Home › Forums › Trading System Mentor Course Community › Progress Journal › Said Bitar Daily Journal

- This topic is empty.

-

AuthorPosts

-

October 1, 2017 at 4:54 pm #107748

SaidBitar

MemberFinally its been long time

October 2, 2017 at 8:48 pm #107750SaidBitar

MemberSo today i wanted to start trading rotational system on NASDAQ100 on the same account with the rotational system on S&P500 and since there are some trades that overlapped in the two systems the trades merged together.

I had to close the new trades in order not to mess the existing system and i opened ticket to IB support asking how to set TWS so i can see the trades separate and not merged, there answer was that it can not be done in TWS and that i may do some stuff from one module in account management called tax optimizer.

over there i can see what to set for each stock if it is first in first out or last in first out or other specific orders (sounds a bit complicated)here is the log:

2017/10/02

14:52:41 Hi

I have problem in TWS, if i have open position in a stock and then i buy some shares of the same stock on different price/date TWS is merging the two trades together and averaging the price. I would like TWS to group them together so i can see each trade separately so in the future i can select which trade to close.thanks

2017/10/02

15:51:06 IBCS Dear Mr. Bitar,You are not able to configure this within the TWS, however you will make any lot-specific (or account level method) changes by using the Tax Optimizer. Please see below:

LINK../ibto.htm

Regards,

Steve

IB

2017/10/02

16:34:48 thanks i will read thru the files, but what i understood that i will sell then after selling i will match the sold lots to the existing lots?

2017/10/02

16:41:59 IBCS Dear Mr. Bitar,That is correct. You have until the following trade date.

Regards,

Steve

IBOctober 2, 2017 at 10:46 pm #107767Nick Radge

KeymasterGuys, you’re overthinking this. The process is extremely simple.

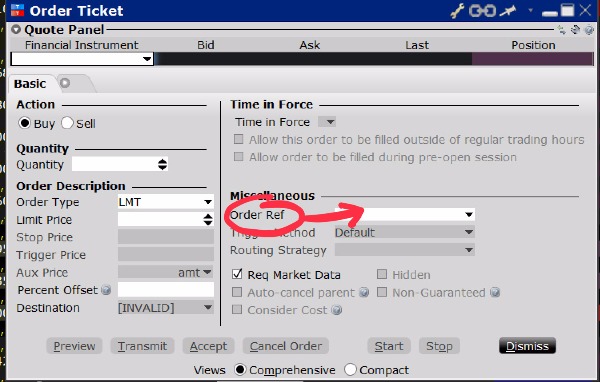

Place the trades separately (API or manually) using different reference tags in TWS.

If using the API then insert the reference tag in the Preferences tab.

If doing it manually, place the trade then “Amend Order Ticket”. On the right side of the order ticket is the reference box. Add the appropriate reference tag.

When you execute the trades, sort the trade log using the reference tag.

October 3, 2017 at 3:28 am #107768JulianCohen

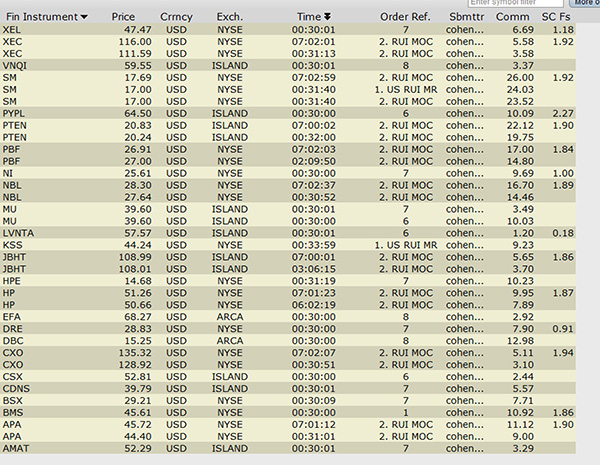

ParticipantSaid here is my trade list from last night. There’s a lot of trades because the three momentum systems were rolled last night and I got a few trades in my MOC. All these are in one IB account.

