Home › Forums › Trading System Mentor Course Community › Progress Journal › Matthew O’Keefe’s Journal

- This topic is empty.

-

AuthorPosts

-

June 20, 2020 at 6:18 am #111690

JulianCohen

ParticipantAgreed!

June 20, 2020 at 7:58 am #111691SaidBitar

MemberSorry if i caused confusion but honestly this topic made me worried, because i ran it on all my systems and all of them have around 25% risk of ruin.

This is totally against what they are made for.

The thing that we agree on is that we don’t know what is happening in MCs in Amibroker, the only thing is that some results are coming out.

If it is based on bar by bar data which means taking trades that are of lower ranks and replacing them with trades of higher ranks then why in their documentation they mentioned the case of overlapping?June 20, 2020 at 4:14 pm #111693JulianCohen

ParticipantI think the important thing here is to understand what is meant by overlapping trades. My view was that it meant buying the same stock in different tranches, for example buying a total position in a number of entries.

June 21, 2020 at 1:04 am #111633ScottMcNab

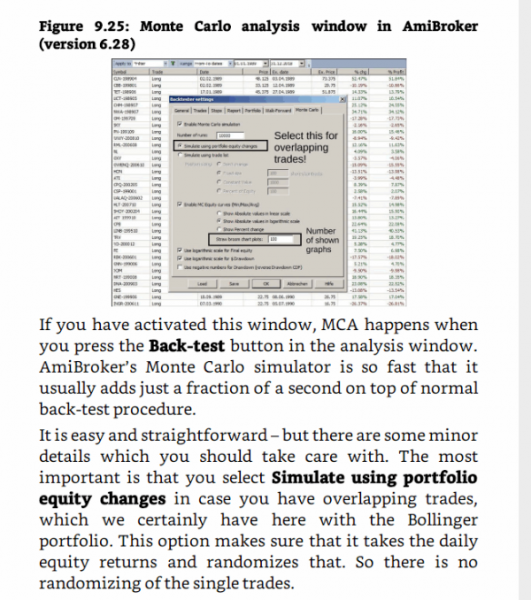

ParticipantWas reading “Trading Systems. A new approach to system development and portfolio optomisation”…. the quote below was instruction on how to use Ab MC for a standard breakout bollinger band breakout stock system on SPX (20 positions at 5%)..so MOC may still be different but at least clears it up for MRV and TF systems

June 22, 2020 at 2:39 pm #111699

June 22, 2020 at 2:39 pm #111699Howard Lask

ParticipantThanks so much Matthew for sharing your thoughts and process – I am near the beginning of my MOC system building journey and these detailed insights based upon your experiences have been invaluable education.

I have a question regarding how you use IS and OOS data during the development and optimisation process…. I have up to this point used a historic data set – say 1/1/2003 to 31/12/2010 for idea development and for IS initial optimisations and then apply the optimised parameters to more recent OOS data. I have found that with MOC systems the results will frequently deteriorate in the OOS period, I may tweak a few parameters to see if that helps but will often need to go back to the drawing board.

I am coming round to thinking that I have this the wrong way round, particularly with MOC systems where market evolution is more likely to influence system performance and where arbitrage for successful strategies will lead to system deterioration. In which case an alternative/improved approach might be to develop and optimise on a more recent IS data set and then see how the system holds up further back in history….

June 22, 2020 at 8:23 pm #111702Anonymous

InactiveHoward,

Your thinking is basically the way that I have done it on my MOC style system, particularly in the past. I called it “Walk-Backward” instead of walk-forward testing.

I approached it with two schools of thought:

1. That more recent market conditions are just not as they were ten years ago or more. I mean in terms of the volatility, speed at which it changes direction etc. Algo, PC, Robinhooders, who cares for the reasons why, but it is fair and reasonable to say it likely works faster or differently in more recent years. Therefore I liked to backtest or optimise on more recent periods of time. Say the last 5 or maybe 10 years. Then I will extend it out to 15 or 20 years after that and see how it goes in the backtest. Does it hold up over the longer term as per how it was designed for the more recent years?

However, I also think that this method/thinking may not apply too much because….

2. I have more recently been of the school of thinking that the age-old methodologies and what makes the market work are still as solid today as they were decades ago. I mean price action in the chart, traditional charting patterns, candlesticks etc and how they translate from what you have seen recently, to what the price action is likely to do tomorrow. So in this thought process, this is what tells me walk-forward or walk-backward testing is a good thing, but it just can’t beat finding a system/method that works well through the entire period with very little optimisation by leveraging the age-old methodologies.

