Forums › Trading System Mentor Course Community › Progress Journal › Kates Journal

- This topic has 268 replies, 1 voice, and was last updated 3 weeks ago by

KateMoloney.

-

AuthorPosts

-

February 26, 2022 at 7:11 am #114436

KateMoloney

ParticipantNick fuck fuck fuckedy fuck

It really does help!

February 26, 2022 at 7:20 am #114438KateMoloney

ParticipantTerry, thank you for your message.

Spoke with Craig this morning who reminded me that traders take time off for holidays, flights and personal crisis. Then he suggested not doing back tests when you don’t trade. Its a good idea, I think I’m just in the habit of doing them daily which is why I did it.

Been pondering the lessons this weekend as well as the other “stuff”.

As much as we are here to make money long term, from a process perspective, I did the right thing. My husband and I have been grieving this weekend and being present for that is more important than the money.The money will come, and it already has. Already profitable and its still year one. Perspective.

February 28, 2022 at 3:47 am #114439KateMoloney

ParticipantLast week … what a week !

Flood waters in Brisbane are predicted to have peaked this morning …. stopping 3 doors down from our home.

Getting back into my usual daily trading rhythm now we know our home is safe.Had a session this morning with my coach working through my “oh fuck” moment last week. My biggest learning was that taking that night off allowed me the space to honour and grieve my friend who had passed away. Had I participated in the big win, I wouldn’t have remembered all the business wisdom and lessons he taught me. I would have covered up my grief with money.

In a few years, I’ll be much more detached from monetary gains & losses, but right now I’m still a new trader and stumbling along. Being able to make over 10%+ in a night wasn’t in my reality 6 months ago. I am still learning elation management, especially for those extreme winning days.

Another realisation from my session is that creating a system and trading it each day can be quite mechanical. With the timing of my friends death and the impact he had on my life, I’ll be naming this new system after him and trading with him in mind (from a legacy perspective). He told me his children were “managers and not entrepreneurs”. He wanted to pass on some of his entrepreneurial lessons and wisdom, so he did so with anyone who showed interest.

It might sound silly to some, but to me, trading with meaning and a purpose in mind makes us better traders.

So, other than Nick having a wee jab this morning

(joking) I’m all good with missing out on the profits last week.February 28, 2022 at 3:51 am #114440

(joking) I’m all good with missing out on the profits last week.February 28, 2022 at 3:51 am #114440KateMoloney

ParticipantAnd just to add, whilst I had done a daily non compounded P & L as Nick had instructed, mentally knowing the ups and downs VS actually handling them are two very different things.

So we did some work on that too, especially with some of the up coming volatility, I want to be able to handle those outlier loss making days without flinching.

February 28, 2022 at 4:02 am #113441ChrisThong

ParticipantThank you for the post and glad to know that you and your family are safe from the flood water.

March 1, 2022 at 7:20 am #114441KateMoloney

ParticipantASX momo 0% – CASH

Growth Port 0% – CASHUS TLT -1.56%

US Momo +2.38% (about to go 100% cash)MOC systems

TB -4.27%

WP -9.87%All longer term systems will be cash for March.

Great lessons with the MOCs this month. They would have achieved a much healthier return if it wasn’t for blondie here! Been discussing the lessons at length with my husband today, so definitely getting value from it in and will be banking that value later. Took about 2 days to fully get over it, feeling no remorse or guilt now.

Been discussing the lessons at length with my husband today, so definitely getting value from it in and will be banking that value later. Took about 2 days to fully get over it, feeling no remorse or guilt now.One insightful thing my husband shared is that if you have certainty with your system and back testing performance etc, then you are more likely to stick to trading it even through the volatility. If you are uncertain with your system then you are more likely to over ride it. So the initial back testing & research period is critical to gain that certainty and trust.

A while back I printed out the daily non compounded P & L and put it on the fridge. We have been discussing that a lot today.

I can also see that during periods of volatility, like now, the day trade systems thrive while long term strategic holds and longer term systems lose money. So you are being tested with your non day trade strategies and in a way need to have your head “in the right place” even more so than “normal times”.

In the future I will be even more ruthless with distractions that take my focus & attention away from my trading game, especially during periods of volatility.

Have also come up with a potential solution for day trading during holidays or personal leave. Mum said she is willing to learn to run explorations and load the trades. In 3-6 months I’ll set up video instructions for her and see if this is a feasible option to try for short term periods.

