Home › Forums › Trading System Mentor Course Community › Progress Journal › Nick Radge – Daily Journal

- This topic has 543 replies, 32 voices, and was last updated 3 weeks, 6 days ago by

Nick Radge.

-

AuthorPosts

-

January 1, 2021 at 1:34 am #112706

Nick Radge

KeymasterDecember 2020

ASX

Growth Portfolio: +1.61%

WTT: +3.00%

ETF: +8.00%

ASX Momo: +15.85%US

HFT: +8.00%

US Momo: +5.39%

MOC: +18.49%

DTVI: +7.97%That’s a record year for me. I’ll write a more comprehensive report card some time in the coming days.

January 1, 2021 at 9:20 am #112752Nick Radge

Keymaster2020 REPORT CARD

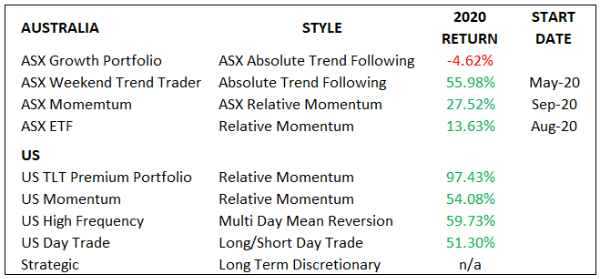

In summary a record year for me with 5 of my 8 systems returning > 50% and my Strategic portfolio making big headway mainly thanks to $TSLA. The goal for 2020 was to continue to diversify through various portfolios, especially with my retirement account in Australia.

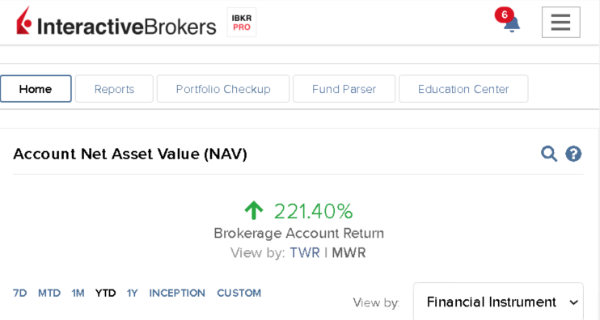

The 221% return shown above is from all the US strategies ex-High Frequency. It sits in a separate IB account & all Aust. portfolios sit in other accounts.

For the last 20-years my almost all ASX exposure was in the Growth Portfolio. With better understanding of signal luck, mainly thanks to @choffstein, that had to change.

Three more strategies were added & as can be seen by the Growth Portfolio, it was just as well.

I also added shorts to the Day Trade strategy in mid-October with almost immediate positive results. As mentioned herein I saw a marked increase in winning days (53% > 61%) and W/L ratio (1.0 > 1.3). Considering the brief window, they’re quite large improvements.

My next project is adding shorts to my HFT strategy. Initial testing is extremely positive but volatility is somewhat higher than I’m willing to cope with (must be getting old). I’ll scale that down by reducing the universe from all US stocks, to just the R-3000.

Another goal is to increase execution fill frequency on the Day Trade strategy which will increase profitability and smooth the equity curve.

Considering the years that was, both in the markets, in life and the BS from the regulator, I’m quite chuffed at how it all panned out.

Here’s to 2021 and #next1000trades.

-Nick

January 1, 2021 at 9:33 am #112772GlenPeake

ParticipantAfter reading this report card, if I wasn’t already apart of the Mentoring course, I would definitely going through FOMO and wanting to sign up for the Mentoring…

Very juicy numbers, across all strategies.

Well done!

January 2, 2021 at 3:55 am #112773MichaelRodwell

MemberVery inspirational Nick. Congrats on the great year and achieving your objective re: the GP.

