Home › Forums › Trading System Mentor Course Community › Progress Journal › Nick Radge – Daily Journal

- This topic has 543 replies, 32 voices, and was last updated 3 weeks, 6 days ago by

Nick Radge.

-

AuthorPosts

-

October 31, 2019 at 9:06 pm #110436

Nick Radge

KeymasterOctober 2019

ASX

Growth Portfolio: +1.47%US

HFT: +5.00%

US Momo: -0.15%

MOC: N/A

DTVI: +3.60%

DMK-9 N/ABack on the HFT but no MOC system. Off again today. Busy few months into year end.

October 31, 2019 at 9:57 pm #110508MichaelRodwell

MemberNice return to the HFT Nick – good when things work out like that

November 2, 2019 at 10:52 pm #110513

November 2, 2019 at 10:52 pm #110513Nick Radge

KeymasterYeah, pretty happy with the HFT. It’s now +15.2% YTD which is a result considering how mean reversion is going elsewhere.

BTW, those trading rotational systems, I follow another guy in the US and he’s now down -11.5% YTD, so its not just us having a crappy year.

November 4, 2019 at 9:32 pm #110524TimothyStrickland

MemberI feel like my rotational system would be struggling if not for some really good picks. More good earnings announcements, a string of good luck I guess ( I am long overdue for some good luck lol).

November 13, 2019 at 4:28 am #110542Nick Radge

KeymasterOfficially launching my DMK-9 strategy today with a small test account. I’ve opted for long side only but the correlation to my other MR systems is 0.20 which I’m happy with.

November 13, 2019 at 8:46 am #110566Anonymous

InactiveCan you give us a quick refresher on the core concept of the DMK-9?

November 14, 2019 at 11:04 pm #110567Nick Radge

KeymasterMatt,

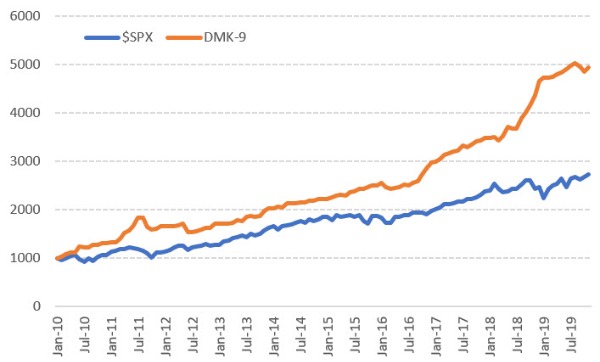

The DMK-9 strategy is based on the Tom DeMark sequential theory.Below is the equity curve since 2010. It doesn’t do a heap of trading but has nice numbers, lower volatility than my other systems and importantly lower correlation. It’s correlation to my other short term system is 0.20 and to the S&P 500 is 0.25.

November 14, 2019 at 11:43 pm #110576

November 14, 2019 at 11:43 pm #110576Anonymous

InactiveBrilliant! Thanks for the info.

November 23, 2019 at 10:35 pm #110577Nick Radge

KeymasterA long time friend of mine is a trader at the secretive Caxton hedge fund which was started by Bruce Kovner. Got a message from him today:

Quote:…if you have a tough year on momentum (MOMO) strategy it is because each rally phase has been driven by the laggards (worst 20%). Leaders have been mostly flat in this bull market.You can see that almost on a daily basis: the average gain of leaders (top 100 SP names by ranking) cannot even keep up with the main index.

He then goes on to say:

Quote:at the end of each WEEK rank SP 500 names by 20-day (1 month) rate of change. BUY the worst bottom ones (test different levels other than the usual 20, that would be the bottom 4%) and sell after one week.No filters but you can play with that if you like (filter on the market and filter on the stock itself).

The best rallies in a stock, in the short term, are, unfortunately for us trend followers, are for stocks in downtrend: the best reactions (in the s/t!) are associated with deep oversold conditions that, usually, are only found in downtrends.

so a filter could be for the stock to be actually below its 100-day ma. and deeply oversold (bottom 10% of the SP on a 1-month basis).

Inr

November 25, 2019 at 3:17 pm #110608LEONARDZIR

ParticipantNick,

This is an interesting message from your traderfriend who works for a hedge fund, namely traditional long momentum is not working for them this year. My mean reversion has stopped working as well and I received a message from Cesar Alvarez that his long mean reversion isn’t working.

The big question is have these strategies become to popular and the edge is gone?November 25, 2019 at 3:18 pm #110609LEONARDZIR

Participanttoo popular

November 26, 2019 at 2:18 am #110610Nick Radge

KeymasterOur High Frequency Strategy is up 19% this year.

I don’t think they’re too popular simply because people tend to be doing different things.

One of the things I’ve noticed is that holding positions overnight or for several days is doing much better than MOC. Suggests low volatility environment perhaps?

That said, I’ve started looking at other types of trading such as bar patterns and, as per my DMK-9 strategy, more complex types of setups. using non-indicator methods.

Nick

November 30, 2019 at 1:35 am #110611Nick Radge

KeymasterNovember 2019

ASX

Growth Portfolio: -2.38%US

HFT: +4.90%

US Momo: +1.30%

MOC: +2.65%

DTVI: +0.10%

DMK-9: +1.60%December 3, 2019 at 9:46 pm #110621Nick Radge

KeymasterTasty…hope everyone got a piece of that.

December 3, 2019 at 11:24 pm #110662Anonymous

InactiveI jumped out of my chair and did a happy dance when I saw result after logging onto TWS!

-

AuthorPosts

- You must be logged in to reply to this topic.