Home › Forums › Trading System Mentor Course Community › Progress Journal › Ken’s Progress Journal

- This topic is empty.

-

AuthorPosts

-

April 4, 2021 at 4:12 am #102115

KenHall

ParticipantMarch 2021 Stats

TurnKey’s

WTT ASX 6.35%

ASX Momo -6.48%

US Day Trade L 2.07%

US Day Trade S -0.27%

TLT US -5.08%Calculating % Monthly Performance?

I’ve been going round in circles trying to find a straightforward way to actually calculate the monthly strategy returns for each of the systems using the historical reports available in STT.

I can run a ‘Date Range Snapshot’ report for Feb 21 which will give me the Opening NAV for March by looking up the value of “Open Position Totals” of the Feb Report.

I can then run another report for March 21 which will tell me

‘Bought Trades Totals’ – including ‘Purchase Costs’

‘Sold Trades Totals’ – ‘Total Sale Proceeds’ and ‘Realised Gross P&L’

‘Open Position Totals’ – ‘Ending Month Nav’ and Including ‘Unrealised Gross P&L’I have NOT been tracking any cash positions for the strategies, not sure if this is my problem.

I’ve had a go using the CTFC Performance Tables spreadsheet mentioned in this thread https://edu.thechartist.com.au/kunena/progress-journal/519-cftc-performance-tables.html to no avail.

Does anyone know how I can calculate the strategy monthly return using just the data from the

Code:‘Date Range Snapshot’ I.e. = (‘Realised Gross P&L’ + ‘Unrealised Gross P&L’) / (Closing Nav – (Opening Nav + Purchases – Sales))etc.

Or

Code:= Ending NAV – (Starting NAV + Purchases – Sales) / (Starting NAV + Purchases – Sales)The monthly performance figures I posted above are from APM (see below) but I’m not 100% sure of their accuracy until I can double check with using the data from STT.

Mentor Course

March has been full on getting everything together for FY20’s taxes so haven’t made as much progress as I would have liked. However, I’ve started the Full System Coding in section 2 this month, intending to complete section 2 by the end of the month.

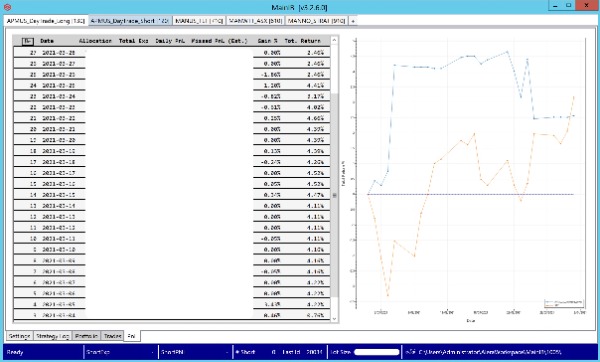

APM Integration w/ Turnkey Day Trade strategies

I’ve integrated the turnkey Day Trade strategies using Alera Portfolio Manager (APM) with IB as a first step in learning APM and to understand what needed to be done for a future crypto intraday strategy I’m working on. Thought I’d share my experience…

I’ve been running both the turnkey Day Trade Long and Short strategies fully automatically for a month now with APM and the experience has been pretty good (I was using the ‘Chartist API’ fine before this). With some help from ‘Systematic Investors Group’ / I’ve updated the turnkey code with additional explorations for creating the APM ready signals, setup the Amibroker batches / scheduler etc it was good to go.

Daily – I check APM a few hours before US market opens just to – visually verify the signals have been processed and all the regular limit orders have been placed along with the corresponding ‘Reset to Neutral (RSN)’ conditional MOC orders that activate for any fills.

The following day I’ll do a quick check on the previous night session trades and review P&L for the strats which are tabs within APM.

One unexpected side benefit of implementing APM is it treats any existing positions that may have already been in your IB account as ‘orphans’ unless you assign them to a strategy.

So I’ve created ‘Manual’ APM dummy strategies for each of the other strategies I trade in the same IB account (ASX WTT, US TLS etc) that visually group each strategies positions together and so provide daily historical and visual reporting – Allocation, Exposure, Daily PnL, %Gain, and Total Return etc

I now actually make the required weekly / monthly changes to these manual strategies through APM via a CLI tool i.e.

Code:ATL TLSA 10 %PORTFOLIO MOO ID 314. – ‘Add To Long’ TSLA with 10% Portfolio allocation with a Market on Open Order.

As well as assigning this order to a strategies portfolio, it means when I do my trade reporting for import to STT, the manual strategy trades are also already tagged in IB with the correct strategy id.