And on this second point is exactly where I have landed with how my MOC system is built now. In the past, I would be facing the problem you mention. Work well in say, 2000 to 2010 or 2015. But then start to lose steam in 2015 to 2020. I would blame it on “reversion not working much any more” or trading apps/algos and perhaps that my parameters needed to be “tuned” for the more recent conditions and not to panic so much if not tuned for the conditions of ten years ago. Generally I found that I was probably using too many ‘indicators’ stacked on top of each other to meet entry conditions to make it work. Too many whacky analysis methodologies (which absolutely have their place) but you get lost in thinking they are going to be the holy grail in opening you up to a new way of thinking and finding a new edge for modern times. This almost always led me to failure.

Only in my rediscovery/redesign over the last few months have I gone old-school, back to the basics about price action. No fancy indicators, just moving averages or the basics of how price action works in recent past to what it is likely to do tomorrow, and then bomb it with a massive number of trades, high leverage and smaller exposure per position in my overall portfolio.

You can see the results in my short system stats that I have posted here. You can see that in general, over the last 15 years or so the concept has generally worked in the right direction. Yes, sure, I agree there are the big peaks in 08 and 20 however in the flatter periods it is still moving in the right general direction. Also my two Long systems complement it well to help smooth out the ride.

So I would say that I know where you are coming from and can see the logic in doing walk-backward testing, however I am more of the opinion these days that if a method is only working well in more recent periods that perhaps it may be prone to failing into the future as well, and that perhaps you have not discovered or using a very stable/dependable/robust method within your system.

June 22, 2020 at 8:33 pm #111634LEONARDZIR

ParticipantMatt,

At your suggestion I ran a Monte Carlo analysis on my MOC which Nick helped me develop. Using your parameters of trade list and no change I had a 50% risk of ruin. This makes no sense to me and I doubt it has any relevance to real world results. I suppose if there was a historic crash and all 40 positions went down 2.5% it could happen. I suspect Monte Carlo analysis is not that useful with mean reversion since the assumption of a random reordering of trades doesn’t pertain to a system with no selection bias.

I use another testing software in addition to Amibroker and Monte Carlo analysis did not show risk of ruin. I could be wrong but those are my thoughts.

You did pick my interest in adding A short MOC strategy. Currently trading a long and short MR system and am looking at a long/ short MOC system without leverage that is very promising.

Be interested in Nick’s commentsJune 22, 2020 at 8:40 pm #111707Anonymous

InactiveYeah you’re probably right. It would be great to understand the workings of the monte carlo in regards to the single day MOC style systems. In a case where losing trades could easily occur within the day before all the profitable ones do, it could still cause a problem. However on the flip side as long as you aren’t fully leveraged, all positions filled and 100% of your account capital is not allocated to this system only, I doubt IB would put any constraints on the trades during the course of the open session. They will only make their final tally at the end of the day because instantly after each LMT order is filled we are placing the MOC order, so they can see within the course of the day we will be closing via MOC.

I guess it just makes me worry that in something well designed like Amibroker is, it has an interpretation that a system with certain settings can lead to ruin.

June 23, 2020 at 1:36 am #111708GlenPeake

ParticipantRE: Amibroker in-built Monte Carlo simulation discussion.

A really good discussion about the AB Monte Carlo simulation…. I’ll confess it’s something I don’t have a solid grasp of in terms of what’s happening ‘under the hood’… and the ‘ruin’ scenario… so I don’t have a lot to offer in terms of ‘better clarity’ of what is actually happening there. I’ve always just gone with the modifying/adding of MCS AFL code within the course etc….

But one option/’stress test’ technique I’ve used in terms of picking the ‘worst’ trades is to reverse the ranking order, this way I get to see what happens if the ‘truly worst’ setups were selected etc….

