Home › Forums › Trading System Mentor Course Community › Progress Journal › Matthew O’Keefe’s Journal

- This topic is empty.

-

AuthorPosts

-

June 23, 2020 at 8:12 pm #111706

Anonymous

InactiveMatthew O’Keefe wrote:. Generally I found that I was probably using too many ‘indicators’ stacked on top of each other to meet entry conditions to make it work. Too many whacky analysis methodologies (which absolutely have their place) but you get lost in thinking they are going to be the holy grail in opening you up to a new way of thinking and finding a new edge for modern times. This almost always led me to failure.From https://norgatedata.com/alternative.php

I read this and I just love it:

Technical indicator: – a transformation of a price series that contains less information than the series itself. Different technical indicators throw away information in different ways.

June 24, 2020 at 9:13 am #111717Wayne Verney

ParticipantPriceless link 😆

June 26, 2020 at 7:30 am #111716Anonymous

InactiveHey Julian did you try reading the log file from the API the day you ended up holding some positions overnight?

Perhaps the log might tell you the reason for why orders were ignored/rejected? Who knows, it might be something other than the margin squeeze?

June 26, 2020 at 10:42 am #111734JulianCohen

ParticipantMatthew O’Keefe wrote:Hey Julian did you try reading the log file from the API the day you ended up holding some positions overnight?Perhaps the log might tell you the reason for why orders were ignored/rejected? Who knows, it might be something other than the margin squeeze?

Yes. It said the orders were cancelled by IB

2020-06-12 14:22:35,655 INFO : [6] – [Broker] Error ID: 4699 Error Code: 202 Error Message: Order Canceled – reason: Order cancelled by Global Cancel.

2020-06-12 13:57:42,779 INFO : [6] – [Broker] Error ID: 4700 Error Code: 202 Error Message: Order Canceled – reason: Order cancelled by risk mitigation – ORPH.

June 26, 2020 at 2:24 pm #111735Anonymous

InactiveQuestion for you guys with high order quantity MOC systems:

I have been listening to some podcasts that mention signal strength, and as one does in quarantine, I added it to the list of “when bored”.

My MOC system seems to perform better with 20 positions and double the position size, to the tune of 10% more CAR with ~3% more MDD.Tinkering with the stretch (or 30 positions) looks like it can increase return without impacting drawdown much at all, in IS and OOS and on R1000 and R2000.

I assume (but I am happy to be wrong) you have many positions per system because your balance is so large – but is this the actual reason?

Thanks,

SJune 27, 2020 at 5:53 am #111737Anonymous

InactiveI don’t have a large quantity of positions because balance is large. It is mainly because of leverage. If I didn’t have the leverage I am using, then perhaps 20 to 30 positions might be good. I haven’t really tried though.

I have found two important dimensions when doing this system:

1. Need to escape commission drag when positions are so small. See my earlier post on how I use optimisation of the starting equity to see where there is a sweet spot where additional funds no longer improves the stats. After that sweet spot is where I would use as the minimum capital on the system. This method would still apply without leverage. My minimum balance on my systems at the leverage I am using is around 80k USD.

2. Need to remember to keep order quantity at a reasonable level. I mean orders of no more than perhaps 1 or 2,000 units per order. Depending on your minimum share price setting, your equity, your number of positions, all of these need to balance out so you don’t push yourself into a system that needs to be placing orders of 10,000 units per symbol. Sure, 10,000 may still be a small fraction of the daily volume, but that is not the bottleneck. The bottleneck is IB filling you in a split second when the limit price is hit. Small order quantities fill easily and quickly, large orders don’t.

I have also found increasing the minimum share price helps. I mean to 30 or even $50. This however reduces your number of signals. Therefore considering I am trading RUI and RUT I just stick to $10 and 100K daily vol minimum.

100K USD balance on 4x Leverage is 400K to spend. On 80 positions that is just 5K per position. On $10 min that is a max order volume of 500 units. Even on 300K capital that is still only needing to place 1,500 order size per positions, and that is on the lowest $10 stocks. The volume is obviously even less on the 20, 50, 100 dollar stocks.

I know the temptation is to use lower number of positions because the profits usually always look better, however there is the balance you always need to make between this and the practicality of the size of orders you are entering.

