Home › Forums › Trading System Mentor Course Community › Progress Journal › Matthew O’Keefe’s Journal

- This topic is empty.

-

AuthorPosts

-

September 3, 2020 at 1:03 am #112110

Anonymous

InactiveYeah I am the huge trade volume lover for sure. Love seeing those numbers/stats play out over time over large numbers.

Ah well its not a race. Gotta play to my strengths. Taking a one month time out on the MOC trading to see if I am any good at other things is no big problem.

And I already know I am no good at day trading, live trading in real time under heavy volumes, lots of activity in my face at one time. Thus the reason for being an end of day trader and needing API’s to help me out in whatever I do.

Nothing wrong with learning to play all the instruments in the band one instrument at a time. One day I’ll be able to bring them all together and play simultaneously. For now, its learning mode on.

September 6, 2020 at 3:44 pm #112119Anonymous

Inactive September 9, 2020 at 12:56 am #112098

September 9, 2020 at 12:56 am #112098Anonymous

InactiveWell it has been a full 5 days of trade now testing this new trading method so I thought I better give an update how it is going. I was going to do it on the long weekend but got lazy and had a nice break.

Here are the stats….

Obviously not looking good (as could be expected from a week of trade where the market has been tanking) but still there is plenty of learning I have been able to take from it.

First thing is that I am happy given I was able to buy some positions right at the very top of the market (and not give any days in trade for these positions to run upwards in my favour) before selling off. This illustrates to me in ways a worst possible case scenario. To buy right at the top and then immediately be stopped out in the majority of positions as losers. Thankfully as I am running small position sizes to test the water (yet still have enough skin in the game to not be too happy about losing) it is teaching me some good lessons without instilling any panic/worry. I am confident at the right time I will scale it up, but now is not the time for obvious reasons. I’d say index moving in the right direction in relation to a moving average and only after I have done perhaps 2 to 300 trades and the stats are moving in the right direction will I be happy to take first steps in scaling up. I’d say first step up will be to double the size. Then after a while maybe double it again. Of the losses so far, it is probably indicating to me I’d probably be comfortable trading it perhaps five times the size of current tests?

Second thing is the stop methodology seems to be running well on all the positions closed out at a loss. The 32 closed losing trades averaged a 4.0% loss. 24 of them on the 3% initial stop, 4 on the 6% initial stop and 2 on the 9% initial stop. 2 trades on $DOCU were stopped out on a 9% trailing stop. One of them at 9.1% profit and the other at 1.7% loss.

As of today’s close I am holding three partial positions in $GRVY, $CSTL and $NFE. It is interesting that even in a sea of red for the market you can still find symbols that go against the trend. I guess this is one of the features of this type of system.

For the API I am developing to help me automate this system, it is going ok but only ok. It is a step or two closer to completion, but still not ready yet. It is a bit of a slow process because of testing the thing, working out bugs, then shortlisting how to attack those bugs and work out the kinks. As this process is taking time, this is why I have been staying up late and watching the open and managing the process manually. It seems the more time I play in TWS I learn more about it. I am slowly becoming the master of entering orders manually in the classic TWS Order Entry Page (I was only ever using the simple order entry window in Mosaic to manage orders one symbol at a time. Now I’m doing multi-line orders with attached sell orders in the classic page before releasing some or all from there in batches, depending on how I see volume flowing at around 10am).

As previously commented I have not been trading my MOC system because I want to have clarity in watching the open and trading this new method to see if it fits me well. Especially after today’s result, I am guessing my MOC system would be deep in the red for the month to date because today’s session ended pretty much at the same low at which it opened. I haven’t run any backtests to see, but if I had to bet I would say I would be down on my MOC if I had been trading it.

September 9, 2020 at 4:53 am #112130JulianCohen

ParticipantMy MOC is flat to small up so far this month, so I doubt you’re missing out on anything. DON’T run it and see though

September 9, 2020 at 5:07 am #112132

September 9, 2020 at 5:07 am #112132Anonymous

InactiveHehe don’t worry I won’t. Missed profits always burn more than actual losses.

September 9, 2020 at 5:16 am #112134MichaelRodwell

MemberAre your stops based on percentages and not taking into account price action support/ resistence?

September 9, 2020 at 6:54 am #112135Anonymous

InactiveYes percentages only. No support/resistance measures.

