Home › Forums › Trading System Mentor Course Community › Trading System Brainstorming › Reducing Entry Signals

- This topic is empty.

-

AuthorPosts

-

December 13, 2016 at 11:11 am #105967

SaidBitar

Memberwow this exposure made lots of noise, according to my understanding exposure is calculated on daily basis how much money was in the market out of the whole capital and then it is averaged on the duration tested

if you have 5 days and your daily exposure was 50%, 40%, 100%, 0%,0% then your exposure is 38%end of the day exposure is just a measure to show how much the capital was active for a specific strategy.

regarding the plot of the signals vs trades I will make it later today. but what got me confused is the noise how to know if the noise levels are so high in my system. If it will be based only on winning percentage for very short term system I couldn’t make it higher than 56%-57% .

Regarding the other metrics honestly i pay less attention to them when I am having MOC system in mind, what i care most about is the Sharpe ratio , DD and for sure the edge of the system i prefer to have smooth equity curve sloping up nicely and not to have huge jumps in either directionDecember 13, 2016 at 11:38 am #105968ScottMcNab

ParticipantSaid Bitar wrote:wow this exposure made lots of noise, according to my understanding exposure is calculated on daily basis how much money was in the market out of the whole capital and then it is averaged on the duration tested

if you have 5 days and your daily exposure was 50%, 40%, 100%, 0%,0% then your exposure is 38%end of the day exposure is just a measure to show how much the capital was active for a specific strategy.

regarding the plot of the signals vs trades I will make it later today. but what got me confused is the noise how to know if the noise levels are so high in my system. If it will be based only on winning percentage for very short term system I couldn’t make it higher than 56%-57% .

Regarding the other metrics honestly i pay less attention to them when I am having MOC system in mind, what i care most about is the Sharpe ratio , DD and for sure the edge of the system i prefer to have smooth equity curve sloping up nicely and not to have huge jumps in either directionI was trying to look at the noise issue. If we had a metric that allowed us to design systems that didn’t generate more buy signals than available positions (or at least reduce this occurrence) then wouldn’t that be reducing the noise ?

I

December 13, 2016 at 7:49 pm #105969SaidBitar

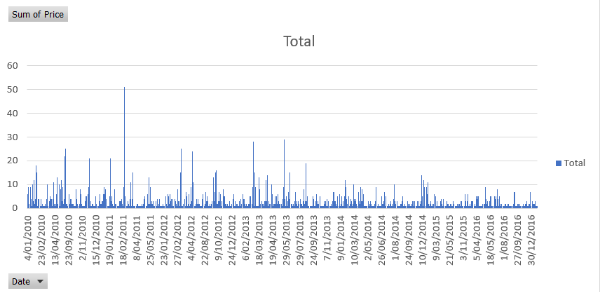

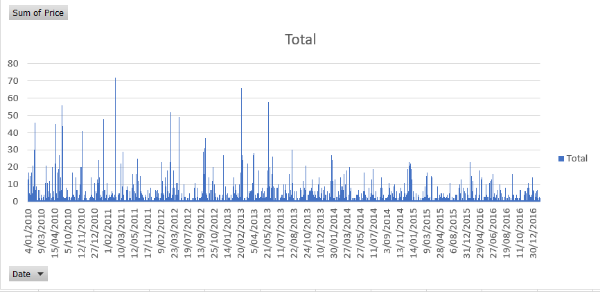

Memberhere is the signals vs the trades for the last duration i tried to capture longer duration but then it is unreadable but this will give good idea.

February 9, 2017 at 4:51 am #105970CAIHuang

MemberI am currently experiencing a high number of trades with my MRV system and am in the process of testing it out on different universes i.e. russ1000, snp500 and nasdaq100 etc. Also modifying price filters to reduce the possible entries.

I am now adding a few different entry conditions into the mix such as volume, ADX and RSI to see how they reduce the trade frequency without adversely effecting my performance stats too much.

