Home › Forums › Trading System Mentor Course Community › Progress Journal › Julian’s Journal

- This topic is empty.

-

AuthorPosts

-

July 19, 2018 at 11:35 pm #108869

LachlanPhillips

MemberHi Julian,

Thanks a lot Your time and answer.Also i would like to thank You for the Selection Bias code what You share on the forum.

I am not looking for secrets, just i have been reading Your journals.

I am played around little bit with the parameters as well; i changed the price to 1-100$ (from 1-10$) as well, i checked Russell3000, S&P400;S&P600 and S&P1500…

My average exposure around 23-26%; but the risk adjusted return is very high around ~35-44%.(maybe i am doing something wrong, i am not quite sure).( My prefrererd time frame of trading around 30-90Days, except if i get some home run); so I changed the entry criteria little bit longer timeframe; like 100days-250days (or 20week-year) and also the index filter to 10weeks to 20 weeks even i tried 26 week.

Hopefully i am not entering the data mining area, but looks to me thanks to Your Selection Bias Code,and Craig help; most of time the risk adjusted return over 30% or higher.Average: 36%.

Also i find the winning trade % very high for trend following system; i got around 46-52%.

DD 25-29% what is not low; but my last 5 years result (not systematic trading) CAGR:15%; DD around 30%.Thanks

Have a great week!

TamasJuly 20, 2018 at 1:23 am #108885JulianCohen

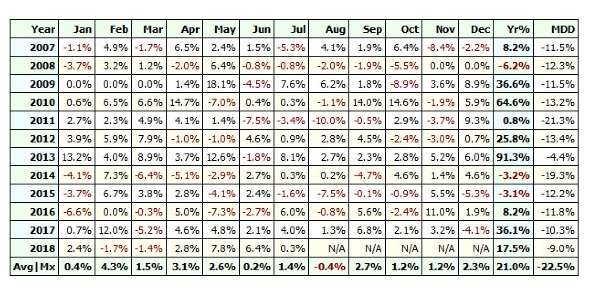

ParticipantDon’t necessarily go by the last 5 years Tamas. Have a look at mine for the last five years

For me this is very much a diversification system to add to my other trend following systems. It works the small end of the market and has some nice years and some rubbish ones. As a stand alone system this would be hard to trade!

July 20, 2018 at 7:33 am #108884RobGiles

MemberJulian Cohen wrote:I never actually tested a weekly rotational system to be honest.When I first started coding I had a go at coding the WTT as I had read the book and didn’t realise that Nick didn’t actually trade it himself. It wasn’t too hard to code so I pretty much just started to trade it, until I really understood selection bias and then I stopped trading it. In the meantime I had written monthly rotational systems, but never made the mental connection to test it weekly. Then when the CBT selection bias code came along I plugged it into my old WTT and found it worked nicely. 20% CAGR with 25% drawdowns is pretty good for a trend following system, so I added it back into my portfolio.

So the honest answer is, I never tested a weekly rotational system. Now I’m going to have to do it!

Thanks Julian,

By “the book’ you mean Unholy Grails right?

July 20, 2018 at 10:05 am #108887JulianCohen

ParticipantYup

July 20, 2018 at 11:30 am #108889LEONARDZIR

ParticipantJulian

Did you have to alter the selection bias codes in any way or just plugged the codes we are using for MR/MOC into the WTT?July 20, 2018 at 11:43 am #108883SaidBitar

MemberRob Giles wrote:Hi Julian,

What’s the attraction of WTT vs a weekly rotational system?weekly rotational systems = deep drawdowns this what i found

August 1, 2018 at 5:21 am #104227JulianCohen

ParticipantJuly ’18

Short-Term Systems

US MR: 3.87%

US MOC: 13.09%Long Term Systems

S&P 500 Momentum: 1.24%

NASDAQ Momentum: 5.5%

Long Term NASDAQ: 3.2%

US WTT: -4.0%

ASX Momentum -8.59%

ASX Growth -0.71%Total Account: 4.03%

August 1, 2018 at 5:51 am #108933Nick Radge

KeymasterNice result for your MOC mate.

August 1, 2018 at 7:48 am #108934JulianCohen

ParticipantNick Radge wrote:Nice result for your MOC mate.Yes it was a nice month for that. Balances out the ASX Momentum which is my bogie portfolio. There seems to be always one that is a constant disappointment and mine is ASX momentum.

