Forums › Trading System Mentor Course Community › Running Your Trading Business › MOC with Smart API on ASX?

- This topic is empty.

-

AuthorPosts

-

July 13, 2020 at 1:50 am #102031

Anonymous

InactiveHas anyone been using the API software to trade MOC style on the ASX?

Once again I am challenging myself to try and get a MOC system going on the ASX.

I have been testing on paper trade account and one challenge I have discovered today is the API receiving an error message from TWS after a successful fill of one buy order….

Error ID: 106 Error Code: 387 Error Message: Unsupported order type for this exchange and security type.

It is received as a result of a buy order filling and the API transmitting the MOC order to TWS. It doesn’t seem to like a MOC order?

Is this an issue with order types in paper trade account only and the API can in fact successfully send MOC orders to TWS in the non paper trade account?

Also I posted a little while ago about the cutoff time for transmitting a MOC order from API to TWS when trading ASX. Until someone tells me otherwise I will assume it is the usual 15 minutes prior to 4pm and set it at 3.40pm.

July 13, 2020 at 2:50 am #111878GlenPeake

ParticipantNot sure about the error there….. The API should work fine on the ASX. I believe others have used it in the past on the ASX without drama etc…. are there any more errors in the error log files?

But…

I think the biggest challenge you’ll face is slippage and fills, especially fills for the (near) lows (or highs) of the day. Not too mention (limited) potential setups versus the US markets etc…. you’ll probably need to target the ASX100 to ensure liquidity is in ‘your ballpark’ etc…. which will restrict the number of opportunities etc. Brokerage is another factor to consider etc…

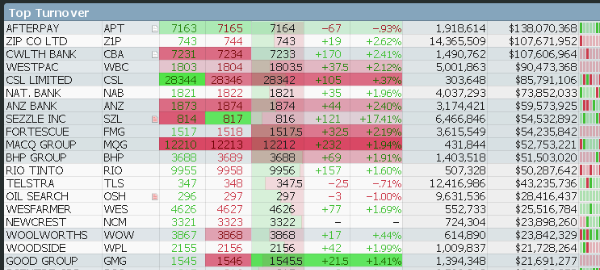

Liquidity, even in some of the bigger stocks ‘intra-day’ could be a little thin, a couple of examples below:

TOP Stocks in terms of Turnover Today

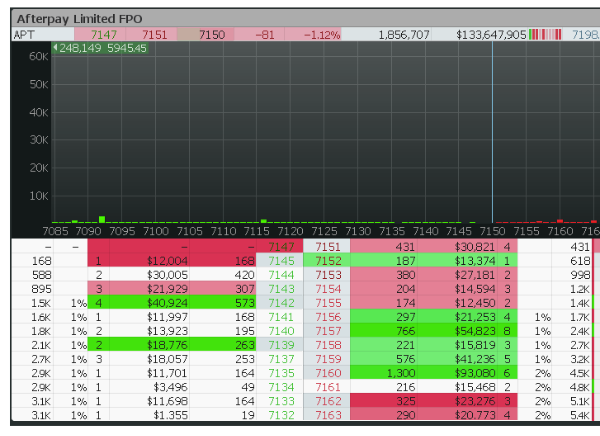

APT is the leading stock in terms of turnover today, but the BID/OFFER may not be right for you:

Another example JBH, which is almost $7mil turnover today, but the depth is ‘thin’ etc

I believe Nick and also Julian tried MOC’s on the ASX but some of the challenges mentioned above inhibited success etc. Not trying to put you off trying etc

… but just highlighting that it may also be something that you also find challenging etc

… but just highlighting that it may also be something that you also find challenging etc  July 13, 2020 at 3:46 am #111879

July 13, 2020 at 3:46 am #111879TerryDunne

ParticipantI don’t think the ASX accepts MOC orders?

July 13, 2020 at 4:25 am #111880JulianCohen

ParticipantSave your time and effort Matthew. That’s my two bob’s worth. Brokerage is too high and fills are too poor.

I didn’t have any issues with the API though so you might have to wait for Nick to get back and check with the developer. I just tried to look at my old API set up but I don’t have a copy of it

July 13, 2020 at 5:45 am #111881Anonymous

InactiveThanks for the tips everyone.

Julian do you still use the Smart API supplied by The Chartist? Or are you using some other method/API these days?

July 13, 2020 at 6:42 am #111882SaidBitar

ParticipantI traded MOC on ASX, there is no MOC you need to place close with market orders. this is what i remember

July 13, 2020 at 7:38 am #111883ScottMcNab

ParticipantI used to trade ASX MOC too (few years ago)… This is all a bit hazy but I’m pretty sure I got the API developer (Levente ?) we were using back at that time to code me up an API for me for the ASX ..I think its all included in the modern api but not used that function for a while…u need a live data feed with IB (can be expensive depending on how IB classified you)…at the closing auction (after 4pm) the API then places limit orders to sell at a predefined amount below the last traded price prior to the 4pm closing auction…so set time to place limit order (eg 16:02:30) and price modifier….at 4.10 pm the closing auction occurs and everyone gets the closing price (as long as determined price by exchange by matching the buy limit and sell limit orders in the closing auction is above the sell limit you set)

I don’t bother with ASX either any more…just wasn’t worth the effort for me.

