Still testing various momentum approaches on the ASX. Have been testing from June ’07 to Sept ’18 on the back of Nick’s advice to select a period where the system has a chance to perform, but is also subject to some challenges. Got the following stats:

CAR 19.26%

MaxDD -30.61%

CAR/MaxDD 0.63

Profit Factor 2.17

Whilst performance was fine, I was unhappy with the max DD I was getting so tested using Julian’s ADX(dur) > 30 (on the individual stock, not the Index). This changed the performance stats to:

CAR 14.39%

MaxDD -22.41%

CAR/MaxDD 0.64

Profit Factor 1.97

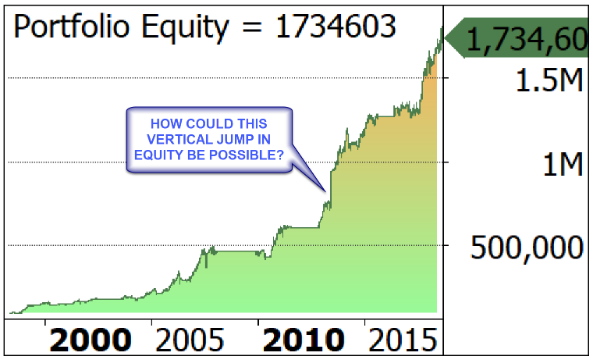

The thing that I can’t get my head around is the large jump in equity (i.e. a vertical jump) in June 2013. Looking through the trade data, there was a 869% profit on 1 stock (FGX). Have others seen a large impact from 1 stock like this in their testing and is it something to be wary of?

Any other ideas on how to keep MaxDD at around -20% but kick the CAR would be appreciated.