Forums › Trading System Mentor Course Community › Progress Journal › Mike’s (UK) journal

- This topic is empty.

-

AuthorPosts

-

April 14, 2020 at 3:38 pm #102007

Anonymous

InactiveI started the program right at the beginning of February 2020, aiming to develop a process to create new systems, that would serve me over years to come (both the process and the systems).

Worked through the modules, and thanks to Craig for such patience, and helping me through the first couple of sections.

Having been a basic level Amibroker user for a couple of years, great to learn new and effective things. Yes, the Amibroker guide has a lot (an awful lot) of information – what Craig and Nick have made me realise – complexity does not equate to system success.

Section 3 with Nick, and we decided to work on developed an MOC system – this would complement my existing pre-Chartist ASX rotational system (also have a NASDAQ rotational that I had not yet traded live).

Thanks to folks who gave input to some early questions I put out there.

Nick took me in a direction that I would never have even considered or thought about previously.

(Pre Chartist I had a go at trying to develop a MRV system based on Boll Bands / RSI, and got nowhere).

And the testing methodology and questions Nick raised, made me really think about and appreciate the nature of the system that he has guided me to.

So, Nick installed the API for me , and I intended to make 1st live test runs this week to get me comfortable with the API. Once this stage completed – I can then start to slowly add to the account, and create comfort in the daily process, and the system.

That plan is on hold however – internet I use here is struggling over the last few days – slow speeds, and line interruptions. In the UK we have 2 internet networks – one established by British Telecom, 2nd by Virgin (ultra fast but only available in high density locations – major cities). So living in the countryside, I have to go with the BT system.

Engineer booked to investigate the issue later this week – will most likely be a local area issue that effecting the neighbourhood, so hopefully resolved so I can get on with testing.

Case for VPS strengthens.

April 14, 2020 at 4:20 pm #111297JulianCohen

ParticipantI was just going to say go for the VPS. Then you just need internet to last in order to connect to it and upload your orders. I have even done it from a plane wifi!

April 14, 2020 at 9:26 pm #111301Anonymous

InactiveThanks Julian – will definitely go that route. Just wanting to get to grips with the basics of the API technology, and that process (+ be comfortable that the system performs within bounds of testing) – I’m only using very small $ amounts during this testing stage, but to have the comms risk dealt with is a bonus.

Cheers

April 22, 2020 at 8:32 am #111303Anonymous

InactiveTesting live MOC had 1st 2 fills last night.

The last week since started testing API and MOC has had a few orders placed each day, but non hitting my limit price.

Last night was the 1st limit prices hit and filled. NB nominal values only but both were in the green, and fully in line with backtest.The great thing for me was to see the API closing down trades not filled, and then everything squared off at close of play, without having to get involved, and introduce my potential for human error.

Will continue this low value testing short term, to get comfortable with the process, and the discipline of the routines.

Thanks to Nick and Craig for getting me to this point.

April 28, 2020 at 1:22 pm #111323Anonymous

InactiveWill try and post up some backtest details of current live MOC system

April 28, 2020 at 1:52 pm #111351Anonymous

Inactive April 28, 2020 at 4:56 pm #111352

April 28, 2020 at 4:56 pm #111352Anonymous

InactiveApologies for the earlier posts – working out how to post chart pics.

