Home › Forums › Trading System Mentor Course Community › Progress Journal › Said Bitar Daily Journal

- This topic is empty.

-

AuthorPosts

-

May 8, 2016 at 9:47 am #102551

TrentRothall

ParticipantI agree about the % of daily vol, if is set to 10 or even 5 when you test a system over a long period 20+ years it can look like the system is degrading and losing its edge but really there is nothing wrong. The Net profit might not be achievable but the annual return should be in theory if you took some profits out.

May 8, 2016 at 11:01 am #103784SaidBitar

Membermay be the best way to check the advantage of diversification of strategies and capital allocation for each can be done using Amibroker but this should be done with custom backtesting which i do not know yet how to use it.

I have to find a good source to learn it

May 8, 2016 at 2:03 pm #103790SaidBitar

MemberOK i managed to do one thing looks more like a workaround but it give an idea

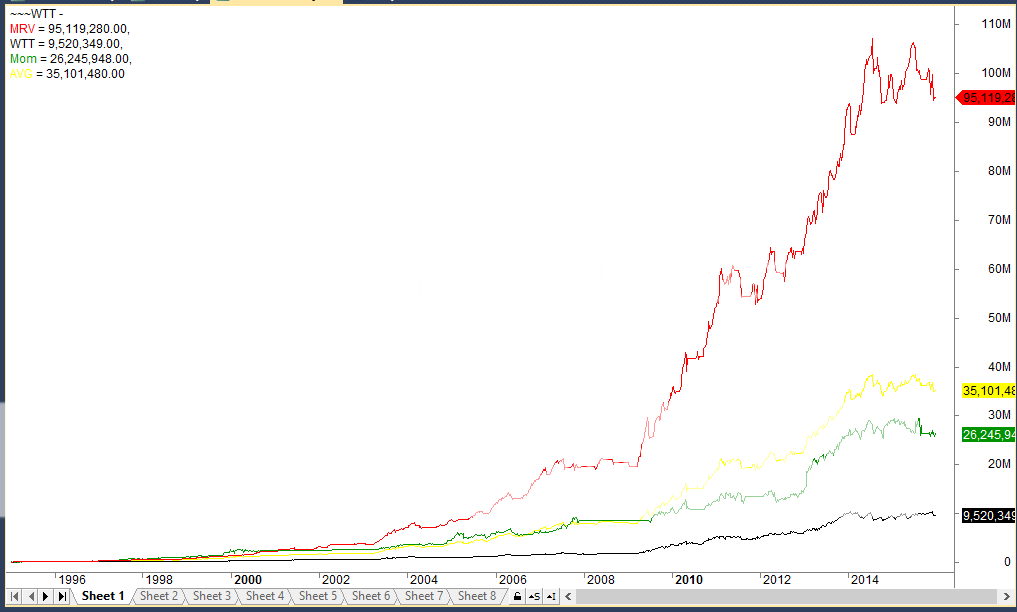

here are the equity curves of all the systems at the same time and the yellow line is the average based on the current configuration that i have

50% WTT 25% MRV 25 % momentum for the period from 1/1/1995 till 1/1/2016

it is clear that DD are lower and so is the CAR. another thing that i noticed and didn’t see it till now that the WTT is the worst 😳 while the Momentum strategy was the one that outperformed since 1995 till 2001 after that the MRV took its place.

