Home › Forums › Trading System Mentor Course Community › Progress Journal › Luke’s Progress Journal

- This topic is empty.

-

AuthorPosts

-

May 8, 2017 at 8:43 am #101627

CAIHuang

MemberHey guys,

It’s been a long time coming setting up a progress thread for myself. I have been very steadily designing my mean reversion system and definitely spent too long optimizing and stress testing it. But I did see it as a learning process too and I have a better framework for other systems I design in the future. I did learn a lot from all the various tests I conducted and I know what makes my system tick and what needs to be optimized going forward to adapt my system to ongoing volatility changes in the market, well hopefully anyway.

I am also hoping this thread keeps me somewhat accountable early on while paper trading it and tracking results.

I appreciate any input from others here. Hopefully there won’t be too many hiccups but if there is I know there are some avid posters who would probably have been through the same troubles. There are some great contributors in this forum. Even though I don’t contribute much at all I really appreciate the effort you put in this forum and the advice you give.

My system specs:

System – Mean Reversion

Universe: Russell1000

Price filter: $10-$100

Position sizing: 30 @ 6.66% (50% LVR)

Volume filter: Average turnover (50 day MA) > minimum turnover ($400k) & turnover > minimum turnover ($400k)

Index filter: 100 day MA of Rus1000The majority of my testing was probably spent configuring various filters and indicator parameters to reduce my systems trade frequency whilst maximising the systems profitability. In the end, I arrived at a level of percentage of trades captured and percentage of days where all trades were captured that I was happy with.

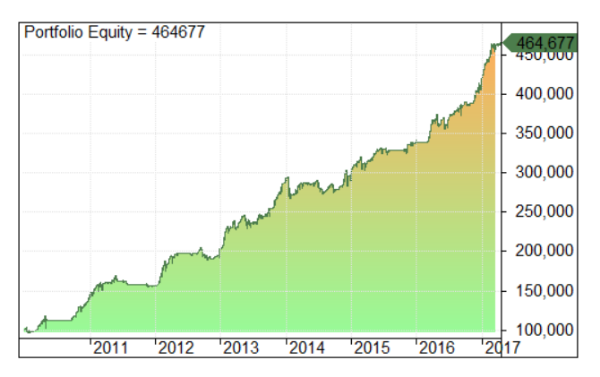

Here are some equity curve charts, basic performance metrics and trade frequency stats for some recent test periods. My system is heavily weighted to more recent data as you can see. I hope I can optimize my system periodically and still maintain that edge.2010-2017

Average Returns 100 run Monte Carlo

Annual Return (CAR): 21.70%

Max Equity % Drawdown: -12.27%

Profit Factor: 1.45

Trade win %: 63.71%

MAR Ratio: 1.77

Trade Frequency %

Percentage of trades captured: 77.2%

Percentage of days all trades were captured: 96.9%

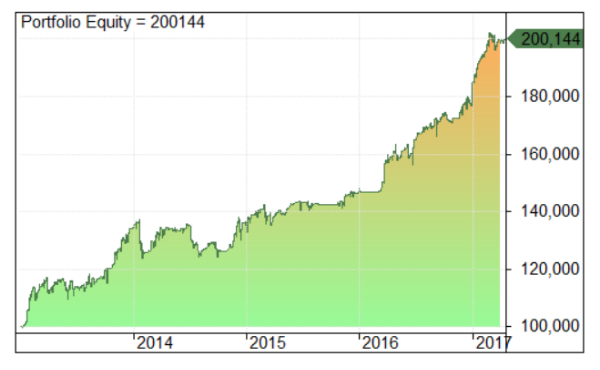

2013-2017

Average Returns 100 run Monte Carlo

Annual Return (CAR): 16.86%

Max Equity % Drawdown: -9.90%

Profit Factor: 1.39

Trade win %: 62.87%

MAR Ratio: 1.7

Trade Frequency %

Percentage of trades captured: 81.21%

Percentage of days all trades were captured: 97.74%

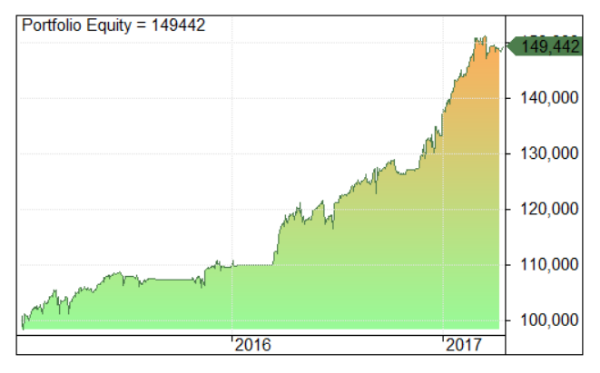

2015-2017

Average Returns 100 run Monte Carlo

Annual Return (CAR): 18.30%

Max Equity % Drawdown: -6.10%

Profit Factor: 1.57

Trade win %: 64.77%

MAR Ratio: 3

Trade Frequency %

Percentage of trades captured: 88.2%

Percentage of days all trades were captured: 99.15%

I will be commencing paper trading of the system tonight.

