Home › Forums › Trading System Mentor Course Community › Progress Journal › Nick Radge – Daily Journal

- This topic has 543 replies, 32 voices, and was last updated 3 weeks, 6 days ago by

Nick Radge.

-

AuthorPosts

-

October 31, 2017 at 8:47 pm #107735

Nick Radge

KeymasterOctober 2017

ASX

Growth Portfolio: +8.2%

MR: 0% (system paused)

DTVI: 0%US

HFT: +1.42%

Momo: +4.69%

MOC: +3.38%

DTVI: +9.5%November 30, 2017 at 9:41 pm #107916Nick Radge

KeymasterNovember 2017

ASX

Growth Portfolio: +2.5%US

HFT: -0.26%

Momo: +4.29%

MOC: +0.62%

DTVI: -0.66%December 5, 2017 at 11:02 pm #108110Nick Radge

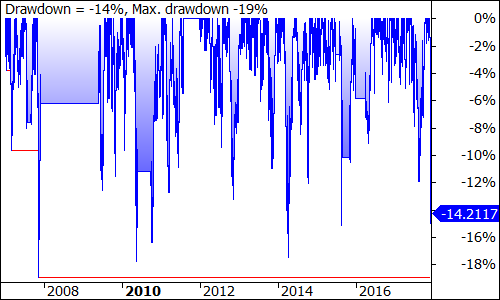

KeymasterTiming is everything. I doubled my allocation at the start of this month and promptly went into drawdown. I want to add more on this drawdown…looks like we’re in the zone.

December 6, 2017 at 12:10 am #108162

December 6, 2017 at 12:10 am #108162LEONARDZIR

ParticipantNick

Which systems? Which markets?December 6, 2017 at 12:17 am #108163TrentRothall

Participantwowee shot down quickly!

December 6, 2017 at 2:18 am #108164Nick Radge

KeymasterThis is the DTVI which, as I’ve said before, is the high volatility strategy, so no surprises with this.

December 6, 2017 at 3:02 am #108165LEONARDZIR

ParticipantNick

I just added to my nasdaq momo with similar results. My intention is to add on any further pullback.December 24, 2017 at 7:10 am #108168Nick Radge

KeymasterMerry Christmas everyone. I trust you have a safe and enjoyable break.

Trish and I sincerely thank you for your support this year and look forward to continuing to work with you in the years to come.

I’ve been suitably impressed with everyone’s progress and more so with the attitude and collaboration of this forum. I think we have a special group of people who will continue to build toward our common goals over the coming years.

Nick

December 29, 2017 at 9:35 pm #108252Nick Radge

KeymasterDecember 2017

ASX

Growth Portfolio: +3.8%US

HFT: -1.21%

Momo: +0.30%

MOC: +0.78%

DTVI: -6.36%I’m doubling my allocation to the MOC system as at 1 Jan 2018.

Also, I’m introducing a new system in 2018 which I have called DMK-9. It’s a mean reversion system with a trend following element, in other words, buying weakness then following any resultant trend higher that comes from a recovery.

January 8, 2018 at 11:35 pm #108258LEONARDZIR

ParticipantNick,

Surprised nobody has asked about your new system. Let me be the first. Could you give us some more details such as CAR and MDD and what market you are trading. Any other details appreciated.

Also are you planning to add it as a new product?January 10, 2018 at 9:43 pm #108281Nick Radge

KeymasterAt this stage the system is not quite 100% systematic. There is a slight anomaly that I cannot code (as yet) that doesn’t make the testing completely accurate.

The initial basis of the system started with the Tom DeMark Sequential setup which I have been interested in for a number of years. I then noticed a pattern within that setup that allowed a lot more scope and robustness than the Sequential setup (i.e. easy to understand and see).In essence the system is looking at the following:

(1) stock long term trending higher

(2) stock pulling back but within n% of 100-day highs

(3) contraction of volatility – this is the important one as it creates low risk entries which in turn allows multi R gains.

(4) we use a fixed fractional position size method rather than fixed dollar or ATR style. Maximum 10 positions unless one is above breakeven.

(5) a trail stop is used to track prices higher in the hopes of capturing a trend from a retracement.Regarding (3) above. This is something I used to use back in the 90’s with my futures trend system. It basically ensured I was only ever involved in very high return trades (which are established from low risk entries). I basically have a risk hurdle of 3%. What this means is if the difference between the entry and initial stop is >3% the trade is ignored. You can read an article on it HERE. Also there is a lot written about it if you Google ‘Radge + Bang for Buck”

Win rate will be nearer 40% – 45% but the potential gains are huge. So far this month the system is +8% but I’m only using 0.5% risk per trade.

January 31, 2018 at 9:51 pm #108291Nick Radge

KeymasterJanuary 2018

ASX

Growth Portfolio: +6.6%US

HFT: -0.26%

US Momo: +3.07%

MOC: -0.18%

DTVI: +12.6%

DMK-9: +13.89%Notes:

DMK-9 was at half risk in its first month of trials. What I like about it is that it doesn’t keep buying as the market rises. It needs not only a decline, but a drop in volatility as well.I’ve made a small adjustment to the HFT strategy. Performance has been flat for well over a year now due to this low vola environment. I have added an extra filter but extended the universe out to the Russell 1000 to try and capture more volatility without increasing selection bias.

February 1, 2018 at 2:38 am #108322TimothyStrickland

MemberI had noticed that issue with the HFT Nick, I have decided to stick with the US power as it has been performing far better lately. I do plan on switching over once the HFT performs a bit better. Either way, your transparency is always very much appreciated. Not something you can find from most courses out there.

February 1, 2018 at 2:39 am #108331TimothyStrickland

MemberNot US Power, US Original setup

February 1, 2018 at 2:56 am #108332TimothyStrickland

MemberNick, I am unfamiliar with the DMK-9 strategy, are those new? I know you also mentioned a US aggressive strategy, I am eager to see what those are! 14% in a month are some very impressive gains.

-

AuthorPosts

- You must be logged in to reply to this topic.