Onwards and upwards.

March 7, 2022 at 11:32 pm #114457KateMoloney

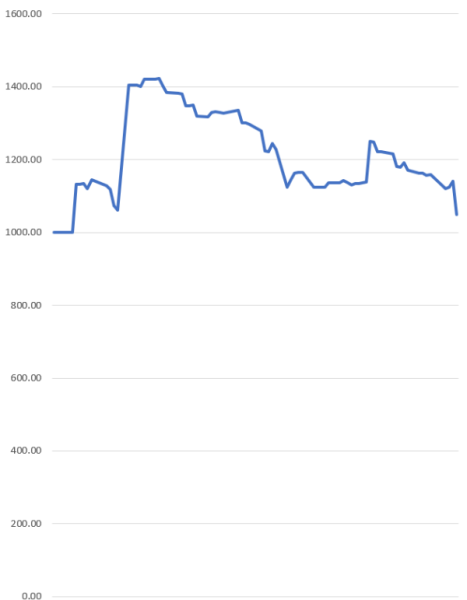

ParticipantDuring the testing phase, Nick got me to do an exercise where you look at the daily profit and loss (non compounded). So in advance of trading, I knew there would be large down days too.

Last night the system dropped -8.1%. No emotion felt. Will be trading tonight.

This is just the cost of doing business.March 10, 2022 at 7:08 am #114550KateMoloney

ParticipantWanted to share some recent lessons. The market is certainly a great teacher.

Upper limits.

I attend a weekly business mindset class online. The class is all about human behaviour, mindset and psychology in relation to business and investing. Lately we’ve been discussing peoples upper limits in terms of their wealth creation, and its been interesting to see my upper limits play out in trading.

For example, the night of the 24th of Feb was a bit winning night that I missed out on. In many ways I don’t think that I was ready to handle another big win so early in my trading business. There was a part of me that felt it was “too easy” to make money like this so soon, and that I was potentially being greedy.

Because I love investing, it doesn’t feel like work to me. I can easily spend 12 hours in a day testing a system and be disappointed because its 10pm and I don’t want to go to bed. Recently there has been a string of losses in the MOC systems (all within the back testing). It has made me question my beliefs around the winning days and whether or not it is greedy. My new answer is, nope, I deserve to make that money. I’ve earned it through the daily work I commit to my trading business and mindset. And also – just because you love what you do, doesn’t mean that you don’t deserve to make a healthy profit from it.

Our mindset group have been working through a linking exercise, where we’ve set our next net wealth goal and are linking benefits to achieving that level of net worth. The exercise literally changes the neuro pathways in your brain. Looking forward to seeing how that plays out in trading.

Lesson two – fear around loss

Even though I had back tested it and was expecting days where the system could lose say 8% or 10% in a night, there was still a part of me fearing it. When it did come the other night, I felt no emotion about it and was able to carry on.

The lesson? Losses are never as bad as you think they will be. On that day, we could still eat and had a roof over our heads. Our daily lives did not change.

The day the system lost 8.1% I intentionally focused on the % and turned the blinkers on to the $ amount. Whilst I deal with the $ in the daily P&Ls, I’ll focus on the $ figures on a monthly basis. One trading session is not enough of a data snapshot to determine how good a system is. Nor is one month.

March 18, 2022 at 3:57 am #114567KateMoloney

ParticipantThe few weeks have been very productive and personally very rewarding.

Have revamped system #2. Same rules, just overhauled the system from a $5 price minimum to $20 price minimum. It seems like a minor thing, but it’ll add up to a lot in the long run in terms of increased profit margin.

Average brokerage across last 200 trades with IB (tiered pricing)

Trades $20+ $2.62 brokerage (buy and sell, including exchange costs)

