Home › Forums › Trading System Mentor Course Community › Progress Journal › Said Bitar Daily Journal

- This topic is empty.

-

AuthorPosts

-

May 4, 2016 at 12:57 am #102548

TrentRothall

ParticipantThe way i have tried ranking on MRV systems is still having a limit buy order in the code but entering the following day on the open if the limit gets triggered. This way instd of ranking a lot of trades that might not be any good anyway you are only taking trades that would normally be traded if you were using a limit order. Also there are a lot less trades to rank so the chance of a error in backtests is reduced. It worked quiet well on my system and i think could be traded ok. It might work on this system also, i will test it. Are you entering above the setup bar or below?

May 4, 2016 at 5:47 am #103674TrentRothall

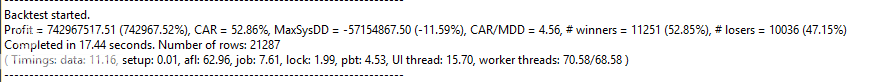

ParticipantSaid Bitar wrote:everything looks good for me it will be great if someone can code it and check the results

Hi Said i coded up your rules but my results are very different. These are the rules i used.

ADX( 8 ) > 30

StochK(8 ) < 40 ?? not sure if thats the right figure?

TrailStop of 0.5% below the low or exit on day 5 – i used a intra day stop but tested exit next open

index filter of MA(50) of the SPX

vol + Price filters

DI+ > DI-

Rus3000

Position score = low stoch value ( tested high too)

Buy on open after setup barAs far as i can see my code is correct but going by the stats it isn’t!

May 4, 2016 at 7:29 am #103677StephaneFima

MemberCraig,

In which section of the course did you amend the text about PositionScore?

Thanks

May 4, 2016 at 7:37 am #103678Stephen James

MemberModule 17 – Settings, Stephane.

May 4, 2016 at 8:04 am #103679SaidBitar

MemberAs Nick and Craig mentioned I had mistake with the ranking. I was referring to the future and this is why the results were that good.

My daily journal is becoming like those websites with fake stuff to attract traffic. :silly:

Any how sorry for the confusion the end result this system is not ok.

May 4, 2016 at 8:18 am #103680TrentRothall

ParticipantHAHA no worries, that is one system that you dont have to worry about now!

May 4, 2016 at 10:15 am #102549LeeDanello

ParticipantDamn I was hoping we could have all shared in the profits. Could have been a a group collaboration.

May 4, 2016 at 10:27 am #103682SaidBitar

MemberThere is always another chance.

And honestly this is one of the advantages of the forum that you can share things with others they can see better what you don’t see.

May 6, 2016 at 10:31 am #103684SaidBitar

MemberTough week trading the US market, almost everyday the S&P500 is closing lower than the previous day

The trend following strategy is giving back the open profits that were from last month so open profits dropped from around 12% to 4.5% ( painful)

MRV is staying fully invested some exits on daily bases and quickly getting replaced but the open profits are -5%so my week was as follows:

update prices–> place orders–> update tracker –> update prices .. and so on, a routine that i enjoyi hope today will be better day

May 6, 2016 at 11:21 am #103683

May 6, 2016 at 11:21 am #103683TrentRothall

ParticipantMaurice Petterlin wrote:Damn I was hoping we could have all shared in the profits. Could have been a a group collaboration.I am sure we could come up with something!

May 6, 2016 at 1:05 pm #103695LeeDanello

ParticipantWould be a good idea if we could come up with a group strategy that we could all share in addition to the ones we are creating.

