Forums › Trading System Mentor Course Community › Progress Journal › Julian’s Journal

- This topic has 635 replies, 2 voices, and was last updated 3 weeks, 5 days ago by

JulianCohen.

-

AuthorPosts

-

December 3, 2016 at 10:31 am #105880

SaidBitar

ParticipantJulian Cohen wrote:The MOC system in theory can’t hold any positions if the Swing is fully loadedI do similar with one account i trade ASX MRV and US MOC but i split the cash in the account into 2 parts so all the time i can trade both of them. Your idea of using all the cash for the two strategies is a bit interesting since for each strategy you are using more cash amount I have to backtest it to see if there is benefit .

December 4, 2016 at 2:18 am #105901JulianCohen

ParticipantSaid Bitar wrote:Julian Cohen wrote:The MOC system in theory can’t hold any positions if the Swing is fully loadedI do similar with one account i trade ASX MRV and US MOC but i split the cash in the account into 2 parts so all the time i can trade both of them. Your idea of using all the cash for the two strategies is a bit interesting since for each strategy you are using more cash amount I have to backtest it to see if there is benefit .

How can you backtest it Said? I just figured that two winning strategies, run back to back would work the funds as hard as they can be worked. The drawdowns on each system are acceptable to me. The only problem would be if both are in drawdown at the same time, then the pain could be twice as bad.

Let me know how you plan to backtest it as I’d love to have a go too.

December 4, 2016 at 3:56 am #105910LeeDanello

ParticipantJulian,

If you’re wanting to know how to perform a backtest on two or more systems maybe the following links may help.

Simulating a Portfolio of Strategies in Amibroker (1/2)

Simulating a Portfolio of Strategies in Amibroker (2/2)I haven’t tried it myself.

December 4, 2016 at 9:24 am #105911ScottMcNab

ParticipantWould be interesting to see…my MOC makes most of its profits for the month on only a couple of days…similarly big losses come over 1 or 2 days….skipping some of those trades in the MOC due to insufficient equity could change things ….would be nice to examine if the MRV was fully invested (so no spare equity) at those times when MOC more likely to make gains, losses or neither?

December 4, 2016 at 12:17 pm #105915SaidBitar

Participantthe links posted by Maurice are good in case you are running the strategies side by side I do the same for this, but in case you will use the remaining cash from one strategy to run another one it is a bit more tricky.

the example here is as follows:

the same cash will be used to trade ASX MRV with 20 positions 10% each and in case of any available cash it will be used to trade US MOC strategy 20 positions with 10% per position.for example if you have 10 positions on the ASX MRV this means that the maximum fills on the US MOC will be 10. in case the ASX MRV is fully loaded then you will not take any trades on the US MOC. so in short the number of positions that will be taken on the US MOC will be 20 – (open positions on the ASX MRV) the tricky part is open positions and not the filled positions since most of the positions will remain open for several days.

I added the code bellow in the ASX MRV

Code:SetCustomBacktestProc(“”);

if( Status(“action”) == actionPortfolio )

{

bo = GetBacktesterObject();bo.Backtest();

NumTrades = 0;

// iterate through eventually still open positions

for( trade = bo.GetFirstOpenPos(); trade; trade = bo.GetNextOpenPos() )

{

NumTrades++;

}

AddToComposite(NumTrades,”~~~ASX MRV1″,”X”,atcFlagDeleteValues|atcFlagEnableInBacktest|atcFlagEnableInExplore);}

it will return the number of open positions on any given day and save it in ~~~ASX MRV1

then in the US MOC strategy you have to read the number of poisitions open from the ASX and adjust the max allowed positions 20 – AsxOpenPositions

Code:AsxOpenPositions= Foreign(“~~~ASX MRV1″,”C”);but since life is complex

it is not straight forward I mean you can not do the following:Code:MaxPos = Param(“Maxium Open Positions”,20,1,10000,1) – AsxOpenPositions;

it is not straight forward I mean you can not do the following:Code:MaxPos = Param(“Maxium Open Positions”,20,1,10000,1) – AsxOpenPositions;

SetOption(“MaxOpenPositions”,MaxPos);because SetOption requires number for the second parameter and not an array (AsxOpenPositions) is an array.

so i believe it should be done in custom backtester in order to control the number of entries and i am still trying to find out how.

in case i succeeded i will post the code and the final step is to generate the equity graph for each system and add them together.