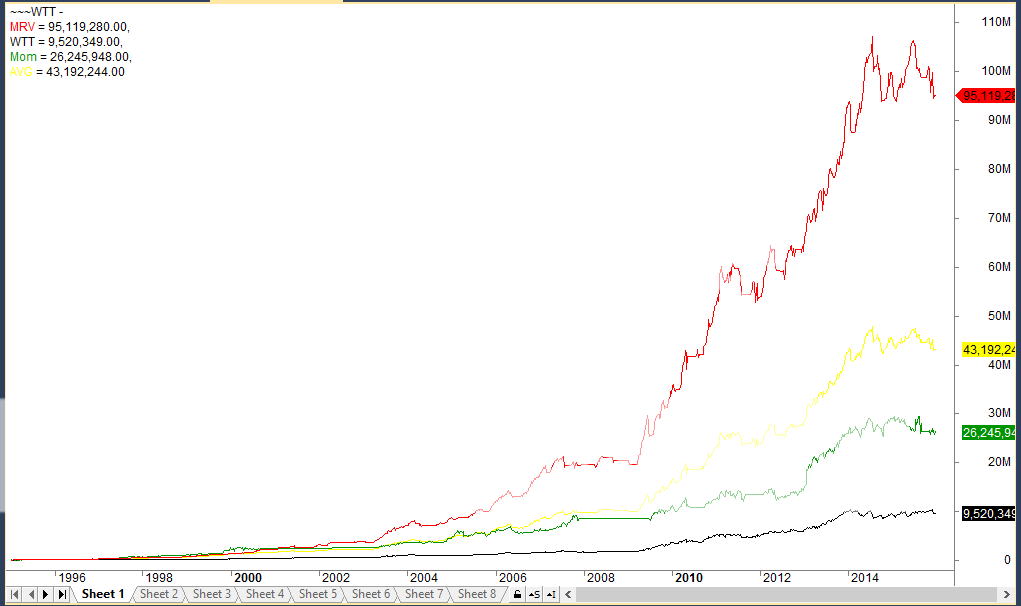

the second scenario is equal allocation for each strategy here is the result

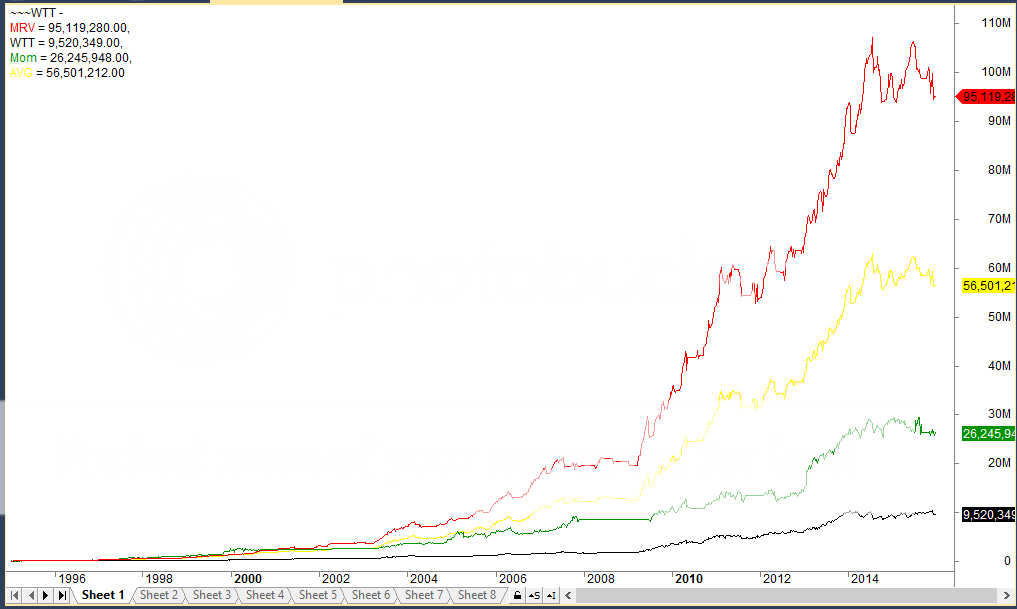

last scenario is 50% for MRV 25 % for Momentum and 25% for WTT

:blink: this is the type of test that you do it and wonder what to do after this

May 8, 2016 at 2:08 pm #103791LeeDanello

ParticipantJust noticed that when using the trading system stress tester macro that you built, if you don’t past the profit able in in the top row ie

then you get a #DIV/0! in the correlation sheet

and the report doesn’t generate properly

May 9, 2016 at 7:25 am #103805SaidBitar

MemberYes

I mentioned this before

May 9, 2016 at 8:46 am #102552ScottMcNab

ParticipantI found with the MRV it was interesting to do backtesting/stress testing by changing