Pretty straight forward to try this out. For example if your RANK is something like:

Rank = 100 + <whatever rank criteria etc>;

Then change the PLUS + sign to a minus sign…. This will reverse your RANK setups and the ‘worst’ setups will at the top etc

Rank = 100 – <whatever rank criteria etc>;

This way you can gain confidence in a ‘worst case rank’ scenario etc…

June 23, 2020 at 4:25 am #111710Nick Radge

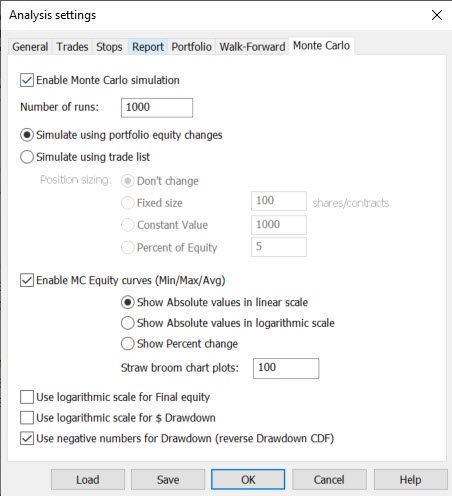

KeymasterBelow are the settings I use and these correlate very closely with my real time results since 2006.

What we need to remember is that the MCS in Amibroker is using the bootstrap method which is basically shuffling either (a) equity returns, or (b) trades.

I don’t really agree with either as we’re trading highly serially correlated strategies. In other words, taking trades from 2009 and adding them to a series of trades in 2008 makes no sense to me. The market conditions were quite different, especially when we look specifically at trend style strategies.

The settings above are the ones I use. But, I also use our trade skipping code and the data/signal variance tests as well.

Remember the key question being asked by MCS is, “What if the future is different to the past?“

By doing the variance tests that’s exactly what we’re doing but without shuffling trades/equity into different market phases. We’re changing the data and therefore creating a different equity path.

June 23, 2020 at 4:50 am #111709JulianCohen

ParticipantActually Matthew I think they do a constant mark to market process on the orders and portfolios in real time. Last week during the big down day IB wouldn’t let me put the MOC orders on for one of my systems as those orders would have taken me over margin. They seem to treat an MOC Order to close a position as an additional order, not a closing of a position, therefore doubling your use of leverage.

June 23, 2020 at 10:52 am #111711Anonymous

InactiveThanks for the tip Julian.

Can I assume if you had this issue you have your account fully dedicated to your MOC systems (if there is no spare cash or leverage available).

I’m hoping that as my MOC systems only form part of my total cash on hand that I would not run into this issue in live trade.

June 23, 2020 at 12:23 pm #111705Howard Lask

ParticipantThanks for the response Matthew and I take your final point well – an emphasis on recent performance may lead to selection of a system and parameters that may be prone to failing in the future.

Since you are looking for time-established market truths your approach makes a lot of sense….

June 23, 2020 at 6:17 pm #111715JulianCohen

ParticipantMatthew O’Keefe wrote:Thanks for the tip Julian.Can I assume if you had this issue you have your account fully dedicated to your MOC systems (if there is no spare cash or leverage available).

I’m hoping that as my MOC systems only form part of my total cash on hand that I would not run into this issue in live trade.

Actually I thought I had a decent margin of safety but I ended up about 70% filled on positions and the MOC orders were placed for most of them, but if you consider that the MOC orders and the filled positions actually counted as double, then I was over stretched and couldn’t place the last set of MOCs. It was also a matter of bad timing as well I think, with the way that orders got filled on the day, but I do think it’s worth considering that MOC orders probably count towards the margin allowance. In my case I got filled on all the orders, but the MOCs were not all placed and I ended the day long of positions overnight. I had to manually place the sell orders for the open the next day.

At least that is what I think happened. I couldn’t face talking to IB about it so I just cut back my position size and haven’t had an issue.

June 23, 2020 at 8:06 pm #111703Anonymous

InactiveHey Howard –

Best thing I have found when working on MOC construction is to (big surprise here, I’m sure) keep it as simple as possible. My first system had shit everywhere. Condition 1/2/3/4/5/6/7/8/call grandma/9/10 – and I did make it look pretty good on a backtest.I have settled on only changing ONE parameter due to time – the stretch multiplier. I think that is best. If the system needs all parameters optimized, I won’t be confident enough to trade it.

For what it is worth, I also used a two period IS/OOS – the 2000s IN and the 2010s OUT. Before 2000 the tick size was different, so I don’t bother.

Actually, I just looked that up. It happened in April 2001 – I wonder if that matters in my testing. -

AuthorPosts

- You must be logged in to reply to this topic.