Forums › Trading System Mentor Course Community › Progress Journal › Rob K’s Journal

- This topic has 13 replies, 1 voice, and was last updated 3 weeks, 3 days ago by

RobertKinnell.

-

AuthorPosts

-

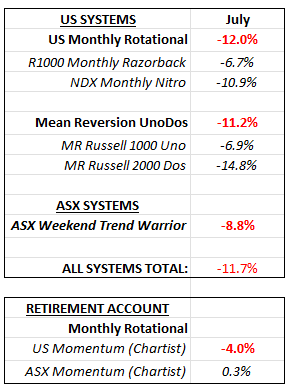

August 1, 2024 at 10:35 am #102309

RobertKinnell

ParticipantHi everyone

I have about 2 months left to go on the mentor course and so thought it would be good time to start a journal.

So far, I am trading 5 systems that I have developed:

• NDX and Russell 1000 monthly momentum systems

• Two mean reversion systems on Russell 1000 and 2000

• A version of the ASX Weekend Trend TraderI also have developed monthly systems for the ASX 100 and XAO that I may start trading sometime in the future.

This month (July 2024) was when I went live with the last of the 5 systems.

August 3, 2024 at 9:28 am #116242

August 3, 2024 at 9:28 am #116242ScottBilton

ParticipantHi Rob, welcome to the forum, nice to see your post.

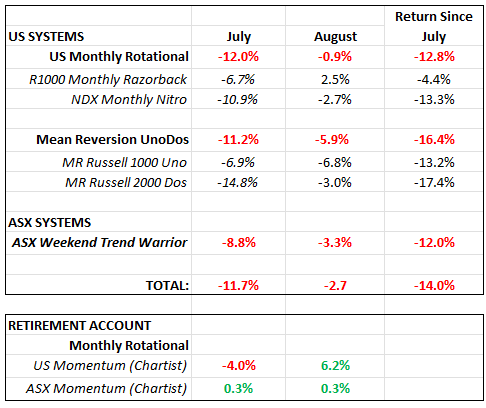

August 31, 2024 at 2:31 am #116243RobertKinnell

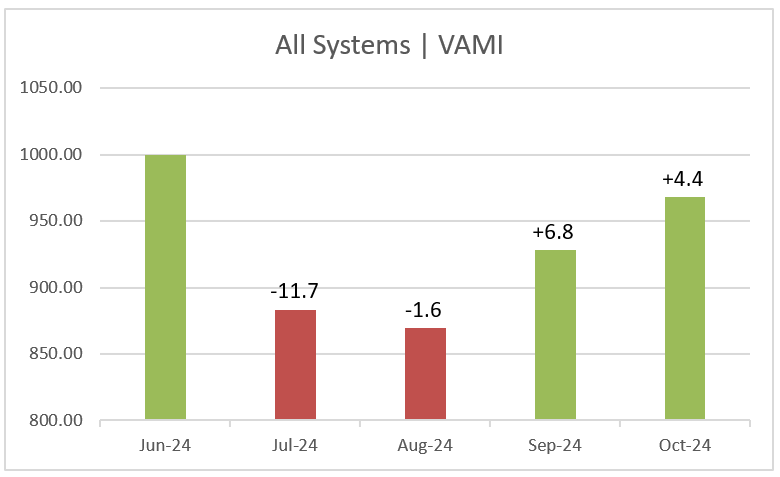

ParticipantEnd of August 2024

Drawdowns continue, though not as bad as July.

Both my R1000 and NDX monthly systems had positions in SMCI which got hit hard with allegations of accounting irregularities. This was the only position down significantly for the month. Luckily, all other positions were positive which offset the loss in SMCI.

With -38%, SMCI was the 4th largest negative trade for the R1000 system (since 2005), and the largest ever (since 2005) for the NDX system.

Both systems also had positions in CRWD during August, which was a large contributor to August’s fast drawdown (including an all time MaxDD since 2005 for the NDX system) due to the issues with the world IT shutdown.

The mean reversion systems had a drawdown in line with the market correction, but failed to recover with the subsequent market move up.

The ASX weekly trend system had some big negative hits with ACW (-68%) and KLI (-44%).

September 1, 2024 at 11:07 pm #116291

September 1, 2024 at 11:07 pm #116291Sean Murphy

ParticipantHi Rob,

Good to see you in the forum.

SMCI – a bit of signal luck there, ouch. Elsewhere in the forum, wiser folk than I have discussed the merits of excluding the same symbol from being present in multiple strategies. But its great to see you citing where these trades sit in the historical context of the systems.