Trade reporting involves an additional step over the ’Chartist API’ export and import – I export daily (or all at once at the end of the week) via TWS using the ‘Classic TWS’ – Trade Log export. I paste this into spreadsheet which changes ‘SLD’ to ‘Cover’ for the Day Trade Short strategy etc and looks up the Full Name of the strategy for each trade from the IB ‘Order Ref.’ field ready to paste all this into the STT upload sheet. Again this is now one process for all strategies.

I ended up running everything in the cloud with speedyservers.com – so the cloud instance has Amibroker, Norgate, Alera and IB Gateway – I needed a larger VPS (Mega) to run the Amibroker explorations without any memory issues.

You can run Amibroker locally and sync the signals via Google Drive or Dropbox but I didn’t want the the risk of signals not getting to APM because of home/office internet connectivity issues. This also means I was able to continue running and reviewing the strategy on a recent trip without having to VPN back to the home/office etc.

April 6, 2021 at 12:38 am #113168TaranveerSingh

MemberHad the same doubt about monthly returns. Nick sent a sample sheet that helped.

Alternatively, here’s the response I got from XLautomation. Maybe it would help.

“The only method that you can use to calculate a particular months return would be to run a Date Range Report from the start of that month to the end of the month

This will give you an purchases made in that month, plus the value of any open positions at the end of the month and sales made during that month.You could then run the same report for the month prior and the month after and use the values for open positions to calculate a monthly return.”

April 6, 2021 at 5:50 am #113185Nick Radge

KeymasterI did do a video on this somewhere…I’ll need to dig it out.

Basically, I use STT only to store trade data for each portfolio. I keep separate sheets for higher volume portfolios to enhance speed. All longer term portfolios, or low volume portfolios stay in a single sheet with separate portfolios.

At the end of each month I record the net ending balance from STT, add it to the following spreadsheet (link below) and subtract prior months. This provides me a net profit for the month, and the correct formulation to account for deposits and withdrawals which STT can’t do.

https://edu.thechartist.com.au/kunena/progress-journal/519-cftc-performance-tables.html

May 3, 2021 at 5:24 am #113169KenHall

ParticipantKens Journal – April

April 2021 Stats

TurnKey’s Monthly Returns

WTT ASX 7.47%

ASX Momo -5.52%

US Day Trade L 0%

US Day Trade S -0.28%

TLT US 8.36%WTT continues to deliver, with NEC closing out at the start of the month for a 50% return. Dividends helped contain things a bit with the ASX Momo and TLT recovered well from last month.

Mentor Course

Completed the the coding section this month – I found the looping section to be really helpful – I can now decipher the turnkey strategies and see how they work!

Starting to think about what type of strategy/s I’d like to explore and develop in the course…

I love the WTT and how over it time it appears to converge to a portfolio of trending stocks. I also like that it’ll effectively revert to cash in a bear market.

I don’t fully understand rotational systems yet, but they appear to be a significant area of systems trading so I’m thinking there is no better way to learn than to attempt to develop a rotational strategy.

I do also like the Day Trade / MOC strategies I’m running, I’ve been experimenting with using the Day Trade Long strategy intra-day with a crypto universe and it looks like there might be something there. So exploring a multi-day / period version of the strategy interests me.

Alera Portfolio Manager continues to do it’s thing well with with the day trade strategies for stocks. But I found some significant issues with it’s support for Binance in crypto – related to confirmation of orders and respecting ‘Time in Force’.

June 2, 2021 at 2:37 am #113170KenHall

ParticipantKens Journal – May

May 2021 Stats

TurnKey’s Monthly ReturnsWTT ASX 1.36%

ASX Momo 7.50%

US Day Trade L 2.54%

US Day Trade S 1.08%

TLT US 0.61%Mentor Course

Getting close to completing the trading section of the course.

Thought the section on expectancy, estimating the likely max run of losing trades and how this can be used to manage/work out the %Risk Fixed Fractional Position sizing was really enlightening.

All of the things to consider in evaluating possible bias in your strategy appears a bit daunting, but this is one of the reasons why I’m here.

If I understand all this and can evaluate it against any strategy I develop or trade, then it’s one more thing that will add to my confidence to enable me to execute every day.

August 29, 2021 at 10:39 am #113353Howard Lask

ParticipantHi Ken – I was listening to the August group call and intrigued by the Systematic Crypto course that you mentioned – have done some googling but can’t seem to find it. Can you help point me in the right direction?

August 29, 2021 at 2:36 pm #113763RobertMontgomery

ParticipantAny rumors of Norgate offering cyrpto data feed? If not are there any recommended data sources?

