Forums › Trading System Mentor Course Community › Progress Journal › Nick Radge – Daily Journal

- This topic has 546 replies, 33 voices, and was last updated 3 weeks, 4 days ago by

RichardKoziel.

-

AuthorPosts

-

February 8, 2016 at 7:11 am #102772

Nick Radge

KeymasterMonday

No US trades

Add new Glossary of technical terms to the LMS

Get out of jail card on the BAL trade with a nice gap on open for exit. This one was looking nasty there for awhile.

1 new trade on ASX (VOC) and 2 open positions. 6 new pending orders for tomorrow

Good discussion with 2 students today show casing their new systems – great progress being made. February 9, 2016 at 7:19 am #102345

February 9, 2016 at 7:19 am #102345Nick Radge

KeymasterTuesday

No US trades

3x buys in ASX for mean reversion and 6 more pending for tomorrow

1x Sell for ASX trend system. 2x sells for tomorrow to take me to 60% cash.Drawdown in Growth Portfolio now circa 10% and about the time people start to question it’s validity, even though market is -16%. Drawdowns become much more personal when you’re in control and pulling the trigger each day. As I always say, most can handle a lot less than they think they can.

Next 1000 trades. Take the long term view.

February 10, 2016 at 7:41 am #102346Nick Radge

KeymasterWednesday

No US trades

2x Exits in ASX trend system today and 2 more pending for tomorrow

Worst thing would be a ‘V’ shaped low in the ASX just as we exit all trades – makes you feel like a goose, but the alternate is worse.

Mean Reversion held up ok considering the battering the market took – 5 new positions for a total of 11.

1 exit pending and 5 new positions pending.February 11, 2016 at 6:40 am #102347Nick Radge

KeymasterThursday

No US trades.

2 exits for ASX trend system. Now 70% cash.

Great day for the mean reversion system after catching yesterdays weakness.

1 trade exited today. 1 new entry and 9 exits pending for tomorrow.

Subscriber webinar tonight.February 12, 2016 at 10:15 pm #102348Nick Radge

KeymasterFriday

No US trades

9 exits in ASX mean reversion system – gap down on open diluted some P&L – it happens

1 pending entry for Mon

Client meeting with financial planning firm who want to implement a trend system for their clientsFebruary 16, 2016 at 8:50 pm #102349Nick Radge

KeymasterTuesday

Still very quiet on the trading front

No US trades

ASX Mean Reversion doing smalls. No open positions. 3x pending tomorrow

Sydney for TV – quite a lively show for a change even though sentiment is quite weak

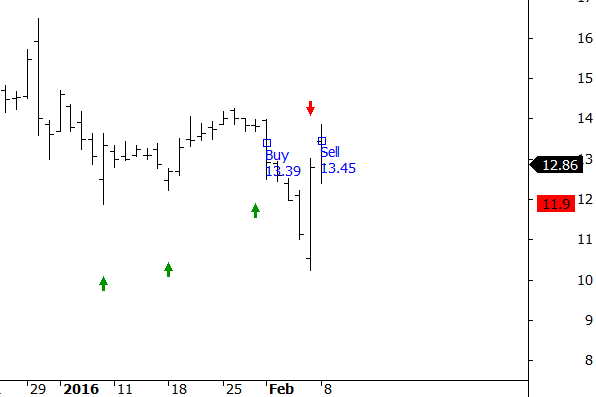

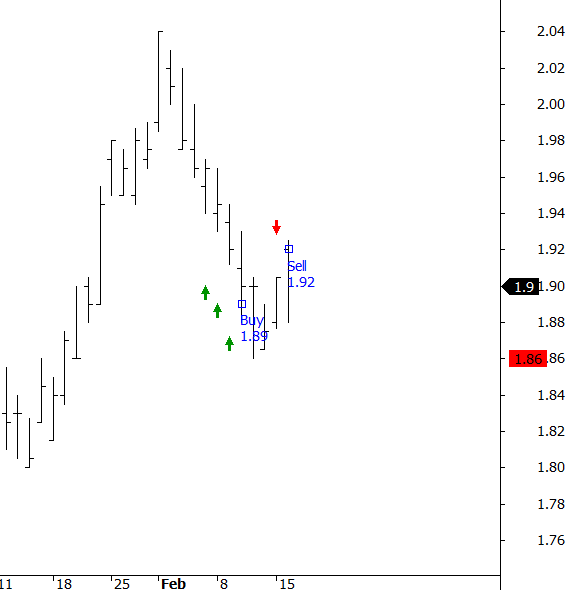

Doing some testing with our Momentum model using a variety of ETFs for when the strategy goes to cash.One of not many recent mean reversion trades – SKI.asx

February 25, 2016 at 12:00 am #102350

February 25, 2016 at 12:00 am #102350Nick Radge

KeymasterStill very quiet across the board, even though I don’t use an index filter for my ASX mean reversion – not many trades.

