Forums › Trading System Mentor Course Community › Real Test Software › MRV System From Amibroker to RealTest

- This topic is empty.

-

AuthorPosts

-

January 26, 2021 at 8:53 am #112898

JulianCohen

ParticipantGlen is this issue more for Trend Following systems than for Mean Reversion systems? I’ve always built just MOCs with RT and so far it seems really solid.

January 26, 2021 at 9:43 am #112899GlenPeake

ParticipantMOC systems won’t experience this ‘nuisance’ as you’re in/out on the same day and no open positions overnight.

FYI: when I coded up a MOC in RT, all was ok…. backtest stats were much the same.

Not 100% sure if it’s more or less of an issue for Trend systems in RT, but you would want to double check.

But for MR systems, it’s definitely something you would want to look at. FYI: our AFL templates are coded to remove the excess signals.

Let me if you need more details.

January 26, 2021 at 10:35 am #112900JulianCohen

ParticipantI’m not so sure I would worry about it for a short term MR either. Unless I misunderstand the concept, which is extremely likely, what you are trying to avoid is picking a stock, say BERY, the day after it was a setup but not taken as a position due to other stocks being higher in the ranking or being filled first.

You want to wait until it would have completed its cycle, as if it had been filled, and then it would be eligible again.

For me, I think I’d rather allow it to be taken the next day if the setup was still valid.

January 27, 2021 at 12:51 am #112901GlenPeake

ParticipantJulian Cohen wrote:what you are trying to avoid is picking a stock, say BERY, the day after it was a setup but not taken as a position due to other stocks being higher in the ranking or being filled first.You want to wait until it would have completed its cycle, as if it had been filled, and then it would be eligible again.

100% spot on with your thinking Julian!

Backtesting shows better returns and less DD waiting for the setup to ‘reset’.

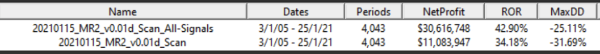

A comparison below.

43% / -25% (waiting for the pattern to ‘reset’…how my MR systems in Amibroker do it)

34% / -31% (let all signals through etc)

The ‘waiting for the reset’ option is also how I’ve been testing with Amibroker since the beginning etc… So I want to make RT ‘in symc’ with Amibroker etc

I guess moving forward, any new MR system I can test in RT using both ‘options’ etc.

January 27, 2021 at 1:30 am #112902TrentRothall

Participantlooks good Glen, I’m doing something similar while trying to code my WTT into it. You need to track open positions. I didn’t think of that for your differences, sorry!

Good to see its sorted thoughJanuary 27, 2021 at 1:55 am #112903GlenPeake

ParticipantAll good Trent!!

I needed to weed out a few things and learn RT at the same time etc….

Liking RT atm…. pretty user friendly etc and Marsten has provided some good Script Examples to get us going etc…

From a ‘coding skill’ perspective I’m glad I’m going from Amibroker to RT as opposed from RT to Amibroker…. much more straight forward coming from Amibroker.

January 27, 2021 at 3:45 am #112904TrentRothall

ParticipantAgree, learning AFL is a huge advantage. It’s closer to a programming language and you learn skills you wouldn’t if you jumped straight into RT

May 22, 2021 at 6:19 am #112839ScottMcNab

ParticipantI am hoping for some advice on settings people are using in the IMPORT section please for the following 2 areas…from what I can understand from the pdf and forum I am using:

Padding: AllMarketDays

Adjustment: CapitalSpecial

May 22, 2021 at 9:26 am #113295JulianCohen

ParticipantI am using

Padding: None

Adjustment: CapitalSpecialThe RT Helpful says

When Norgate is the data source, padding of any of the above types is provided by Norgate.

So I have kept it at None but I don’t think using AllMarketDays will affect things too much

Trent, Glen what are you using?

May 22, 2021 at 10:09 am #113296GlenPeake

ParticipantI’m just using the defaults…

I currently don’t have any specific settings for Padding or Adjustment in my script(s)

Might play around with it (Adjustment) a little later to see if any effect etc….

From memory, I briefly used Padding on a Rotational system as a quick test and don’t ‘think’ there was much/any difference. I’d need to double check.

May 23, 2021 at 5:53 am #112840ScottMcNab

ParticipantThanks for the replies gentlemen

May 23, 2021 at 9:12 am #113297TrentRothall

ParticipantSame as Glen for myself, just the defaults.

February 21, 2023 at 10:03 am #113298KateMoloney

ParticipantInteresting thread.

Just curious. How did you go getting your AB and RT results to match ?

I’m working on the Swing system atm. The difference between RT and AB is about 10% CAGR atm.

Edit: the australian version seems to match reasonably OK, the canada one is out by about 10% CAGR

February 22, 2023 at 2:09 am #115441GlenPeake

ParticipantThe following thread explains what I needed to do.

Essentially it had to do with removing excess signals.

https://forum.mhptrading.com/t/remove-excess-signals/475/6

Since cutting over to RealTest, I’ve now removed the excess signals code and ‘trust’ what RealTest produces etc….

RE: Your Swing System

In terms of making RT the same (or close to) AB, some indicators are calculated slightly different in AB vs RT so that ‘might’ explain some of the variation(s)…Not sure if others have noticed a difference in the Swing system results RT vs AB…..?

I don’t have Canadian data so I can’t offer any insight/experience on any potential differences… As a stab in the dark, are the constituencies and the use of the “IN…” e.g. InSPTSX correct…

i.e.

$SPTSX InSPTSX S&P TSX Composite

$SPTSX60 InSPTSX60 S&P TSX 60

$SPTSXC InSPTSXC S&P TSX Completion

$SPTSXDA InSPTSXDA S&P TSX Canadian Dividend Aristocrats

$SPTSXMC InSPTSXMC S&P TSX MidCap (Inferred)

$SPTSXSC InSPTSXSC S&P TSX SmallCapFebruary 22, 2023 at 6:36 am #115442ScottMcNab

ParticipantI’ve also removed from short term systems but found long term trend following works better if I keep them (may just be for that system of course)

-

AuthorPosts

- You must be logged in to reply to this topic.