Home › Forums › Trading System Mentor Course Community › Progress Journal › Said Bitar Daily Journal

- This topic is empty.

-

AuthorPosts

-

February 21, 2016 at 8:45 pm #102860

Nick Radge

KeymasterInteresting – Thanks Said.

I have done the same for the Growth Portfolio but didn’t see a difference worthy of pursuing further.

February 22, 2016 at 7:51 pm #102870SaidBitar

MemberRecently i came across this news for TSL it is company for solar systems

Trina Solar Gets Offer to Go Private From CEO

summary is that they want to go private and the company that is planning to buy them is offering 11.6USD per share, at the moment TSL is around 10.x USD

but doesn’t this mean that the stock will reach 11.6$ that is the price offered?Even though i do not believe in this type of trading but sometimes i think why not to buy it if the future price is known

February 23, 2016 at 7:51 pm #102876SaidBitar

MemberTUE 23/2

Final trial for better index Filter. Instead of Simple moving average for the close it became a channel made up of simple moving average for the highs and moving average for the Lows. if the close is above the MA of the highs then the index is UP if the close is bellow the moving average for the low then it is down.

tested it and the result is like this:

number of trades decreased around 30%

draw downs increased

CAR decreased

winning percentage increased about 5%no more playing with the Index Filter

it is good as it is

it is good as it isstarted to draft idea for a system (combo ) mean reversion and swing trading. Still building up the idea so coding later will be easier. the principle is like this:

if the market is in trading range then the mean reversion will be ON

if the market is trending then swing trading is ONthe swing trading part will be something similar to Dr. Elder Triple screen system but with a twist since the original system has so many filters but the main concept will be pull back on the daily and still higher MACD on the weekly

I will check the coming days what will have

February 23, 2016 at 8:36 pm #102883Nick Radge

KeymasterQuote:no more playing with the Index Filter it is good as it is

it is good as it islol. Yes, simple tends to work reasonably well.

February 24, 2016 at 10:11 pm #102884SaidBitar

MemberWED 24/2

Few months back i started developing web application to manage the different portfolios that i have/had. The target was to replace the separate excel sheets that i have for each portfolio. The final target is to have one thing where i can check my trades almost real time (15 min delay because of yahoo finance delay) and access to the history and other statistics from my phone/tablet/computer online and offline.

But it seems like never ending mission all the time new ideas to add and modifications to do.

I know that in the course there was the excel sheet “Share trade tracker” which is beautiful and lots of work is done in it, but i use multiple brokers and thus multiple commission schemes also if the portfolio is using margin it does not help to inform me about the remaining amount of money in the account and finally it does not support partial sell (maybe it does all of what i mentioned but did not figure it out yet)

regarding trading

All Index Filters are still in no trade Zone

one open position on the weekly system (shame i did not have huge position )February 26, 2016 at 7:57 am #102885

)February 26, 2016 at 7:57 am #102885SaidBitar

MemberTHU 25/2

nothing special was done

MRV index filter is back in the green

orders are placedFebruary 28, 2016 at 6:04 pm #102890SaidBitar

Member26/2 –> 28/2

Cleaned up some codes

Tested some swing trading ideas and MRV ideas from Street smarts (results are ranging between non profitable i.e. CAR <= 5% and drawdowns >= 25 and the ones that are OK are just OK nothing impressive) most probably if they were tested on intra day data results would have been better.

Still looking for swing trading strategy to fill the idle time of the MRV strategy.

Trading wise:

None of the MRV orders were filled on Friday. 2 orders for Monday

WTT still the index Filter is red so no new trades open positions is still 1February 29, 2016 at 9:39 pm #102892SaidBitar

MemberMon 29/2

Some testing for the NR4/NR7 signals on the SPX and S&P500 nothing interesting.

some testing on exit strategy for MRV systems noticed that the longer the exit signal such as waiting to cross over or under the MA will help in increasing exposure time (expected), winning percentage, and maximum drawdown.

may be combining two exits will be good still i have to test it such as first higher close exit 50% of the position and cross above or bellow MA exit the remaining position

Trades:

Monday:

MRV orders are not filled So no trades

Tuesday:

I will wait till morning to update the prices to be sure but looks like

Mean reversion

Seems that the Index filter will be RED again

Momentum

Index Filter is still Red (have to wait till end of march)March 1, 2016 at 8:44 pm #102894SaidBitar