I want to have automated exits and use order types that are native to Interactive Brokers such that after today’s close, the API will disconnect and then tomorrow when the API connects again any open position that were opened in today’s session do not need to be read or “reconnected” or resolved by the API any further tomorrow. The reason for this is that I do not want any open position from today needing to be managed by the API into the future because, for example, I may wish to not trade this week. Or I may not be able to completely resolve the API to managing partial positions tomorrow. Or I might want to go on holidays and not bother managing any positions.

Because one of my weak points is exiting at the right time, this is why I am trying to be very rigid with myself on using this stop based exit mechanism. Perhaps it isn’t the sexiest method, but others seem to certainly have made it work.

The concept is that an open position may run for days/weeks/months before being stopped out. Any filled buy order (buy orders will have DAY validity) the API will see this and respond with a closing order in two different flavours with GTC validity. The first flavour will be a stop loss with a dollar figure. This will be 3, 6, or 9% below the fill price. It will also be issued with a TRAIL stop order for a 9, 18 or 28% trailing stop. I wish I could do something a bit more dynamic than just a percentage trailing stop, however the only type available in IB/TWS is a dollar/cents amount or a percentage amount. The second flavour of stop order will be the same as the first with the initial stop price and trailing stop, however this part will also have a bracketed profit taker attached at a specific price (which will be 27, 54 or 81% above the fill price). The concept is that a portion of profitable orders will run into perpetuity and the other portion will close with a quick profit (hopefully!).

These percentages and why I chose them will likely change as I run with it, see how it operates in real time. I am simply plucking them out of the air as in following some traders who have made this work some say they like to keep their initial stop loss tight, to perhaps 3 or 4%. Others talk higher than this in the 7 to 10% mark. Then on stop losses some use moving averages and some user trailers. Anywhere from 10 to 30% to ensure you can still get some of the large swings. In me trying to cover a number of bases I am simply just going for a range and seeing how it falls out. Perhaps this is a silly idea and I drop the idea of splitting across three separate buckets or I will likely fine tune the numbers. Time will tell!

September 9, 2020 at 6:56 am #112136Anonymous

InactiveP.s. of course I will still be able to see open positions each day in TWS. If I become any good at it, I would still be able to alter any stop positions or close a position manually if I really wanted to.

I would prefer to have it “crude and automated” than “sophisticated but needing to be manually managed”.

September 9, 2020 at 5:53 pm #112137LEONARDZIR

ParticipantMatt,

It sounds like you are running a mean reversion system with stops. I believe Nick has pointed out that stops degrade mean reversion systems. Other traders such as Sutherland have noted similar findings. I apologize if I have misinterpreted your results.

LenSeptember 9, 2020 at 11:29 pm #112140Anonymous

InactiveHi Len, thanks for the tips!

I’d say it is more like momentum/trend following whereby the trigger to enter is price breaking out in an upward direction from a basing or consolidation pattern of some sort breaking through resistance. I am looking to find symbols that have the potential for a high amount of growth/momentum either already in play and about to go further after said patterns, or a symbol that has been languishing/basing in its price action and about to breakout out in the upward direction. Finding these candidates is probably the only real discretionary part of this style/system. I will set three price targets above the current price (in the zone where you could say the breakout has occurred) with my whole position allocation in thirds across the three targets. After watching the volume traded in the first 15 to 30 minutes of trade, I will release the stop orders with those three buy price targets on those symbols trading increased volume and hope that the price does move up to those zones and I get the fill (hopefully all three fills, but if not, I can always reassess tomorrow and perhaps still target this symbol tomorrow for more fills if the story is still a good one). Obviously the dream is that after the fill the price keeps heading North in the coming days/weeks/months.

On the exits, yes they are stop based, so I guess this exit technique you could probably call a mean reversion aspect as the price at that point would be deviating from the (hopefully) upward moving average/direction.

Overall I don’t think I would call it a mean reversion system though. Part of it is in line with O’Niel and Minervini methods where you are trying to find symbols with high growth potential and the entry point is right at the beginning of when that potential commences. I came across these people/methods earlier this year in the March/April rout downtime where I decided to take a step back and read plenty and try and find a way that might suit me better.

And I absolutely agree on how destructive stops can be to momentum based systems. This is one thing I am monitoring very closely in the testing of this method. What I do know is that it seems these individuals like O’Niel/Minervini don’t complicate things too much and those who have replicated their method in very simple use of basic stop methods like this have had the tenacity to ride large trends and use it as a safety net for when things turn sour. As I am still on my journey to becoming anything of a good trader, I therefore am simply replicating what these industry stalwarts have done and not trying to reinvent things too much. I know one of my weaknesses is exiting at the right time, so I will just replicate their exit method for now.