Trades $10 – $20 $7.01

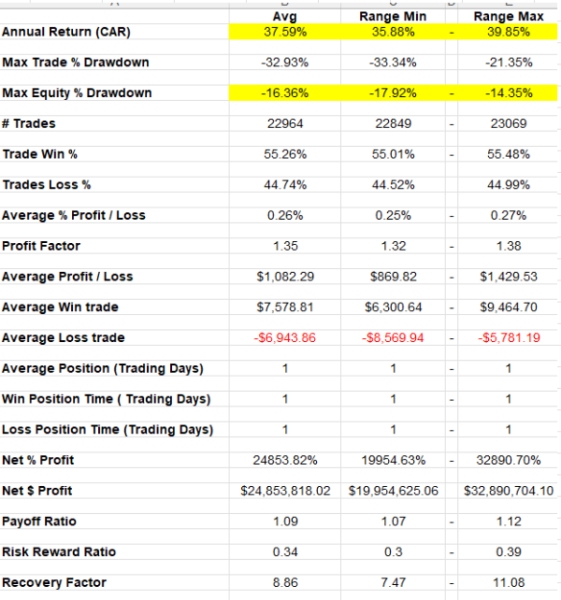

Trades $5 – $10 $8.71Redid the optimization tests and made sure I only adjusted ONE parameter this time. When I was a newbie I had optimized a couple of parameters. Made money on the system, but didn’t think it was going to be sustainable long term. The metrics of the new version with a $20 price minimum are similar to the old system.

Now that this is done, I am trialling a few ideas with system #2 and some of these ideas have slightly improved the metrics. For example, one idea reduced the max % loss (in a day) by 7%, with fewer outlier losing days than the previous system. This will make the system easier to trade over the long term.

Once the new model is complete and thoroughly tested, it will be traded, and then I will do the same for system #1 – change the minimum price to $20 and trial a few ideas. It is a big job because I am essentially testing everything from scratch again to make sure I haven’t over optimized, curve fit etc. Having the Trading Course to refer to along the way has been very valuable. Applied learning rather than learning theories.

In Jan/Feb I invested a lot of time into creating a system that I didn’t like (42% max DD). Initially it seemed like a waste of time, but now that I’m revamping my current systems, I’ve noticed my skill set has improved. Perhaps next 1,000 trades should become next 1,000 systems ?!

Finally, the other day the penny really dropped around the perception of missing out on the high profit night (in Feb). Had it happened I would have left the systems as they were. But because I missed out on a tidy profit, I got annoyed and focused on what I could control … which was improving what I’ve already got. These changes will improve profit margins in the years to come.

If I had the choice between a healthy profit early on in the game, or a sustainable system that I can comfortably trade long term, I would choose the later. Compounding wins, even it takes longer to come into fruition.

April 1, 2022 at 12:49 am #114586KateMoloney

ParticipantMarch update

ASX Momentum – CASH

Growth Defensive -0.11% (missed two signals due to being overseas)US Momentum +0.75% (missed dividends added to records)

TLT +1.5% (missed dividends)The Buffett +7.84%

White Pocket -5.24%Been a productive month overall. Really enjoying the process of trading.

Have launched phase I of the White Pocket remodel, which saved brokerage costs. So far, so good.

Currently working on Phase II of the remodel and will launch the beta mode next week on a reduced account size.Once this is done, I’ll do the same for The Buffett, with the goal to launch both phases by early May.

I have also been reading “The Psychology of Money” book that Nick recommended. It is a great read. One of the chapters talks about single points of failure in business, which really got me thinking about our trading business.

Last year our mobile and internet provider, Optus, upgraded a tower in our area, which led to verryyyyyyyy slooooowwww / non existent internet for 6 weeks. And we live near the Brisbane CBD! Since that bad experience, we got Telstra mobile internet for our home, and as a backup, I kept my Optus phone plan with 125GB of mobile data. Since the floods last month, the Telstra internet has been playing up and I am hotspotting off my mobile. Bloody Murphy’s Law!

After reading the book, and reflecting on how disruptive losing the internet was, I looked at other single points of failure in the business.

I upgraded my laptop and kept my old one as a spare – in case a laptop dies. Having two laptops has been very handy during the MCS and optimizing stages, has saved so much time, and its been handy having a laptop to refer to for the correct AB settings.

I have also set up AB and Norgate on my VPS for emergency situations.

Then I looked at data backups. I use onedrive, but heard of a business friends experience … they were hacked and lost all their documents on onedrive. It took Microsoft a month to restore their documents. Quite scary.

So now I have a secondary backup with idrive, who back up documents and also do disk imagining. The cost is minimal and I consider it cheap insurance. I also have a hard drive that I back up once a month and store in a safe.I have also started rewriting my brokerage access documents in more detail, including setting up two trusted people with logins with the broker. The process with IB has so far been very easy.