Cheers

Luke

May 8, 2017 at 9:15 am #106788SaidBitar

Memberlooks beautiful good luck with it

May 8, 2017 at 9:56 am #106796TrentRothall

ParticipantAgree with Said, good looking stats. Next 1000 trades =]

May 8, 2017 at 10:33 am #106789ScottMcNab

ParticipantAgree that looks very good. Win rate higher than I have been able to achieve unless I add a profit tgt.

How does it go without the Index Filter Luke ? One of the nice things about a MRV system is that they often can do well in an environment in which other systems (momentum/TF) don’t do so well in. You may find in the future if you trade multiple systems like Nick, Said or Julian that some tweaking to allow removal of the index filter beneficial to your portfolio of systems.

eg tighten the entry criteria to compensate for removal of index filter…something to maybe play around with in the future

when i tested 30 positions I used 6.65 as just couldnt bring myself to use 6.66… felt like I was asking for it !

May 8, 2017 at 11:36 am #106797CAIHuang

MemberThanks guys!

Scott, I have tested without the index filter and profitability was increase substantially but also MaxDD%. I never thought to further test with tightening up the entry criteria. Definitely something to play around with down the track.

Never thought of that with 6.66, it is a bit of an evil position sizing ratio lol.

May 8, 2017 at 7:29 pm #106798ScottMcNab

ParticipantIn the end might be nice to have both MRV systems…one with index filter and one without…it surprises me how different the profile of returns can be by changing only one or two things in a system…eg remove index filter, add one more line in the buysetup (eg filter based on price action or ATR/PDI/MDI/ADX etc) and/or make exit different (eg moc verses close>ref(c,-1) )…if correlation low then have 2 for the price of 1…. use one on R1000 and other on SPX..or sytem with fewer trades on ASX and high frequency on US

May 9, 2017 at 8:01 am #106800CAIHuang

MemberI had 2x trades execute last night. Although both of the trades did not register when I cross checked my entry prices with a back test of my standard operating version. They appeared as ‘buy setup’ signals in the DDE version but not the operating version. They were valid signals.

I have created a thread in the AFL coding section explaining the issue.

Cheers

May 10, 2017 at 11:53 am #106806CAIHuang

MemberHad the issue sorted. Thanks to Scotty for his help. Issue was regarding the DDE version of my system coding.

I had 2x entries on the first night (which shouldn’t have even been taken because they were technically already positions from the days prior). One I have a sell order for tonight and one I am still holding and is 5% down. These 2x positions won’t appear in my backtest when I am tracking system results. I am wondering if I should start my paper trading again with the DDE code and associated buy signals linking accurately with my operating version so my paper trading results can be compared accurately with backtesting of my system. Thoughts?

I guess it won’t matter having a false start paper trading and resetting the account and starting again say tonight or tomorrow?

May 10, 2017 at 7:42 pm #106834ScottMcNab

ParticipantI think Julian contributed to the code…love to take the credit but I can’t fix my own.

I’d start the record again so it gives you an accurate record of the system…good for the psyche.

May 10, 2017 at 9:50 pm #106835JulianCohen

ParticipantScott McNab wrote:I think Julian contributed to the code…love to take the credit but I can’t fix my own.I’d start the record again so it gives you an accurate record of the system…good for the psyche.

I did ? I couldn’t find my arse with both hands!

Like I’d definitely start again from scratch. No point using data you know is ‘contaminated ‘

Good luck

May 11, 2017 at 1:53 am #106837ScottMcNab

ParticipantI was probably wrong (again)..was it Matt’s code you fixed JC

May 11, 2017 at 5:23 am #106839JulianCohen

Participantha ha yes ’twas I

May 11, 2017 at 6:35 am #106841TrentRothall

Participanti’m claiming responsibility for Luke’s code haha

May 18, 2017 at 12:53 pm #106843CAIHuang

MemberHey guys,

Having some issues with exporting trade reports on TWS. I want to put the data into share trade tracker.

When I try to ‘export today’s report’ It sends and error message saying ‘there are no trade reports to escort’ but there are trades there from the last few days.

I have sent a message to IB but was wondering if anyone else has come across this issue? Is it possibly because I am using the paper trading account?Cheers

May 18, 2017 at 7:56 pm #106902ScottMcNab

ParticipantI use “export displayed reports” and use the settings on the right (under more options) to select asx for exchange to limit to aus trades or to change the times if I want to pick a particular day from the last week…worth a try

-

AuthorPosts

- You must be logged in to reply to this topic.