Who knows, perhaps I will find it too frustrating. I am guessing if I do, my next attempt at finding my way with trading will probably be somewhere in the middle between the MOC daily system and this long term discretionary style, like in a swing trading style with medium term hold times. Then I will absolutely be in reversion land!

September 10, 2020 at 7:19 am #112142SaidBitar

MemberGood luck with it

But seems it is not 100% mechanical system

Just one note about the method for stops and profit taking you can use whatever method you just need to do the math in the api

You can use atr based or standard deviation and place the order

Even though i use percentage for position sizing because of its simplicity but I know the volatility based will be better but the difference in the returns doesn’t justify the added complexitySeptember 14, 2020 at 8:07 am #112145Anonymous

InactiveSaid, no, not 100% systematic this one, but that’s ok, I need to try different approaches to find what fits me well.

Understood with the API being quite dynamic on stops and order management in real time, however that would only be possible within the scope of the same trading day that the orders are placed and the API is running. Yes, sure I can get the API to run tomorrow and hopefully pick up the filled orders/positions from today and still manage them further with more dynamic stop management, however as per my previous comments I’m hoping to use simple, native order types in IB such that when the API closes today the positions can be managed/closed out by IB automatically in time without any further use of the API. This is to help keep things basic and also to help with if I miss trade days or don’t do what I should be doing in running/managing the system.

September 14, 2020 at 8:49 am #112131Anonymous

InactiveI thought I should give an update of how this system is going at the end of the second week. Ultimately, it is not much of a change to the first week because my previous update was after 5 trading days and now this one is only after 8 trading days, however I am trying to do the right thing by doing it once per week and keep me disciplined for the process.

So here is how it is looking…

It has been nice to see a few green results have come back to help out in the last few sessions since my last update. The stats overall are not where I expect them to be long term, however at least I think it is moving in the right direction.

As part of my review of my progress I also sat down yesterday and analysed every single trade one by one to see if I made any errors, could have done anything better, or changed anything up to improve things. Here are a few of my findings…

Heavy Selloff

Most of the losses are due to the heavy selloff in most of the large index stocks. I say it this way because on analysis of the positions I took and their performance it is clear that the stocks in the NDX, SPX and RUI all suffered for no other reason than that the market in general suffered. Alternatively, the stocks that were in the RUT or were IPO plays and they were not large caps (I consider large caps anything larger than 1.8 Bil market capitalization. Why? That is the cap limit for RUI versus RUT and also the lower limit for the S&P 500 if I am right) well these ones didn’t get punched around the ring nearly as much as the others.So my point here is not to fight the index. I know this may seem like a “Gee, really” kind of thing to say however I have really appreciated doing the work manually in both the real time trading and the post analysis to see how the small cap and IPO stocks were far less influenced by the market moves and these stocks were more likely to have their own strengths/directions. No, it is isn’t perfect and there were still some of the heavier cap stocks in IPO and RUT that still followed the down trend a little, but not as perfectly as what the NDX, SPX and RUI stocks seemed to follow. Therefore I will need to keep an eye on which stocks I play and how heavy I position size them given what the indexes are doing.

On this, at the start of the year I was experimenting with a “Market Breadth” indicator of sorts. Something that would help me a little more than just a simple moving average on the index with a “risk on / risk off”. After creating it, I put it down and stopped using it however I think I need to pick it up again and start using it for this system because I think it will be very useful in helping me to know when to go long full scale, when to go long but with smaller positions and when to stay out altogether (or even consider going short, hedging a position on the index etc). I will make another post on this item in the forum in a few minutes…..

Volume

For the size of positions I’m running (and what they will likely be if I take this system full scale) I definitely need roughly 200,000 average daily volume for their to be enough liquidity in the market to get fills at my target prices at start of the session or when I get stopped out. My original lower threshold was 50k ave daily volume, but that is clearly too small if expecting close to an instant fill.One of the features I am programming into the API is that for the orders entered today the volume needs to be checked at 10am. If the daily volume is up, then the order will be released. If the volume is not up, then the order will be cancelled and not transmitted to TWS.

