Home › Forums › Trading System Mentor Course Community › Progress Journal › Mike’s (UK) journal

- This topic is empty.

-

AuthorPosts

-

May 1, 2020 at 12:32 pm #111385

JulianCohen

ParticipantThat’s a really good way of looking at it Mike. No real reason we should just choose to look on a year against year basis.

May 1, 2020 at 12:57 pm #111386Anonymous

InactiveThanks

And depending upon your outlook, you can just vary the rolling period looked at i.e. if very short term is key, then 3 months rolling basis up to 24 months basis if you have a longer term outlook.

As I say, if I get to develop AB coding skills, will try and create as auto report – however, that is a cast well into the future

May 29, 2020 at 6:05 am #111387TrentRothall

ParticipantHi Mike,

I was wondering if you have stumbled on any Amibroker code for your above table? i really like that idea

I’ve tried a few times and looked myself but i haven;t found anything as yet or had any luck coding anything

Cheers

May 29, 2020 at 9:20 am #111535Anonymous

InactiveHi Trent

that is way way way beyond my coding knowledge.

I hunt around, and for now use excel when ready to have a look at something.

Someone will be able to produce, I’m sure.

All the best

May 29, 2020 at 2:52 pm #111300Anonymous

InactiveHey guys, I see some discussion about stretch methods and I wanted to throw in my two cents:

My live system uses

Rank = 100 – ROC(C, 1)

[which it looks like Julian does also rank by losers, so I do feel slightly vindicated by seeing that I have inadvertently replicated a veteran around these parts]

and I have a pretty tight stretch. Fill rate for the last 10 years is 27%.

I’ve not had any luck with ATR stretch, but I did make another system that is not live that uses this bastardized version of a stretch:

Code:// Stretch

ATRmult = Param(“ATR Multiplier”, .6, .1, 1, .01);

StretchLookback = Param(“Stretch Lookback”, 1, 1, 5, 1);// Noise

Crabel = Max (H-O, O-L);

AvgCrabel = MA(Crabel, StretchLookback);

Noise = AvgCrabel*ATRmult;BuyLim = C – Noise;

I started off messing with ATR here and some of the variables still show it. Also, based on my system (not sure if this is good or bad), I totally ditched the “average” part and ended up finding that:

Code:Crabel = Max (H-O, O-L);

Noise = Crabel * ATRmult;

BuyLim = C – Noise;worked well enough. Give it a shot, spin it around, try with different permutaitons of OHLC and I’d love to hear what you come up with.

Cheers

May 30, 2020 at 9:14 am #111543JulianCohen

ParticipantI just tested that on one of my MOCs , chosen at random, Seth. It didn’t make a big difference to the bottom line, but it did make a difference to the number of trades when the multiples were set at the same number. The average profit /loss was much better with the ATR system though

May 31, 2020 at 2:44 pm #111555Anonymous

InactiveInteresting! I think (key word) that this type of a stretch calculation would fit into a system where ranking is based on volatility instead of ROC, RE: Michael’s Rank = ATR/C style.

I stumbled into it since I was looking to have a system that would share the same pool of dollars as my live one, with a low correlation. I’ve since discussed with Nick and it does make more sense to have systems keep separate equity pools, so my goal was moot but I’ll keep the system on the back burner.

June 1, 2020 at 7:42 am #111560Anonymous

InactiveFrom my testing, the rank method probably is influenced by the system style / criteria you are working with.

For example, an MOC I am playing with at the moment.

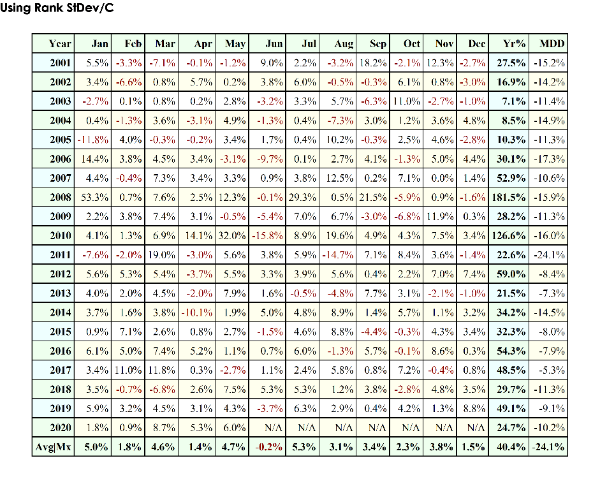

Table 1 uses a rank method of StDev / C

Net Profit = 68,642%

Profit Factor = 1.38

AVe P/L = 0.22%

No. of Trades = 84,498

Win% = 54.6%

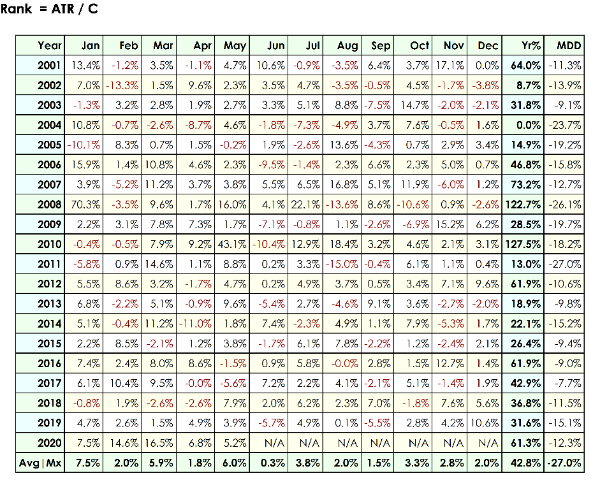

Same system, this time using ATR / C

Net Profit = 96,631%

Profit Factor = 1.32

AVe P/L = 0.20%

No. of Trades = 95,803

Win% = 54.02%

End result not dissimilar, but quite a different journey across the years.

