Home › Forums › Trading System Mentor Course Community › Progress Journal › Said Bitar Daily Journal

- This topic is empty.

-

AuthorPosts

-

July 24, 2016 at 8:08 pm #104857

ScottMcNab

ParticipantSaid Bitar wrote:Scott McNab wrote:Be nice to be able to use same systems on UK/European/Asian markets if had the data…will happen eventually I guessI am already thinking about it, so that i can trade MRV on AUS market and then MRV on US market.

the thing that is keeping me reluctant is that the performance on AUS market is not as the US market.

lower CAR and Higher DD

Try mucking around with ASX 200 using 10 positions at 10% with exit on next open or same day MOC..

July 30, 2016 at 1:23 pm #104858SaidBitar

MemberHere is the performance for July 2016

it was very good month for Trend following the trend following system was doing good, MRV the first 3 weeks were OK the last week was a bit tough so amost half of the profits disappeared

I- US MRV +4.86%

II- WTT (open profits since there is nothing closed) +22.7%

III- Momentum +5%July 31, 2016 at 4:54 am #104920JulianCohen

ParticipantNice one

August 6, 2016 at 11:21 pm #104921SaidBitar

MemberVacation is over Monday back to office :unsure: 4 vacations in the last 6 months seems that I don’t have any mood to work anymore

The good thing I will have more time for testing and validating some ideas

August 24, 2016 at 8:09 pm #105008SaidBitar

Membermarket was slow and normal

I went for few beers

came back 5 minutes before the close

market was destroyed

:blink:

(maybe it was the beer )September 1, 2016 at 10:35 am #105092

)September 1, 2016 at 10:35 am #105092SaidBitar

MemberAUG 2016 performance

#US MRV : -6.63%

#US TF : based on closed trades -0.71% (it is difficult to report based on open profits but the difference between last month open profit and AUG is around -4%)#starting from 25th of AUG i started MRV on the ASX So for the last 6 days of AUG :

13 trades

win % 46%

W/L ratio 1.13

profit factor 0.97

SAR.asx is ugly loser but still in the open trades#Also started another MRV on the S&P1500 it is with MOC exits

286 trades

win% 47%

W/L ratio 1.06

profit factor 0.92

still doing some testing mainly for the second MRV strategy, the idea most probably will be reducing the number of trades and changing the exit to the open of the day following higher close.

the strategy works better with MOC but due to the fact that i am having lots of duplicates between this and the main MRV strategy somehow seems to me that i am increasing the exposure / risk on certain stocks, while holding the trade a few days maybe will help.the ASX MRV and the S&P1500 are trading the same account so i split the cash in half but still i have to think of the way to report it in the STT.

My base currency is in USD and periodically i have to change the open profits from AUD to USD , also STT does not differentiate between currencies maybe i should have two copies one for USD and the other for AUD.September 9, 2016 at 11:12 am #105125SaidBitar

MemberIn the last few weeks I was playing around with RightEdge. The reason I was testing it and checking it is that I had some ideas for intraday trading such as gaps, trendfollowing on smaller time frame and mean reversion. So before I started testing these ideas I wanted to be sure that if I found some of them profitable and tempting I can execute them. The options were as follows:

1- I should have API for each strategy where the strategy is hard coded in it so it can read live data from TWS and then check the conditions to buy/Sell and then generate orders.

2- Find a trading software that has the ability of autotrading.

The first option is OK but somehow not the smartest since either I have to spend few months to finish it and then whenever I need to modify any parameter then I have to modify the original code and then generate the executable file. The other option is to give it to someone to code it and in this case I will be tied to this person which honestly I prefer to be independent.

For the second option I found RightEdge, lots of people say good stuff about it. So I downloaded it, I got 45 days testing period.

RightEdge looks like the developers where writing API that has the trading strategy inside it and kept working on it and expanding its capabilities till it became trading/testing platform.

Honestly there is not much on the net where you can find guidance on how to get your code done. Even though I know how to program with C# still it took me more than one week to write few lines in it. After that it becomes a bit easier with time. But the initial learning curve is strong and requires lots of trial and error.

For the data I used AmiQuote to download intraday data from Google finance (I know it is not good idea but I was verifying and learning how to use the tool) then I exported all the stock historical prices into SQL server and linked the SQL server to RightEdge. Lots of work!