January 23, 2021 at 6:06 am #112795Nick Radge

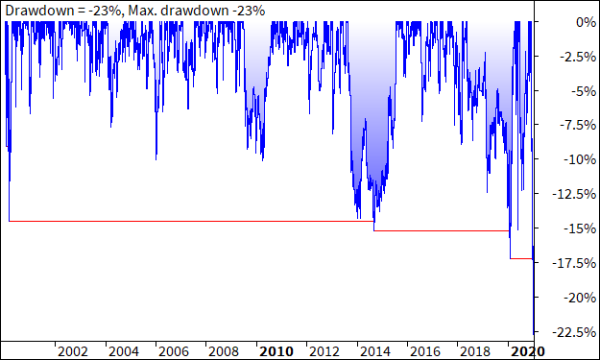

KeymasterWhen you real time beta test trade a new strategy and it immediately goes into new max drawdown…

January 23, 2021 at 7:31 am #112893

January 23, 2021 at 7:31 am #112893GlenPeake

ParticipantOuch….

…I’ll take a “wild” stab in the dark and say that’s the multi day Mean Reversion Short side system….?

Marsten posted similar comments about his MR short system on his forum… and has switched that it off…

January 24, 2021 at 4:33 am #112894Nick Radge

KeymasterCorrect.

Got to say he seems to switch his systems on and off with regularity. Just wonder how robust they really are…

January 24, 2021 at 1:30 pm #112895Howard Lask

ParticipantI had a similar experience last week – beta launched a new MOC short system on Monday, ended the week shorting GME (+51% on Friday). Ended the week in a 19% DD

January 24, 2021 at 9:57 pm #102386ScottMcNab

ParticipantHow does it go simply changing exit to MOC Nick ? Wondering if same system split 50:50 into a MOC (with potentially higher leverage) and MRV systems gives a smoother ride ?

January 24, 2021 at 10:06 pm #112896Nick Radge

KeymasterI already have a MOC system so the specific goal was multi day hold. I’ll keep plodding along with it…

January 30, 2021 at 12:17 am #112897Nick Radge

KeymasterJanuary 2021

ASX

Growth Portfolio: +3.52%

WTT: +2.89%

ETF: +1.76%

ASX Momo: -3.29%US

HFT: -2.90%

US Momo: +2.52%

MOC: +4.21%

DTVI: +4.69%February 27, 2021 at 1:02 am #112937Nick Radge

KeymasterFebruary 2021

ASX

Growth Portfolio: -1.15%

WTT: +6.88%

ETF: -4.26%

ASX Momo: +2.94%US

HFT: +1.5%

US Momo: +11.90%

MOC: +0.49%

DTVI: -7.67%March 31, 2021 at 9:58 pm #113039Nick Radge

KeymasterMarch 2021

ASX

Growth Portfolio: -2.56%

WTT: -4.99%

ETF: Discontinued

ASX Momo: -6.35%US

HFT: +10.40%

US Momo: +2.78%

MOC: +10.32%

DTVI: -12.39%I found a coding error in the ASX ETF strategy that I was unable to resolve. Performance of that strategy was mediocre and I was simply trying to park funds in a more diverse strategy. I’ll allocate those elsewhere in the coming months.

ASX trend systems continue to get chopped around in this sideways range. Really is a stock pickers market at the moment.

This past month I’ve been working hard on position sizing with the MOC strategy and feel I’ve come up with a formula that should boost returns. Early signs are promising.

April 30, 2021 at 9:35 pm #113142Nick Radge

KeymasterApril 2021

ASX

Growth Portfolio: +3.66%

WTT: +4.96%

ASX Momo: +9.41%US

HFT: -1.60%

US Momo: +6.60%

MOC: +3.68%

DTVI: +11.51%May 4, 2021 at 12:46 am #113226TimothyStrickland

Membergood results for this month Nick. I noticed you brought up the Hedge tool to category 4 from a 3. I was curious of your thoughts about inflation in the US. I am a little concerned with the crazy spending we have started to do, that this will effect inflation quite a bit. Luckily we all have strategies to deal with this sort of thing but would you suggest doing anything further?

-

AuthorPosts

- You must be logged in to reply to this topic.