June 27, 2020 at 5:54 am #111736Anonymous

InactiveJulian, that’s a shame.

Oh well, need more money in account. Mortgage house at low interest rate?

June 27, 2020 at 6:01 am #111739JulianCohen

ParticipantMatthew….that’s a good idea…should I tell my wife do you think?

June 27, 2020 at 6:04 am #111740JulianCohen

ParticipantSeth I use 50-80 orders for RUT systems mainly to keep the position size at such a level to allow for more chance of getting filled. I use 20-40 position size for RUI systems as there is a much higher fill rate and it’s not so dependent on order size.

If I could get guaranteed fills on RUT I would probably use bigger positions with fewer orders.

June 29, 2020 at 12:00 am #111741Anonymous

InactiveThank you both for the replies and sharing. I will think on it more.

July 2, 2020 at 9:50 pm #111665Anonymous

InactiveSo overall it is the short MOC strategies that saved my skin this month. 7.7% return on the MOC strategies alone. A nice positive result overall. I would have been about -6.1% on the MOC’s if I had traded the long side only.

I don’t know how it will look for July, but I am guessing the volatility is going to continue and the short side will likely continue to work well, perhaps the longs not so much, but I am not in the prediction game so I will continue to run them all diligently. Stats…

558 total trades (All MOC, I performed no other trades in the month).

273 Long

285 Short

Win % 52 %

Win/Loss 1.58

Profit Factor 1.74Stats are generally pointing in the right direction. I would have preferred the win rate closer to 55% which is the long term expectancy. Win/Loss and Profit Factor are all on target though. It wasn’t until I got to about 3 to 400 trades that the stats started levelling out to their long term expectation. As they progress towards 1,000 trades I’m sure they will become even more consistent with the backtested expectation.

50% Cash is to be used for other strategies which I am currently fine tuning. I did not deploy any of this cash to those other strategies during the month as I am still currently developing/learning/training on them. Perhaps I could increase my exposure on my MOC systems a little until I hit the go button on these other strategies, but I am not in any great hurry. It is currently returning well enough so why fix what aint broke.

DISCO.LONG.BALLS

This is a discretionary long only strategy that seeks to capture large moves over the medium to long term. It is a very O’Neil/Minervini style strategy where discretionary decision making is placed on trying to find stocks that are forming certain breakout patterns and may have large growth potential into the future.I am trying to perfect my entry techniques, however also trying to work through automating the order execution for both entries and exits, analysing and entering the orders outside of hours but have software execute during the live session, as much as I can. One of the things I am learning about myself is that I don’t think I would be a very good day trader. I don’t think I can see the patterns through the noise in real time when I have a barrage of information flying at my face, or have a fast enough decision making process that connects to my fingers, which generally means I work better when I can sit down and distil the information, analyse it in my own time and then lead myself to my decision making in my comfort zone. This means end of day trading is clearly best for me.

So in this discretionary strategy I am trying to continue learning on how to identify the correct patterns/setups for entries and on the automation side I am trying to work through how to manage both the entry orders and the exit orders. The concept is that I want to be able to enter the orders outside of trading hours and combine them with (if orders are filled) an automated sell order in the form of an initial stop loss with a bracketed percent trailing stop loss and percent profit taker order on a portion of the filled volume. I wish I was able to do something a little more dynamic with IB order types like an ATR trailing stop, something which might be a bit more dynamic than just a percent stop and percent profit taker, however the limitation/concept I have is that I want to be able to enter these orders into TWS each day and then effectively forget them forever and ever amen once the buy is filled and have IB manage them by themselves with their own native order types. It seems IB only offer percent methods on profit taker and trailing stop orders. I don’t want to have to manually update these stop levels each day on any open positions nor have an API continually running all day every day just to manage them. I want them to fully self manage within IB with GTC sell orders. The exiting of trades should be all automatic either through hitting initial stops, trailing stops or profit taking targets. The only discretionary exit would be on the small portion of positions that are not set up with a profit taking exit (these will still have an initial stop and trailing stop) and only these will be the ones I need to manage manually for exits in time. If everything is going well, these should only be a handful of positions and should always be the extremely profitable ones as all the other positions and portions should have closed out either lossy by hitting initial stop, maybe a little bit of profit hitting a trailing stop, or perhaps a little more profit by hitting a profit target.