In RE (RightEdge) I had to create watch list and add the tickers to it, so that I can backtest on them. There is one thing interesting in RE that the universe of the stocks that you backtest on it you can select the stocks one by one or you can select the watchlist and thus all the stocks under it (still you can unselect some of them). You run your backtest and it generates report somehow similar to the one from Amibroker.

The cool thing in RE is that by default when you run backtest it has graphical representation of the money invested and the available cash in the portfolio so you can know your exposure for each day. Also it has the ability to backtest multiple strategies at the same time this is helpful when you are trading multiple strategies on the same account and you can check what is the best way to allocate capital between the strategies (I did not test it). The difference in the way the backtest is ran in RE and AB is that in Amibroker the strategy is ran on each stock so it generates the buy and sell signal on the specific stock for all the history then in the second run it works as a portfolio level testing where it starts adding the signals from different stocks to each other. In RE from the beginning it works in bar level not stock level so let’s say you are testing with daily bars it will take day one and check on the watchlist which ones has buy signals which ones has sell signals how many open positions. So it is almost impossible to look forward and see the future bars. The advantage of this is that it reduces errors. Also whenever the testing is OK and you are happy with the performance all what you need to do is to click one button and the strategy goes live. It connects automatically to IB TWS and starts executing the strategy (I believe for execution you need to have real time subscription in TWS)

Recently I got busy at work so I stopped testing with it may be later I can add some snapshots so things will become comprehensive.

So is RE better than AB in my opinion NO it is not better since it is not easy to use at least in the beginning and whatever you want it can be done in AB but if someone is interested in Autotrading maybe this is good optionSeptember 9, 2016 at 8:29 pm #105159SaidBitar

MemberWhat a day, feels like BREXIT all over again

results from today

S&P500 -2.45%so out of 60 positions in all the systems everything is in RED

Weekly Trendfollowing -5.25%

MRV1 -7%

MRV2 -5% making 7% per month is damn hard thing losing it in one day is so easySeptember 10, 2016 at 1:22 am #105163

making 7% per month is damn hard thing losing it in one day is so easySeptember 10, 2016 at 1:22 am #105163TrentRothall

ParticipantHave you looked into Ninjatrader Said? from my limited understanding i believe you can auto trade on that platform.

September 10, 2016 at 5:07 am #105166SaidBitar

MemberTrent Rothall wrote:Have you looked into Ninjatrader Said? from my limited understanding i believe you can auto trade on that platform.I did not check it and yes it has the auto trade feature.

i decided that before running i need to learn how to walk.September 10, 2016 at 7:31 am #105167SaidBitar

MemberI was checking the exit signals on the weekly trend following system.

