Home › Forums › Trading System Mentor Course Community › Progress Journal › Said Bitar Daily Journal

- This topic is empty.

-

AuthorPosts

-

June 9, 2017 at 6:39 pm #107045

SaidBitar

Memberthis is when you know that either you found the holy grail or you had a bit too much to drink

June 11, 2017 at 3:02 pm #107098SaidBitar

MemberQuestion regarding account size and commission drag

for example i trade 3 strategies on the same account

US MOC

US MRV

ASX MOC

initially when i decided on the account size i was trading only US MRV so i calculated to have the commission drag in the range of 2%

if i will check for each system separate the commission drag is less than 5% of the account size but if i will combine all together the commissions will shoot high and it is becoming more than 15%did not pay attention to this before today

Not GoodASX MOC average trades per year 400 Trades ==> 400*2*6 = 4800 AUD ~3650USD

US MRV average trades per year 830 trades ==> 830*2*1 = 1660 USD

US MOC average trades per year 1650 trades ==> 1650*2*1 = 3300 USDtotal expected commissions is 8610 USD in order to keep the comm drag around 2% then i need to have 430,500 USD

i hope i messed up the calculations

June 11, 2017 at 3:38 pm #107101SaidBitar

MemberSaid Bitar wrote:Question regarding account size and commission drag

for example i trade 3 strategies on the same account

US MOC

US MRV

ASX MOC

initially when i decided on the account size i was trading only US MRV so i calculated to have the commission drag in the range of 2%

if i will check for each system separate the commission drag is less than 5% of the account size but if i will combine all together the commissions will shoot high and it is becoming more than 15%did not pay attention to this before today

Not GoodASX MOC average trades per year 400 Trades ==> 400*2*6 = 4800 AUD ~3650USD

US MRV average trades per year 830 trades ==> 830*2*1 = 1660 USD

US MOC average trades per year 1650 trades ==> 1650*2*1 = 3300 USDtotal expected commissions is 8610 USD in order to keep the comm drag around 2% then i need to have 430,500 USD

i hope i messed up the calculations

i checked with STT looks like the calculations are OK

from 1st of jan till today i paid comm in this account around 4000USD June 11, 2017 at 10:56 pm #107102

June 11, 2017 at 10:56 pm #107102Nick Radge

KeymasterQuote:commission drag is less than 5% of the account size but if i will combine all together the commissions will shoot high and it is becoming more than 15%You need to measure it on a per system basis, especially if you’re using notional funds.

June 12, 2017 at 1:07 am #107105TrentRothall

ParticipantIf you’ve tested the systems using the correct commission costs in AB does it really matter?

For example if your ASX Moc has a 30% CAR on a $100,000 account and you pay $10,000 in comms. They should all be factored into the CAR calculation anyway. Just a cost of doing business.

June 12, 2017 at 3:31 am #107103LEONARDZIR

ParticipantSaid,

Maybe I am wrong but shouldn’t your commissions be higher. You quoted $1 per trade for your commissions. That assumes you are trading no more than 200 shares per trade. Ib rates are 0.005 cents per share ,minimum $1 and max 1/2% value of trade. Please correct me if I am wrong.

LenJune 12, 2017 at 4:51 am #107106SaidBitar

MemberNick Radge wrote:Quote:commission drag is less than 5% of the account size but if i will combine all together the commissions will shoot high and it is becoming more than 15%You need to measure it on a per system basis, especially if you’re using notional funds.

This is much better

June 12, 2017 at 4:56 am #107107SaidBitar

MemberTrent Rothall wrote:If you’ve tested the systems using the correct commission costs in AB does it really matter?For example if your ASX Moc has a 30% CAR on a $100,000 account and you pay $10,000 in comms. They should all be factored into the CAR calculation anyway. Just a cost of doing business.

True

June 12, 2017 at 4:57 am #107110SaidBitar

MemberLen Zir wrote:Said,

Maybe I am wrong but shouldn’t your commissions be higher. You quoted $1 per trade for your commissions. That assumes you are trading no more than 200 shares per trade. Ib rates are 0.005 cents per share ,minimum $1 and max 1/2% value of trade. Please correct me if I am wrong.

LenI was calculating the minimum just to get idea

June 12, 2017 at 10:16 am #107118SaidBitar

MemberSaid Bitar wrote:Nick Radge wrote:Quote:commission drag is less than 5% of the account size but if i will combine all together the commissions will shoot high and it is becoming more than 15%You need to measure it on a per system basis, especially if you’re using notional funds.