At 10am, I should have seen roughly 10% of the daily order volume flowing in order to determine that the volume is on target for an average volume day. I however don’t want to release the orders on an average volume day. I generally only want the fills if the volume is up. Therefore I will likely set the volume target to something like 12 to 15% of daily volume by 10am, which should roughly mean volume is on target for the day to be above daily average by about 20 to 50%.

Order release time

As above, I will release orders at 10am after the volume check. I did not do this in the last 8 days of trade. In some cases I released all the orders before the open ( I am using buy stop orders, because the target price to go long is in a zone above the current market price). In other instances I waited until 10am. In the majority of the profitable positions, it was waiting until after the opening 30 minutes of volatility that I ended up getting positions in profitable stocks. None of the positions I took right on the open ended up profitable. I mostly just got high fill prices, the market pricing came back down and I got stopped out.Stops

I previously commented on my 3/6/9% initial dollar stop loss levels. These worked well, however overall I only seemed to have gotten stopped out on mostly the 3’s, a handful of the 6’s and only one 9. After analysing all the trades it actually turns out that these levels are probably a bit too loose. The success stories of this type of strategy discuss expecting a stock to move immediately upward after a fill and if not, they just cut if off and get out right away with a super tight stop. I thought this was a little strange and thought “but aren’t you going to get stopped out of everything? Don’t you need to give room to play?”. I think however I am seeing now what they mean with expecting them to run upwards immediately, because of the winning stocks I am still holding, they did in fact run up quite well right from the outset. So much so that in my analysis much tighter stops would still see me in all of the same positions right now.Therefore I am going to revise the initial stops to 2% 4% 6% instead.

I did the same check of every trade also with the trailing stops to see if I could do any better there. I was setting them at 9% 18% and 27%. I will also dial these in a little to 8% 16% and 25% as even the profitable positions I am still now holding would not have been stopped out at these revised levels and the few closed trades that I did get stopped out as profitable would have been improved slightly.

Ok that’s it for now. Onto week three!

November 5, 2020 at 8:39 am #112161Anonymous

InactiveOK so a bit of a breakdown of the performance of my Disco Long trading for both Sep & Oct… (I didn’t bother doing a summary at end Sep as I was still fiddling with the system and position sizing was minimal).

Sep -1.3%

Oct +7.0%Account +6.9%

I’ve only been trading it two months now, so don’t have any more history as yet.

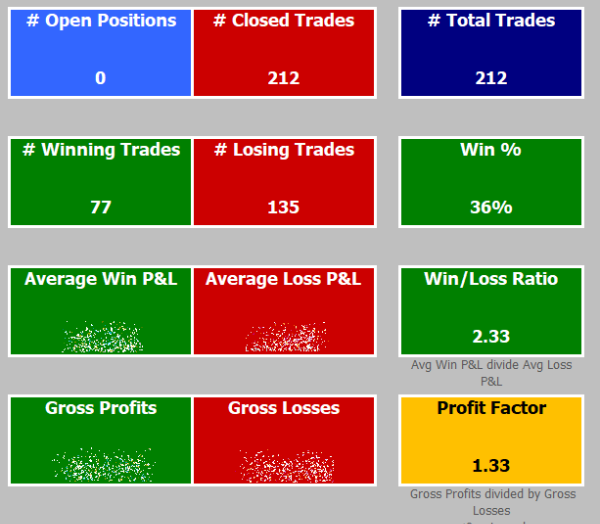

Here is how the stats are looking at the end of the two months….

The Win% seems to be doing ok and is where I would expect it to be long term. The Win/Loss Ratio is lower than desired because the first month I performed a lot of very small transactions in testing/fine tuning my entries and exits. Also I was scaling into positions and then also back out again thus creating a large number of transactions (three for the buys and another three for sells) in that “beginning of September learning phase”.

I have found my way to mostly doing IPO’s in their institutional advancing phase, say anywhere from about 1 to 3 years since IPO. Just as they have corrected from their lows formed since IPO, and forming a basing pattern, coming back to breaking through all time highs (sometimes a 52week high) and therefore pushing through with new momentum upwards. It is very much a breakout trading method, looking for volatility contractions prior to popping with low/reducing volume for a few days/week, then pushing through highs, with high volume, on the breakout day and that is when I pounce on releasing the buy order, obviously with the hope that it will continue upwards.