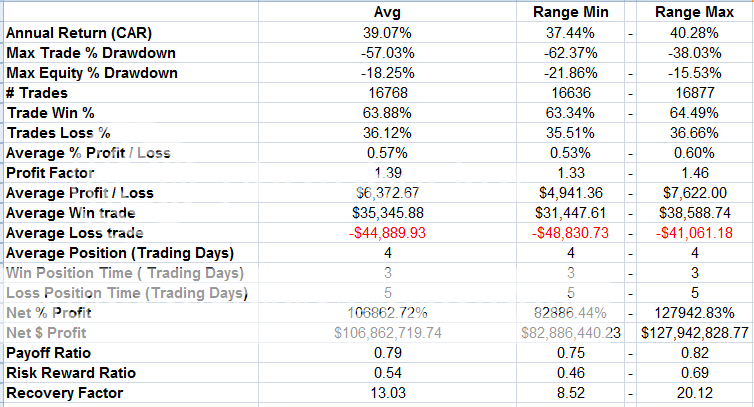

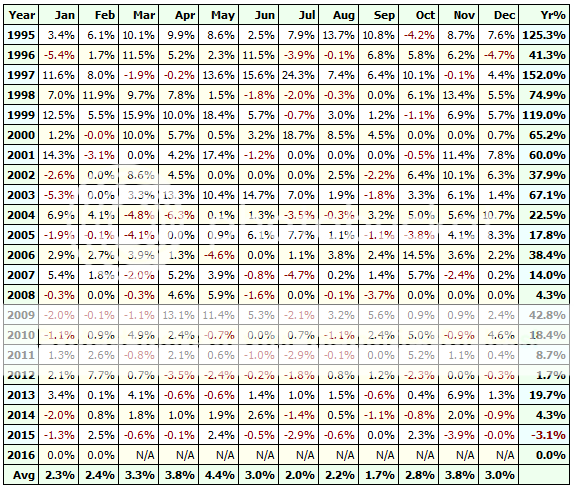

MemberRecently i was working on new mean reversion strategy

the performance of the strategy was surprising because the idea is so simple 5 days low enter on Limit price and I tested it with three different exits all similar results.

above are the results of 100 runs, i did not put it for the full testing yet but i noticed one thing the same pattern in all the mean reversion systems i worked on

as if the performance is degrading with time. In mid 1990s there were several years with 100+ % returns while as we move towards the current date the best performing year is 40+% as if the average return is just sliding down.

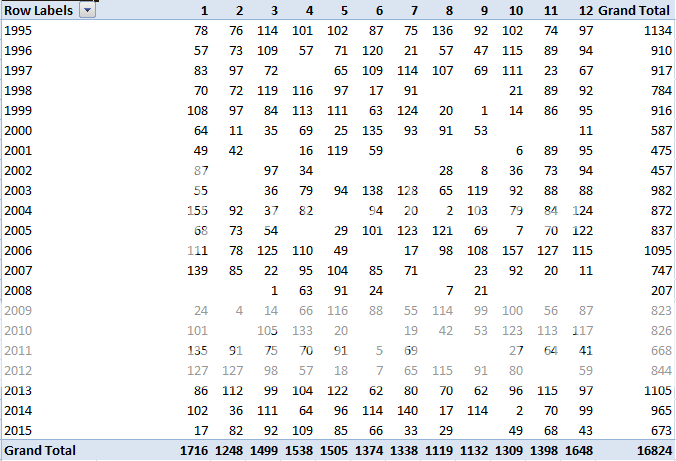

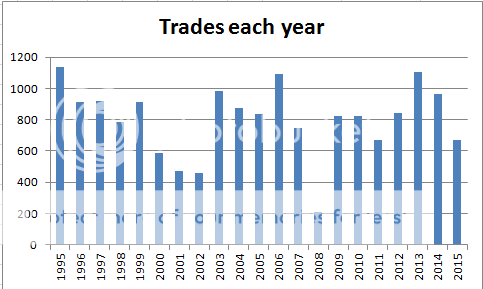

i was thinking that maybe it is due to trade frequency that may be in the 90s there were more signals than now

so i checked the number of trades per month and per year

but seems that the number of trades did not decrease.

so i started to think that it is possible that the EDGE is disappearing and may be soon it will not work, but again the idea is difficult to accept there is no optimization done, no special pattern nothing out of the ordinary.

March 1, 2016 at 11:58 pm #102526TrentRothall

ParticipantHi Said

I am guessing that you are testing it in the US? I noticed the same thing with my MR system when testing there big results early on and fading away now – although not too bad. My system has been in drawdown for the best part of 2 years by the looks. This is on the Rus 1000 with index filter on. the equity curve is also alot choppier than on the ASX with deeper and longer drawdowns.

March 2, 2016 at 8:00 am #102896SaidBitar

MemberYeah I am testing on Russell 1000 and with index filter. no idea why the results degrade this what I was trying to find out. regarding the ASX honestly I have no idea, never tested anything on it.

Another thing I believe that the ASX trends better than the US market, may be because the difference in the number of traders and volume adding more volatility to it.

March 2, 2016 at 8:17 am #102904SaidBitar

MemberTrades for Wed 2/3

MRV systems

20 signalsMarch 2, 2016 at 8:36 am #102527TrentRothall

ParticipantHow have your MR systems been going last few years?

March 2, 2016 at 8:50 am #102906SaidBitar

MemberI started trading the first one recently I think around Aug 2015, and the other one since Dec 2015 so both are totally new not enough history to mention.

I can say regarding system 1 there is difference between backtest of the same duration and the performance and this is due to the following reasons:1- I was using Russell 3000

2- I was not using Index Filter

3- I had few days with gap down on all the stocks and I got filled on much more than what I wanted and I had to close them and this caused drawdownsso let’s see how things will move from now on. Honestly I am optimistic but it is annoying to place your trades and nothing get filled, but it was clear from the backtest since the exposure time is low around 20%.

this is why instead of trading the two systems on two separate accounts I am trading them now on the same account according to backtest it will increase exposure by 5% and increase trade frequency by 30% which is good

still looking to push the exposure to 50% may be by adding another system to the group.

March 2, 2016 at 9:27 am #102528TrentRothall

ParticipantOk thanks for the insight – yeah i think i might do a fair of trade placing and no fills. I tested a fair bit with buying on the open but it hurts return and MDD too much plus selection bias would be an issue

-

AuthorPosts

- You must be logged in to reply to this topic.