Home › Forums › Trading System Mentor Course Community › Progress Journal › Said Bitar Daily Journal

- This topic is empty.

-

AuthorPosts

-

July 1, 2017 at 5:05 pm #107184

JulianCohen

ParticipantYou know the answer….test it and see :cheer:

August 1, 2017 at 5:45 pm #107185SaidBitar

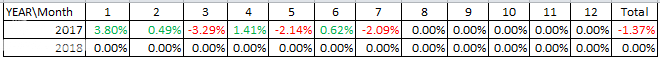

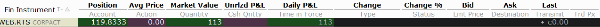

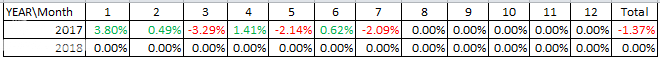

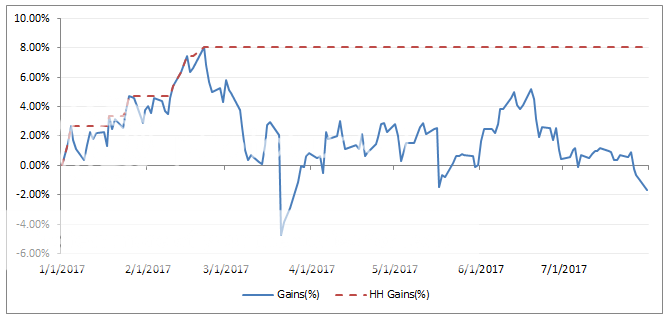

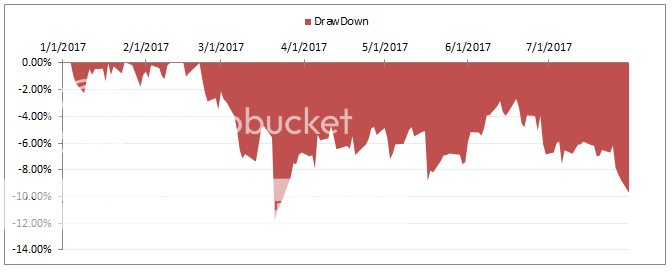

MemberJuly 2017

Account 1

US MRV = -1.66%

SP500 MOC = -2.91%

ASX MOC = -0.31%

Acct 1 Total = -3.33%Account 2

ASX MRV1 = -0.01%

ASX MRV2 = -0.01%

SP1500 MOC = -4.39%

R1000 MOC = -0.93%

Acct 2 Total = -4.91%Account 3

US WTT (Closed Positions) = 0%

US WTT (Open & Closed Post.) = 0.34%Account 4

US MOMO (Open & CLosed Post.) = -1.07%All Accounts = -2.09%

Tough results for such a slow month

August 3, 2017 at 8:57 pm #107287SaidBitar

MemberVery Strange

I found that i have one stock WEB.RTS in my account and i do not remember placing any trades for itI know that i have WEB.au

August 4, 2017 at 1:06 am #107303

August 4, 2017 at 1:06 am #107303TrentRothall

ParticipantI have the same Said.

On tuesday WEB went into a trading halt and in the ASX announcements it says it’s doing a capital raising or entitlement offer i think, i don’t really understand it.

I think you are entitled to those extra shares WEB.RTS

http://www.asx.com.au/asx/statistics/announcements.do?by=asxCode&asxCode=web&timeframe=D&period=W

Someone might be able to help

August 4, 2017 at 2:08 am #107306Nick Radge

KeymasterThey’ve bought another business and funding it with a non-renounceable entitlement offer at an 8.6% discount to the prior closing price.

As these are non-renounceable you cannot sell them and your holdings will be diluted if you continue to hold the normal shares.

They’re trading again today so you can exit the WEB.au but unless you intend to pay for the entitlement offer they’ll just disappear.

August 6, 2017 at 9:04 am #107307SaidBitar

MemberI was listening to the group call few days back and the idea of optimising the parameters every 6 months made sense since the markets change and it is not normal what worked in the early 2000 will work exactly same in 2017.

so i tested to optimise the stretch and index filter on one MOC system it took many hours to finish and then i plot the Out Of sample graph and i compared it to the single run backtest. and the result of the walk forward was around three times lower than the single run. I was surprised since I was expecting since the walk forward is more adaptive to the recent history the return should be better.Did anyone got the same results?

August 6, 2017 at 9:11 pm #107311Nick Radge

KeymasterSeems odd. For what period of time to you optimise?

I would suggest a minimum of 2 years.

August 7, 2017 at 9:52 am #107312SaidBitar

MemberI ran it from 1/1/2000 until last Friday

IS 3 years OOS 6 month

Then i plot the OOS graphI will check again because it doesn’t make sense it should be better

August 7, 2017 at 6:08 pm #107314SaidBitar

MemberMy mistake

i found the correct report that shows the OOS statistics

now things makes sense again

i think over this weekend i will have to change the params of the systemsAugust 13, 2017 at 5:53 pm #107316SaidBitar

Member:woohoo:

(they should create one emoji pulling his hair since it will fit my situation more)

I started the optimization on the system that i have to fine tune the index filter and the stretch with the most recent data

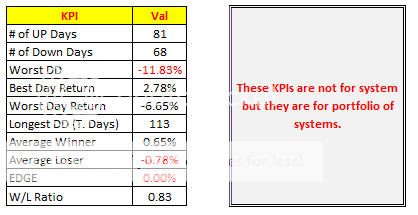

Normally i prefer to optimize stuff one at a time since it is less time consuming but in ASX MRV and some MOC systems i am using two stretch values and the index filter to switch between them so i had to run optimization on all of them at the same time and it consumes lots of time.anyhow I wanted to share the way i used to select the winning combination so if there is any flaw others can point it out.

the thing with multiple parameters to optimize that i can plot bar graph and look at the area that looks ok and pick one value from it since the values are spread all over the place so i short listed them as follows:

1- exposure % should be higher than the average since sometimes the best results are with 5% exposure

2- Car/MDD top 30% of the previously filtered list

3- Sharpe Ratio top 30% of the list (after the previous two filters)4- select the top one based on CAR/MDD

the thing that the results are so spread from each other it made me wonder what the hell i am doing

August 13, 2017 at 6:03 pm #107288

August 13, 2017 at 6:03 pm #107288SaidBitar

MemberSaid Bitar wrote:

Wow this photobucket is not working anymore time to use another way

August 13, 2017 at 6:10 pm #107342JulianCohen

ParticipantI’m not sure I like the sound of the results being spread so far from each other….I’d like to see an example before I comment

August 13, 2017 at 6:26 pm #107344SaidBitar

Memberhere is an example attached

yellow columns are the optimized ones

green row is the one that i pickedAugust 14, 2017 at 5:47 am #107345JulianCohen

ParticipantSaid Bitar wrote:here is an example attachedyellow columns are the optimized ones

green row is the one that i pickedI see what you mean!

If you run an optimization on just one criteria, say Index Filter only, is it a better spread across the results?August 14, 2017 at 7:11 am #107343LeeDanello

ParticipantTry Imgur.

-

AuthorPosts

- You must be logged in to reply to this topic.