Just wondering if many others have added an extra trade condition to restrict entriy signals and therefore trade frequency or have you mainly gone the way of changing the trade universe or changing up the price filters (i.e. $10-$100 reduced to $10-$50 etc.) Or all of the above.

Obviously there are hundreds of ways to counter the trade frequency issue. Be interesting to see what has worked for other people.

Cheers

February 9, 2017 at 5:28 am #106202ScottMcNab

ParticipantAll of the above

from R1000 went down to SPX

price 10-100

add adx and atr filter to buysetup…

then take system to other markets and make sure expectancy similar and haven’t curve fittedFebruary 9, 2017 at 8:40 am #106203CAIHuang

MemberThanks Scott,

What trade frequency % were you happy with in the end?

I have some systems that produce varying trade frequency results and i’m trying to strike that balance with a high percentage but also not negatively effecting my CAGR to much etc.

e.g

2072 trades (20 positions @ 5%) out of 2314 (100 positions @ 1%)

therefore 2072/2314 = 89.5% of trades are taken3785 trades (20 positions @ 5%) out of 5265 (100 positions @ 1%)

therefore 3785/5265 = 72% of trades takenThis was for backtests from 2010-present.

I guess I am aiming for something with an 80% or greater hit rate of trades taken. Not sure if others are comfortable with a lower percentage then that? I know Nick’s MRV systems are 95+ and his ASX MRV has a 100% hit rate of trades taken. I just see my systems performance being degraded too much trying to achieve percentages like that and wonder what others out there are comfortable with.

February 9, 2017 at 9:08 am #106205SaidBitar

Membermeasuring the trades in this way is good but also you need to check on per day statistics. what you need to do is take all the possible trades and check how many you are having per day and compare it to the maximum number of trades allowed. This is what i did because there are days where the possible number of trades in 200+ especially if your universe is the R1000 and you will trade only 20 out of these. If you found out that 90%+ of the days you are capturing all the trades and 10% of the days you have more trades than your maximum allowed then it is OK.

Again the lower the better and it is good to do this exercise before you start adding additional conditions because you do not want to kill the system only for 5% or so of the days

February 9, 2017 at 10:51 am #106206ScottMcNab

ParticipantFurthering what Said has posted, I find Darryl’s code for the graph on buy signals very helpful. I used to work on limiting the number of times per month when buysignals>postions to 1 but now I am aiming for once every two months or 5-6 times a year. In the testing I have been able to do comparing live results with what was expected, I find on these days I am averaging a 1% drop in CAR each time one of these events occur….so the 20% trade skip ends up giving realistic live results/expectations for me.

In your first example in which you were able to capture 89.5%, why not try 25 positions at 8%…or 30 at 6.66%. I think aiming for Nick’s results are a worthy goal but I don’t imagine many of us here are able to generate systems like he can … I think Nick might use 40 positions at 5% from memory ?

my SPX MRV over last 6 years: 71%

my ASX MRV over last 6 years: 81%Again, as mentioned by Said, most of this drop is due to the missed trades that are concentrated on those occasional days where 100+ orders may trigger

Its something that has bothered me a lot so far Luke so I’d love to hear what you decide and your experiences as you trade it.

February 9, 2017 at 11:05 am #106207ScottMcNab

ParticipantASX was on 10 positions at 10%…if increase to 20 positions at 10% then it takes 3028/3210…94%

But CAR of ASX only about 20% while CAR for SPX higher due to much higher trade frequency (code for systems same)Hope something in that rambling helps

February 9, 2017 at 11:16 am #106208CAIHuang

MemberScott McNab wrote:ASX was on 10 positions at 10%…if increase to 20 positions at 10% then it takes 3028/3210…94%

But CAR of ASX only about 20% while CAR for SPX higher due to much higher trade frequency (code for systems same)Hope something in that rambling helps

Was over a similar time period to what I mentioned above i.e. 2010-2017?