December 4, 2016 at 12:31 pm #105916SaidBitar

ParticipantCode:SetCustomBacktestProc(“”);

if( Status(“action”) == actionPortfolio )

{

bo = GetBacktesterObject();

for(AsxOpen = AsxOpenPositions;AsxOpen<21;AsxOpen++)

{

for( sig = bo.GetFirstSignal(); sig; sig = bo.GetNextSignal() )

{

if( sig.IsLong() )

{}

}

}

}some stuff should be added inside the if

maybe the loop no idea yet//

I ended up doing it in Excel

there is benefit in combining the systems since it is giving more returns but also DD are becoming bigger.

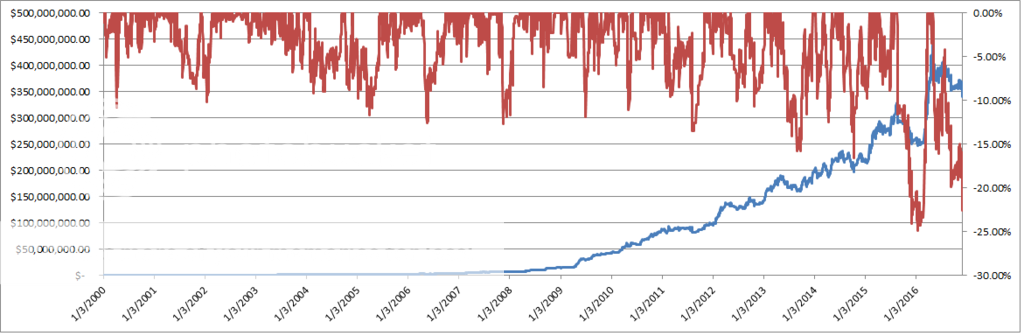

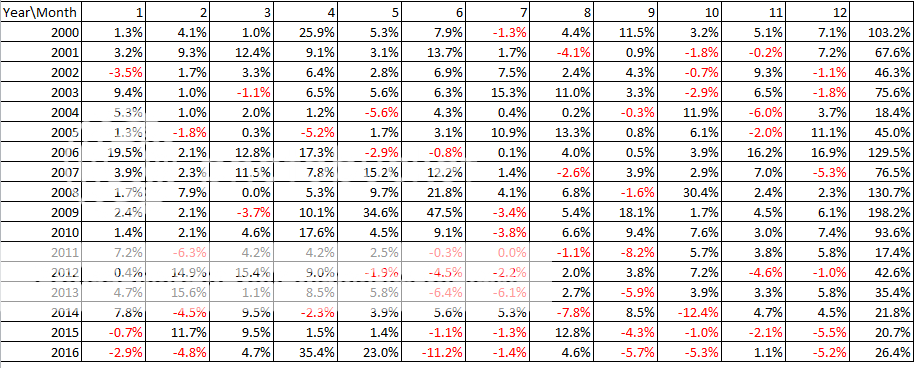

Since i can not make MCs in excel due to time when i was eliminating the excess trades due to positions held by ASX MRV i removed the best return trades and kept the worse ones so I will get idea about how the ugly looks like .here are some of the results

December 4, 2016 at 10:07 pm #105917

December 4, 2016 at 10:07 pm #105917JulianCohen

ParticipantThanks Said. That’s brilliant.

I am cheating somewhat as even if I have a full position on the MR I still run the MOC at full positions. This is because each system only takes up about 15-20% of the total equity, so I can afford to run them both full blast irrespective of positions held.

However don’t think about trying to code for that as that’s a lot easier than what you are trying to do

December 5, 2016 at 5:42 am #105918

December 5, 2016 at 5:42 am #105918TrentRothall

ParticipantAnother way of trading the MOC you be to use 4:1 leverage in the way Brent explained else where. Eg allocate say 25k to be used for the MOC but trade it as though it’s 100k (total for 20 pos) that way you will always be involved in the market.

You would have to calculate total risk based on the allocated $$ for those two systems.

