Forums › Trading System Mentor Course Community › Progress Journal › Kates Journal

- This topic has 268 replies, 1 voice, and was last updated 3 weeks ago by

KateMoloney.

-

AuthorPosts

-

June 14, 2022 at 4:29 am #114833

JulianCohen

ParticipantGood luck Kate

June 15, 2022 at 1:17 am #114834RobertMontgomery

ParticipantI hope the best for your surgery Kate, the markets will be here when you are ready. I recently took a week off to help my mom recover from knee replacement, it gave me a lot of peace to focus on her needs and place my account on hold for the week.

June 16, 2022 at 6:26 am #114836KateMoloney

ParticipantRob M post=13104 userid=5369 wrote:I hope the best for your surgery Kate, the markets will be here when you are ready. I recently took a week off to help my mom recover from knee replacement, it gave me a lot of peace to focus on her needs and place my account on hold for the week.Thanks guys.

That is great advice Rob re: taking time off and finding peace with it. The market isn’t going to go anywhere

Operation went a lot longer than expected and it has really knocked me around this time. It has been really nice to take time off from trading.June 16, 2022 at 8:48 am #114841JulianCohen

ParticipantDon’t have FOMO because the massive up day that often happens after a big down day hasn’t happened…..yet

June 16, 2022 at 8:49 pm #114842MarkCottle

MemberI can relate to this Kate.

I just had my 3rd back surgery in 6 months a few weeks ago. My back now looks like a zipper on a jacket.

Trading hasn’t been at the top of my things to focus on. I’ve got my L Plates on with the coding…and each time I open the editor I just close it again within a couple of minutes. Hospital definitely put the brakes on my plans this year!

The upside (gotta find an upside while having the shit kicked out of you, right?!) of being butchered repeatedly is I’ve mostly been in cash for months and sidestepped the daily carnage.

Get well soon!

June 17, 2022 at 2:33 am #114845KateMoloney

ParticipantMark Cottle post=13113 userid=5419 wrote:I can relate to this Kate.I just had my 3rd back surgery in 6 months a few weeks ago. My back now looks like a zipper on a jacket.

Trading hasn’t been at the top of my things to focus on. I’ve got my L Plates on with the coding…and each time I open the editor I just close it again within a couple of minutes. Hospital definitely put the brakes on my plans this year!

The upside (gotta find an upside while having the shit kicked out of you, right?!) of being butchered repeatedly is I’ve mostly been in cash for months and sidestepped the daily carnage.

Get well soon!

How did your surgery go Mark? Have you recovered ok from it? Is that your last one?

With the benefit of hindsight, I can see I was pretty stressed about the surgery before hand and should have given myself some time off in advance.

Cumulative surgeries can really take their toll, hey.

June 17, 2022 at 2:36 am #114844KateMoloney

ParticipantJulian Cohen post=13112 userid=5314 wrote:Don’t have FOMO because the massive up day that often happens after a big down day hasn’t happened…..yetNo FOMO here Julian! Tell me when the red clown show is over

June 17, 2022 at 5:30 am #114843

June 17, 2022 at 5:30 am #114843OliverBenson

MemberWishing you a speedy recovery Kate.

June 17, 2022 at 8:22 am #114847MarkCottle

MemberShould be all done now.

Spinal fusion done in November, that subsequently got infected right down to my spine. Caught it in time before it got inside my spine, but was fairly serious.

That required two more surgeries to firstly remove the infection, insert antibiotic beads, then another surgery to remove the beads and check the infection is gone.

It absolutely takes the wind out of your sails. I spent a month taking enough antiobiotics to kill a horse I reckon.

Trading or doing anything demanding just has to take a back seat in times like that. Hopefully you feel better soon and the market stops closing on it’s bloody lows every day!

June 21, 2022 at 11:07 pm #114848KateMoloney

ParticipantMark Cottle post=13118 userid=5419 wrote:Should be all done now.Spinal fusion done in November, that subsequently got infected right down to my spine. Caught it in time before it got inside my spine, but was fairly serious.

That required two more surgeries to firstly remove the infection, insert antibiotic beads, then another surgery to remove the beads and check the infection is gone.

It absolutely takes the wind out of your sails. I spent a month taking enough antiobiotics to kill a horse I reckon.

Trading or doing anything demanding just has to take a back seat in times like that. Hopefully you feel better soon and the market stops closing on it’s bloody lows every day!

That sounds fairly nasty Mark. My friend broke his ankle and had an infection in the bone, it took a while for him to get over it.

Hopefully you are on the mend now. Do you know when you will get back into trading?

June 22, 2022 at 12:21 am #114850KateMoloney

ParticipantSharing some lessons.

Still on the mend post op, so had a lot of time to reflect on things. The wound dressing inside my ear throws my balance off and I get confused with words / conversations….. so I will not be trading until next week when the dressing is out. After that, I will blame my blondeness for the dumb things I sometimes do !

Day trade update

In terms of the day trade strategy, when I started it in Nov 2021 & Jan 2022, I anticipated not making any money for the first 8 – 12 months. Based on a back test I did during the GFC, the strategy made roughly a 5% total return on capital in the first 8-10 months of trading. My rule was if my initial capital went into a drawdown of 35% then I would stop trading and evaluate the strategy.

Given the recent market of late (!) I am grateful for my past thinking around protecting initial capital VS dreams of making a tonne of money as a trader in the first year.

Whilst Lambos and “too the moon” would have inflated my ego, I don’t like Lambos and crypto moon BS talk is for the get-rich-quickers.First day trade strategy is currently in a drawdown of 29%.