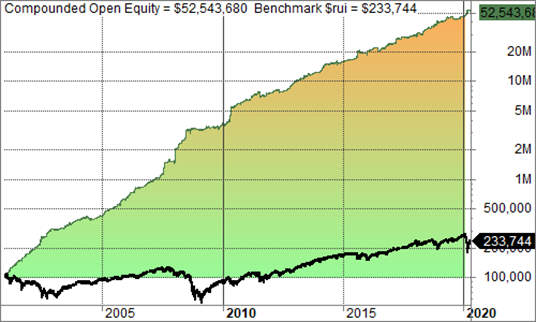

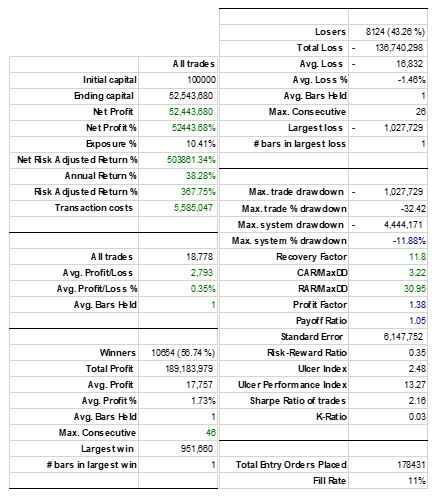

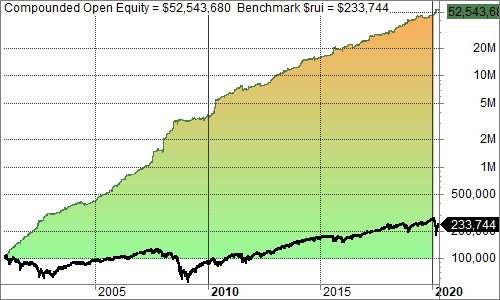

Anyway, initial MOC running live through the API.

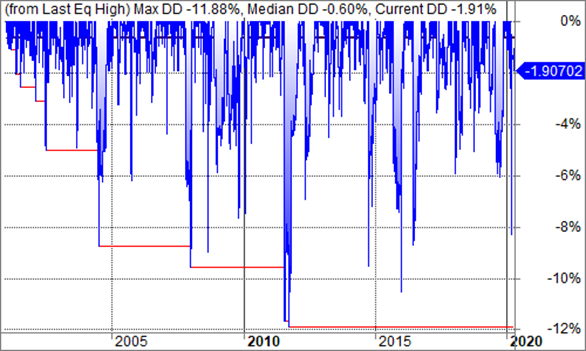

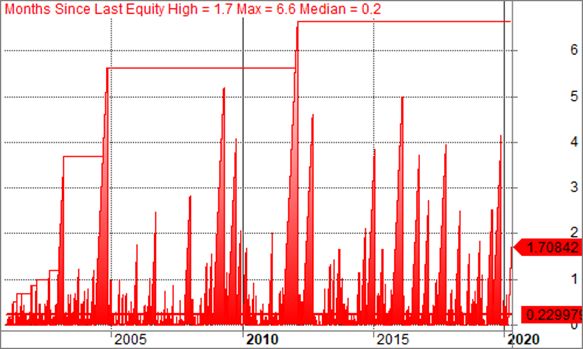

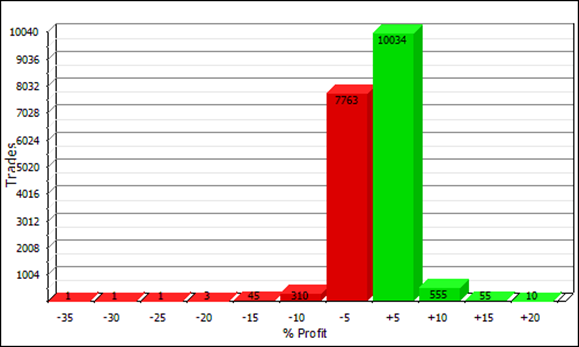

Here is a summary of the main backtest results of this 1st system.

As someone else mentioned on the forum, Nick advocated KISS, yet with a twist, and the results of where he took me are summarised.Whilst 1st system up and running, now starting to look at new ideas, initially MOC.

One point I have found is that with various testing, both on the initial system, and now other ideas, is that I always end up with my Rank method as ;

ATR1 = ATR(ATRPeriods);

Rank = 100+(ATR1/C);Various other ranking methods tried, but each one tried so far dilutes performance.

Is this the experience of others?

Any feedback appreciated.

Thanks

April 28, 2020 at 9:27 pm #111353

April 28, 2020 at 9:27 pm #111353ScottMcNab

ParticipantAlways found Julians’ to work well

100-ROC(C,3)

Could also divide by the C to favor cheaper stocks but nice if second system using totally different rank, even if slight hit on backtest performanceApril 28, 2020 at 9:35 pm #111354Anonymous

InactiveRetry of missing charts

April 28, 2020 at 9:37 pm #111355

April 28, 2020 at 9:37 pm #111355Anonymous

InactiveWill investigate, thanks Scott.

April 28, 2020 at 9:43 pm #111356TerryDunne

ParticipantHi Mike,

I use exactly the same ranking on my MOC. I seem to get a higher fill rate than using other rankings.

