Forums › Trading System Mentor Course Community › Trading System Brainstorming › Mean Reversion – June 2022

- This topic is empty.

-

AuthorPosts

-

July 18, 2022 at 5:40 am #114952

JulianCohen

ParticipantNice Glen.

I just tried it and it cut the CAGR back as much as the MDD for me so I’m relatively satisfied with the same stretch across all markets.

BTW in RT you can really simply that code:

SPXFilter: Extern($$SPX, PDI(5)) > Extern($$SPX, MDI(5))

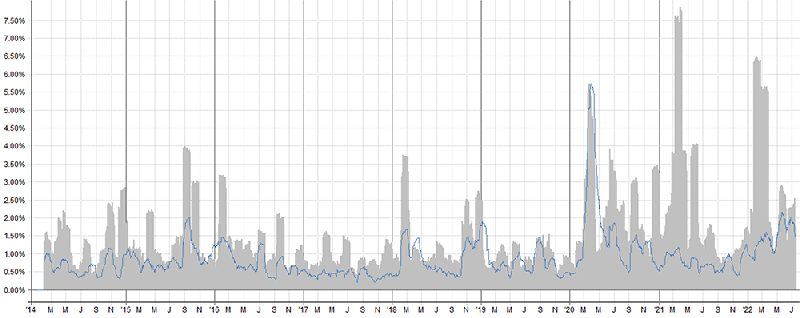

I did try this test in RT which is really interesting. I compared the volatility of returns with my MOC against the volatility of returns with the SPY….It wasn’t what I expected, especially since 2020. The strategy has been much more volatile this past couple of years, especially when compared to SPY.

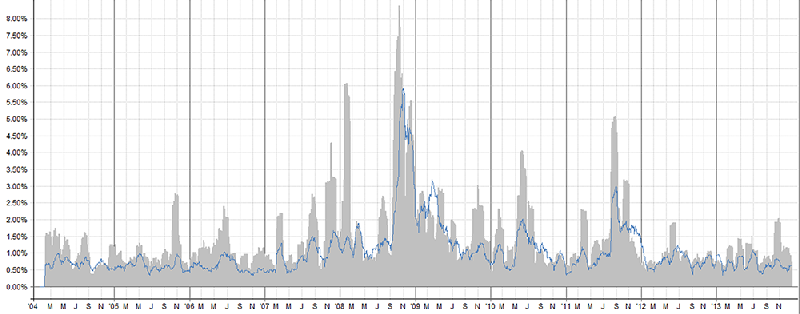

To compare this is from 2004 to 2014

Again a deviation between portfolio and SPY around 2007-2008 and then back in step again.

I’m not reading too much into this, but it’s an interesting thing to look at.

To see this edit the Graph Formulas and add

Volatility: {%2^} stddev(S.NetPct,20)

July 18, 2022 at 7:03 am #114888SaidBitar

ParticipantUsing PDI and MDI are a bit lagging especially for MOC systems. MOC systems they are short term and follow the changes in the market faster than longer term systems. So using any indicator that is a bit lagging to modify the stretch is not the best way (at least in my opinion). Why not using the ROC for a certain duration to change the stretch

July 19, 2022 at 4:03 am #114889SladeChisholm

ParticipantThanks for posting this Glen, I am working on my second MOC system so your timing is great.

I tried it out and have a solid improvement. I followed your lead and reduced the stretch where the Index PDI was above Index MDI which gives the below:

Sample AB Code below for info:

// Generate PDI/MDI for $SPX.

SetForeign( “$SPX” );

IndexPDI = PDI(5);

IndexMDI = MDI(5);

RestorePriceArrays();// Calc Stretch based on Index PDI/MDI.

StretchMulti = IIf(IndexPDI > IndexMDI, PDIUpMulti, MDIUpMulti);

EntryStretch = ATR(ATRRange) * StretchMulti;I also messed around with the PDI/MDI at the stock level but found it a bit inconsistent.

Plenty for me to play with here.

Cheers

July 19, 2022 at 6:45 am #114954KateMoloney

ParticipantSlade Chisholm post=13238 userid=5407 wrote:Thanks for posting this Glen, I am working on my second MOC system so your timing is great.I tried it out and have a solid improvement. I followed your lead and reduced the stretch where the Index PDI was above Index MDI which gives the below:

Sample AB Code below for info:

// Generate PDI/MDI for $SPX.

SetForeign( “$SPX” );

IndexPDI = PDI(5);

IndexMDI = MDI(5);

RestorePriceArrays();// Calc Stretch based on Index PDI/MDI.

StretchMulti = IIf(IndexPDI > IndexMDI, PDIUpMulti, MDIUpMulti);

EntryStretch = ATR(ATRRange) * StretchMulti;I also messed around with the PDI/MDI at the stock level but found it a bit inconsistent.

Plenty for me to play with here.

Cheers

Thanks for sharing Slade.

What timeframe did you test on?

July 19, 2022 at 7:17 am #114890SladeChisholm

ParticipantIt was 1 Jan 2005 to current day, same as Glen I think.

CheersJuly 19, 2022 at 8:01 am #114955GlenPeake

ParticipantThanks for the update Slade.

Looks like you might have a nice addition to move forward with on your testing.

Thanks for the AB code. I hadn’t gotten around to running it through AB.

July 20, 2022 at 12:15 am #114953Anonymous

InactiveGlen Peake post=13232 userid=314 wrote:#2. Hybrid dynamic $SPX PDI/MDI Normal/Increased Stretch.Hey Glen, something you may find benefit from is dynamically adjusting that 5 day lookback when times are less volatile and more volatile.

At my recent gig, they loved volatility adjusted moving averages. In RT terms, it would be like:Quote:recent_vol: StdDev(C, 63) / StdDev(C, 252)

normed_vol: Bound(recent_vol, 1.5, 0.5)DMI_param: 5 * normed_vol

While I doubt you would want to REDUCE the 5 to anything lower, you may find value in using it only as an extension, or maybe centering at 10… you get the picture.

Note I’ve not tried this. Hah!

Cheers

July 20, 2022 at 12:57 am #114956JulianCohen

ParticipantThanks Slade….no idea why I didn’t think of this before. Instead of making my stretch wider when the filter was on, I kept the stretch the same but made it narrower when the filter was off instead. That did make a difference of a couple of percentage points.

So it’s made me confident that my original stretch is good for my strategies at least.

July 25, 2022 at 11:32 pm #114891KateMoloney

ParticipantThanks Glen for the idea with the stretch filter.

Noticed that daily drawdowns increased from a maximum of 18% to 27%, mainly during 2020. Something to be considered ……

-

AuthorPosts

- You must be logged in to reply to this topic.