown in the table was somehow under-cooking the results. here is the code that calculates the maxDD for the ‘enhanced profit table’:

Code:// — MaxDD —

EQ = C;

MaxEQ = Highest( EQ );

DD = EQ – MaxEQ;

MaxDD = Lowest( DD );

DDpct = 100 * ( EQ – MaxEQ ) / MaxEQ;

MaxDDpct = Lowest( DDpct );im not sure why the difference in maxDD between the backtester and the table. i would tend to believe the backtest resutls over the table

June 28, 2016 at 9:45 pm #104479Nick Radge

KeymasterJust a word from an old hand: 20% position size is quite large. You open yourself up to large exposure in my view.

June 28, 2016 at 10:53 pm #104480ScottMcNab

ParticipantJust checked Wiki…largest drops over 1 day for SP500

1987…20%

3 times in 2008 at 8%20% drop when using margin is a terrifying prospect

June 29, 2016 at 12:37 am #104481

June 29, 2016 at 12:37 am #104481LeeDanello

ParticipantWhat about having the system on all the time and turning leverage off and reducing position size when the index filter turns down and then cranking it up when the filter turns up.

June 29, 2016 at 12:45 am #104662TrentRothall

ParticipantYeah i don’t know if i could do 20% leverage, seems like a fair bit. If the results are achievable you only need 50% anyway i think.

June 29, 2016 at 7:59 am #104482ChrisVirides

MemberI am in the midst of doing a Daily Walkthrough from 2010 until present 20 pos @ 20%. Not sure if anybody could honestly handle the daily variance in this strategy. The Maximum drawdown in this setup is comparitively low compared to the potential returns, but the drawdown on a daily and weekly level is significant.

June 29, 2016 at 8:35 am #104661SaidBitar

MemberScott McNab wrote:Just checked Wiki…largest drops over 1 day for SP5001987…20%

3 times in 2008 at 8%20% drop when using margin is a terrifying prospect

Instead of checking on the index you can check on the stocks in the universe you are trading.

Filter = LEAdd column the distance in percentage from the entry to the low

This will give clear idea

Of the real riskJune 29, 2016 at 1:17 pm #104483ScottMcNab

ParticipantAny reason that a system that exits on the close of the same day as entry would not allow the same capital to be used on US markets overnight and then the ASX during the day (ie work capital twice as hard) ?

June 29, 2016 at 3:15 pm #104671SaidBitar

Memberone weird question

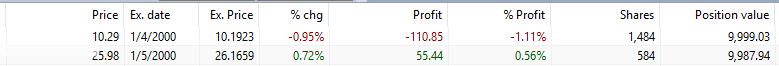

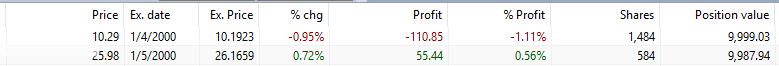

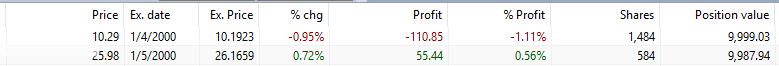

AB is giving me weird stuff:

if i multiply the position size by the entry price it is not equivalent to the position value shown10.19*1484 = 15121 while position value displayed is around 10K

anyone had this issue before

thanks

June 29, 2016 at 6:00 pm #104663JulianCohen

ParticipantMaurice Petterlin wrote:What about having the system on all the time and turning leverage off and reducing position size when the index filter turns down and then cranking it up when the filter turns up.I tested with 30/10 with Index Filter on and 20/10 with it off. I can achieve 30% CAGR with below 10% drawdowns. I need to play with this some more but this is not pushing out to 20% position size so not as aggressive and yet still getting a very good result.

I’m going diving for two weeks so I’ll see what you guys have done with this on my return.

June 29, 2016 at 8:02 pm #104672ScottMcNab

ParticipantSaid Bitar wrote:one weird question

AB is giving me weird stuff:

if i multiply the position size by the entry price it is not equivalent to the position value shown10.19*1484 = 15121 while position value displayed is around 10K

anyone had this issue before

thanks

I just ran a test Said…it does not occur for me with RUI (which is all am paper trading) but did when I loaded up for ASX300…not sure if you were using ASX?

June 29, 2016 at 11:10 pm #104677LeeDanello

ParticipantJulian, I thought you mentioned this in the group call. It’s something I will try and test on my own system.

June 30, 2016 at 12:41 am #104673TrentRothall

ParticipantSaid Bitar wrote:one weird question

AB is giving me weird stuff:

if i multiply the position size by the entry price it is not equivalent to the position value shown10.19*1484 = 15121 while position value displayed is around 10K

anyone had this issue before

thanks

I don’t have this issue on any market guys, not something to do with margin or anything somehow?

I am not sure…

June 30, 2016 at 4:09 am #104680Stephen James

MemberSaid – check currency settings as well

-

AuthorPosts

- You must be logged in to reply to this topic.