Here’s one from a few days ago – one of not many

February 26, 2016 at 8:44 pm #102351

February 26, 2016 at 8:44 pm #102351Nick Radge

Keymaster– Been very quiet on the trading front although the ASX Mean Reversion system has finally started spitting out some orders.

– 14 pending for Monday

– Been doing some additional research on mean reversion systems and revisiting some old ideas. The issue is that there is distinct clustering of trades meaning that capital is sitting idle for periods of time. Wanting other systems in there to fill the void and get the capital working harder.

March 9, 2016 at 7:54 am #102352Nick Radge

KeymasterStill quiet here.

US systems went on for one day then off the next. No trades.

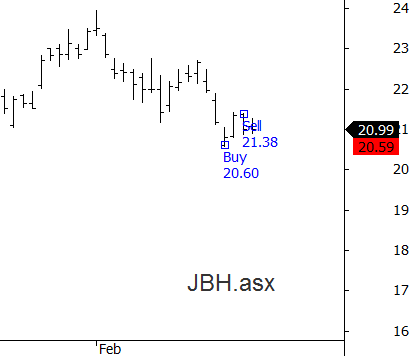

ASX Growth Portfolio has had a few entries and 1 exit due but the stock is in a halt – always the way!

ASX MR has done a few trades here and there, currently3 open

2 exits pending

7 new pendingMarch 24, 2016 at 10:17 pm #102353Nick Radge

KeymasterFinally a little more activity in the US trading, although not much in the way of fills coming through.

Underperfoming the S&P 500 this month as it’s been so strong the system has been unable to get involved. I suspect that will change soon. Hopefully we’ll get some range trading and we’ll try and play catch up.

March 28, 2016 at 9:11 pm #102354Nick Radge

KeymasterPlaced 60 odd trades in US last night and not a single fill. Can be frustrating at times…but alas, that’s the test for us.

Have a long SPXL (3x Bull ETF) position open using a single market system in an exploratory phase.

Also going to test another little pattern I cam across yesterday which is a slight variant on the one I already use.

About 20 pending orders for the ASX today.

April 4, 2016 at 9:14 pm #102355Nick Radge

KeymasterUS Momo triggered 16 buys for this month

US HFT closed March at +1.77% on quiet trading.

Today US HFT has 4 open positions and 43 pending orders which has been the most for some time.

ASX very quiet and plodding back and forth.

April 28, 2016 at 8:36 am #102356Nick Radge

KeymasterTrading slow and steady.

Trend systems near new equity highs in ASX.

ASX mean reversion systems chugging along at new equity highs

US Mean reversion systems two-steps forward and 1.5-steps back

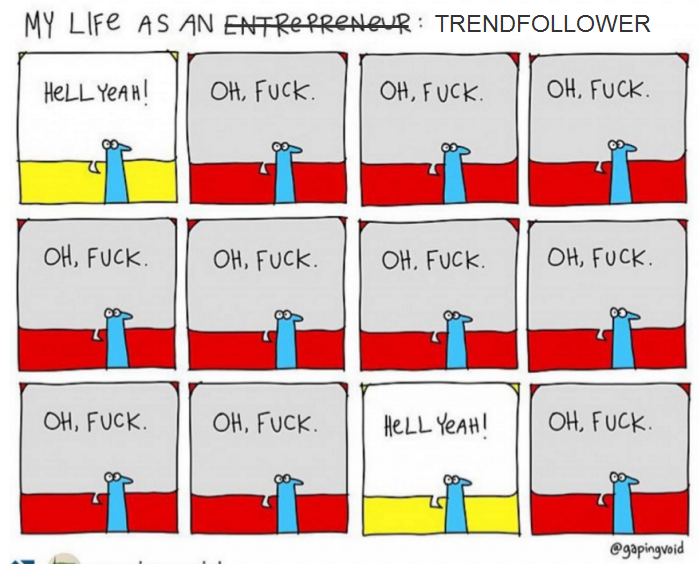

US Momentum remains in drawdown.Found this for a laugh…

May 2, 2016 at 10:34 pm #102357

May 2, 2016 at 10:34 pm #102357Nick Radge

KeymasterRolled my trades in the US Momo strategy last night. Opened TWS this morning to find all the sells had been executed, but no buys.

Got on the IB chat and they told me I had placed orders to the value of $18m so all were rejected. Can’t quite see it in my audit report…

May 3, 2016 at 6:53 am #103663StephaneFima

ParticipantI also rolled the US Momo strategy positions yesterday.

Last month was not so good, but yesterday was nice (check SYY and AWK …).

Let’s hope this will be a good month despite the moto “Sell in May and go away”

PS: My $50m orders went through! (just kidding

)

) -

AuthorPosts

- You must be logged in to reply to this topic.