…MOC orders are not supported on ASX.. Now TSX does support MOC… if we could just persuade Norgate to fire up on that front…anyone would think there was some significant world event happening that may impact the launch of a new product

July 13, 2020 at 8:39 am #111885TerryDunne

ParticipantHi Julian and Scott,

I’d like to explore your thoughts about MOC on the ASX a bit further if I could…I’m keen to do it as my MOC money is sitting idle between the US close and next open. My thoughts were that even if the slippage was so bad as to turn a back tested 20% CAGR into, say, an actual 10% CAGR it would still be worth it as it is more than zero, so adds to the quantum.

I think what you guys are saying is that the slippage is so bad that it wouldn’t make any profit at all? Is that the case even on the ASX 100/200 (which is what I was hoping to trade)?

I’d appreciate your views as I’ve got plenty to do without wasting my time on this if it’s a complete dud.

July 13, 2020 at 10:06 am #111887Anonymous

InactiveTerry,

The issue I am seeing at the moment is the same as everyone is saying about liquidity.

Assuming we can work around the API issue and get that part solved, the liquidity is still the biggest bottleneck I have been facing.

Take for example the issues we even see in the US market when trying to get fills in seconds, in the volume you want, so you can hit the price you are chasing. In practice, lets say you are issuing orders that are no more than 2,000 units at most. To trade on the ASX many of the symbols are trading in the 1 or 2 dollar bracket. If you assume that you take 2 dollar minimums, and that you are only going to get about 1 or 2,000 units fill in a short period of time, then it is likely you are only going to be able to do roughly $4,000 positions.

On $4,000 positions, considering the universe is relatively small, you are probably only going to be able to run perhaps a 20 or 30 position system. Let’s say you can make a 30 position system work, at $4k per position, that is $120,000 in orders. At 4x Leverage, this means you would be able to dedicate no more than about $30K AUD to the system.

If you can get some reaosnable numbers to work, let’s say 15% CAR, this would net you $4,500 a year profit.

I am not saying I would he happy to forego $4,500 however all that work, and challenges we need to face in solving the technical side, and assuming you can actually get 2,000 units filled in a split second near the lows of the day, then the challenges do seem very steep all for what seems a small potential profit.

I originally made this post because I just didn’t want to be defeated and wanted to try it again, but it seems I just can’t get past these challenges of low liquidity. Sure, the technical issue seems to be an issue as well, but until the liquidity issue is solved I don’t know if the effort is worth it.

July 13, 2020 at 10:39 am #111890TerryDunne

ParticipantFair enough Matthew, everything you say makes sense. Annoying though.

In terms of the technical issue, according to Nicks API – and a quick look on the internet – you can’t do MOC orders on the ASX through IB. The way you have to do it as Scott described, and as specified in the API – it’s the last of the MOC options on the list under ‘Preferences’.

I think that just exacerbates the problem as you described it as there is a fair chance that the low offer might move the close if volume is that low?

July 13, 2020 at 11:16 pm #111891Anonymous

InactiveRe what Julien mentioned: I did a bit of back-of-napkin math at one point, and it does look like the fees and commissions are too high to make a bother of it without a very large volume, which then of course will create issues with liquidity. That’s my “two bob’s” (never heard that one before).

July 14, 2020 at 12:37 am #111896TerryDunne

ParticipantI haven’t seen anyone who has made MOC on the ASX work, so I’m putting this is the junk pile.

July 14, 2020 at 4:49 am #111898JulianCohen

ParticipantI use the SMART API and did use it on ASX but can’t for the life of me remember how I did it.

Said’s suggestions sound correct as there is an “auto close Positions with Limit Orders” button and you can choose the Limit Coefficient and the time you want to place the orders. Have to check how many minutes before/after closing you need to place them so they go in the closing auction.

Basically although the theory states that if you have a backtest that shows a 20% profit which includes the brokerage, you should be able to trade it and make money, after trading for two months and paying as much brokerage as I made in profit, I thought it was too much effort to split the profits 50/50 with IB. That is really a state of mind thing, as the theory says it’s profit that you have accounted for, so you should trade it.

But who pays attention to theories in this game of emotions and egos

July 14, 2020 at 8:48 am #111892

July 14, 2020 at 8:48 am #111892ScottMcNab

ParticipantHi Terry,

I traded exactly as you are thinking about for a while…6 months perhaps…it was my first system in the mentor course….traded same MOC system on RUI and ASX so was working capital around the clock..the issue, as others have stated, came when I tried to increase my allocation.

I don’t think that you would impact/move the closing price in the closing auction too much as the liquidity in the closing auction is significant…the liquidity issue happened during the day at the level that I had the buy limit set to trigger for that stock….so while both the open and close will have plenty of liquidity, the volume traded at each of the price levels throughout the day were the rate limiting step (partial fills became increasingly common as size increased). I did experiment by modifying the system to trade on the open and close only as a way to get around this…think I tried LOO (limit on open order)…but cant remember now if this was available on asx, US or both. I then tried Hong Kong Stock Exchange…and then Japan…….so many rabbit holes

Hope something in there helpsJuly 14, 2020 at 8:53 am #111903TerryDunne

ParticipantMaybe not a rabbit hole I need to go down right now…sounds like the fruit will be lower hanging elsewhere.

Thanks guys – and sorry to hijack your journal Scott!

-

AuthorPosts

- You must be logged in to reply to this topic.