Forums › Trading System Mentor Course Community › Progress Journal › Said Bitar Daily Journal

- This topic is empty.

-

AuthorPosts

-

February 7, 2016 at 8:22 pm #102773

SaidBitar

ParticipantSAT & SUN 6/2 7/2

Stress Test for one strategy and some optimization for the parameters (Found out that the result of the parameters that i use are better than the average so i started looking in my notes to see if i did optimize the parameters before) it will be good point to stop writing on papers or txt files and keep track for all inside the AFL file.

Finished reading the document that is shared by Nick Short Swing Trading interesting strategy so i coded it and start verifying the code and the results because the results were normal (CAR, MDD, % of winning trades) were falling in the normal range of most of strategies. then i changed the price limiters and the values rocketed up.

i should check everything again especially the code is bit trickyFebruary 7, 2016 at 8:28 pm #102806SaidBitar

Participant

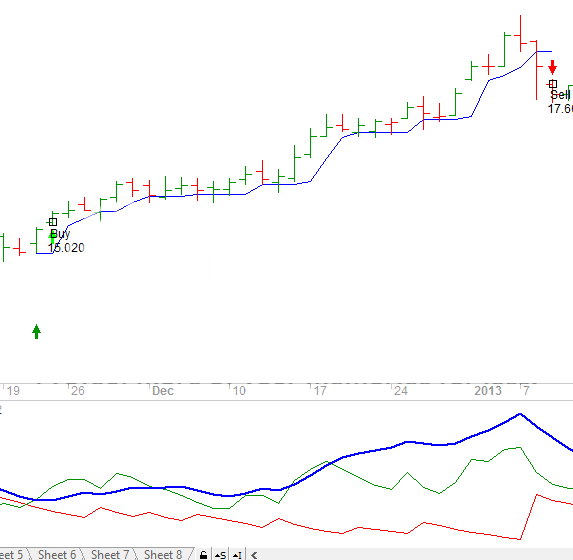

sample trade from SST

February 7, 2016 at 10:39 pm #102807SaidBitar

ParticipantAs expected i made the holy mistake and not found the holy grail

here is the mistake

Code:LE = Ref(BuySetUp,-1) AND NT==0 AND L >= Ref(StopBuyPrice,-1);and it should be

Code:LE = Ref(BuySetUp,-1) AND NT==0 AND H >= Ref(StopBuyPrice,-1);so by using the Low instead of the High i was only taking the trades that only moved upwards and that is why things were looking beautiful.

February 9, 2016 at 12:59 pm #102610SaidBitar

ParticipantMonday 8/2

Parameter optimization on Momentum strategy

February 14, 2016 at 4:21 pm #102810SaidBitar

ParticipantTuesday 9/2 till Sunday 14/2

1- Testing the momentum strategy in order to get more familiar with it

2- Developing another trend following strategy based on momentum (even though I feel that the code is correct but the results are telling me other stuff. For sure i missed something somewhere)

3- trying to combine two mean reversion strategies into one for two purposes

a- Increase the exposure %

b- use the same capital for two strategies

till the moment what i noticed is that trading frequencies increased which is expected, exposure increased a little bit.maybe the reason that they are so similar in nature that almost 70% of the times the signals overlap.

but still i prefer to have one capital with exposure of 25% of the time rather than 2 capitals with exposure about 20% eachRegarding trading all index filters are still in RED

so no new entriesNo exits

still holding one position

February 16, 2016 at 8:03 am #102611SaidBitar

ParticipantMonday 15/2

1- Developing another trend following strategy based on momentum (even though I feel that the code is correct but the results are telling me other stuff. For sure i missed something somewhere)

one thing fixed still results are bad i think there is one more mistake hidden somewhere

February 16, 2016 at 8:51 pm #102828Nick Radge

KeymasterIt’s great that you’re able to pick these anomalies up and question the veracity of the results. Excellent!

February 17, 2016 at 11:36 am #102829SaidBitar

ParticipantTuesday 16/2

Finally the strategy is sorted out. Thanks to Craig for his support.

sometimes small tiny stuff are the problem, who could have imagined assigning null to a variable acts different from assigning value.