December 5, 2016 at 7:45 am #105919SaidBitar

ParticipantSo today i added 2 more systems to the mix and it became real mix

with IB i have 2 accounts and it will be as follow:

Account 1:

1- ASX MRV1 10 positions 10% each (50% of the cash)

2- ASX MRV2 10 positions 10% each (50% of the cash)

3- US MOC1 20 positions 10% each (100% of cash)Account 2:

1- US MRV 25 positions 8% each (50% of cash)

2- US MOC 20 positions 10% each (50% of cash)so with each account i am targeting 4:1 during the trading hours and 2:1 overnight

wooo it is becoming real mess i hope i did the math correct December 5, 2016 at 6:13 pm #105920

December 5, 2016 at 6:13 pm #105920LEONARDZIR

ParticipantJulian, Said,

I notice that you both are trading multiple systems in the ASX and US. They include WTT,MOC,SWING and momentum rotation. I am curious why neither of you are trading momentum rotation in the US. I found with my own testing and in discussions with Nick that momentum rotation in the US is a much more robust strategy than any stock trending strategy in the US( I have never tested strategies in the ASX). Perhaps your testing results are different from mine?December 5, 2016 at 9:22 pm #105922JulianCohen

ParticipantLen Zir wrote:Julian, Said,

I notice that you both are trading multiple systems in the ASX and US. They include WTT,MOC,SWING and momentum rotation. I am curious why neither of you are trading momentum rotation in the US. I found with my own testing and in discussions with Nick that momentum rotation in the US is a much more robust strategy than any stock trending strategy in the US( I have never tested strategies in the ASX). Perhaps your testing results are different from mine?That’s entirely possible Len, but I found that the ASX has a better trend following environment. I didn’t get very good results from my momentum strategy on the US. Maybe I’ll look at it again. I’ll keep you posted

December 5, 2016 at 9:25 pm #105921JulianCohen

ParticipantSaid Bitar wrote:So today i added 2 more systems to the mix and it became real mix

with IB i have 2 accounts and it will be as follow:

Account 1:

1- ASX MRV1 10 positions 10% each (50% of the cash)

2- ASX MRV2 10 positions 10% each (50% of the cash)

3- US MOC1 20 positions 10% each (100% of cash)Account 2:

1- US MRV 25 positions 8% each (50% of cash)

2- US MOC 20 positions 10% each (50% of cash)so with each account i am targeting 4:1 during the trading hours and 2:1 overnight

wooo it is becoming real mess i hope i did the math correct

You can leverage Account one more on the MOC if you want Said as it isn’t trading the same time as the ASX

December 6, 2016 at 11:17 am #105924SaidBitar

ParticipantJulian Cohen wrote:Said Bitar wrote:So today i added 2 more systems to the mix and it became real mix

with IB i have 2 accounts and it will be as follow:

Account 1:

1- ASX MRV1 10 positions 10% each (50% of the cash)

2- ASX MRV2 10 positions 10% each (50% of the cash)

3- US MOC1 20 positions 10% each (100% of cash)Account 2:

1- US MRV 25 positions 8% each (50% of cash)

2- US MOC 20 positions 10% each (50% of cash)so with each account i am targeting 4:1 during the trading hours and 2:1 overnight

wooo it is becoming real mess i hope i did the math correct

You can leverage Account one more on the MOC if you want Said as it isn’t trading the same time as the ASX

Yes i totally agree

anyhow i modified a bit from the upper post i am not trading half cash instead each strategy is trading the full account. the next step is to trade MOC on ASX even though the results are not so interesting but still it can add some benefit to the account.

the reason i did not start yet is that i am still testing the API that i developed I want to be sure that it is stress tested enough before i trade with itDecember 6, 2016 at 11:19 am #105923SaidBitar

ParticipantLen Zir wrote:Julian, Said,

I notice that you both are trading multiple systems in the ASX and US. They include WTT,MOC,SWING and momentum rotation. I am curious why neither of you are trading momentum rotation in the US. I found with my own testing and in discussions with Nick that momentum rotation in the US is a much more robust strategy than any stock trending strategy in the US( I have never tested strategies in the ASX). Perhaps your testing results are different from mine?for me i have WTT on the ASX waiting on the sidelines as well as Momentum on S&P500 and ASX I am waiting to have enough capital for them, since these strategies require a bit higher capital in comparison to MRV so that the profits will be a bit meaningful.

December 31, 2016 at 9:23 am #104184JulianCohen

ParticipantHere’s December’s results. I added one more MR system to the ASX which uses ROC as it’s main technique.

Overall I am very happy.ASX ROC -1.97%

Combined ASX MR and SPX MOC 4.14%

Combined ASX MOC and RUA MR 4.94%

WTT US 1.00%

WTT ASX 0.23%

ASX Momentum -1.03%Overall Account 2.6%

-

AuthorPosts

- You must be logged in to reply to this topic.