Home › Forums › Trading System Mentor Course Community › Progress Journal › Nick Radge – Daily Journal

- This topic has 543 replies, 32 voices, and was last updated 4 weeks ago by

Nick Radge.

-

AuthorPosts

-

August 26, 2017 at 9:36 pm #107445

Nick Radge

KeymasterJust remember that using a LIT order could mean you miss an open gap down in the opening auction. The LIT order will only become active AFTER the open auction.

August 27, 2017 at 5:47 am #107458JulianCohen

ParticipantNick Radge wrote:Just remember that using a LIT order could mean you miss an open gap down in the opening auction. The LIT order will only become active AFTER the open auction.So what do you think? Is it 6 of one and half a dozen of the other? I guess we have to try and see what happens.

We know for sure that our results on the ASX are not equivalent to the backtest at the moment due to missed trades.

August 27, 2017 at 9:23 pm #107459Nick Radge

KeymasterI’m going to use it for awhile and see if it makes a difference. If there are large down days in the US I may revert back to LMT.

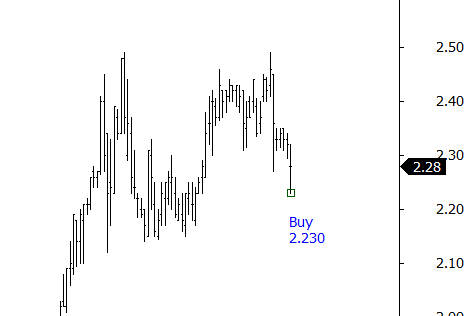

Below was the late trade I did on Friday using LIT in AGI. Absolute low of day and yes, got a 100% fill. Sample size of 1…

August 28, 2017 at 12:31 am #107464

August 28, 2017 at 12:31 am #107464Nick Radge

KeymasterSo I had a LIT order in for CNU at $4.15 this morning.

Open was $4.12.

I rec’d a partial fill of about 75% of my volume at $4.12 then the balance at $4.14 for an average fill at $4.125.

This suggests to me that opening sellers offered over at $4.12 of which I got the 75% allocation. My order then paid up to the next offer at $4.14 for the balance, although I note that came in two tranches about 15 secs apart.

Chances are that had the excess offer at $4.12 not occurred then I would have missed that price.

August 28, 2017 at 6:05 am #107465JulianCohen

ParticipantNick Radge wrote:So I had a LIT order in for CNU at $2.15 this morning.Open was $2.12.

I rec’d a partial fill of about 75% of my volume at $2.12 then the balance at $2.14 for an average fill at $2.125.

This suggests to me that opening sellers offered over at $2.12 of which I got the 75% allocation. My order then paid up to the next offer at $2.14 for the balance, although I note that came in two tranches about 15 secs apart.

Chances are that had the excess offer at $2.12 not occurred then I would have missed that price.

What do you think would have happened if you had a LMT order?

August 28, 2017 at 6:27 am #107466Nick Radge

KeymasterCompletely filled at $4.12. Closed at $4.00

August 28, 2017 at 7:41 am #107467JulianCohen

Participantso we are back to 6 of one and half a dozen of the other.

Amazing that this occurrence happened on the first try.

August 28, 2017 at 7:45 am #107468ScottMcNab

ParticipantI got a few thousand CNU with LMT this morning at 4.11…..closed out at 3.97….not sure how I lucked out on the extra few cents in the closing auction…beautiful trade all round

August 28, 2017 at 8:15 am #107469Nick Radge

KeymasterMy mistake – close was $3.97.

August 31, 2017 at 9:39 pm #107470Nick Radge

KeymasterAugust

ASX

Growth Portfolio: +4.2%

MR: -2.3% (system paused)

DTVI: 0%US

HFT: -4.25%

Momo: -0.2%

MOC: -2.96%

DTVI: +3.6%Notes:

(1) The ASX MR has been paused for several reasons, the main one being is that comm’s have now outweighed net profit which is a big no-no for me. Buggered if my broker is going to make more out of it than me. Performance has been lacking due to missing fills on low of day although the LIT order seems to have improved that a little (sample too small). There is no selection bias. Another reason is that I’m traveling a lot in the coming months, and some of that will be completely off the grid with no internet and it won’t be possible to trade shorter term systems. During this time I’ll take a think about the benefits of ASX short term trading. It could be that I revert to just the ASX-100 where liquidity is better. The system holds up ok on that universe.(2) The US DTVI has started off well. Being an aggressive strategy I expect the ride will be bumpy. I have also started the exact same system on the ASX-100 and will reallocate some of the MR funds there. Index filter is off at moment so no activity.

September 14, 2017 at 3:56 am #107560Nick Radge

KeymasterTax return back.

SMSF was +10.5% for the year – not too bad considering I was only 50% invested for most of the year.

Family Trust, which is our main trading vehicle, was +48.7% for the year.

September 14, 2017 at 4:47 am #107667TrentRothall

Participantwowsers good stuff!

Where did the bulk of those gains come from?

September 14, 2017 at 4:51 am #107668Nick Radge

KeymasterTrend following and strategic positions.

September 14, 2017 at 9:17 am #107669ScottMcNab

ParticipantNick Radge wrote:Trend following and strategic positions.Boom …where do I sign up for the Strategic Positions Mentor Course ?

September 29, 2017 at 9:15 pm #107561

September 29, 2017 at 9:15 pm #107561Nick Radge

KeymasterSeptember 2017

ASX

Growth Portfolio: +2.8%

MR: 0% (system paused)

DTVI: 0%US

HFT: +1.42%

Momo: +3.35%

MOC: +1.32%

DTVI: +2.2% -

AuthorPosts

- You must be logged in to reply to this topic.