Lesson Learned things should be as simple as possible.February 17, 2016 at 9:26 pm #102840SaidBitar

ParticipantWED 17/2

Some philosophical moments regarding whipsaws how they can eat the equity curve and pull draw downs deep. Especially like the situation on last period of 2015 where the index filter was switching On and OFF all the time causing entries and then later exits with small losses. The thing with small losses is that they add up

End of the day nothing to do they are part of trading either accept them or forget about trading.

To avoid whipsaw losses, stop trading. -Ed Seykota

[video]https://www.youtube.com/watch?v=LiE1VgWdcQM[/video]Start thinking about Trend following system based on Volume. My opinion is that position sizing and trailstop are the ones that will help to lock profits and manage the trade, and in the worse case to insure that if a loss is taken it is small. Regardless on the reason we enter the trade (new X days high, new 52 weeks high, all time high, breakout of a channel) most of them are talking same language Strength. So i want to think how to find strength in volume and to use it as entry point.

Still the idea is not clear to me but may be in the coming period it will be.February 17, 2016 at 9:31 pm #102846Nick Radge

KeymasterOther ideas for index filters:

New High / New Lows index

Volatility, i.e. average range of last 30 days vs last 200 daysFebruary 17, 2016 at 9:39 pm #102847SaidBitar

Participantthat is something to think about and test

February 21, 2016 at 12:35 pm #102849

February 21, 2016 at 12:35 pm #102849SaidBitar

Participant,Saturday 20/2

Testing Index Filter based on ROC(30) and ROC(252)

So ROC(30) > ROC(252) Index Filter Green else Red

so the index filter became as in the snapshot long durations of OFF and ON

this means less trades which is not good since the edge depends on the number of trades, the more trades the more profit, less trades less profit , CAR,..

so my opinion i am not ready to sacrifice frequency of trades for better index filter

February 21, 2016 at 12:58 pm #102854SaidBitar

ParticipantIndex Filter Modification II

Buy signal will be generated when the Index makes new 3 bars high trailing stop will be tighten if the Index is making new 7 Bars low

results are OK but is it better than the simple MA filter??

not much better so again i will be sticking to the MA filter

February 21, 2016 at 2:15 pm #102855SaidBitar

ParticipantSunday 21/2

Playing around with position sizing for WTT so i changed the position size from 5% to the same position sizing used in the momentum strategy

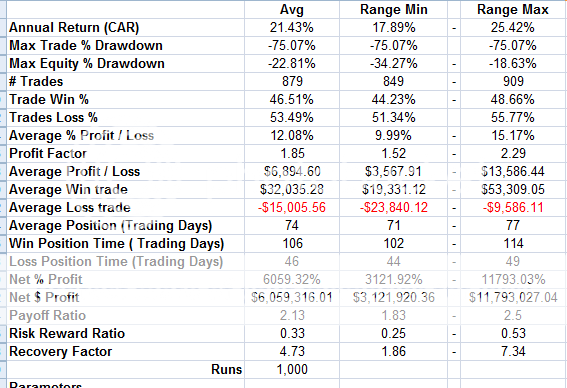

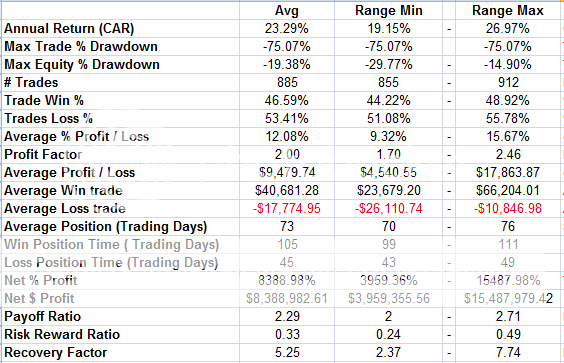

results are good from CAR point of view it is a bit better while the average MDD dropped down.Running 1000 MCs to compare the results with the results of the 5%

February 21, 2016 at 4:16 pm #102856SaidBitar

ParticipantSo i Ran 1000 MCs on the modified position sizing to compare it with the original and here are the results

5% position sizing

Modified Position sizing

-

AuthorPosts

- You must be logged in to reply to this topic.