February 9, 2017 at 11:42 am #106209CAIHuang

MemberYes I was told by Nick to look into the number of days that there were greater then 20 trades. I just played around with my results in excel and assessed this statistic for various data sets.

e.g.

For the system I mentioned previously:

89.5% of trades taken :

9 days out of 675 were over 20 trades = 98.67% of days all available trades were captured

72% of trades taken

42 days out of 926 were over 20 trades = 95.46% of days all available trades were captured

So I guess those percentages are acceptable?

I was testing various extremities of my system to achieve a high % of the number of trades taken and wasn’t focused at all on the number of days where all trades were taken. I definitely don’t want to jeopardise my trading performance to achieve a super high % rate of trades taken when a lower % rate of trades taken is acceptable and my performance stats are a lot better. I guess i’m just trying to gauge what are acceptable results. I kind of draw from this that a % of trades taken over 70/75% is acceptable if the number of days where all available trades were taken is over 90/95%. I guess it does differ for each person as to what they deem acceptable.

Very helpful to see your results Scott and draw some comparison’s. I just re read and saw that your test was over the same period.

Does your SPX MRV system use 20 positions at 10%?Yours and Said’s ramblings have helped for sure. Still a fair bit more testing to do trying to strike that balance!

February 9, 2017 at 2:12 pm #106210LEONARDZIR

ParticipantLuke,

My 2 cents. I have been trading an extremely simple MOC system and have 7% of the days with more signals than I took(I just rechecked it from 2011 to 2017). I am using SPX, prices 10-75, 30 positions at 10%.. Been trading the system since October and has been profitable and basically my returns fall around the average return when I do MCS backtesting. So far on days I have not taken all signals the results look pretty random winning on some and losing on some although recently haven’t had many of those days.

Len.February 9, 2017 at 10:24 pm #106212ScottMcNab

ParticipantLuke Aram wrote:Very helpful to see your results Scott and draw some comparison’s. I just re read and saw that your test was over the same period.

Does your SPX MRV system use 20 positions at 10%?Yours and Said’s ramblings have helped for sure. Still a fair bit more testing to do trying to strike that balance!

SPX is 25 at 8%

February 15, 2017 at 5:08 am #106211Anonymous

InactiveI too, am struggling with selection bias with MRV systems! I wasn’t really aware of how much of an issue it was until Nick pointed it out!

I’ve been struggling for a couple of weeks now trying to see if I can get anything usable out of the MRV systems I’d been working on with ok returns but, only capturing 35 – 55% of the trades.

Like some of the others here, I’ve tinkered with price filters/watch-lists etc, but any time I get anything close to 85% there’s next to no return to achieve those figures.

I just wonder if I’m flogging a dead horse with the systems I’m trying, and was wondering from those on here your thoughts on the following;

It seems the biggest factor is the size of the Universe – with the smaller historic watchlists for USA limited to S&P100, and Nasdaq, the next jump up is the Midcap 400 (which my systems work pretty well on – selection bias aside) Has anyone tried creating a smaller custom watch list of say, the 100 – 300th largest companies? The Nasdaq and S&P don’t have the same price movements as those smaller firms, and I don’t really get great results with them. The biggest issue here of course is finding historic data for the new Universe. But I’m just trying to get a smaller universe!

Also, obviously another way to bump up trades taken is to allow more positions/smaller % per trade. I note the course mainly talks about keeping to 20 positions, and most of you here seem to be in the 10 – 25 position basket. The returns of course drop off somewhat, but is there really too much of a problem with say 30 positions at 3.33% if the backtesting gives adequate results?

Sorry for the long post but I’m really stuck with this!

February 15, 2017 at 6:35 am #106249Nick Radge

KeymasterSend it through. That’s what I’m here for…

Just looked at my MOC system on the Russell 1000 for the last year.

# signals taken = 1219

# signal possible = 124997.5% capture

CAGR +23.2

maxDD -7.05% -

AuthorPosts

- You must be logged in to reply to this topic.