i have some signals to exit and some of them are really nice ones.CDE, HL

they were nice ride bad to see them leaving

September 10, 2016 at 4:29 pm #105168SaidBitar

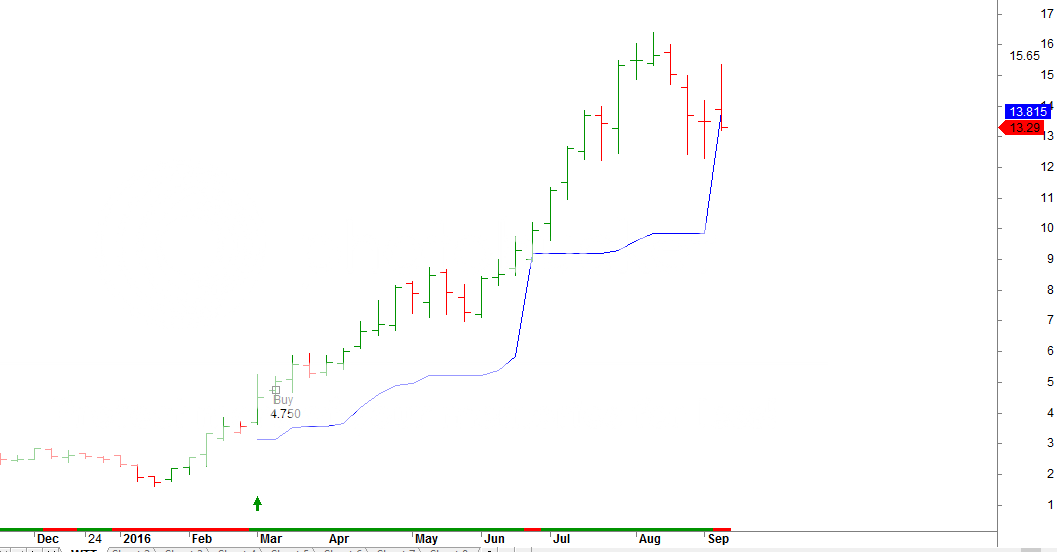

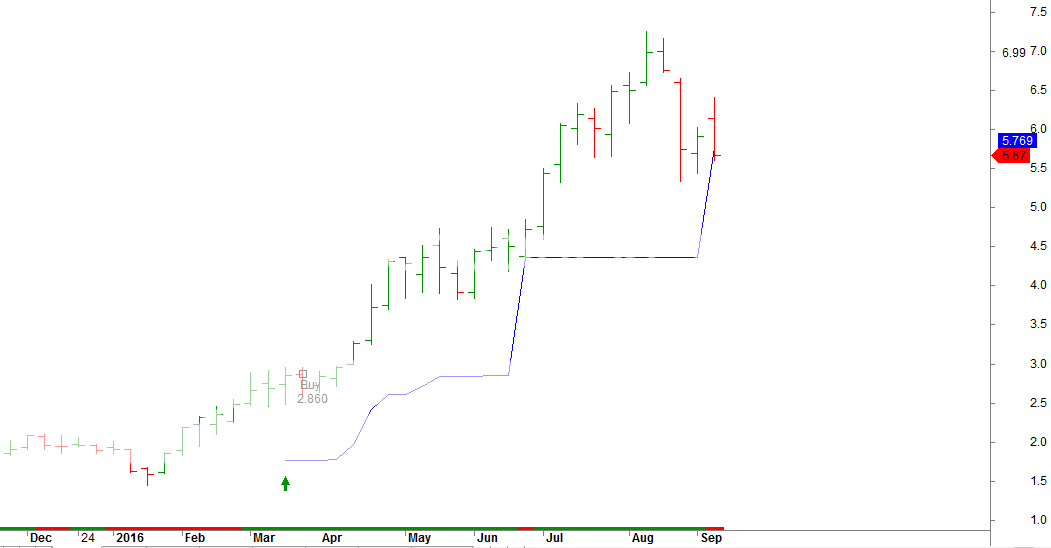

MemberBeen working recently on a trend following strategy on the All Aord.

actually i was planning to make a rotational strategy based on momentum then i switched to TF 2 conditions to enter and a trailing stop so simple.the results are good much better than what i was getting with rotational strategy. the only draw back is the number of trades it is low even if i test starting from 1992 i couldn’t get 1000 trades.

Another thing “FGX.asx” played a very good role in the strategy i tried my best to exclude it but i couldn’t anyhow it is one trade that gave back 40% return on portfolio level due to one day that had 900% no idea if it is mistake in the data or it really went this huge.