I am usually shortlisting around 5 to 15 symbols a day. I will enter a starter position for each one as an order in TWS but not release it, just have it sitting there waiting as a saved order in the classic window so I can see how price is tracking during the opening trade and then only release it as a live order with a Buy Stop price above the market price if it is behaving correctly with price and volume action.

I have learned that I cannot drive this method with software. It is too strict to do something like “Only release these ten orders if more than 10% daily volume by 10am”. This is because sometimes you can see the volume and price action really working by 9.50am and waiting any longer and the price has popped through your target and then you are chasing too high a price if you were to release the Stop order at 10am and your risk versus return is out of kilter. Sometime it doesn’t happen until 10.10 am. Sometimes 150% of volume is enough to make sense to release. Sometimes 60%. Sometimes 500%. Also in watching the open for the first hour or so on these handful of shortlisted symbols means you get an appreciation of whether something really is truly moving or not. Or sometimes it does nothing for 20 minutes then really starts popping between 10am and 10.10am. So yes, annoying part is that my sleeping patterns have changed a little because I have been sitting in front of the machine watching the open and pressing a few buttons when I have to in that first 30 to 60 minutes. I am finding I am going to bed around 1 to 2am Qld time these days and getting up around 8 or 9am.

I find the opportunities on whether or not the symbols I have targeted for the day will have played their hand within the first hour. Sometimes none of them are playing and I just cancel all the saved unreleased orders and then go to bed by 45 minutes after the open. Other times of the short listed symbols I may have released five or six of the orders with a stop price above market and an attached child hard stop loss order which only becomes active if the buy order fills. I would still go to bed in that instance. So it is about 1 hour of work watching the action during the open. Next morning will tell the story if I got any fills or not. Sometimes 1 or 2. Sometimes none. I might even get a fill during the time I am sitting watching that first hour or so. With the 20 to 30 minutes of prep earlier in the day I’d say I am doing about 90 minutes of work on this a day.

Max positions I had during the two months was about 25 positions. The majority of them had starter positions. About 5 of them I had pushed them out to about 20% of cash/account. 25 positions is too much though. I was getting better at more targeted positions towards the end of the month and through the last week or two of October was down to about 8 to 10 active positions with 3 or 4 at 20% allocation.

It is totally true that it is just a handful of large winners is where the money is made. The biggest contributors during the end Sep/beginning Oct burst were Peloton, Jinko Solar, Zoom Video, Snapchat, Pinterest, and a few other energy stocks.

When they all peaked around mid Oct I got a margin call (or at least the warning flag) because I totally loaded up my account into about 180% of cash and then everything went well through to about 12 Oct and grew and I got to about 190 something % of cash which is when I got the warning. None of my positions were closed by IB. I sold out a few trades that were sideways next day, luckily enough one of them was Fastly because just two days later it gapped down. That was pure luck.

I’m not doing the “Enter three buy stop orders at three target prices” like I started with in Sep. I am simply entering one order at 0.5xATR(10) above the breakout/high price. If the volume action is working and price seems to be working towards my target that is when I will release the order. Maybe it fills, maybe it doesn’t. If it fills then in the next day or days is when I will watch how it goes with price action and if moving in my favour is when I might order another tranch. If it isn’t working or goes sideways it will get stopped out pretty quickly. The initial stop is always 2xATR(10) below the buy price which ends up being anywhere around 6 to 10% on average.

I am using my market breadth indicator to help decide on position sizing and when to be in/out of the market:

Green: Can open new starter positions. New positions 5% of cash. Winners can be added to in blocks of 5 or 10%.

Yellow: Can open new starter positions. New positions 2.5% of cash. Winners only added at 2.5 or 5% of cash.

Red: Not allowed to open any new positions or add to winners. Manually look at stops to see if they should be moved up to any recent/support zones.Some people may decide to sell out of extended or profitable positions if market seems to be dropping but my opinion is to simply tighten the stops and let them do their work. You never know, you might get some good luck and still have some prices moving north of individual stocks, so I don’t think I am going to adopt a method of “red = sell everything now”.

I am still using a three-tier percentage trailing stop for exits but no longer just a raw percentage like 3/6/9 as I tried at the beginning. I am using H-2xATR(10)% at one third and H-3xATR(10)% another third and H-4xATR(10)% on the final third. I see what these calculations mean in percentage terms and simply update the percentage for each GTC order in TWS each morning. I also compare the resulting price at each of these percentages to a 10, 20 and 30 day EMA. I use the highest of the two numbers in each case for the manually entered stop price. The idea here is that the percentage method is the dynamic part and helps work its magic during the live session in case there are any price pops upwards that I might be able to catch. The MA method helps to ensure anything that starts tracking sideways for perhaps 10 days or more will slowly meet its maker and may need to be sold out. This is perhaps like a stale exit of sorts.