This is much better

So I calculated for each system the amount required and I will use the max value as the account size. This means I have to balance my accounts by putting my savings over there.

Not nice idea but much better than knowing comissions are pulling me back.July 1, 2017 at 6:55 am #107120SaidBitar

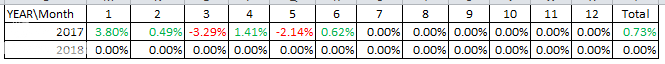

MemberJune 2017

Account 1

US MRV = 3.36%

SP500 MOC = -4.16%

ASX MOC = -0.89%

Acct 1 Total = -0.65%Account 2

ASX MRV1 = 3.33%

ASX MRV2 = 0.87%

SP1500 MOC = -3.34%

R1000 MOC = 0.99%

Acct 2 Total = 0.8%Account 3

US WTT (Closed Positions) = -1.76%

US WTT (Open & Closed Post.) = 4.99%Account 4

US MOMO (Open & CLosed Post.) = -2.53%All Accounts = 0.62%

July 1, 2017 at 8:16 am #107180

July 1, 2017 at 8:16 am #107180JulianCohen

ParticipantWow you have expanded your number of systems as I have reduced them

Are you running the SP1500 with leverage? If so are you running into any problems with that?

July 1, 2017 at 9:19 am #107181SaidBitar

MemberActually i am running these since last year the new addition was the Momentum system.

regarding the SP1500 yes it is with leverage 20 positions 10% no problems until now.regarding leverage I am pushing two accounts towards 400% area but yesterday i found one thing in account 1 i was carrying full positions on the US MRV system that represents 200% of the account so when i tried to put the trades for the ASX MOC the orders didn’t pass thru first time to happen but looking at the ASX market how it ended not feeling bad that they did not go.

Regarding running all these systems the only thing is that i feel they talk the same language so it is not bad idea to reduce them.

July 1, 2017 at 9:33 am #107182JulianCohen

ParticipantSaid Bitar wrote:Regarding running all these systems the only thing is that i feel they talk the same language so it is not bad idea to reduce them.That was one of the reasons I cut back on my systems. My ASX MRV system is now totally different to the US MRV system so I’m happy with the double diversification that gives me.

I’m still trying to improve my MOC system. It is so simple at the moment it is almost criminal

and there’s nothing wrong with that.

and there’s nothing wrong with that.Actually I’m only really doing it as an exercise to see if I can back engineer Nick’s results from this month. Helps keep me busy otherwise I’d be up to no good

July 1, 2017 at 2:23 pm #107183

July 1, 2017 at 2:23 pm #107183SaidBitar

Memberyes they are impressive

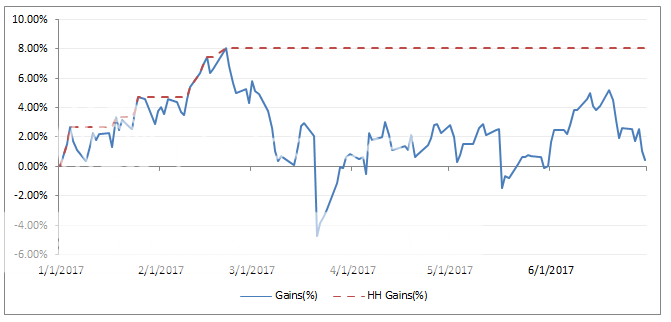

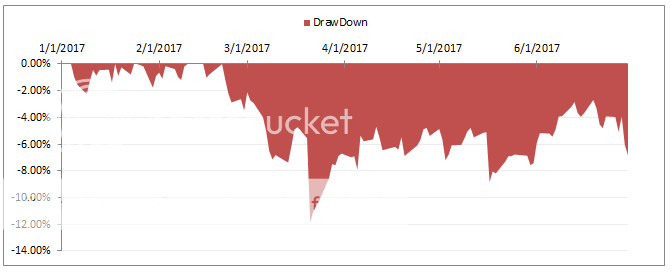

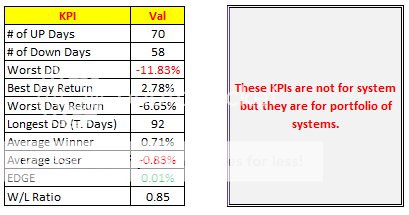

now i was checking the % return chart i noticed i make lots in the first two weeks of each month and i give them back in the last two weeks.Maybe I should trade only till the 15th

-

AuthorPosts

- You must be logged in to reply to this topic.