- This topic is empty.

-

AuthorPosts

-

May 12, 2022 at 1:46 am #101403

KateMoloney

ParticipantThought I would expand on my question from last night.

I am currently renovating my second day trade MOC system and have been playing with different ranking systems.

Some ranking systems produce similar results across a variety of parameters. Whereas other ranking systems produce better returns in the lower range of parameters.

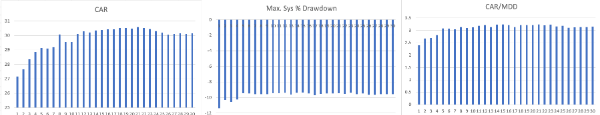

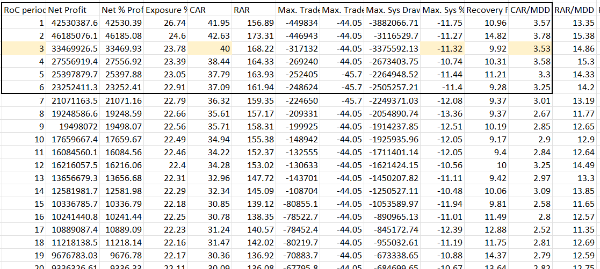

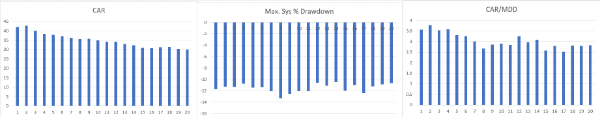

Below is a 17 year optimization & 3 year optimization example.

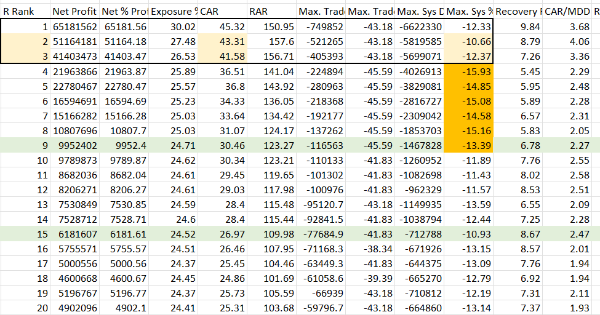

I did not use this ranking system because whilst it was profitable, there was a deterioration in drawdown results past ROC(3). Whilst the returns were acceptable, I didn’t like the increase in fill rate % which is why I dumped this ranking system.

Graphs to come …

May 12, 2022 at 1:49 am #114755KateMoloney

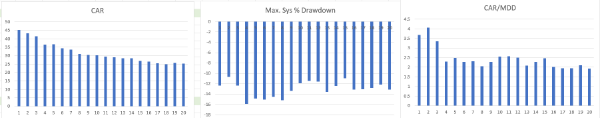

Participant17 Year optimization

May 12, 2022 at 1:51 am #114756

May 12, 2022 at 1:51 am #114756KateMoloney

ParticipantWhereas with this ranking system, which is based on volatility, the parameters are pretty stable across the board.

May 12, 2022 at 1:55 am #114757

May 12, 2022 at 1:55 am #114757KateMoloney

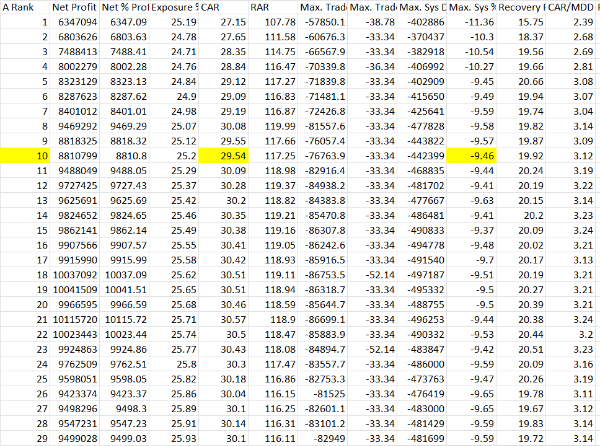

ParticipantI then played around with the ROC rank and managed to get the following results…

The results deteriorate as the param gets higher, but not as much as the first ROC example.

My question to Nick is, do you still consider the above example to be a robust system? Given that ranking rule is ranking on a smaller sample of stocks compared to the normal rules/conditions we put in our trading system.

My thoughts are it is a robust system. The 3 year optimization showed similar results and given it is a short term system, it makes sense that the shorter term ranking parameters will produce better returns.

May 12, 2022 at 8:15 am #114758TerryDunne

ParticipantHi Kate,

Logically, I’d expect a bigger number of bars to be less useful for an MOC system. Personally, I’d have no issue with using 2 to (maybe) 5 bars and wouldn’t consider it curve fitting. However, if there was a patch of bars, say from 10 to 12, that gave great results, I’d have significant misgivings using any of them…why would what happened almost 2 weeks ago be relevant for a system that holds positions on average for a few hours?

My 2c for what it’s worth.

Terry

May 13, 2022 at 1:50 am #114759JulianCohen

ParticipantI would look at it the same way as Terry…When I look at an MR or MOC strategy I rarely have the parameters go out past two weeks. I am trying to find patterns from the last few days and exploit those.

I mainly use ROC3 and sometimes ROC1 for my short term strategies…

May 13, 2022 at 9:52 am #114760KateMoloney

ParticipantThanks for sharing Julian and Terry. Good points.

In the past I’ve had the belief that ranking parms “should be” fairly consistent with returns etc … eg flat spots, find the middle. Similar to how we’d expect for normal conditions for a system … But like any belief I have, am willing to challenge it and be proven wrong.

May 13, 2022 at 10:13 am #114761JulianCohen

ParticipantI treat it as any other parameter…however with a short term strategy I’m only interested in the very recent rate of change. With a long term strategy I’d be looking at ROC(180) or ROC(200)

May 13, 2022 at 10:33 am #114762KateMoloney

ParticipantThanks for sharing Julian

I’ve started getting a bit more creative with ranking systems, multiplying, adding, subtracting indicators etc, to try and create points of difference.

Similar results to a straight indicator eg ROC, but a slight tweak.One of my future goals is to create my own tweaked indicators (eg Bollinger bands – like Nick did) and apply them to the systems.

May 14, 2022 at 1:34 am #114764JulianCohen

ParticipantGood plan Kate.

I have a few short term strategies, and one of the criteria I have when developing them is to use ranking to differentiate between them, so that helps to prevent double holding of stocks in different strategies on any one particular day. I can’t weed that out totally, but I do feel that striving for that difference when backtesting is a great help.

One issue of course, is that is much much easier in RT than in Amibroker.

Get well soon.

-

AuthorPosts

- You must be logged in to reply to this topic.