Forums › Trading System Mentor Course Community › Progress Journal › Nick Radge – Daily Journal

- This topic has 546 replies, 33 voices, and was last updated 3 weeks, 6 days ago by

RichardKoziel.

-

AuthorPosts

-

March 28, 2020 at 5:02 am #111187

JulianCohen

ParticipantI’m thinking that your initial idea of trading one half monthly and one half weekly might be preferable. It has a double benefit because it also changes the signal from 200 days to 100 days therefore giving an added variation plus the logistics of splitting the system into tranches and trading that could be a little onerous. Maybe I haven’t thought it through properly.

Do you run each month, and then just split each entry or exit signal into four and then each week buy or sell each quarter until you run again at the end of the month?

March 28, 2020 at 11:06 pm #111188Nick Radge

KeymasterJulian,

That’s my thought process as well. It’s a slight variant to the strategy so will add diversification to both the signal and the rebalance.I intend to split the portfolio into two and run monthly signals as per normal on half and then weekly on the balance.

March 29, 2020 at 3:45 pm #111192TimothyStrickland

ParticipantSeems like an easier way to do it, Nick, I was going to start working on that too.

March 30, 2020 at 4:58 am #111193JulianCohen

ParticipantNick or Craig have you found a clean way of coding the weekly method? The function month() seems to account for any non business days but there is no function for week that I have found that does this. If you just specify a weekday to roll then you can’t account for holidays. Have you found a way around this?

March 30, 2020 at 7:02 am #102385GlenPeake

ParticipantHey Julian.

The weekly rotation was something I was also scratching my head over…..

I’ve been playing around with the following code below, which would rotate on a Monday….e.g. explore after Market Close on Friday and then rotate/trades on Monday etc

I’m not sure if it’s 100% OK…i.e. caters for public holidays on a Monday (then trades on the next available trading day) etc

But thought I’d share, for further discussion/testing etc. Maybe Craig has a better piece of code….

Code:SetBacktestMode(backtestRotational);

//EOM = Month() != Ref(Month(),-1);//First trading day of the month

Mon = DayOfWeek() == 1;

EOM = Mon; // Trades on a Monday

score = Ref(Rank,-1);//score is the rotational criteria

Score = IIf(LE,score,0);

PositionScore = IIf(Year()>=1985 AND EOM,Score,scoreNoRotate);FYR: (This link also has code for trading every 2nd Monday, if that’s something of interest etc)

http://www.amibroker.com/kb/index.php?s=rotationCode:SetBacktestMode( backtestRotational );

posScore = 100 – RSI(); // sample scoring indicator

SetPositionSize( 10, spsShares ); // sample position sizingMon = DayOfWeek() == 1; // identify Mondays

countMon = Cum( Mon ); // count Mondays// rotate only on Monday, every 2nd one

rotation = Mon AND (countMon % 2 == 0 );

PositionScore = IIf( rotation, posScore, scoreNoRotate )March 30, 2020 at 9:40 am #111194JulianCohen

ParticipantThanks Glen,

I went back and reread the Amibroker forum post concerning the holidays and Tomasz seems to be saying that if paid and align is on then it will work correctly. It’s a little tough to read in between the lines of his scolding newbies

March 30, 2020 at 2:15 pm #111180

March 30, 2020 at 2:15 pm #111180Anonymous

InactiveNick Radge wrote:I’d suggest you missed an easier solution, though.You can continue to do monthly (4-week) signals; just divide your portfolio into 4 equal sub-portfolios and trade each of those sub-portfolios at the end of a different week!

Best,

CGah – this is very clever and quite simple. Good food for thought.

March 30, 2020 at 8:11 pm #111195ScottMcNab

ParticipantHi Glen

Craig has mentioned previously to me a better way for getting around the fact the Monday is often a public holiday is :

FirstDayofWeek = DayOfWeek()

March 30, 2020 at 9:15 pm #111197Stephen James

MemberScott’s line will pick the first trading day of the week which could also be adapted to that second Monday from Tomasz – I’d never thought of that method before..

March 30, 2020 at 10:21 pm #111198GlenPeake

ParticipantScott McNab wrote:Hi GlenCraig has mentioned previously to me a better way for getting around the fact the Monday is often a public holiday is :

FirstDayofWeek = DayOfWeek()

Thanks Scott!!

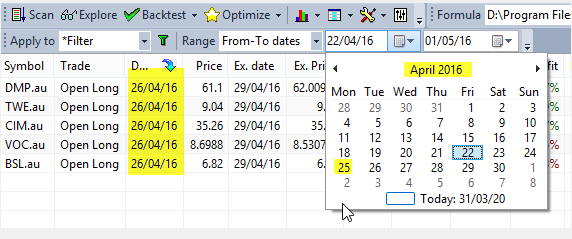

Just tested an Anzac Day Public Holiday on a Monday for 25/4/2016 and the trade rotation took place on the following day.

My code I had posted earlier wouldn’t ‘capture’ this rotation.

So the line of code you posted looks to have done the trick.

Cheers

March 31, 2020 at 9:41 pm #111199

March 31, 2020 at 9:41 pm #111199Nick Radge

KeymasterI have started shuffling things around as per my presentation a month or so ago. More adjustments to come this month…

March 2020

ASX

Growth Portfolio: -3.21%US

HFT: -2.3%%

US Momo: +0.53%

MOC: +1.92%

DTVI: +2.98%DMK-9: Discontinued

April 22, 2020 at 4:09 am #111202Nick Radge

KeymasterSome discrepancies with my MOC system last. Was a profitable session but missed the backtest by a fair margin.

Further investigation showed 4 fills at the low of the day. Two were small partials and the other two were not filled.

Shit happens…

April 22, 2020 at 5:16 am #111320JulianCohen

ParticipantYes I noticed that on Monday. I think it was just bad luck that a few more signals were low of the days which happened to be the open. Rarely get filled on opens that are the low of the day

April 22, 2020 at 5:51 am #111321Nick Radge

KeymasterI think that’s the first aberration between real time and the backtest for the year. Just surprised there were 4 on the same day.

Next 1000 trades…

April 22, 2020 at 3:51 pm #111322JulianCohen

ParticipantActually what I should have said is I rarely get filled on R2000 orders at low of the day on the open….R1000 is normally no problem but Monday I missed a few R1000 as well

AuthorPosts- You must be logged in to reply to this topic.