I have a rule that stops can only be moved upwards in price, not down, whenever I am adjusting them.

I have not sold anything manually for the whole two months. Even though now I am in 100% cash (I thought I would have a break for the week to see what plays out with the election) this position is not as a result of having exited anything manually. It is all “stopped out of everything” action. During the course of the months I regularly had situations where the first tranch was stopped out for a quick profit (or small loss) and then the other two tranches held well and continued to move up for a few days. A few of them went nowhere/sideways and still got stopped out, but letting some portion of them have a broader leash is part of the the process.

And yes, this means I have had to deal with drawdown these two months. From mid Oct to when the account peaked with the margin call to end Oct when everything stopped out automatically I experienced perhaps about 12% drawdown. If I had sold everything out at the peak around 13th Oct I would have made about 19% for the month. BUT, surprisingly I found myself to be quote ok with the whole affair because I had my stop losses in place, at levels that I already new were above my buy (and yes, understood for the dangers of gaps down) however this gave me a very calm attitude during the whole journey. I definitely found myself sleeping better at night, even at the times when I was leveraged to the max I was still saying to myself “Bah, who cares, the stops will take care of everything and still collect me at least some form of profit”. Yes a few times in the morning I would check and see I got stopped out of something and say “Ahh you bastard” because I thought I was onto a great winner but lo and behold within days the thing would be chopping sideways or lower so I could easily see the lesson of getting out early. The other great thing that I didn’t mind the 12% drawdown considering everything had ripped upwards by about 19% before hand. It is certainly a good stroke of luck to have some upwards movement before facing a drawdown. I also am able to understand the reality of using a trailing stop system in that you are always going to hand something back on your way out the door.

The feelings/thinking I have had in doing this method has been in contrast to me trading monthly or weekly rotational strategies in the last few years. One of my previous challenges/worries was always what was happening when I was asleep, not watching the trading day. That I “cannot touch the system until rotation day and in the meantime it is tanking”. It always felt to me like I was somewhat trapped. This method of having stops, combined with a more targeted, active approach to what I am buying fills me with much more satisfaction or perception of control and safety in what I am doing.

I know Said would not be able to trade this method because it isn’t mechanical/defined/automated enough. And I know it goes against systematic methods Nick is trying to teach us here, however it has been a very interesting method I have learned none the less and I am feeling comfortable with it for now.

I have not been trading my Long/Short MOC in these two months. I have not backtested them over this period either, for fear of getting annoyed with missed potential profits (losses???).

I would say once the dust settles on the election I will hit the go button on continuing this method in November. Perhaps next week, Monday.

November 5, 2020 at 8:59 am #112425Anonymous

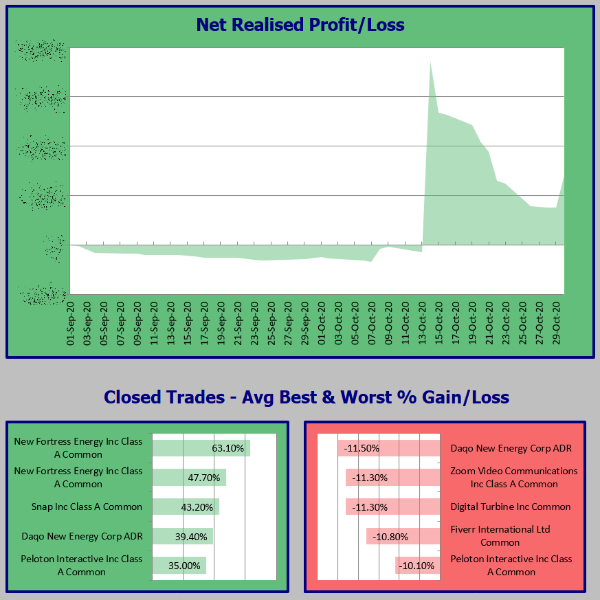

InactiveP.s. If you’re interested, this is what the chart and major winners/losers looked like for the two months….

Can easily see the winners really popped and even the worst of the worst losers were limited to within a reasonable percentage loss.

-

AuthorPosts

- You must be logged in to reply to this topic.