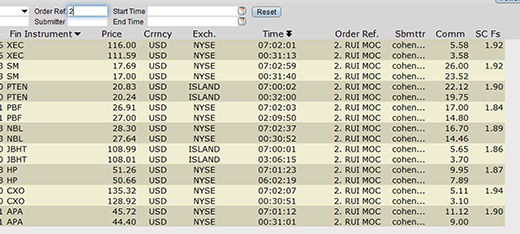

The references can be put into SmartAPI or Batchtrader and appear on the Trade log as you can see. Then I sort them so each system is displayed and save that one, then move to the next. Them I have a separate TWS to STT for each system so load that up one at a time and transfer to STT in one go.

If I need to close a position I look in STT to see how many shares are held in the position and manually enter that into the order ticket. Then I set the relevant reference number and it will appear in the trade log on execution.

So in the trade log above the ones with the full system name are buys from SmartAPI and the numbers are sell from manual entry.

here it is sorted to system 2

October 3, 2017 at 5:16 am #107779

October 3, 2017 at 5:16 am #107779SaidBitar

MemberThanks

But I was not talking about placing the orders because as you mentioned I use order reference to seperate the trades I was talking in tws after the trades are filled they merge together

So if you have 100 shares of abc at 12 and you bought again 100 shares of abc at 10 and you are holding them for some time you will see that you have 200 shares of abc at 11

For distinguishing the orders I use the reference as you mentioned but for separating the trades in order to sell is my problemI hope I made myself clear

October 3, 2017 at 5:36 am #107782JulianCohen

ParticipantSo in STT you have the 100 at 12 in one system and the 100 at 10 in a different system. You place an order to sell 100 in TWS. Then in STT you enter the sell ticket into the correct system.

I’m not sure why it matters in TWS if they are amalgamated as it is in STT that you are keeping track of the trades

October 3, 2017 at 6:33 am #107783TrentRothall

ParticipantThat’s what i was doing Julian and Said using STT to keep track

October 3, 2017 at 6:40 am #107784SaidBitar

Memberthis what i used till now STT to track everything but i thought there is better way

thanks for the advice and sorry for the mess

October 3, 2017 at 6:50 am #107785JulianCohen

ParticipantNo better way that I’ve found yet

October 3, 2017 at 11:59 pm #107786

October 3, 2017 at 11:59 pm #107786Nick Radge

KeymasterDo all tracking and reporting is STT…that’s what it was built for.

November 1, 2017 at 9:51 pm #107800SaidBitar

MemberOCT 2017

the month started really good i was dreaming where I will be if the year continued like this then earning season started throwing punches

ASX MRV:-0.18%

ASX MOC:-1.3%

US MRV:-0.42%

US MOC:+1.33%

SP500 Momo:+4.77%

NDX100 Momo:4.33%

US WTT: +2.31%total:1.52%

November 1, 2017 at 11:16 pm #107933

November 1, 2017 at 11:16 pm #107933Nick Radge

KeymasterQuote:i was dreaming where I will be if the year continued like thisYou put the mockers on it. Never dream ‘what will be’.

Just let it happen.

November 2, 2017 at 7:28 am #107934SaidBitar

MemberSaid Bitar wrote:OCT 2017the month started really good i was dreaming where I will be if the year continued like this then earning season started throwing punches

ASX MRV:-0.18%

ASX MOC:-1.3%

US MRV:-0.42%

US MOC:+1.33%

SP500 Momo:+4.77%

NDX100 Momo:4.33%

US WTT: +2.31%total:1.52%

the other images were missing

November 14, 2017 at 4:21 am #107945

November 14, 2017 at 4:21 am #107945LEONARDZIR

ParticipantSaid,

A question. Just tried to run the worst case scenario spreadsheet and it is giving me a runtime error can’t divide by zero. Ran fine for me in September when you first posted it. Any ideas?

LenNovember 14, 2017 at 7:21 am #107990SaidBitar

MemberNo Idea i need to take a look at it.

-

AuthorPosts

- You must be logged in to reply to this topic.