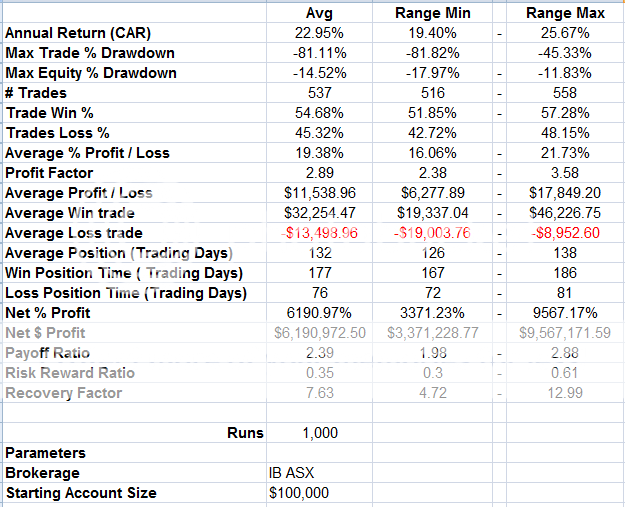

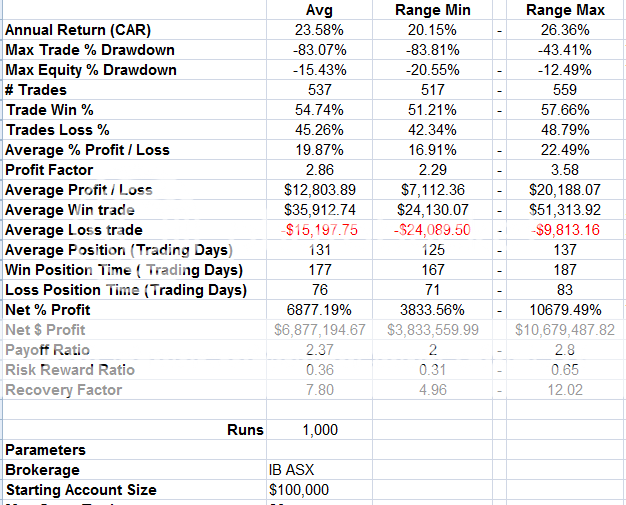

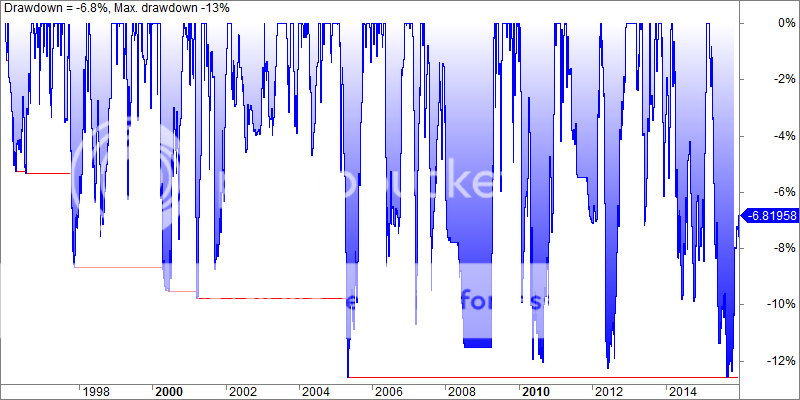

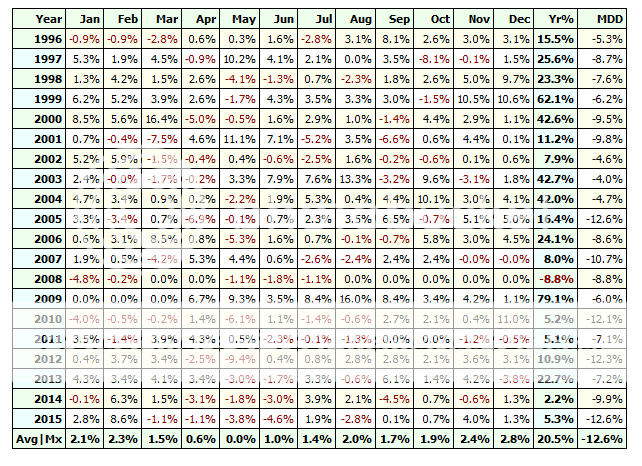

anyhow here are the stats:

from 1/1/1996 until 31/12/2015

this strategy will run on the ASX so all is in AUD and my base currency is in USD.

so i wanted to test the effect of the currency exposure on the strategy performance.

so i ran Mcs again for the same duration but this time leaving the base currency as USD and the conv. rate will be taken from USDAUDthe results are still good slight change the performance .

the Results are quite good especially for TF strategy the win rate is a bit high the %Profit/Loss is a bit high. Intersting

September 10, 2016 at 4:38 pm #105173SaidBitar

MemberI managed to exclude that stock from the backtest by adding it to favourites and excluding favourites

here are the results of single run from 1996 till 2015

[/img]September 13, 2016 at 3:05 pm #105174

[/img]September 13, 2016 at 3:05 pm #105174JulianCohen

ParticipantDaily or weekly system Said?

September 13, 2016 at 3:34 pm #105193SaidBitar

MemberWeekly

-

AuthorPosts

- You must be logged in to reply to this topic.