Home › Forums › Trading System Mentor Course Community › Progress Journal › Said Bitar Daily Journal

- This topic is empty.

-

AuthorPosts

-

March 31, 2016 at 10:42 am #103477

SaidBitar

MemberTHUR 31/3/2016

MRV

1 Exit

0 Open positions

5 Entry OrdersApril 1, 2016 at 10:36 am #103480SaidBitar

MemberFri 1/4/2016

MRV

0 Exits

0 Open positions

6 Entry OrdersMom

0 Exits

0 Open Positions

20 Entry OrdersMRV performance for March 2016 +11.67%

and it all came from 5 or 6 days and the remaining of the month was mainly putting orders and not getting filledApril 1, 2016 at 11:40 am #102535

and it all came from 5 or 6 days and the remaining of the month was mainly putting orders and not getting filledApril 1, 2016 at 11:40 am #102535LeeDanello

ParticipantThat’s excellent

April 1, 2016 at 9:25 pm #102536Nick Radge

Keymasterboom!

April 2, 2016 at 2:17 am #102537TrentRothall

ParticipantVery nice!

Are you trading the system where you added multiple systems together, or still your original one?

April 2, 2016 at 10:48 am #103487StephaneFima

MemberWell done Said!

April 3, 2016 at 8:42 am #103488SaidBitar

MemberTrent Rothall wrote:Very nice!Are you trading the system where you added multiple systems together, or still your original one?

Still Original

April 3, 2016 at 11:26 am #103489SaidBitar

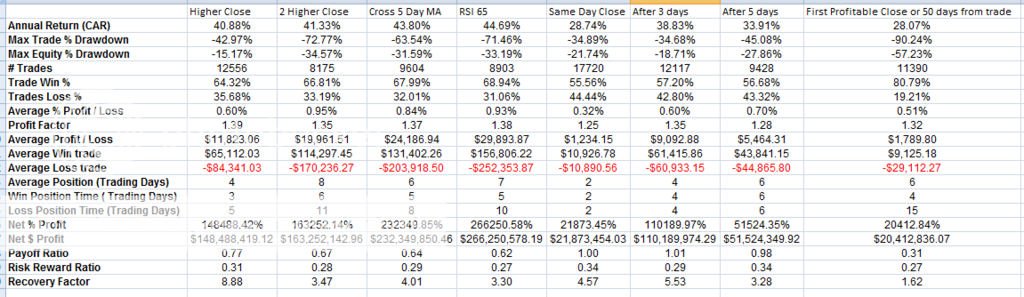

MemberI noticed from testing some codes and playing around with strategies that for Trend following strategies the exits/trailing stop i.e. the trade management is much more superior to the entries and for mean reversion strategies the entries are more important.

So i decided to test several exit criteria on MRV strategy over the same universe , period, ..

the exits are the following:

[ol]

[li]1 Higher close[/li]

[li]2 consecutive higher closes[/li]

[li]Cross above the 5 day MA[/li]

[li]RSI above 65[/li]

[li]after one day[/li]

[li]after 3 days[/li]

[li]after 5 days[/li]

[li]with the first profitable close or exit after 50 days[/li][/ol]

here are the results

so the exits play a role as well depending on what is your risk tolerance and target

Cross with the 5 Day MA OR the RSI 65 gave the highest returns many multiples of the other exits also higher CAR and percentage of winners but deeper DD

2 consecutive higher closed returns were high also CAR and winning percentage is high also DD were deeper

using x days for exits were also decent closes but with lower winning percentage and CAR

1 higher close is lower in gains and DD but the returns are good as well and the risk is low

finally if you like to be correct more than wrong then the last exit will provide this with 80+% winning rateApril 3, 2016 at 9:40 pm #102538Nick Radge

KeymasterQuote:for Trend following strategies the exits/trailing stop i.e. the trade management is much more superior to the entries and for mean reversion strategies the entries are more important.Yes, this is a good observation. Basically it comes down to time – the less time involved, the more important entry accuracy becomes. The more time the more important the w/l ratio becomes.

It follows the expectancy curve.

Another important element in one’s personality. Let me use a real time example.

Salem Abraham has a CAGR of 17% and manages about $240 million

Toby Crabel has a CAGR of 10.4% and manages $2.1 billionThe main reason why the assets being managed is because of the volatility of the strategies, namely the risk/adjusted returns. It shows that investors want a better risk adjusted return rather than just the highest return. This is a difficult concept for many new traders to conceptualize.

In summary, it means you trade to your own personality, beliefs and risk tolerance and forget what the next person is doing.

.

April 4, 2016 at 7:43 pm #103506SaidBitar

MemberMON 4/4/2016

WTT

4 Entry orders

16 Open positions

0 ExitsHFT

17 Entry orders

0 Exits

2 open positionsApril 5, 2016 at 10:06 am #103517SaidBitar

MemberTue 5/4/2016

MRV

1 Exit

5 open positions

59 Entry Ordersrecently i changed the WTT system position size from 5% per position to volatility based position size, what i noticed is the following:

Now i have 20 open positions so i should be fully invested but since it is based on volatility i am only 83% invested same for the Momentum strategy i am holding 20 positions with 83% invested.maybe when the market conditions will be calmer then the percentage utilization per position will increase.

April 5, 2016 at 1:38 pm #103519JulianCohen

ParticipantThat’s interesting. I would have thought the vol based position sizing would have eaten the equity much faster…What settings are you using?

April 5, 2016 at 7:15 pm #103523SaidBitar

Memberhonestly this is what i was expecting

I am using portfolio risk of 0.5% per position for WTT and 0.1 for momentum

April 5, 2016 at 7:47 pm #103524SaidBitar

MemberI was asked recently on the slippage that i have on the MRV and the effect

So i checked for March 2016

Total number of trades is 55 trades

trades that had positive slippage ( sold higher than the open) 5

trades that had negative slippage (sold lower than the open) 3slippage in total was 0.15% for my favor

April 6, 2016 at 9:51 am #103525SaidBitar

MemberWED 6/4/2016

MRV

3 Exits

17 Open positions

112 Entry orders -

AuthorPosts

- You must be logged in to reply to this topic.