August 1, 2018 at 9:27 am #108935TimothyStrickland

MemberSorry for my ignorance guys, what does the MOC stand for? MR is mean reversion correct?

August 1, 2018 at 9:28 am #108941ScottMcNab

ParticipantMarket On Close…..system exits at end of each day

August 5, 2018 at 6:44 am #108936RobGiles

MemberJulian Cohen wrote:Nick Radge wrote:Nice result for your MOC mate.Yes it was a nice month for that. Balances out the ASX Momentum which is my bogie portfolio. There seems to be always one that is a constant disappointment and mine is ASX momentum.

Julian is the ASX MOM based on the same rules / logic as the US MOM systems you trade?

Also, what’s the difference between the Nasdaq Mom and Long Term?

August 7, 2018 at 4:17 am #108955JulianCohen

ParticipantRob Giles wrote:Julian Cohen wrote:Nick Radge wrote:Nice result for your MOC mate.Yes it was a nice month for that. Balances out the ASX Momentum which is my bogie portfolio. There seems to be always one that is a constant disappointment and mine is ASX momentum.

Julian is the ASX MOM based on the same rules / logic as the US MOM systems you trade?

Also, what’s the difference between the Nasdaq Mom and Long Term?

Hi Rob,

ASX is based on the same system. All my rotational systems are based on the same system.

Long Term is Nick’s Nasdaq and Nasdaq Mom is the one I wrote

August 20, 2018 at 7:57 am #104228JulianCohen

ParticipantThe last couple of weeks I have been testing on markets outside the US and Australia. The primary reason is to find an MOC system I can run outside of US hours in order to maximize my funds when they are not being used. Originally the ASX was the best place for this but I have had issues with fills and the system was not matching the backtest in reality because of this.

So I looked at other markets. My primary search was to find markets that have a decent size, so that I wouldn’t face the same issues I had on the ASX. There are really only four other markets to look at that have a decent size, Hong Kong, Tokyo, London and Euronext. Other markets like India and South Korea are both roughly the same size as ASX in market capitalisation so I ruled them out. Plus if the algos are running on the ASX they will be rampant in India.

Scott has been working on this for a while so the two of us combined forces and did some research. MetaStock seemed the best place for data, so I got a subscription and set up Amibroker on a different computer, so that I wouldn’t have any issues with my existing database.

It hasn’t been a particularly smooth journey, and the MetaStock website doesn’t have half the information you need to accomplish this, but we got there in the end, although Scott is still having issues.

I decided that to try and avoid survivorship bias I would not try and use a historical constituent stock index, but would run price and volume filters on the whole stock market, therefore the only survivorship bias would be for stocks staying solvent.

Each stock market has its own peculiarities that affect how you backtest. After a lot of research we decided to drop the Hong Kong market, as stocks there are traded in blocks of shares of differing sizes. There are 100 lots, 200, lots, 300 lots, 500, lots etc etc… and to complicate matters we couldn’t find a list that gave any consistency. Shares seem to move in and out of the lot sizes and we couldn’t find any way of knowing what they were in the past and what they would become in the future. Too hard basket! Maybe if I could find a HK stock broker I could find out how they go about it.

Tokyo is simpler. They have 1000 lots and 100 lots and by 1st October they will all be 100 lots. Simple to code. However I could not find a combination of parameters that gave me a system I would want to trade. I thought for a while I had, but I had set the minimum share price to 1 Yen which gave me 50% CAGR but in some cases I was over 20% of the market for a particular stock, and when I changed the min trade size to 50 or 100 Yen to eradicate this, the CAGR went down to 20% with -20% MDD. Not worth trading especially considering the unreliability of the data. The data has to be paramount for me, as it is intrinsically unreliable, so if I can’t find a system that will give me a really good CAGR and MDD then I won’t trade it. I have to go into this with the assumption the CAGR will be less than the backtest and the MDD will be worse.

I then started to look at LSE and there I found a good system, but it’s making all it’s money in the last two years and starts to tail off fast the further back you go. I don’t trust that.

I will look at Euronext next but I’m having a break for a few days to think things through. I thought I would document this for two reasons; one to help me consolidate my thoughts, and also to let everyone else know about it, as it is often something that we have mentioned on the forum, or on group chats.

August 30, 2018 at 3:59 am #109012JulianCohen

Participant

Made out like a bandit on DKS last night!

-

AuthorPosts

- You must be logged in to reply to this topic.