Those little stocks in the ASX sure are jumpy. Happy days when they bounce our way.

September 2, 2024 at 6:58 am #116302RobertKinnell

ParticipantHi Sean

After last and this month, I did look at the US monthly systems not trading the same symbol. While it reduces the MaxDD it also reduces the ROR (double edge sword) when combined as one system. Still a good system, but I’m ok with the extra volatility in achieving a higher return with a concentrated position from time to time in my current system.

I think the biggest factor with volatility is the volatility of the stock, rather than multiple symbols. SMCI’s HVOL is over 50.

September 2, 2024 at 11:57 am #116309TerryDunne

ParticipantHi Rob,

I 100% agree with you on this. The whole point of back testing is to see what works, or at least what works better than alternatives. Trading the same symbol over many systems gives significantly superior returns than not, for me anyway.

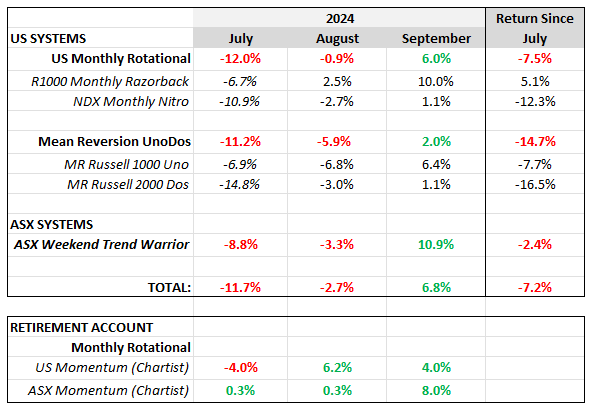

By the way I was also slapped by SMCI.October 1, 2024 at 10:46 am #116244RobertKinnell

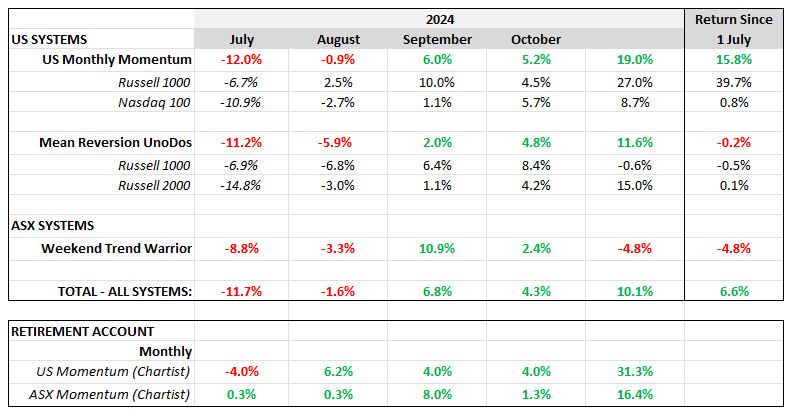

ParticipantEnd of September 2024

Some recovery this month, helping to offset recent drawdowns.

The Russell 1000 monthly system came away with +6% return, with the equity curve bouncing straight out of its drawdown into a new equity high. VST was the stand out position (+40%). In contrast, NDX monthly stayed flat with its equity curve still in a down trend.

The Russ1000 MR system had a 6% bounce while the Russell 2000 was flat.

The ASX WTT made a nice 10% bounce mainly thanks to EZZ and CYL. Equity curve has recovered and is back just under all time highs.

Also, good to see the ASX Monthly (Chartist) perhaps soon to come out of its longer-term drawdown with +8% this month:

November 1, 2024 at 9:19 am #116341

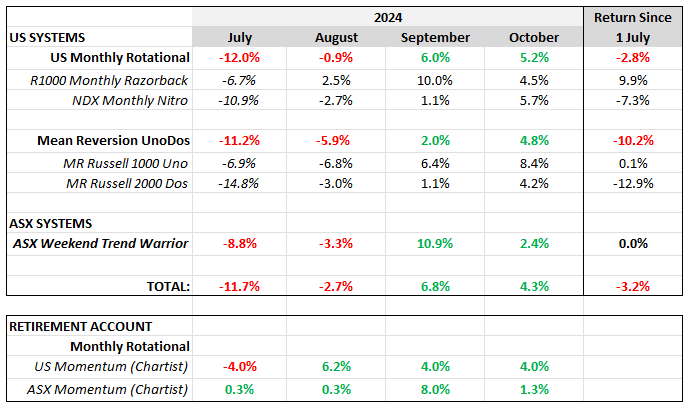

November 1, 2024 at 9:19 am #116341RobertKinnell

ParticipantEnd of October 2024

Improvement from the account’s recent drawdown continues.