My recollection was that Nick thought this was not very common when I discussed it with him…

Best wishes,

Terry

April 28, 2020 at 11:59 pm #111298ScottMcNab

ParticipantMeant to be working from home Mike but bored so … initial thoughts

1. I would trade this…nice !

2. exposure (10%) on low side…is it possible to get more bang for your buck?

a. is there a filter (index or indiv stock) that may be able to be relaxed ?

b. is the stretch too much such that the fill rate is only 11%

3. results in March 2020 gives confidence…was this due to system being off due to index/stock filter or did it continue to trade thru the month

4. nice low maxDD

5. what leverage are u using Mike?

6. see 1.April 29, 2020 at 10:27 am #111357Anonymous

InactiveHey Scott – appreciate the feedback

2a) This system is exactly as Nick guided me, so no Index or stock filters used. Seen discussion on Index Filters, so curiousity will get the better of me to explore.

2b) uses 0.65 stretch. Reducing to 0.4 improves fill (19%), CAR up to 43%, but ave P/L drops(0.22%), MDD up (23% CAR:MDD down (1.84), Profit Factor falls(1.26) and payoff falls (1.05) – so it becomes a risk :reward assessment.

3) as no index filter, traded through March with 82 wins & 89 losses . Backtest on March 2020 alone gives loss $1k / MDD $8k, so painful, but essentially almost recovered.

Then April 2020 to date backtested in isolation $0.6 k loss / $0.9k MDD 2 wins and 4 losses, so minimal activity.

5) This backtest is using 25 Margin / 40 Positions.

6) This is running live now, though as stated before, just using nominal $ whilst get comfortable with API process, and the discipline of following the same steps every day, before 9am US time + getting used to no trades being filled day after day (at the moment), ensure I don’t switch off and start manually over-riding this system.

My intention is to scale up with this system in the near term.

In the meantime, as Nick said to me, I will start going down various “rabbit holes” as I look for system 2,3 etc

And I need to try and develop Swing / MRV / Rotation / WTT style…..Becomes infectious.

April 29, 2020 at 9:23 pm #111299ScottMcNab

ParticipantNice..thanks for the info Mike..best of luck with your new addiction

May 1, 2020 at 12:03 pm #111362

May 1, 2020 at 12:03 pm #111362Anonymous

Inactive

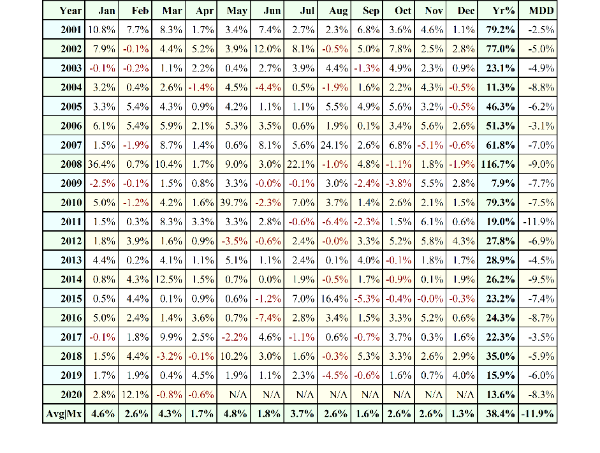

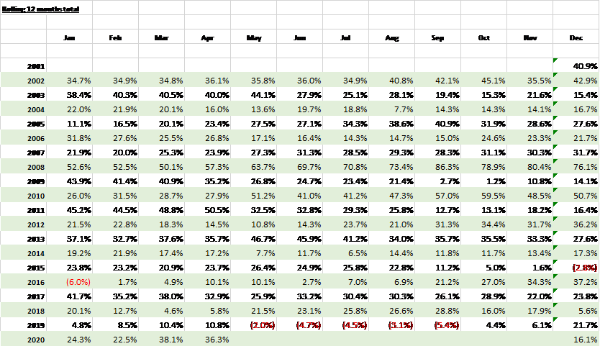

One thing that I look at is the rolling 12 months performance of a system, so rather than just the Jan – Dec annual total, see what the 12 month historical performance is, for every month in the test period. Similar to the Walk Forward, but as an ongoing extract.

Forces me to consider not simply the very recent performance ( which may be good or bad), but what performance is doing over last 12 months.

I have to do this as manual excel extract at the moment. Sure it can be coded as a report having seen what the more advanced folks are achieving.

As an example, the MOC system posted above has the following 12 month rolling performance.

12 mths to Dec 2015, and Jan 2016 system performance were negative.

Similar for the 12 month periods to May 19 / June 19 / July 19 / Aug 19 / Sep 19.

Then positive from then on.Just a different way of viewing.

-

AuthorPosts

- You must be logged in to reply to this topic.