What other single points of failure have you identified in your business and what steps have you taken to over come them?

April 12, 2022 at 10:50 pm #114609KateMoloney

ParticipantTrading certainly never stops teaching.

I went down a rabbit hole with my research the last 2 weeks. Turns out an idea that looked good on paper couldn’t be applied in the real world. Grateful to be able to extend the mentoring and thanks to Nick for talking whilst recovering from covid. Every time I talk to Nick or Craig I come away with at least a page full of notes and valuable insights.

Wisdom can be gained from experience or a mentor – or both!

April 21, 2022 at 10:20 pm #114639KateMoloney

ParticipantHere is todays head f*ck / lesson from the market.

System one is my first system. I made all the rookie errors, over optimizing too many parameters, changing the rules a lot between the R1000 & R2000 versions. Low trade volume. etc etc. I will be reviewing this system as my next project.

Despite all the errors, system one is profitable.

System two, got a bit better. Applied new learnings. More trade vol. System is nearly back to breakeven.

If I followed what made money, I would stick to the first system and potentially dump or tweak the second system. The problem is that over optimized systems are not sustainable. So measuring success purely from financial results would be naïve.

Another lesson – there is nothing like real world experience. Last year in October Nick suggested I start trading. I was nervous and wasn’t 100% happy with my system. But it was the best feedback he could have given me, it got into the market and with experience comes (eventual) wisdom.

April 21, 2022 at 11:19 pm #114663KateMoloney

ParticipantConfessions from a recovering over optimizing addict.

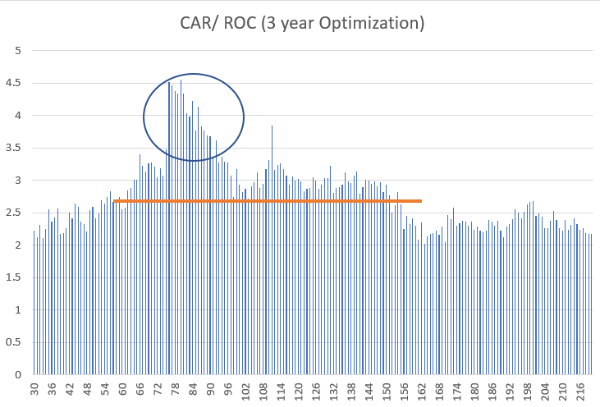

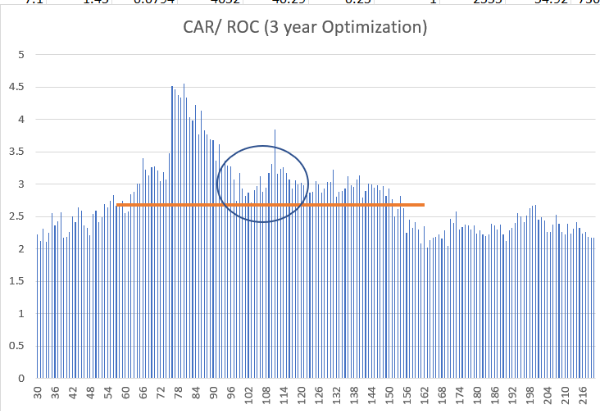

In the past, I defined the below area as a flat spot.

Then I learned it was best practice to zoom out, chuck a line down and pick the middle (as below).

I have had a tendency to aim for the best results without understanding the long term ramifications of making those decisions. I’ve had to rewire my thinking to look for what is sustainable long term VS what is the best return I can make now.

For fun, I ran an experiment using MCS and the above two parameters.

What I noticed is that the second param produced average results in the MCS that were more aligned with the backtest. Also the difference between the high and low return/max DD was a lot smaller (compared to when I tested the first parameter).

This concept probably sounds so simple to the more seasoned traders. But I’m still in newbie phase and before November I didn’t know who or wtf Russell (1000) was.

Step by step, day by day, working on improving skills & knowledge

April 22, 2022 at 4:17 am #114665

April 22, 2022 at 4:17 am #114665JulianCohen

ParticipantJust to play devil’s advocate, why is the flat spot not between 156 and 216?

April 22, 2022 at 7:01 am #114667KateMoloney

ParticipantAs a much wiser (and senior) trader, please state your case.

Love to hear your process.

-

AuthorPosts

- You must be logged in to reply to this topic.