October 1, 2021 at 1:19 am #113764KenHall

ParticipantHi Howard, apoligies for not noticing this sooner – reach out to Adrian Reid at https://enlightenedstocktrading.com ([email protected]) – easiest way is to send “Adrian Reid” a message via Facebook and mention your interested in understanding a bit more about “The Crypto Success System”

October 1, 2021 at 1:25 am #113765KenHall

ParticipantHi Rob, I use https://sites.google.com/site/amibrokerplugins/tradingview_com_realtime_amibroker_data_plugin for data. Interestingly you can get data straight from the source (the exchange) using AmiQuote’s new javascript capability and have recently switched over to this source.

See

Binance: https://amibroker.com/members/library/detail.php?id=1558

FTX: https://amibroker.com/members/library/detail.php?id=1557Binance provide an excellent historical source of data as well @ https://github.com/binance/binance-public-data/

October 1, 2021 at 7:29 am #113918Howard Lask

ParticipantNo worries and thanks Ken

October 2, 2021 at 2:17 am #113928KenHall

ParticipantOhh, and I found the course syllabus for you to review – https://enlightenedstocktrading.com/online-cryptocurrency-course-the-crypto-success-system/

October 2, 2021 at 9:31 am #113933Howard Lask

ParticipantThank you Ken. I am in touch with Adrian.

November 1, 2021 at 10:37 am #113171KenHall

ParticipantKens Journal – Oct 2021

TurnKey’s Monthly Returns

WTT ASX 6.35%

ASX Momo -6.48%

US Day Trade L 2.07%

US Day Trade S -0.27%

TLT US -5.08%Noticed an issue with how I was running the weekly ‘Exploration’ for new buy/sell signals on WTT recently – basically I had only been looking at the exploration results and I think I have a common setting (Turnover for example) with the Day Trade systems that also run on the same speedy server/amibroker instance.

Long story short I should have closed some positions earlier than I did, lucked out as I was still in a position with INR that done well.

Lesson learnt – either hard code parameter settings in production systems, or use unique parameter names/variables!

Day-Trade MR for Crypto

Learning lots by running the day-trade system intraday on crypto… Found a way to query the exchanges for symbol TickSize data and import ito Amibroker to assist with Limit Order placement and backtest accuracy.

Practically learning about the dark side of Mean Reversion by getting spanked a couple of times recently – so been looking into what sort of historical daily movements I should expect based on positions sizing etc.

Correlation is really high with these markets, so looking at exploring a couple of the ideas shared in this post to smooth things out a bit.

December 3, 2021 at 2:32 am #113172KenHall

ParticipantKens Journal – Nov 2021

Monthly Returns

WTT ASX -3.2%

ASX Momo 2.1%

US Day Trade L -2.1%

US Day Trade S -0.3%

TLT US -8.36%ITDL FTX -6.84%

Intra Day-Trade MR for Crypto (ITDL FTX)

Was green until the last couple of days of the month when I got spanked again!

I’m exploring limiting the no of fills I’ll take with this system to reduce risk (no of fills) when there is a market wide pullback.

So I’ll enter 20 limit orders for the period, but may limit the number of fills I’ll take to say 10.

Operationally, I can do this using Alera APM’s SoftCap feature – it’ll allow you to place as many limit orders as you like but will cancel (the others) as soon as you reach the cap.

But of course, I need to be able to backtest it – without selection bias.

Although I rank my limit orders, the market decides which limit orders get hit first. And I suspect that the first to get hit in a market wide pullback could be the weakest – i.e. those less likely to spring-back first!

The only way I can currently see of backtesting this properly is to use a more granular timeframe (5mins instead of 4H), similar to how we use daily bars for weekly, monthly rotational systems. And actually see which limit orders get hit first.

Probably over thinking this – as backtesting YTD maxDD is 16% across 3,600 trades!

Should (and likely to) split capital and combine with another MR strategy instead!

January 28, 2022 at 8:46 am #114150KenHall

Participant2021 Stats (From March 2021)

WTT ASX 32.5%

ASX MOMO -19.3%

US Day Trade L 4.0%

US Day Trade S -0.3%

TLT US 20.77%Year in Review

It’s been great to see how the (WTT) trend following system jumps on and off a trend and also start to get an appreciation for mean reversion with the Day Trade MOC systems across both stocks and crypto. I now feel very comfortable with the style and running of the different types of systems.

I’m doubling the position size (now 10%) for the MOC systems for 2022, now that I’ve ran it for a year and have a bit of a feel for what to expect. I’ve also changed to the tiered pricing model with IB.

I’ve learnt loads through the year in automating my stock/crypto systems, using both Explorations and the the CBT in Amibroker alongside Alera Portfolio Manager (APM).

I’ve still got some work do on my crypto MOC/MR system, as there isn’t really such a thing as Market On Close in crypto – I need to do some work on analysing the effect of slippage and partial fills on these markets – I’m learning that with short term systems this could have a material impact on returns. Also exploring suitable regime or market breadth filter for this system.

-

AuthorPosts

- You must be logged in to reply to this topic.