May 7, 2016 at 7:30 am #103696SaidBitar

MemberOK we can start new thread we can collect ideas and suggestions and let’s see where we will reach

May 7, 2016 at 5:17 pm #103698SaidBitar

MemberApril 2016 Monthly performance (as per Share Trade Tracker):

MRV +2.88%

WTT -1.68%

Mom 0.07%i do not know what should be the technical term for overall performance but anyhow it is : -0.08%

May 8, 2016 at 3:36 am #102550ScottMcNab

ParticipantThe stats you have posted on your MRV system previously were impressive Said. I have not seen/ don’t recall the stats for the other systems. A question I have been thinking a bit about recently is whether the advantage of adding multiple systems to diversify (minimize maxDD ?) harm long term CAR. I guess the simple solution is to have two systems of reasonably similar CAR. I haven’t seen too many trend following systems approach the results of your MRV system though. Was it a choice to accept a reduced portfolio CAR to minimize portfolio maxDD that led you to using multiple systems Said or are your other systems similar to the MRV CAR ? (not after specific results of other systems….interested more in your thoughts on the topic to help clarify the issue in my own mind).

Thanks in advance for your time and thoughts

ScottMay 8, 2016 at 8:45 am #103705SaidBitar

MemberScott McNab wrote:The stats you have posted on your MRV system previously were impressive Said. I have not seen/ don’t recall the stats for the other systems. A question I have been thinking a bit about recently is whether the advantage of adding multiple systems to diversify (minimize maxDD ?) harm long term CAR. I guess the simple solution is to have two systems of reasonably similar CAR. I haven’t seen too many trend following systems approach the results of your MRV system though. Was it a choice to accept a reduced portfolio CAR to minimize portfolio maxDD that led you to using multiple systems Said or are your other systems similar to the MRV CAR ? (not after specific results of other systems….interested more in your thoughts on the topic to help clarify the issue in my own mind).

Thanks in advance for your time and thoughts

ScottFirst when i am testing the performance of any system i remove the limitation that is in the portfolio tab regarding the positions size in comparison to the previous day volume, the reason i do it is not to see huge number in the equity curve but to see a more realistic monthly returns and drawdowns. So regardless of the value of the capital i will know that this strategy would have returned this percentage on this month and suffered this DD. the disadvantage with this is that the returns are huge and this may be the reason it looks so good. Another reason i do not like to set this value is that it minimize the DD on the last years of the test since it is taking only part of the true positions and thus even if i will have losing streak the effect will be small.

here is average performance of my systems with the Limit trade size as % of the entry bar volume.

1/1/1995 till 1/1/2016

MRV

CAR +35%

MDD -18%Momentum

CAR +30.33%

MDD -26.44%WTT

CAR +22%

MDD -22%Capital allocation is as follows

50% for WTT, 25% for MRV, 25% for Momentum

the reason is that for WTT i use expensive broker MAX(25$ or 0.2%) while for the other I use IB (still I wonder why the Hell i do not use IB for all), another reason I was not planning to trade Momentum strategy the aim was 50% WTT and 50% MRV.so now you have idea about all, the reason i diversify the strategies:

I wish i have solid answer to just say it this diversification is new for me almost one year so still I did not have the real feel for the advantages or disadvantages.

but here are the stuff that i say to myself in the attempt to stick with the current configuration.MRV has better statistics than all best CAR and lowest DD, so if i will put all my money in MRV I will be doing better than having three (+1 for MRV), another thing it is faster to get feeling for the market. End of April my MRV started having more losing trades and tiny winners while the Trend following was at its peak later in beginning of May trend following strategy followed the MRV and gave back the open profits (+2 For MRV).

I was testing yesterday how would several MRV strategies perform on the same period of time from 1/1/2016 till last trading day all they perform the same at least the ones that i have, so trading one MRV or 3 different MRV strategies will be exactly same since all are attempting to buy temporary weakness, (result will drop back to +1 for MRV)

MRV daily process for me, i update the prices then run the scans open TWS close the trades and place the orders with the API end of the trading day update my files. OK it is not bad still i enjoy doing it but it needs time and dedication on daily bases while with WTT I place the trades and they take care of themselves I check for signals once per week and in case i need to close positions otherwise nothing to do till the coming weekend (result is 0-0 )

this is the reason i diversify or at least this is how i convinced myself to do it, so it is not only the results but the process as well.

last point regarding the Momentum i am trading it to know if i will like it or not, not the brightest answer in the world.

-

AuthorPosts

- You must be logged in to reply to this topic.