LEPrice = Min(Open,Ref(buylimit,-1));

to

LEPrice = Ref(buylimit,-1);

This should be the worst possible fill with limit order….was an interesting test of the system….helps give some confidence in the system without proving too much I guess

May 9, 2016 at 9:07 am #103804Anonymous

InactiveSaid Bitar wrote::blink: this is the type of test that you do it and wonder what to do after thisthis is the type of test i look at (thanks for posting it) and say to myself “lets start with MRV and think about adding something different if it goes wrong”

May 9, 2016 at 9:15 am #103906

May 9, 2016 at 9:15 am #103906TrentRothall

ParticipantScott McNab wrote:This should be the worst possible fill with limit order….was an interesting test of the system….helps give some confidence in the system without proving too much I guessi had a trade today gap down 5-6% below my lmt order so bought on the open, if it keeps tanking a buy down there is better than at the lmt order

May 9, 2016 at 10:22 am #103907SaidBitar

MemberDarryl Vink wrote:Said Bitar wrote::blink: this is the type of test that you do it and wonder what to do after thisthis is the type of test i look at (thanks for posting it) and say to myself “lets start with MRV and think about adding something different if it goes wrong”

Honestly i was a bit surprised, i knew that Momentum returns were better than trend following but did not have feelings or sense to how much better but when i looked at them at the same time things become clear

May 9, 2016 at 10:26 am #102553TrentRothall

Participantis that a rotational system Said?

May 9, 2016 at 10:30 am #103919Anonymous

InactiveSaid Bitar wrote:Honestly i was a bit surprised, i knew that Momentum returns were better than trend following but did not have feelings or sense to how much better but when i looked at them at the same time things become clearhi said, it looks like from the equity curves of your graph the momentum and MRV they are both run over the same universe using a similar index filter?. if so is that how you run them in reality?

May 9, 2016 at 10:36 am #103921SaidBitar

MemberNo each system runs on different universe with different index filter.

anyhow now i noticed that i did mistake in calculating the average, I calculated weighted average which is wrong. i should do the following instead, divide the capital before running the backtest and running the backtests on all the systems and then add the results together not average them. Finally in order to get the metrics i need to run buy and hold on the result.

Tonight i will do it again

May 9, 2016 at 10:38 am #103920SaidBitar

MemberTrent Rothall wrote:is that a rotational system Said?yes it is rotational system, actually it is similar to the one that is being discussed in the “Group Collaboration System ” thread. So it is based on Stocks on the move but with ROC instead of linear regression

May 9, 2016 at 10:49 am #103922SaidBitar

Memberthe system initially was buying the top 20 and selling if it drops out of the top 20, now i am trying to find my way in Custom Backtester in order to test the following.

Buy the top 20

Sell if it is not in the top 50 or X depends on testinganother idea would be open trades re-balance based on the recent performance and the ATR, for example let’s assume i bought 100 shares because at that time 100 shares were the result of the position size and after some months based on the new value of ATR i should have 150 shares so in this case if there is enough capital then i will add 50 shares.

Still i have to get more confident in the amibroker custom backtester since it is a bit more complicated than the regular AFL and documentation is poor, so mainly it will be based on trial and error and checking stuff with the debug and trace :ohmy:

May 9, 2016 at 10:59 am #103923Anonymous

InactiveSaid Bitar wrote:the system initially was buying the top 20 and selling if it drops out of the top 20, now i am trying to find my way in Custom Backtester in order to test the following.

Buy the top 20

Sell if it is not in the top 50 or X depends on testinganother idea would be open trades re-balance based on the recent performance and the ATR, for example let’s assume i bought 100 shares because at that time 100 shares were the result of the position size and after some months based on the new value of ATR i should have 150 shares so in this case if there is enough capital then i will add 50 shares.

Still i have to get more confident in the amibroker custom backtester since it is a bit more complicated than the regular AFL and documentation is poor, so mainly it will be based on trial and error and checking stuff with the debug and trace :ohmy:

im trying a similar thing now without much success…

:unsure:

:unsure: -

AuthorPosts

- You must be logged in to reply to this topic.