Home › Forums › Trading System Mentor Course Community › Progress Journal › Nick Radge – Daily Journal

- This topic has 543 replies, 32 voices, and was last updated 3 weeks, 6 days ago by

Nick Radge.

-

AuthorPosts

-

October 31, 2018 at 8:45 pm #109227

Nick Radge

KeymasterIt’s good to see others posting monthly results quickly.

Taking responsibility and showing acceptance.

Another opportunity to learn from.

Discipline and staying the path.

October 2018

ASX

Growth Portfolio: -26.1%

US

HFT: -8.17%

US Momo: -16.20%

MOC: -11.08%

DTVI: -20.14% (Trade Long Term)November 20, 2018 at 4:49 am #109346Nick Radge

KeymasterIt’s been pointed out that perhaps my Growth Portfolio data is incorrect – a client who trades the exact same positions suggested his loss was only 13% for Oct and not the whopping -27% I posted.

I do calculate my Growth Portfolio data differently, so I went back and aligned the calcs with the other portfolios…..

….turns out my data has been incorrect for most of the year.

Oct return was -14.8%

YTD is now +10.04%November 21, 2018 at 8:27 am #109412SaidBitar

MemberLooks better

January 1, 2019 at 1:23 am #109416Nick Radge

KeymasterDecember 2018

ASX

Growth Portfolio: -1.1%US

HFT: -14.4%

US Momo: 0%

MOC: -2.68%

DTVI: 0% (Trade Long Term)The Growth Portfolio closed the year +10.55% vs the index -3.5%.

HFT hit a new maxDD.

I’ll be shifting some allocations around this year based on some lifestyle changes.

All the best for 2019 everyone.

January 31, 2019 at 10:45 pm #109492Nick Radge

KeymasterJanuary 2019

ASX

Growth Portfolio: 0.0%US

HFT: +8.0%

US Momo: 0%

MOC: +3.94%

DTVI: 0% (Trade Long Term)January 31, 2019 at 11:11 pm #109583LEONARDZIR

ParticipantNice!

February 1, 2019 at 12:39 am #109584MichaelRodwell

MemberHey Nick,

Regarding monthly rotational systems such as the DTVI, any thoughts about having a scale in/ scale out type approach?

My general hypothesis is that bear markets or down trends tend to be more volatile and aggressive, therefore act on the change of index filter faster when it turns off and is signaling to exit positions at the end of the month.

I haven’t developed the idea, but something along the lines of if the index filter turns down, scale out 25% per week until it either turns back up or the monthly rotation is due and all positions are exited. The intention is to limit the down side to a stronger degree than limiting the upside.

Would this make sense to test in such an approach?

February 1, 2019 at 10:22 pm #109588Nick Radge

KeymasterMike,

It makes sense but unsure how to test that out.Brent, another member here, uses the same system but halved into end of month and mid month so he’ll get a scale out of half if the index turns down.

February 2, 2019 at 2:50 pm #109597Anonymous

InactiveHey Nick, just a quick question about the notation of your systems – what do the acronyms DVTI and HFT stand for? Also, in brief, what differentiates the ASX growth from the US Momo portfolio? Thanks!

February 3, 2019 at 8:48 pm #109602Nick Radge

KeymasterHey Dustin,

DVTI is a secret code which I can’t disclose

HFT stands for High Frequency Trading and refers to a short term (3 day) swing system).

The ASX Growth is a trend system which is loosely based on the BBO strategy in Unholy Grails. It’s not a momentum strategy.

February 28, 2019 at 9:36 pm #109607Nick Radge

KeymasterFebruary 2019

ASX

Growth Portfolio: -2.39%US

HFT: +2.49%

US Momo: 0%

MOC: +5.07%

DTVI: 0% (Trade Long Term)March 20, 2019 at 10:00 pm #109722Nick Radge

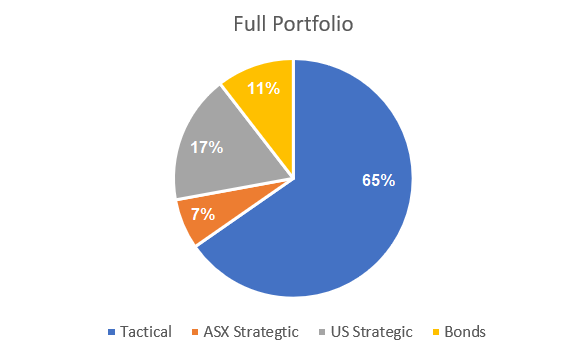

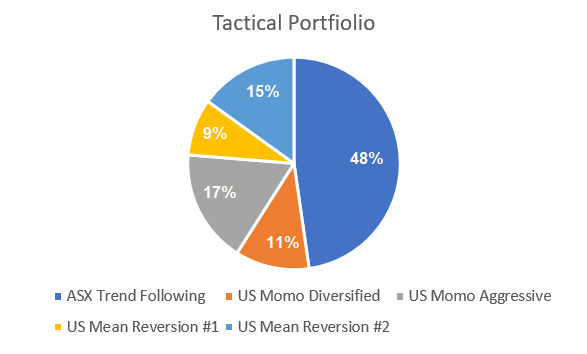

KeymasterHere’s my current allocations across my full investment portfolio (ex. property) and then a breakdown of tactical system allocation

March 21, 2019 at 5:58 am #109836

March 21, 2019 at 5:58 am #109836MichaelRodwell

MemberHow do you define tactical Nick? What are the main drivers for the allocation percentages?

March 21, 2019 at 9:59 am #109839Nick Radge

KeymasterTactical means ‘active’

Strategic means ‘buy and hold’March 21, 2019 at 10:09 am #109841TimothyStrickland

MemberGood info Nick, this gives me some ideas on where I should be looking to allocate my funds. For the buy and hold do you typically just buy the index or is it like trade long term where you pick some strong stocks and hold onto them for a long time?

-

AuthorPosts

- You must be logged in to reply to this topic.