The US Monthly Rotational system returned 5% this month, with most of the recent drawdown almost now recovered. The recovery has been led by the R1000 system (+10% into new high equity ground) with the NDX still underwater with a -7% drawdown. CVNA is leading the charge in the R1000 system with a current +68% return.

The mean reversion system has improved by 5% but is still in a -10% drawdown. While the R1000 system has recovered from its drawdown, the R2000 system is still -13% underwater.

The ASX WTT has completely recovered from it drawdown and is on par with its 1 July starting point. The WTT exited EZZ last week with a 44% return, and is currently holding CYL with a 94% return.

Still hoping the ASX Momentum (Chartist) can start kicking into gear like its US cousin. The system was doing well holding WTC until the CEO’s issues this month:

November 1, 2024 at 10:31 am #116362

November 1, 2024 at 10:31 am #116362Sean Murphy

ParticipantA good couple of months there Robert, building nicely.

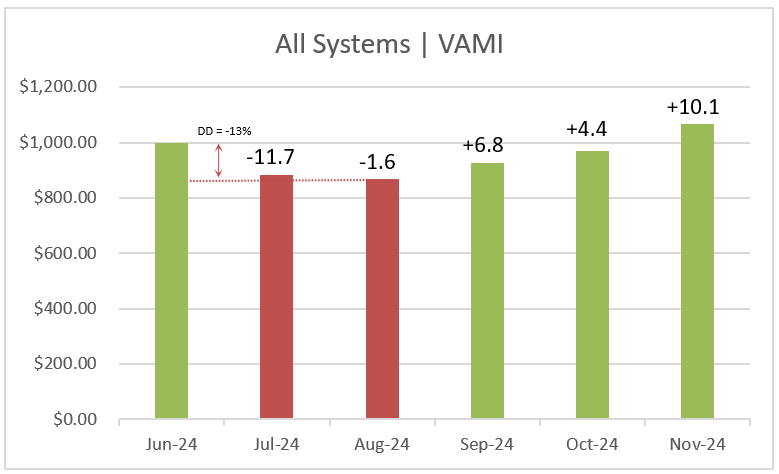

November 30, 2024 at 5:17 am #116245RobertKinnell

ParticipantEnd of November 2024

Wasn’t expecting a positive month at the start. Both US monthly systems took positions in CEG which immediately gapped down, and the R1000 took positions in APP and PLTR which both looked extended. By month end, APP is up 97% and PLTR 60%.

This is an outlier month and year for the R1000 system. November’s 27% return is the biggest in the R1000 20yr back test, and is on track for its biggest year at 83% for 2024. Its unusual to have a 50% or more trade in a single month – let alone two. APP is the 6th biggest winning trade in the back test and none above it achieved it in 1 month. The other trades above 50% that achieve their gains in 1 month was PLTR (this month), W (54%) in Feb 2019 and MRNA (52%) in July 2021.

In other news, looks like SelfWealth is going to be taken over by Bell Potter. I was concerned they would change the brokerage to match Bell’s and was looking around for other brokers, but the information is they will keep Selfwealth separate with no change pricing.

December 1, 2024 at 3:39 am #116399PB

ParticipantA great month for you Rob,

I also like the way you are displaying performance for your different systems – think I’ll adopt something similar for 2025.PB

January 2, 2025 at 4:37 pm #116910RobertKinnell

ParticipantEnd of December 2024

At the start of this month, I brought my two monthly ASX systems into live trading. The first focuses on the ASX 100, while the second focuses on the ASX 500 (minus the ASX Top 100).

All of my monthly systems have gone into cash at the end of December, with the exception of the ASX 100. Cash has been moved into the AAA ETF for AUD and the BIL ETF for USD.

Looking forward to seeing what 2025 brings – there will be the unexpected. For what it is worth, my expectation is returns will be harder to come by after such as strong year.

With my systems now all operational with minimal time commitment, I going to have to keep myself occupied with a new hobby. While I will be looking at new systems (such as on the TSX), my focus for 2025 will be on getting fitter and healthier.

January 2, 2025 at 4:38 pm #116911

January 2, 2025 at 4:38 pm #116911RobertKinnell

Participant

-

AuthorPosts

- You must be logged in to reply to this topic.