Forums › Trading System Mentor Course Community › Trading System Brainstorming › Robustness

- This topic is empty.

-

AuthorPosts

-

August 8, 2024 at 1:13 am #102301

BenOsborn

ParticipantHi All,

I have been testing out different mean reversion ideas and I have developed a very simple system with two parameters (apart from price and liquidity filters) that I have taken from other ideas I have come across. It was developed on the NASDAQ 100 for the past 10 years. After I was happy that the parameters were robust I tested the two 10 year blocks prior and that was fine. I then tested on SPX, everything looked good, RUI, everything looked good, RUT, shit the bed, same again with RUA.

If I add a simple trend filter at the stock level (c > 200 MA for example) then RUT and RUA both look fine. The trend filter reduces the CAGR a fair bit on the NASDAQ 100 while the Max DD remains fairly similar.

What do others think about robustness in this scenario? The stocks in the NASDAQ 100 are going to be different to the types of stocks in the Russell 2000 but it still makes me a little nervous if I want to add something like this to my portfolio of systems and it is not robust.

Cheers,

BenAugust 8, 2024 at 3:37 am #116263Nick Radge

KeymasterDifferent volatility in those smaller caps. The R-1000 universe past and present is quite vast, so with just 2 rules it seems okay to me.

You could add some simple vola filter to the small cap universe and see what that does.August 9, 2024 at 7:29 pm #116264RichardKoziel

ParticipantHey Ben,

Would post the ROR, MDD and Number of Trades for each Index tested. Thanks Rick

August 10, 2024 at 12:09 am #116265BenOsborn

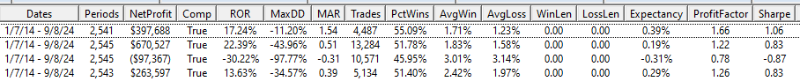

ParticipantSure, I have attached a screenshot. NASDAQ, Russell 1000, Russell 2000, Russell 2000 with simple trend filter.

Results are nothing to write home about on their own but I am just looking for something that is simple and robust that is not overly correlated to my other MOC strategies. If I did go ahead with adding something like this (the NASDAQ version) to the rest of my MOC strategies it reduces overall drawdown of the combined portfolio a little whilst increases he CAGR a little.

tAugust 10, 2024 at 2:00 am #116269

tAugust 10, 2024 at 2:00 am #116269RobertKinnell

ParticipantThis might help, but I didn’t test MOC systems: https://edu.thechartist.com.au/forum/performance-metrics/958-mean-reversion-on-different-universes.html

I found the NDX MR was highly correlated with a monthly rotation system on the NDX, which made me feel it was underlying momentum and the market condition that was driving the returns.

August 10, 2024 at 11:07 pm #116266ScottMcNab

ParticipantHi Ben,

Just looking at R1000 that is a lot of trades to play with over that time period (but then I am not sure how many positions system allows). It may be possible to increase the expectancy and reduce maxDD without harming cagr too much by being more selective with entry. I am guessing that your entry is buylimit which is already using some sort of volatility/atr stretch ? Maybe you could just make the buylimit more stringent (eg use L- atr rather than C-atr stretch) or perhaps increase the stretch further when your index and/or stock filter indicates increased risk ?

August 10, 2024 at 11:35 pm #116270BenOsborn

ParticipantThanks Scott.

It is just super simple at the moment. Buy limit with ATR stretch off the low and when I put a stock trend filter on for the second RUT version I have just used C > 200 MA.

-

AuthorPosts

- You must be logged in to reply to this topic.