Forums › Trading System Mentor Course Community › Trading System Brainstorming › Incorporating an Index Volatility Based Trailing Stop with the WTT

- This topic is empty.

-

AuthorPosts

-

May 30, 2020 at 7:09 am #111490

BenJeffery

MemberFound the problem. It was because I had the volume filters defaulted to on in the code. When I changed the volume settings in the backtester paramaters, the chart would be displaying the buy/sell according to the code and not the backtest I was running. Most confusing was seeing things like that example I posted. It looks like it’s picking up the 130 buy trailstop, but the backtester trailstop would have started much lower and only lifted when the index filter turned red, so it sold at the same point.

June 9, 2020 at 6:39 am #111483TrentRothall

ParticipantDid you end up incorporating the Vol stop glen? i’m doing some testing atm too

June 9, 2020 at 8:05 am #111608GlenPeake

ParticipantTrent Rothall wrote:Did you end up incorporating the Vol stop glen? i’m doing some testing atm tooYes Trent.. it is implemented and running live.

June 27, 2020 at 6:44 pm #111612OmarAouane

ParticipantHi Glen,

Congrats on the results and for bringing on this smart volatitily concept.

When you define high volatility, do you measure it on relative basis from the last 20 weeks for example or in absolute terms (20 wk ATR above 2%)?

Will test both method but glad to have your input

CheersJune 28, 2020 at 3:07 am #111742GlenPeake

ParticipantOmar Aouane wrote:Hi Glen,

Congrats on the results and for bringing on this smart volatitily concept.

When you define high volatility, do you measure it on relative basis from the last 20 weeks for example or in absolute terms (20 wk ATR above 2%)?

Will test both method but glad to have your input

CheersHi Omar,

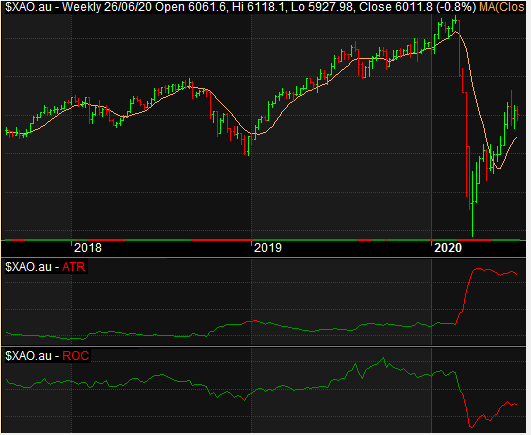

I set the lookback period to X value and then compare the value e.g. ATR value, to see if it’s above or below a value of Y to determine the Volatility level….. higher VOLA and an INDEX Filter of Red/Down = tighter trailing stop as noted above….

Additionally, if the ROC drops W% value over a period Z time…. then this too also triggers tighter stops (if the Index Filter is Red/Down etc)

Chart of ATR/ROC green (low VOLA), red (high VOLA)…. they work independent to each other….. i.e. if either one is in the RED Zone (and the Index Filter is also Red/Down), then this will trigger tighter stops etc.

June 28, 2020 at 9:40 pm #111743

June 28, 2020 at 9:40 pm #111743OmarAouane

ParticipantThanks for the explanations Glenn.

Here is my first feedback. For infa, I am developping my first system that is a variant of the BBO on weekly timeframe on the Russell 1k.

I applied your concept in a simple way, meaning calculating the 20wk ATR vs its 40 wk MA, when above, vol is high.

On the CAGR front not much improvement, but big improvement on the DD being reduced by 30%. At first glance, it seems all the big down months get halved hence the improved risk/return ratio.

One little warning tough, I get this improvement between 2005 and 2020 (including last crash) but during the 2000s dot com bubble, there is a signifiant deterioration of return for the same risk. Probably because the market was much more upside down at this time.

Will keep investigating but it can be an illustration of ever changing markets.March 22, 2021 at 2:44 am #111429HendrikBotha

MemberHi Ben,

Have you had any luck reproducing the advertised WTT performance? I’m getting results very similar to yours and I can’t figure out what I am doing wrong either.

Thanks,

HendrikDecember 13, 2022 at 7:01 am #113119KateMoloney

ParticipantWhat vol / liquidity filters do you use on the WTT system?

I note the default is $500,000 minimum turn over per week. Bit worried its a bit low. Have played around with higher $ amounts but it negatively impacts the CAGR & DD quite a bit….

December 13, 2022 at 7:19 am #115308GlenPeake

ParticipantHi Kate,,

I use:

$1mil minimum Turnover Filter500,000 Volume filter

This is for ASX All Ords

December 13, 2022 at 9:11 am #115309KateMoloney

ParticipantThanks Glen

Would you care to share your up to date CAR and max DD metrics?

I’m currently sitting at 22% – 25% CARG with a max DD of 22% – 26% (depending on the filter settings).

December 14, 2022 at 2:45 am #115310GlenPeake

ParticipantApprox 30% CAR and -26% MDD (current Drawdown).

If you haven’t already done so, look at lowering the MIN $ price filter i.e. from the default $1 to .50cents (or even lower towards .10/.20cents)… Also play around with max positions allowed to see what happens.

You can also change the universe around, i.e. ALL ASX Stocks (or ASX All Ords etc)…. you’ll catch some runners/outliers the wider the universe etc, but you’ll also catch some ‘dogs’ as well (lower liquidity stocks etc)….pending you appetite for risk/reward etc

December 14, 2022 at 6:04 am #115311KateMoloney

ParticipantThanks Glen,

The results I posted prior were using 20 cent or 50 cent price minimums. But that was on the $500,000 T/O settings and on “All ASX” stocks.

Increasing liquidity to 1M diminished results quite a bit, so next step is to play around with the rules and other settings.

December 14, 2022 at 6:04 am #115312KateMoloney

ParticipantBtw Glen … nice results

December 14, 2022 at 6:34 am #115313GlenPeake

ParticipantSounds like you’re on the right track….

The difference with my code is probably the trailing stop modifications depending on the VOLA of the Index (as what I’ve described at the start of this thread).

Take a look at the number of positions as well…. The lesser the # of positions, the ‘quicker’ you’ll deploy your capital when the market turns around i.e. index filter goes from RED to GREEN. However this also comes with the increase of false breakouts/whipsaw/market reversals etc…. and your 100% invested and have to start closing positions etc etc fake outs etc

-

AuthorPosts

- You must be logged in to reply to this topic.