Home › Forums › Trading System Mentor Course Community › Progress Journal › Nick Radge – Daily Journal

- This topic has 543 replies, 32 voices, and was last updated 3 weeks, 6 days ago by

Nick Radge.

-

AuthorPosts

-

December 4, 2019 at 12:23 am #110663

JulianCohen

ParticipantIt takes a long time to load 250 trades into STT. But I’m not complaining

January 1, 2020 at 12:59 am #110664Nick Radge

KeymasterDecember 2019

ASX

Growth Portfolio: -4.46US

HFT: +1.1%

US Momo: +0.0%

MOC: +6.0%

DTVI: +6.81%

DMK-9: +2.8%And that’s a wrap for what could be best described as an average year. Of my 6 tactical portfolios, all finished in the green returning between 2.25% and 20.4%.

Whilst I underperformed the index, the good news was

(a) equity kept moving in the right direction

(b) the two volatility systems performed the best after struggling last year.My goal for 2020 is to increase my exposure to mean reversion systems. Currently I’m 71% trend/momentum and 29% mean reversion, so I want to get that closer to 50/50. That could be increasing allocations to current systems or developing other uncorrelated systems.

February 1, 2020 at 2:07 am #110713Nick Radge

KeymasterJanuary 2020

ASX

Growth Portfolio: +3.89US

HFT: +1.2%

US Momo: -0.77%

MOC: +8.30%

DTVI: -4.56%

DMK-9: +1.1%Full portfolio hit new equity highs earlier in the week. Gave a lot back on Friday.

February 1, 2020 at 2:24 am #110865GlenPeake

ParticipantNick Radge wrote:Full portfolio hit new equity highs earlier in the week. Gave a lot back on Friday.Nice stuff Nick!!

You’re not alone on giving a lot back in the final run for EOM.

February 28, 2020 at 3:32 am #110866

February 28, 2020 at 3:32 am #110866MichaelRodwell

MemberHey Nick,

Did your new hedge system signal correctly for this sell off?

February 28, 2020 at 6:48 am #111008Nick Radge

Keymaster February 29, 2020 at 12:42 am #111013

February 29, 2020 at 12:42 am #111013Nick Radge

KeymasterHere’s my comment for Premium Portfolio members this week:

Quote:Since 1928, this was the 12th largest weekly down close. It would have ranked considerably higher but for a strong close into the session from short covering. I can’t see the value of discussion what and why. What I’d like to discuss is what can we learn from this. During the week I did some minor work on using weekly rotation rather than monthly. Wouldn’t rotating on a more regular basis remove these risks? Not only is the answer no, but it also dilutes the total return over the longer term. I knew the answer to the second part already, which is why I do it monthly. But the first part will probably take many by surprise. It’s logical and intuitive. But as this week shows there will always be a left field event that destroys that logic. So if not lowering the rotation timeline, what is the answer? Or is there even an answer? I believe there is. And it’s back to that hedging tool I’ve been working on. Rather than adjust the portfolio we use a hedge to protect. My current hedge signal gave a warning on 24 January, but then the market shot to new highs before rolling over. So the question I need to continue to research is how to incorporate that into the equation. It needs to be systematic. I do not want to rely on a discretionary decision and I’m happy for it to be 90% correct rather than look for absolute perfection. It’s still a work in progress, but after this week it’s now a top priority. Stay tuned.February 29, 2020 at 12:47 am #111020Nick Radge

KeymasterFebruary 2020

ASX

Growth Portfolio: -10.48%US

HFT: -15.5%

US Momo: -6.26%

MOC: -2.54%

DTVI: -0.86%

DMK-9: -2.1%February 29, 2020 at 1:02 am #111021TimothyStrickland

MemberWow the HFT took a hit!

February 29, 2020 at 1:56 am #111023Nick Radge

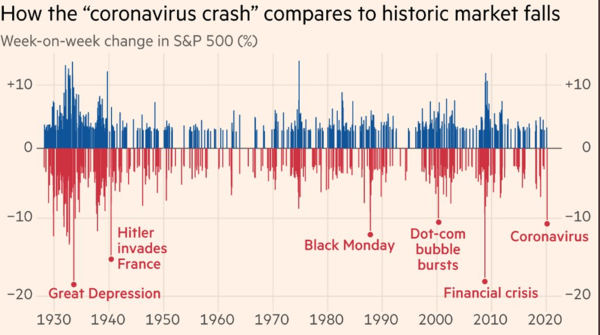

KeymasterSince 1928, this week was the 12th largest decline on a close to close basis.

February 29, 2020 at 2:04 am #111027

February 29, 2020 at 2:04 am #111027TimothyStrickland

MemberThat is pretty crazy, I wasn’t trading during the GFC so I didn’t get to see that one, this decline was the worst thing I had ever seen.

February 29, 2020 at 10:17 am #111022DanielBaeumler

MemberHi Nick. You kindly shared your thoughts on asset allocation earlier this year. You also run a strategic portfolio on a buy and hold basis. Do you still leave it untouched not matter what is happening?

Thanks for your thoughts.February 29, 2020 at 8:26 pm #111034TimothyStrickland

MemberNick, thanks for your research in the area of the hedge. After this week I am extremely interested in your findings and how to implement the strategy. We all took a hit and that is the way it is. My biggest concern I going into the next month is that my system puts me in cash now. After a huge down move like the one we just had, I would think a bounce is not only probable but extremely likely. Does the premium portfolio move to cash as well? Would you remove the index filter and rely on the hedge instead?

March 20, 2020 at 9:55 am #111038Anonymous

InactiveHi Nick, I hope all is well given the ongoing situation.

Given the market chaos, I have a new appreciation for hedging, especially for strategies with longer holding periods. I remember reading that you were trying to implement a hedging process in your strategies. Would you or Craig be able to provide some guidance on how one could do this?

I found the following but it doesn’t seem to work with rotational strategies (and is rather complex): https://forum.amibroker.com/t/hedge-long-portfolio-with-short-spy-using-custombacktestprocedure-issue/5260

Practically the challenges seem to be:

1. Integrating the hedging strategy into an AFL, by hedging with only one instrument (i.e. SPY or QQQ) whereas the long part of the strategy uses the tickers in a selected watchlist (it seems this can only be done in CBT?)

2. Position size for the hedging instrument needs to be different than the position size for the long portfolio, assuming the long portfolio is based on more than one position

3. If building and testing the hedging strategy in a separate AFL (i.e. only looking at the short side with the heding instrument SPY or QQQ), one cannot access the equity balance from the long side of the portfolio to properly size the hedge. In real-time one can easily do this however, from a backtesting perspective the two equity balances with evolve different so you can’t really see how the combined portfolio would really perform.

Thanks as always, especially in these markets!

Dustin

March 20, 2020 at 9:22 pm #111160Nick Radge

KeymasterSometimes you just need to do it the old fashioned way; by hand.

-

AuthorPosts

- You must be logged in to reply to this topic.