Here’s the beautiful part. The strategy made unanticipated profit in the early months, which gave me a profit buffer to handle the current market. My return on my initial capital is 0.13%. So the market basically let me play for free over the last 7-8 months, learn about myself, learn about trading. All I “lost” was my time.Second day trade strategy is in a drawdown of 35% and the drawdown on initial capital is 19.16%. All survivable, all within my emotional comfort range and expectations for a bear market (based on backtests/stress tests).

Some mistakes

I made a mistake a few weeks/months back where I made an error with one of the settings and was trading on that error. I do daily backtests and reconcile all the trades daily, so when the error showed up in real time trading, I picked it up right away. I felt pretty embarrassed about it (still do), but I am in the process of working on it/working through it. My mistake with the settings oddly rattled me more than the $ loss & drawdown.

The situation also revealed to me that I can handle $ losses fine, but when its piled on with other major life events eg surgery, death, flooding, then my ability to cope with trading losses diminishes. For example, last week I was in the hospital trying to diagnose, unpack and learn from my trading errors 30 minutes before I was due for surgery. Of all the dumb sh*t I could do, that was the dumbest thing I could be doing in that moment. Now my rule is take time off … before.. during and after….

OPM (Other peoples money) …

My Dad has a lot of mates who are cashed up ex dairy farmers. Earlier this year, he told them what I was doing and I fielded countless offers to trade their money. I turned all those offers down because I wanted to master my own money + emotions before taking on someone else’s money + emotions. In hindsight, I am glad I didn’t add that additional pressure so early in my trading career. I think as a new trader the focus needs to be on longevity rather than profitability. Any move that challenges your ability to be sustainable should either be sidelined or pushed further down the road until you have the experience to handle it.

It is easy to run through a back test or stress test, but you never know how you will actually handle something until you have real skin in the game.

Feb 25 & this last week have been defining moments for me as a trader, in terms of understanding where my limits & weaknesses are.Trading truly is a psychological game above all else. I grew up on a dairy farm, where I was taught that you work ‘rain, hail or shine’, including and during difficult life events. The cows needed to be milked twice a day, seven days a week, you just couldn’t take time off. What I realise is that belief system in trading does not serve me and I didn’t realise that I had that belief until I was in the hospital focusing on trading instead of a major surgery.

I’m sure there will be many more lessons to come from trading

– lessons that won’t reveal themselves unless I keep showing up and putting skin in the game.

– lessons that won’t reveal themselves unless I keep showing up and putting skin in the game.Finally ….

Just wanted to express my gratitude for this community, including Nick and Craig. Being able to be transparent and share a space with people I trust has made the journey so much more rewarding. THANK YOU.June 23, 2022 at 12:56 am #114851RobertMontgomery

ParticipantThanks for sharing Kate, I can related to a lot of what you are sharing. Especially like the reminder to trade to stay in the game long term.

I need to create myself a “settings checklist” to make sure all are in the correct position when switching from testing to live trading.

July 1, 2022 at 12:59 am #113450KateMoloney

ParticipantHaven’t traded since the surgery. Had hoped to be trading this week, but I’m on day 9 of a really bad flu. Doing some research on my systems, but the brain fog and dizziness has slowed me down. It might be another 2-4 weeks before I’m ready to trade again.

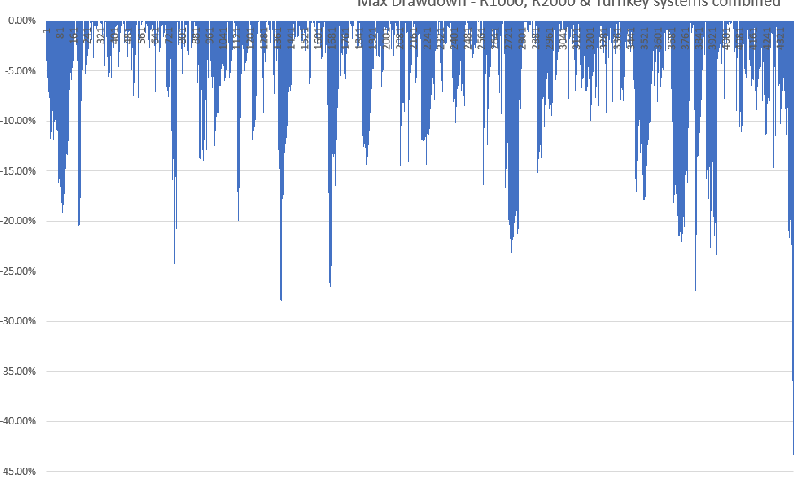

max DD since 2005

Been thinking of the game plan moving forward. I don’t want to make a knee jerk emotional reaction and change my style of trading, or not trade a system because of a challenging month. Will leave the decisions for when I’m feeling better.

ASX Momo, US Momo, TLT & Growth Port – 100% cash

MOC 1 – 17.43%

MOC 2 – 17.55%July 1, 2022 at 5:27 am #114865KateMoloney

ParticipantHopefully this uploads with higher quality … most recent daily P & L on the backtest.

I was lucky to miss some of the downside (the upside to surgery & being sick….). Funnily enough in early June I was starting to research Index filters for the MOC strategy, starting with a basic MA index filter and then looking at volatility index filters. Haven’t done enough research to come to any conclusions yet, but it will be interesting to see what it comes to.

Has anyone else played around with this for MOC strategies?

July 1, 2022 at 7:46 am #114874BenOsborn

ParticipantI have just started to try and see whether some type of Index filter would be useful. However, instead of turning it off, the stretch is increased.

I have only just looked at some random periods, just trying to get some time to do it properly. Might just be a dead end.

-

AuthorPosts

- You must be logged in to reply to this topic.