OPTIONS

I have been trying to learn how to do simple options trades in an effort to broaden what it is that I trade and how. The idea is to build systems/methods with little correlation to my others. Just simple stuff like selling credit spreads, Iron Condors etc.Overall it has been going ok but the bottleneck I am having at the moment is that the Options Chain in TWS doesn’t seem to populate well with required data/information for decision making outside of regular trading hours. If I run my analysis and decide I am happy to pay $1.55 for a spread it is often the case that by the time the market opens this is highly unfavourable price to me and I will definitely get filled, which makes profit potential worse. Or in the other direction I just don’t get filled. If I wait until market is open to avoid this problem the options chain does seem to fill this information much better and I would have a better chance of getting fills on orders at live market pricing if I am happy with that pricing for my strategy, but this presents two problems. First one is that I just don’t want to be awake here in Australia during the US market hours. Second problem is that if I have to trade whilst the market is open I will have no choice but to see my account balance and any live trading that is going on in my MOC system in real time will be flashing in my face. I know myself, and this will distract me and stop me from trading efficiently with the options trading. It might be a heavy day on fills on the MOC, and I might be deep on the red before the market corrects and the day finishes green. However in all that interim I just know I am going to not be able to trade effectively on the options decision making if I have to do it in real time and see all that noise.

So if anyone has any advice or ideas on how to effectively trade options in the US market, entering orders outside of trading hours, being able to see the options chain data well and still get good fills once the market opens, then I would love to hear from you.

July 3, 2020 at 10:54 am #111757Anonymous

InactiveHi guys,

Just one point regarding the discussion on Monte Carlo, looking at the Amibroker guide, it specifically says under best practices. “To remove risks of serial correlation affecting the results of Monte Carlo simulation it is highly encouraged to use fixed position sizing (either fixed dollar value of trades or fixed number of shares/contracts), so the order in which given trade occurs in original sequence does not affect its profit/loss due to compounding.”

My understanding of this is that if you do not use fixed position sizing, then the trade list is just being sorted in different ways, with some of the trades being much larger (due to compounding) and some trades being much smaller. Therefore, its almost a certainty that you will have some risk of ruin if some of the later trades (much larger) are consecutively executed early in the simulation, when your equity value is very small.

In fact, the higher the CAR of a system, the more this factor will be prevalent, given the large compounding effect and therefore increasingly larger trades.

For my MOC systems, I show nearly 50% risk of ruin select “don’t change” position sizing. However, if I use fixed position sizing either by dollar value or by portfolio equity %, I show no risk of ruin and overall am quite happy with the distribution of potential results.

July 4, 2020 at 1:21 am #111774TrentRothall

ParticipantI agree Dustin, it is also the reason why the longer you run the back test the more chance you have of risk of ruin. Because of the effect of compounding the position sizes are a lot larger and once they are shuffled around the volatility of the Monte Carlo runs is higher.

July 4, 2020 at 1:21 am #111775TrentRothall

ParticipantI agree Dustin, it is also the reason why the longer you run the back test the more chance you have of risk of ruin. Because of the effect of compounding the position sizes are a lot larger and once they are shuffled around the volatility of the Monte Carlo runs is higher.

July 11, 2020 at 4:58 pm #111667Anonymous

InactiveHi Matthew

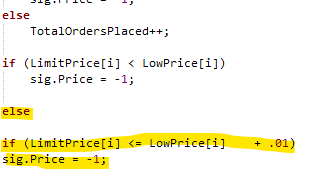

Quote:I have deliberately put a 1 cent error into my code such that Amibroker will assume I did not get a fill if the low/high of the day is right on the exact cent. The low/high of the day has to be completely one full cent higher or lower than the calculated LMT price for Amibroker to include the trade in the backtest.Thanks for this prompt. Made me look to incorporate, so I included a couple of lines in the CBT which seems to work – excludes trades that BuyLimit is within 1 cent of the Low of the day.

Does this look sensible to you?

Appreciate any feedback.

Many thanks

-

AuthorPosts

- You must be logged in to reply to this topic.