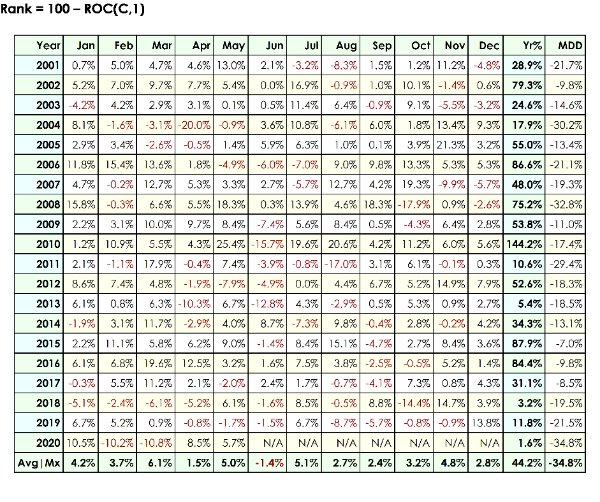

Final version uses 100- ROC(C,1)

Net Profit = 119,929%

Profit Factor = 1.13

AVe P/L = 0.13%

No. of Trades = 95,803

Win% = 53.72%

Highest absolute result, but a more traumatic journey.

Just compare year 2020 for each version where ATR is the horse to be on.

Then contrast against 2009 where MOC seems to perform well.

What I am learning is, there is no best solution to apply across the board.

June 1, 2020 at 9:23 am #111564JulianCohen

ParticipantThe only difference to the three runs is the ranking method? That’s a big difference this year!!

I don’t want to send you off down a rabbit hole, but have you thought of looking to see the correlation between those three “systems”? It looks to me as if you have the start of being able to get two trading systems out of that. Two running in parallel and reducing the risk.

June 1, 2020 at 10:15 am #111565JulianCohen

ParticipantIn fact I sent myself off down the hole instead. I’ve tested Std/c against five of my MOCs at the moment. It always adversely affects the CAGR, and on most it makes the system untradeable, ie drops CAGR from 25% to 8%

But it does produce a good result with one of my systems. ROC is better with that system but the STD is not too bad and the results are different over a good amount of periods to be less correlated. I’m now checking to see how far I can alter that system and still produce a good uncorrelated result.

June 1, 2020 at 1:34 pm #111566Anonymous

InactiveSame system, only the ranking changed to demonstrate impact.

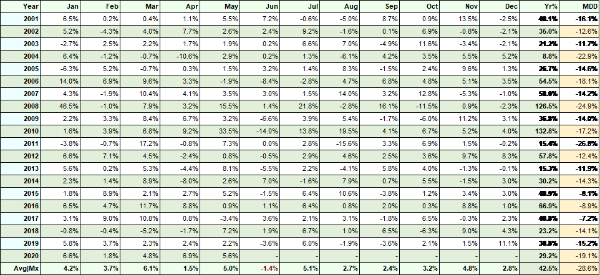

Table below is the 3 versions combined 1/3 each. (simple excel consolidation only used).

So going with your thinking, you could play around to find the most stable combinations, but still need to ensure not massively correlated.

The interesting point is that your ranking methods work for your systems. And if the systems are built using ROC as a parameter, then ROC ranking seems to work best.

Certainly shows that simply dropping a rule / ranking that works for 1 system into another, wont be a holy grail solution.

June 1, 2020 at 3:41 pm #111567

June 1, 2020 at 3:41 pm #111567Anonymous

InactiveQuote:From my testing, the rank method probably is influenced by the system style / criteria you are working with.Absolutely the case.

Negative ROC rank works well to find a pullback (in my experience), but some systems may already have the pullback in the buy setup conditions, so they wouldn’t need such rank.June 2, 2020 at 4:15 am #111569JulianCohen

ParticipantYes I hadn’t thought of it like that Seth. So in fact if the pullback is not included as part of the setup, then having a different stretch system would allow you to trade the two systems side by side and expect not to duplicate the results. there is some correlation between the system I am looking to try this with so I am trying to juggle the parameters to alleviate that as much as possible.

The differences seem quite stark in some months with your system Michael…

June 2, 2020 at 8:45 am #111573Anonymous

Inactive“The differences seem quite stark in some months with your system Michael…”

ROC probably not the rank style for this system, though everything warrants further exploration.

ATR and Std Dev closer, but still slight shifts between same months, so again, further investigation required.

My old way was to try and get the absolute peak of performance out of a system, optimised to the perfect combination of paramaters.

The key thing I am learning is – safety & stability will win in the long run

June 2, 2020 at 9:36 am #111579JulianCohen

ParticipantI used to think the old way too. Then when you discover that they never perform to the ‘optimum’ way you start to realize. Some people never realise

-

AuthorPosts

- You must be logged in to reply to this topic.