Home › Forums › Trading System Mentor Course Community › Progress Journal › Said Bitar Daily Journal

- This topic is empty.

-

AuthorPosts

-

April 28, 2016 at 3:47 pm #103614

SaidBitar

MemberSometimes the market makes you wonder,

SGI had earnings last night

estimated was -0.09$

Reported -0.05$this is 44.44% better than estimation, but still the stock dropped 35%.

I have no idea what are the earnings stuff and frankly i do not care much to understand it but losing 5 cents is much better than losing 9 cents

April 28, 2016 at 4:32 pm #103645JulianCohen

ParticipantBuy the rumour, sell the fact

April 28, 2016 at 8:54 pm #102544

April 28, 2016 at 8:54 pm #102544Nick Radge

KeymasterNasty…

May 1, 2016 at 10:16 am #103648SaidBitar

Member

I wanted so much to get rid of it but the system sad NO

:angry:May 2, 2016 at 7:45 pm #103656SaidBitar

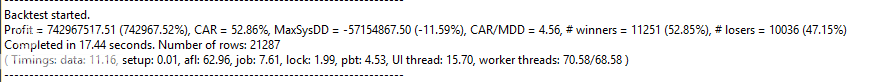

MemberI was trying to arrange the folder in Amibroker where i keel all the folders that have the AFL files, with time I am forgetting which strategy was OK and which was not. So i decided to run all of them and then to sort them according to their types and profitability.

the first strategy i checked it is one i described before somewhere in the forum 5 day momentum.

this strategy is nice and it was hidden jewel then i remembered that i discarded it before due to huge variations in returns so i modified a bit in the code to make more stable.

Modifications are changing the number of positions from 10 to 20, and assigning 5% for each position and things became good i did not expect swing trading strategy to be with these returnsany how attached are some figures of the returns.

May 2, 2016 at 10:31 pm #102545Nick Radge

KeymasterLooks good Said. Be interested in how that performs on the ASX

May 3, 2016 at 9:55 am #103661LeeDanello

ParticipantAre these results unleveraged.

May 3, 2016 at 10:01 am #103662SaidBitar

MemberI don’t have data for the AUS market, so I did not test it.

here are the rules

ADX( 8 ) >30

DI+ >DI-

StochK < 40 Entry stop order 1 cent above the High of the signal day

Trailing stop 0.5% bellow the Low of the signal dayif there is no exit on the TS then u exit on the 5th day

May 3, 2016 at 10:10 am #103671SaidBitar

MemberActually no need to test it anymore

I found the reason the results were that good. I was using ranking on this type of systems.

I changed the ranking to random to be realistic and the results became bad

I felt it is not possible to be this good, anyhow good that things are sorted out

but if the system will be used for MRV then it will be OK

May 3, 2016 at 10:34 am #102546ScottMcNab

ParticipantAny way to tweak it so enter on open next morning ? May lose some profit but gain from being able to use ranking system may make it worthwhile ?

May 3, 2016 at 5:50 pm #103672SaidBitar

MemberScott McNab wrote:Any way to tweak it so enter on open next morning ? May lose some profit but gain from being able to use ranking system may make it worthwhile ?Great idea

works like a charm

so instead of entering on stop order it will be market order on the open, and the ranking is on Stochk value

the results look so good so i had to double check again before posting :blush:

everything looks good for me it will be great if someone can code it and check the results

May 3, 2016 at 5:54 pm #103673

May 3, 2016 at 5:54 pm #103673SaidBitar

MemberI tried it with margin and this stuff is becoming scary

CAR more than 128% and DD 24%

:blink:

Note that i set the limit trade size as % of entry bar volume to ZERO, the reason is just to get real feeling of the performance and returns per year

May 3, 2016 at 10:59 pm #103675LeeDanello

ParticipantI’m interested in giving it a crack although it won’t be until the weekend. When I can confirm your results I will test it on the ASX

May 3, 2016 at 11:12 pm #102547Nick Radge

KeymasterThe first issue I can see here is that the ranking is not accurate and therefore proper testing requires the use of the trade skipping MCS or the ranking needs to be sorted.

Method:

I ran a backtest YTD 2016. I then selected a random day where new positions had been entered – in this case 29/4/16

The new positions on the back test were:

ANIK

UIHC

X

SABR

PPCI then ran an exploration from close of biz on the 28th. In theory the top ranked stocks should be those listed above.

They weren’t.

X

CVC

SABR

AGIO

FRC

CCE

DERM

TROW

CATY

LLY

TMUS

CCF

NBIX

ACAD

CMCSA

PPC

RLYP

RVNC

UIHC

ANIK

VASC

CKP

AFOP

PFSWYou can see X and SABR are at the top which is great. However, PPC appears at #16, UIHC appears #19 and ANIK is at #21.

May 3, 2016 at 11:58 pm #103676Stephen James

MemberThe error was with PositionScore. I’ve amended some text in the course on the function as it was not as clear as it should have been on its use.

When ranking using this function it is necessary to use the value from the previous bar:-

PositionScore = Ref(RSI(14),-1); – This is correct and will match up with ranking in the explorer where you would use RSI(14) for the setup bar.

PositionScore = RSI(14); – This is incorrect as the backtester will take the RSI value at the close on the same bar as a buy signal occurred, thus causing a post-dictive error.

-

AuthorPosts

- You must be logged in to reply to this topic.