Home › Forums › Trading System Mentor Course Community › Progress Journal › Len’s Journal

- This topic is empty.

-

AuthorPosts

-

January 1, 2022 at 8:27 pm #114252

Nick Radge

KeymasterGood to see the MOC is back on track Len.

January 2, 2022 at 9:48 pm #114256LEONARDZIR

ParticipantThank you Nick for your invaluable help with my MOC strategy. You set me straight on my coding issues and basic trading ideas.

January 13, 2022 at 7:27 pm #104625LEONARDZIR

ParticipantUnder the category of ” S*** happens” yesterday my Chartist API did not place MOC orders on my entries. I closed all positions this morning and lucked out that the market opened up and there was some mean reversion. I have no idea why it happened unless I lost connection between the APi and IB.

My habit has been not to look at the market during the day. That will change.January 13, 2022 at 9:30 pm #114296Nick Radge

KeymasterThere was a Windows update yesterday. Maybe check that your VPS or computer is not set to auto update?

January 14, 2022 at 12:24 am #114297LEONARDZIR

ParticipantNick,

I did get a message about the windows update, but the VPS is not setup to automatically update and I didn’t update the VPS during market hours.

It does raise the question about the API. If you lose connection with IB do you just reconnect and the API will continue to put in MOC orders? Also what is recovery mode in the API and when do you use it? Should of asked these questions before.

LenJanuary 14, 2022 at 6:29 am #114298Nick Radge

KeymasterRecovery mode is discussed in the instructions.

February 3, 2022 at 12:39 am #104626LEONARDZIR

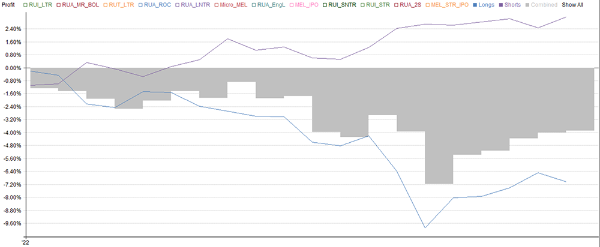

ParticipantJanuary, 2022

TLT -20.69%

US MOMO -1,73%

MOC -6,7%Made a real beginners mistake with my MOC. On the big turnaround day on 1/24 didn’t let my profits run. Basically my whole portfolio excluding my MOC had about a 10% drawdown as background. Had 4 losing days in a row and approaching historic drawdowns in my MOC. Made the mistake of looking at the intraday balances and at one point was down another 3%. Debated about selling all my positions but didn’t. Later in the afternoon was up 11%. Looked again and was now up 6%. Didn’t want to lose any profits so closed all positions. By my estimates if I had closed MOC was up over 20% on that day.

Luckily the MOC is not a large portfolio. Lesson learned. I am now ramping up the size of my MOC.February 3, 2022 at 6:14 am #114370KateMoloney

ParticipantI had that lesson too. Luckily, didn’t exit early and made another 16% – 19%.

Trust the system.March 1, 2022 at 1:11 am #104627LEONARDZIR

ParticipantFeb 22

US MOC +15.52%

TLT +5.82%

US MOMO +4.75%March 27, 2022 at 9:47 pm #104628LEONARDZIR

ParticipantMy MOC is taking a beating so far this month but within backtested results. On a positive note I switched from fixed to tiered commissions on IB based on Nick’s post. This has resulted in a significant reduction in my commission costs.

Thank you NickApril 30, 2022 at 6:29 pm #104629LEONARDZIR

ParticipantApril 2022

US MOMO -3.9%

TLT -5.2%

MOC -10.38%Not thrilled with my MOC so far. Not at historic drawdowns. Have cut down my position size until it starts to turn profitable again.

May 1, 2022 at 4:57 am #114705JulianCohen

ParticipantI don’t think there are many of us making money on MOC or MR this month Len…maybe Howard looks to be the exception

Drilling down into my strategies, the longs were losers, bar one, and the shorts were winners, but not enough to cover the longs losses.

There has to be pullbacks in order to go forward. That’s what I say to comfort myself anyway

May 1, 2022 at 5:37 pm #114707LEONARDZIR

ParticipantThanks Julian.

Good advice and I see that my MOC results aren’t appreciably different from some other members. That is comforting.May 9, 2022 at 11:38 pm #104630LEONARDZIR

ParticipantI was reading “Kaufman Constructs Trading Systems” and I adopted one of his “business risk “ideas. I’ve lost a fair amount of money in my MOC over the last several months(now greater than my max historical drawdown). Today I had a 7.6% loss less than I would have had at full position size. Basically he suggested in leveraged portfolios cutting your position size by 20% as soon as you reach 1/2 to 2/3 of your max historical drawdown. For every 1-2% beyond that reduce your position size by 20%. I started using the model at the beginning of the month. As of today I am down to 40% position size( should be lower because of 7% loss today but will keep at 40% for now. He also has rules for how to increase your position size after a drawdown.

I spoke to him about coding the system but he told me it would be tricky to code. I am basically trying to stay in the game with my MOC. I don’t want to stop trading it even though I am over my max historic drawdon since backtested results are so good.May 10, 2022 at 1:17 am #114740Nick Radge

KeymasterFrom the Turtles:

The Turtles were instructed to decrease the size of the notional account by 20% each time we went down 10% of the original account. So if a Turtle trading a $1,000,000 account was ever was down 10%, or $100,000, we would then begin trading as if we had a $800,000 account until such time as we reached the yearly starting equity. If we lost another 10% (10% of $800,000 or $80,000 for a total loss of $180,000) we were to reduce the account size by another 20% for a notional account size of $640,000

-

AuthorPosts

- You must be logged in to reply to this topic.