Home › Forums › Trading System Mentor Course Community › Progress Journal › Nics Journal

- This topic is empty.

-

AuthorPosts

-

March 20, 2021 at 2:00 pm #113110

JulianCohen

ParticipantNic,

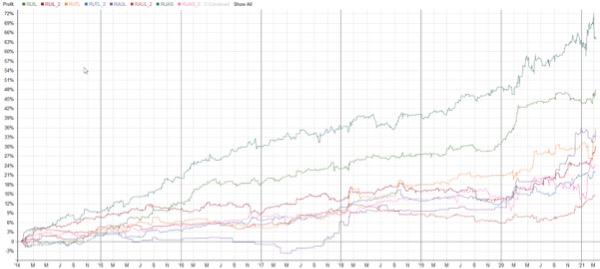

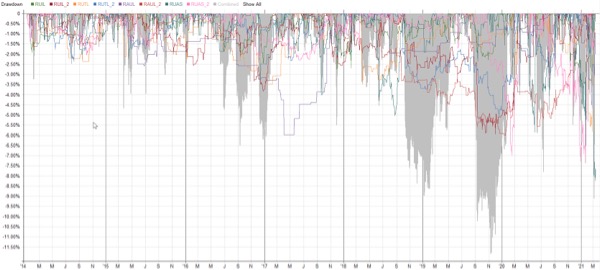

it’s a combination of both things actually. Some are in drawdown when others aren’t and vice versa. Everything contributes to the whole.

Hopefully you can see these clearly.

March 21, 2021 at 3:18 am #113109

March 21, 2021 at 3:18 am #113109GlenPeake

ParticipantNic wrote:Thanks Glen!Not sure if you have the data going back till 2000 but that would be impressive if you’re getting similar results.

thanks for your comments

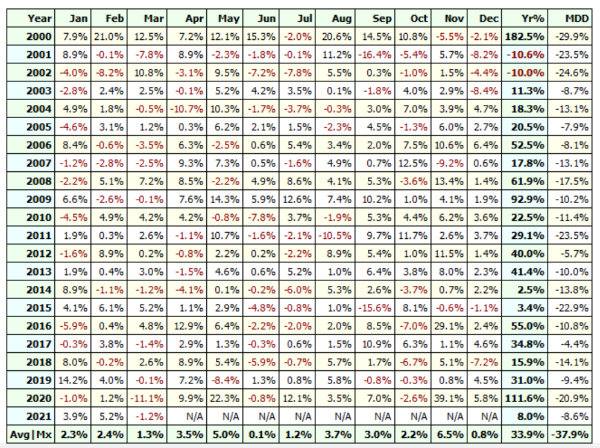

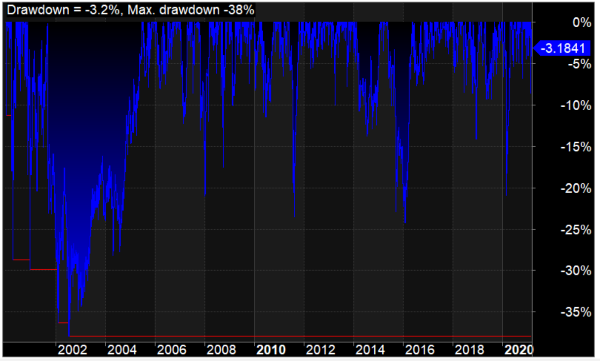

A bit of a ‘buckle your seat-belt’ from the start of 2000.

Keeping in mind that this was the Tech Boom/Crash period etc… so lots of volatility during this time.

Keeping in mind that this was the Tech Boom/Crash period etc… so lots of volatility during this time.

March 21, 2021 at 1:18 pm #113115

March 21, 2021 at 1:18 pm #113115RobertMontgomery

ParticipantHow are you guys adding the MDD to the returns table above?

March 21, 2021 at 9:57 pm #113116GlenPeake

ParticipantRob M wrote:How are you guys adding the MDD to the returns table above?Hi Rob,

Details in this post….

March 23, 2021 at 1:44 am #113117RobertMontgomery

ParticipantThanks for sharing, it would have taken me for ever to figure that out.

March 23, 2021 at 1:59 am #113129GlenPeake

ParticipantYep, no probs Rob.

April 10, 2021 at 1:15 am #113130nicBecker

ParticipantSo again…its been a few days between updates but have made a bit of progress with my system. I had Nick have a look at my system and he flipped my entry criteria to the opposite end of the spectrum and added on a failsafe exit. This smoothed the equity curve regarding the 35+% drawdown to a more manageable ~17% drawdown and bumped the annual return +another 2-3%. With Nicks suggestion of adding a time based filter I ran the system and popped the results into an excel spreadsheet, then broke the returns down on a ‘days in trade’ basis – this showed that on average, trades held up to 3 days were ~70% positive however once they were 4+ days open this average dropped to ~20%. So changing the looping coding here to a sell when LBIT is 3 days has again added another 1-2% and also reduced the drawdown. So currently ~25%annual return with a ~13% drawdown. Nothing exceptional but maybe a bit closer to something more workable.

Still when running the system to show all possible trades I end up with 65000 possible trades over a 15 year period. Using current position sizing of a 10% allocation and no margin I roughly end up with approx. 10,000trades over that period. This would suggest to me there is still some room to not enter some of the negative traders or to try and squeeze some more out of the positive trades.

April 10, 2021 at 5:29 am #113197JulianCohen

Participant25% and -13% are good metrics Nic….Only thing I would say is beware of over optimisation….it can creep up on you slowly, like death from a thousand cuts….I did this over a few years. I kept thinking “Maybe if I just try this, or that” and slowly the strategy morphed into something different.

I love experimenting, and testing ideas, but a few weeks ago I went through and removed all extraneous parameters I had added over time, and the strategies are now much simpler and so therefore, hopefully more robust. Just something to keep in the back of your head whilst experimenting….”this is a great idea and adds x% but what is the big picture effect?”

What I do now whilst experimenting with ideas is to see if the new idea I’m testing works as a stand alone strategy…so say for example you find something that can cut back your universe from 10000 trades to 6000 trades over 15 years. Maybe that idea on it’s own can be a totally new strategy, then you would have diversification from two strategies.

One other thought….try widening the stretch to take less trades and see if that increases the expectancy…hopefully it will

April 10, 2021 at 9:20 pm #113198ScottMcNab

ParticipantI would happily trade a system at 25/-13 …esp for R1000 only…great results Nic. Is it possible to use the original style of entry (before you flipped it) to make a complimentary system sufficiently different to give some diversification..maybe trade it on R2000 or something? Doesn’t even have to be as good for the combined results to make it worthwhile

-

AuthorPosts

- You must be logged in to reply to this topic.